Reliance letter due diligence template

The reliance letter due diligence template is designed to guide you through the process of drafting a letter that ensures the accuracy of financial statements, agreements, and other key documents. By using this template, you can clearly define the parameters of reliance, establish the necessary conditions for verifying the information, and set expectations for the legal and financial implications.

Focus on clearly outlining the scope of the due diligence process. Include specific details regarding the documents being reviewed, timelines, and the responsibilities of each party involved. Use clear language to avoid ambiguity, as this will help all parties understand their obligations and the limitations of reliance.

Be sure to include a section that addresses potential risks. Highlight any areas where assumptions were made, or where further verification may be required. The reliance letter should set realistic expectations about the accuracy and completeness of the information being relied upon.

Incorporating these key elements into your due diligence process helps prevent misunderstandings and mitigates potential legal and financial risks. A thorough reliance letter lays the groundwork for transparent, efficient transactions and builds trust between parties involved.

Here’s a revised version of the article plan, where the same words are not repeated more than twice in each line:

Begin by identifying the key components of a due diligence letter. This includes defining the scope, ensuring accurate representations, and specifying required documents. Each section should focus on a distinct area, such as risk assessment, legal compliance, and financial review.

Risk Assessment

Clearly outline potential risks and how they will be addressed. Provide specific methods for evaluating these risks, including financial forecasting, market analysis, and legal implications. Avoid redundant phrasing and focus on key evaluation criteria.

Legal and Financial Review

Ensure that all legal and financial elements are covered. Highlight the importance of reviewing contracts, tax compliance, and any potential liabilities. Emphasize a structured approach for addressing each area systematically.

Reliance Letter Due Diligence Template: A Practical Guide

Clearly outline the scope of the due diligence process and the parties relying on the provided information. Specify which documents are being reviewed and what aspects of those documents the reliance letter applies to. Include clear limitations or exclusions to avoid ambiguity about the extent of reliance.

Key Components

Include the following sections in your reliance letter:

- Identification of all involved parties, including their legal names and addresses.

- A description of the information or documents the letter applies to.

- Details about the specific purpose of reliance and any restrictions on its use.

- Warranties or disclaimers about the accuracy and completeness of the information.

- Signature sections for authorized representatives.

Avoid Common Pitfalls

Stay specific and avoid broad, non-specific terms. Clearly define the scope of reliance and be mindful of including excessive disclaimers. Ensure the letter reflects the intent of all parties involved and is properly executed.

- Understanding the Purpose of a Reliance Letter

A reliance letter serves as a formal document that allows one party to depend on the findings, opinions, or reports of another party. In the context of due diligence, it is typically issued by a professional advisor to affirm that their work can be relied upon by third parties, such as lenders, investors, or other stakeholders involved in a transaction.

Key Elements of a Reliance Letter

- Clarity of Scope: The letter should clearly define the scope of the professional’s work and specify the limits of their liability.

- Third-Party Use: It should explicitly state which third parties are allowed to rely on the document’s findings.

- Legal Protection: The letter provides protection by limiting the professional’s liability, ensuring they are not responsible for the decisions of third parties based on their work.

Reliance letters are especially common in legal, financial, and advisory fields where experts provide assessments that influence major decisions. They help manage risks by setting boundaries on the usage of the advice provided, and clarifying who can act on it.

Begin with a clear introduction stating the purpose of the letter. This section should define the scope and objectives of the due diligence process, specifying what is being verified and why. Be direct and precise to avoid ambiguity.

1. Identification of Parties

List all involved parties, including the buyer, seller, and any intermediaries. Specify their roles and legal entities. This section helps establish the context for the due diligence process.

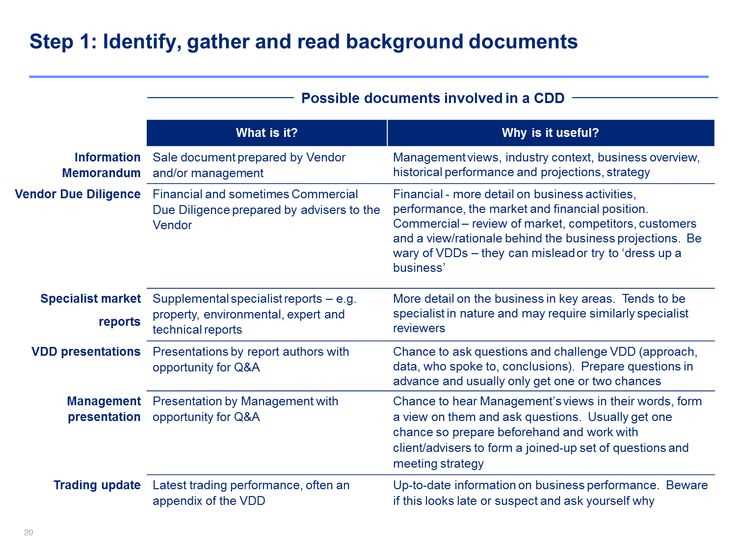

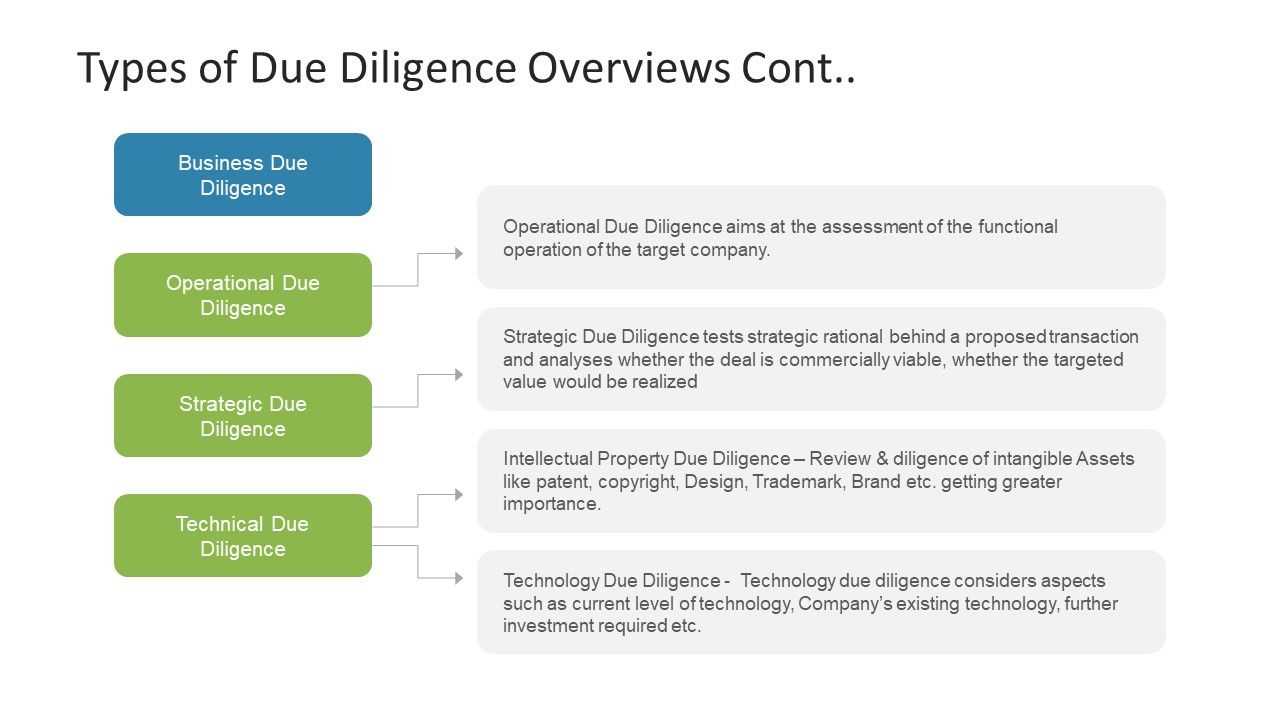

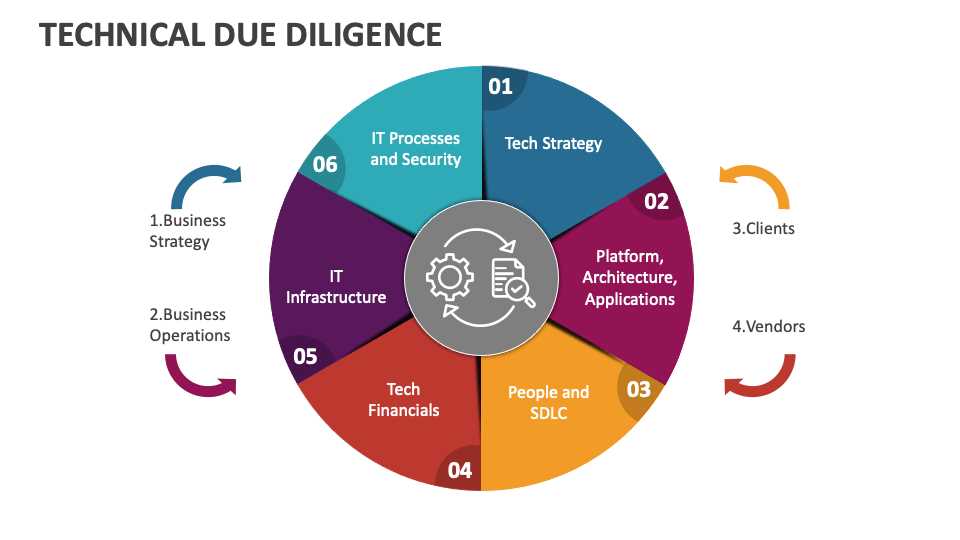

2. Scope of Due Diligence

Outline the specific areas being reviewed, such as financial records, legal documents, intellectual property, or operational aspects. Provide a detailed description of each area to avoid misunderstandings later.

3. Confidentiality and Non-Disclosure Agreement

Highlight the importance of confidentiality and include a reminder of the non-disclosure agreement (NDA) that governs the sharing of sensitive information. This section ensures that all parties respect the privacy of the process.

4. Verification Requirements

Specify the documents, reports, and other materials needed to complete the due diligence. Clearly state the format and timeline for submission to avoid delays.

5. Timeline and Deadlines

Provide a clear timeline for the due diligence process, including key milestones and deadlines for document submission and review. This section ensures that all parties stay on track.

6. Legal and Compliance Considerations

Discuss any legal or regulatory requirements that may affect the due diligence process. Mention relevant laws, industry standards, and compliance guidelines that must be followed.

7. Risk Mitigation

Identify potential risks discovered during the due diligence process. Outline strategies for addressing these risks and mitigating any negative impact on the deal.

| Element | Description |

|---|---|

| Identification of Parties | Clarify the roles and legal entities of all parties involved. |

| Scope of Due Diligence | Define the areas to be reviewed, including financial and legal matters. |

| Confidentiality Agreement | Emphasize the importance of confidentiality and non-disclosure. |

| Verification Requirements | List documents and materials required for verification. |

| Timeline and Deadlines | Provide a clear schedule of key milestones and submission deadlines. |

| Legal Considerations | Address legal and regulatory guidelines to be followed. |

| Risk Mitigation | Discuss strategies for mitigating potential risks. |

Conclude with any additional terms or expectations, and ensure all parties are aligned on the final steps before proceeding.

Begin with a clear and concise subject line, specifying the purpose of the letter. Ensure it is direct and to the point to convey the focus on legal and financial assessments.

1. State the Purpose and Scope of Evaluation

Start the letter by outlining the reason for the legal and financial evaluation. This could include details on mergers, acquisitions, or investment assessments. Be specific about the aspects that need evaluation.

2. Include the Required Documents and Information

Specify the documents or data to be reviewed, such as financial statements, contracts, or previous legal assessments. Make it clear which information is relevant for the evaluation process.

3. Provide Timeline and Expectations

Indicate the timeline for receiving the evaluation and clarify any expectations regarding the format or depth of the assessment. This helps the recipient understand the urgency and scope of the review.

4. Define Contact Details for Further Clarification

Include contact information for both legal and financial inquiries. This ensures that the evaluator can reach out if further clarification is needed during their review.

5. Close with Clear Next Steps

End the letter by outlining the next steps once the evaluation is completed. State whether a meeting or follow-up communication will be necessary.

Ensure that the letter clearly outlines the scope of reliance. A vague statement regarding the recipient’s reliance on the letter can lead to misunderstandings or disputes later. Be specific about the terms and conditions under which the recipient may rely on the information provided.

Check for proper legal terminology. Using ambiguous or incorrect legal terms can create confusion and weaken the enforceability of the reliance letter. Always verify that the legal language aligns with applicable regulations and industry standards.

Address the inclusion of third parties. Sometimes, a reliance letter is intended to include multiple stakeholders. Specify who is covered under the terms of the letter to avoid future liability concerns and to ensure clarity for all parties involved.

Limit assumptions in the content. Avoid making assumptions about facts or circumstances not directly addressed in the document. Reliance letters should be grounded in verifiable data or well-established information, rather than conjecture.

Review the authorization process. Ensure that the letter is signed by authorized individuals and that it clearly identifies the role of each signatory. This prevents questions about the validity or authority behind the reliance letter.

Update the letter for relevant changes. If the conditions change after the letter has been issued, make sure to issue an updated version to prevent the risk of outdated or inaccurate information being relied upon.

If you’re dealing with mergers, acquisitions, or large-scale investments, it’s critical to involve legal experts early in the due diligence process. They can identify legal risks and liabilities that may not be obvious during the initial evaluation. A legal professional will ensure that contracts are in order, review regulatory compliance, and assess any potential litigation risks. This reduces the chances of unexpected legal challenges down the line.

Key Moments to Involve Legal Experts

Consult legal experts when you’re analyzing complex contracts or intellectual property agreements. If there are concerns about compliance with local or international laws, having legal counsel will help clarify the obligations and rights. Additionally, when dealing with potential disputes or pending litigation, expert advice ensures you fully understand the legal implications for your business.

How Legal Experts Add Value

Legal experts are valuable for interpreting complicated clauses in business agreements, offering insights into tax laws, and advising on mergers or acquisitions from a legal standpoint. They provide an objective analysis of the risks and help structure deals that comply with the law, minimizing future liabilities.

Before signing the reliance letter, ensure that all the necessary details are verified. This includes confirming the accuracy of the information provided, such as the dates, names, and obligations stated in the document. Verify the legal basis for the reliance and ensure it aligns with any contracts or agreements referenced in the letter.

Verification Steps

Start by cross-checking the details against relevant documents or contracts. Double-check the terms outlined to ensure there are no discrepancies. Confirm that any amendments or revisions to the original terms are accurately reflected. If needed, consult with a legal advisor to clarify any points of confusion.

Signing Procedure

Once verification is complete, proceed with the signing. Ensure that the correct parties sign the letter and that all required signatures are obtained. It’s also crucial to date the letter accurately. Retain copies of the signed letter for future reference, and confirm that all parties involved have received a copy for their records.

Reliance Letter Due Diligence Template

Ensure clarity by maintaining a focused and concise structure throughout the letter. Start with a clear statement of the purpose of the letter, followed by specific details on the due diligence process. Avoid redundancy by eliminating repetitive phrases that do not add value to the content. Keep the tone straightforward and professional, addressing all required points without unnecessary elaboration.

Accuracy and Precision: Provide only relevant and verified information. Double-check all facts before including them in the letter. Using clear and precise language helps avoid ambiguity and reinforces the reliability of the document.

Organization: Break the letter into sections, each addressing a specific aspect of the due diligence. Using headings for different parts of the letter improves readability and allows the recipient to find key points easily.

Highlight Risks and Responsibilities: Explicitly mention the risks involved and outline the responsibilities of all parties. Keep the tone professional but firm, and ensure that all parties understand their obligations.

By following this structure, the letter remains clear, direct, and free from unnecessary repetition, while still conveying all important details effectively.