Tax opinion letter template

Tax Opinion Letter Overview

A tax opinion letter provides an expert assessment regarding the tax implications of a specific transaction or legal structure. To ensure clarity, it must be well-structured, with precise language outlining key points relevant to the issue at hand.

Components of a Tax Opinion Letter

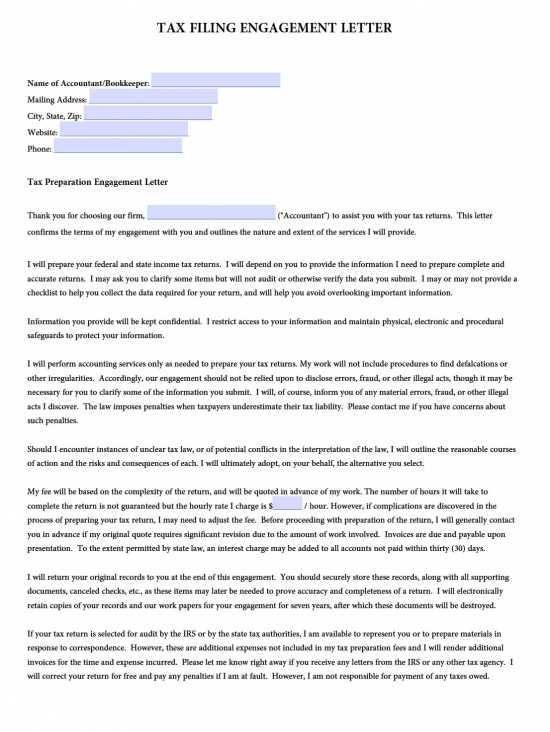

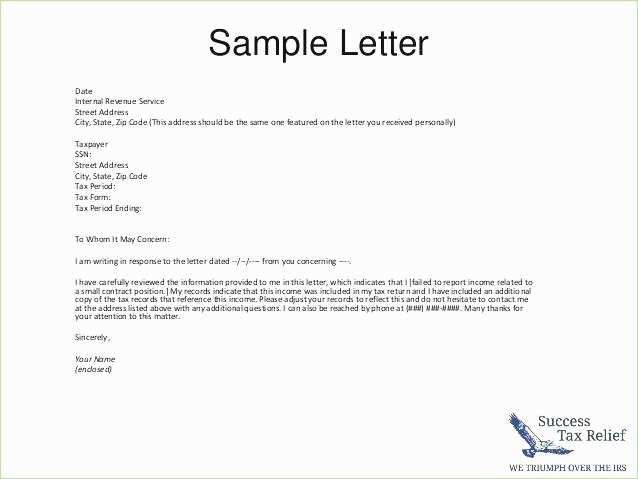

- Introduction: State the purpose of the letter and the subject matter addressed. Provide background information on the transaction or legal structure being assessed.

- Statement of Facts: Clearly outline the facts upon which the opinion is based. This section should be free of assumptions or interpretations.

- Analysis: Examine the tax law and how it applies to the specific facts. Provide a clear explanation of how the transaction is likely to be treated by tax authorities.

- Conclusion: Offer a direct conclusion regarding the tax consequences, based on the analysis provided. Include any caveats or conditions that could alter the outcome.

- Assumptions: List any assumptions made during the analysis. If these assumptions are not met, the tax outcome could change.

Formatting and Presentation

The letter should be formatted professionally, with each section clearly marked. Maintain a formal tone while ensuring the content is accessible and understandable to the intended audience. The use of subheadings aids in organization and readability.

Present the information in a logical sequence, following the structure mentioned above. Avoid unnecessary jargon or overly technical language that may confuse the reader. Ensure that the analysis section directly ties the facts to the applicable tax law, and conclusions are based on that analysis.

A well-prepared tax opinion letter should leave no ambiguity regarding the tax treatment of the transaction and guide the recipient in making informed decisions.

Tax Opinion Letter Template: A Practical Guide

Understanding the Purpose of a Tax Opinion Letter

Key Elements to Include in a Tax Opinion Letter

Step-by-Step Instructions for Drafting a Tax Opinion

Common Pitfalls to Avoid in Tax Opinion Letter Writing

How to Ensure Legal Compliance in the Tax Opinion Letter

Final Review and Best Practices for Submitting the Opinion Letter

To draft a tax opinion letter, focus on clarity and legal precision. A tax opinion provides an authoritative assessment of the tax implications of a particular transaction or structure. The objective is to inform clients or stakeholders of the tax risks involved, based on current tax law.

Key elements to include:

- Introduction: State the purpose of the opinion and summarize the transaction or structure being analyzed.

- Tax Issues: Clearly outline the specific tax questions to be addressed. This could involve issues like taxability, deductibility, or compliance with regulations.

- Legal Analysis: Provide a detailed discussion of the legal framework, including relevant statutes, case law, and IRS guidance.

- Conclusion: Offer a direct response to each question based on the analysis, supported by legal reasoning.

Step-by-step drafting instructions:

- Review the facts: Confirm the accuracy of all facts related to the transaction. Misunderstandings at this stage can result in inaccurate conclusions.

- Research applicable laws: Gather all pertinent tax laws, regulations, and IRS rulings that might affect the transaction.

- Analyze potential issues: Address both the strengths and weaknesses of the case. Identify any areas of uncertainty that might need further exploration.

- Draft the opinion: Present your legal analysis and conclusions in a well-organized manner, ensuring the client understands the risks and benefits.

Common pitfalls to avoid:

- Overgeneralization: Avoid vague statements. Ensure your opinion is specific and grounded in the facts and law.

- Failure to address uncertainties: If there are areas of ambiguity, acknowledge them instead of ignoring them.

- Inadequate research: Never rely on incomplete or outdated legal sources.

Legal compliance: Ensure the opinion complies with all applicable professional standards. Verify that your legal analysis reflects current law, and avoid conflicts of interest by disclosing any potential biases.

Final review: Before submitting, double-check all calculations, references to statutes, and legal reasoning. A well-structured opinion with clear and concise language helps prevent misunderstandings. Always confirm that the letter is addressed to the correct party and formatted properly according to professional guidelines.