TD Bank Gift Letter Template for Homebuyers

When applying for a mortgage, a crucial aspect of the process involves proving the sources of your down payment. Many lenders require confirmation that a portion of the funds is not a loan but rather a financial contribution from a relative or friend. This documentation is necessary to ensure that all funds used are legitimate and not part of a repayment obligation. It helps clarify the nature of the financial assistance you receive, protecting both the lender and the borrower from potential future issues.

For potential homeowners, knowing how to properly document these contributions is key. A formal written statement, detailing the amount and the relationship between the donor and recipient, is often required. This statement serves as proof that the money provided is a gift and not a loan, which could complicate the approval process.

Understanding the specific requirements for such documentation can streamline your mortgage application. It’s important to be aware of the various forms and information that lenders expect to see, ensuring a smooth and timely approval. By following the guidelines closely, you can avoid delays and increase your chances of a successful application.

Understanding the Documentation for Financial Contributions

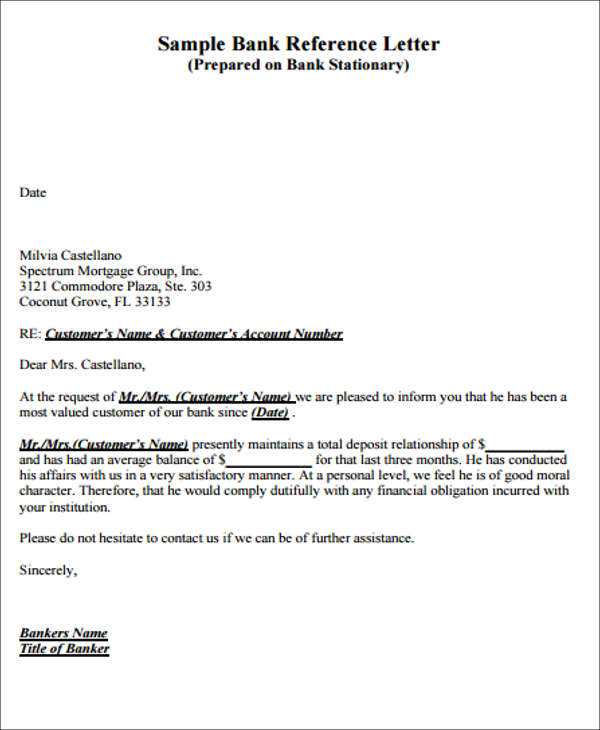

When applying for a home loan, it’s essential to clarify the source of any funds provided by family or friends. Lenders require proper documentation to ensure that these amounts are not loans but rather voluntary contributions. This helps protect both parties and ensures transparency throughout the approval process. A well-structured form outlining the details of the transaction is a standard requirement in most cases.

Why It’s Needed in the Mortgage Process

In order to secure approval, a borrower must demonstrate that the down payment or other funds used are not borrowed and do not need to be repaid. Lenders often ask for a formal statement that confirms the nature of the contribution, ensuring that no future financial obligations are attached. Such documentation prevents misunderstandings and is a vital part of a seamless loan application.

Key Elements of the Documentation

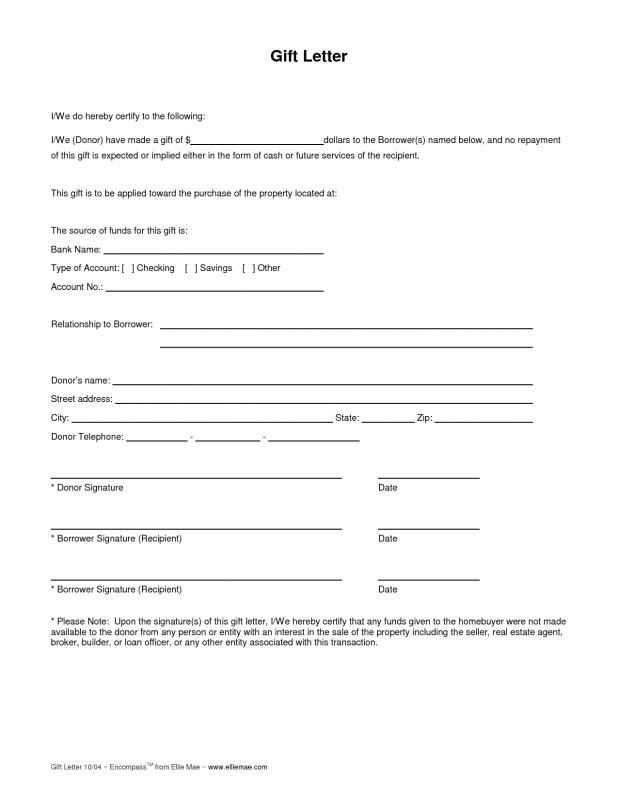

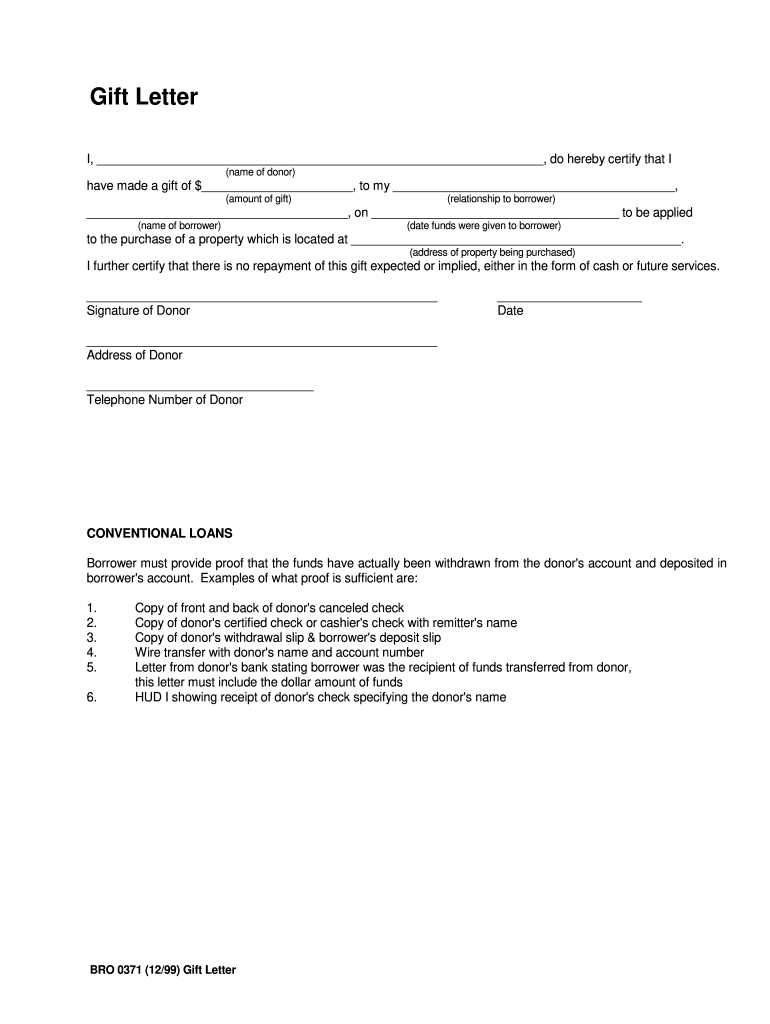

To meet the lender’s requirements, the document should include several key pieces of information: the exact amount of money being provided, the relationship between the giver and the recipient, and a statement confirming that the funds are a gift with no repayment expected. Ensuring that all details are clearly outlined can speed up the review process and increase the likelihood of loan approval.

What is a Letter for Mortgages?

In the mortgage application process, a document is often required to verify the source of funds used for a down payment or closing costs. This document serves as a formal confirmation that the money provided by a third party is a voluntary contribution and not a loan. It ensures that the borrower is not obligated to repay the amount, which could affect their debt-to-income ratio and impact loan approval.

The purpose of such a document is to provide clarity and transparency to the lender, confirming that the funds being used for the home purchase are truly a gift with no repayment expectations. This helps to avoid any potential complications in the mortgage process and safeguards both the borrower and the lender from financial misunderstandings.

Steps to Complete the Gift Form

When submitting a document for a financial contribution, it’s essential to follow a clear and structured process. This ensures that all required information is accurately provided, allowing for a smooth approval process. The form typically requests details about the amount, the relationship between the giver and the recipient, and confirmation that the funds do not need to be repaid.

Provide Accurate Information

Make sure that all fields on the form are filled out with precise and truthful details. This includes the amount of money being provided, the names of both parties involved, and a clear statement confirming that the contribution is a voluntary act with no repayment terms. Double-checking the accuracy of this information is crucial to avoid any delays in processing.

Sign and Date the Form

Both the giver and the recipient must sign and date the form to validate the information provided. This confirms that both parties understand the terms and that the contribution is genuinely a gift. The lender may require these signatures to be witnessed or notarized, depending on their specific requirements. Ensure that these steps are completed to avoid unnecessary complications.

Essential Requirements for TD Bank Documents

When submitting financial documents, certain elements are required to ensure that the information meets lender guidelines. These documents must include specific details that confirm the legitimacy and voluntary nature of the funds being provided. Meeting these requirements ensures that the application process remains smooth and that all necessary information is presented clearly.

- Accurate Information: Ensure that all details, including the amount and the relationship between the giver and the recipient, are correctly stated.

- Proof of No Repayment: The document must confirm that the contribution is a gift with no expectation of repayment.

- Signatures: Both parties involved must sign and date the form, validating the information provided.

- Clear Documentation: If applicable, ensure that supporting documents, such as bank statements or identity verification, are included to validate the source of the funds.

By fulfilling these requirements, the document will meet the standards set by the lender, facilitating a faster and more efficient approval process.

Common Mistakes When Writing Letters

When preparing documentation for a financial contribution, errors can lead to delays or even rejection of the application. It’s important to carefully follow the necessary guidelines and provide accurate details. Common mistakes often involve incomplete information, unclear statements, or failure to meet specific lender requirements.

| Common Mistakes | How to Avoid Them |

|---|---|

| Missing or Incorrect Information | Double-check all fields, including the amount, the donor’s details, and the relationship between parties. |

| Unclear Repayment Terms | Clearly state that the funds are a gift with no expectation of repayment to avoid confusion. |

| Failure to Sign the Document | Ensure both the giver and recipient sign and date the document before submission. |

| Lack of Supporting Documentation | Include any necessary supporting documents such as proof of the source of the funds. |

By being mindful of these common pitfalls and addressing them in advance, you can improve the chances of your documentation being accepted without unnecessary delays.

How a Gift Letter Impacts Your Loan

When you receive financial assistance, it can influence your loan approval process. Lenders often require clear documentation that outlines the nature of the contribution to ensure that it doesn’t affect your ability to repay the loan. Understanding how this type of document impacts your loan application is crucial for a smooth approval process.

- Verification of Funds: It confirms that the funds are provided as a gift, ensuring they don’t need to be repaid, which reduces the financial burden on the borrower.

- Impact on Debt-to-Income Ratio: By demonstrating that no repayment is expected, the lender can more accurately assess your debt-to-income ratio, potentially increasing your chances of approval.

- Ensuring No Loan Fraud: The documentation ensures that there is no hidden loan involved, protecting both the borrower and lender from potential fraud or misrepresentation.

- Strengthening Your Application: A properly completed form can provide additional assurance to lenders, potentially helping you secure better loan terms or a larger amount.

By understanding these implications, you can ensure that your documentation is complete and accurate, which in turn can improve your chances of securing the loan you need.

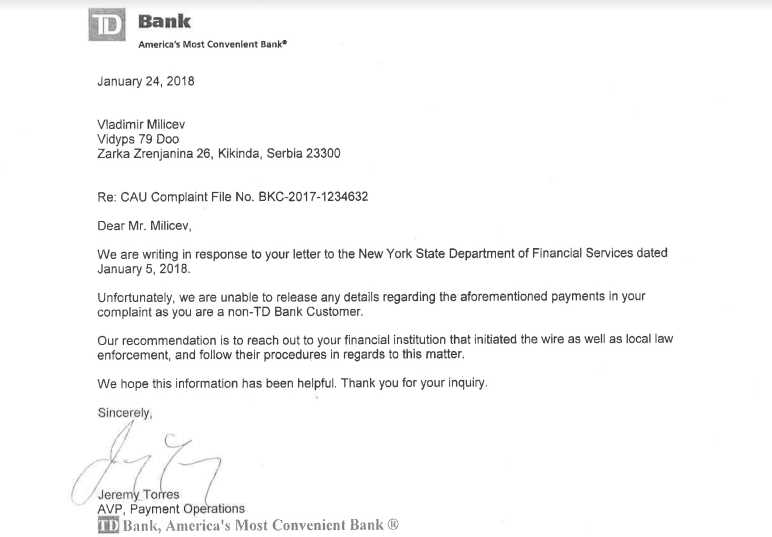

Where to Access TD Bank Templates

When you need a formal document for financial assistance, finding the correct form is essential. There are various channels available for accessing these important documents, ensuring you can easily obtain and complete them for your application process.

- Official Website: The easiest way to access the required forms is through the official website, where they are often available for download in PDF format.

- Customer Service: You can contact customer service for assistance in obtaining the necessary forms directly from a representative.

- In-Branch Assistance: Many financial institutions offer these forms at their physical locations. Visiting a local office can provide in-person guidance and access to the proper documentation.

- Mobile App: Some services may also offer easy access to these documents through their mobile applications for added convenience.

By exploring these options, you can quickly acquire the appropriate paperwork to complete your application with ease.