Debt Collection Letter Template for Efficient Recovery

Managing outstanding payments is crucial for any business. When clients fail to meet financial obligations, having a structured approach to requesting payment can significantly improve recovery rates. A well-crafted communication can guide clients towards settling their balances, ensuring both parties are treated professionally.

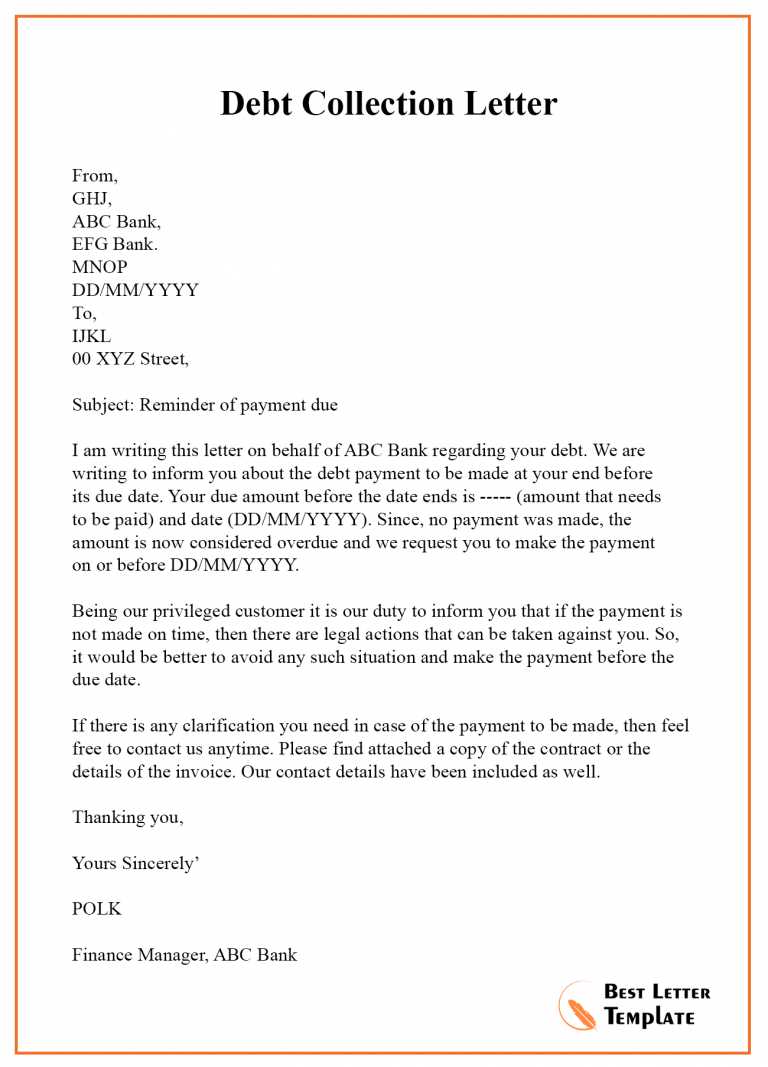

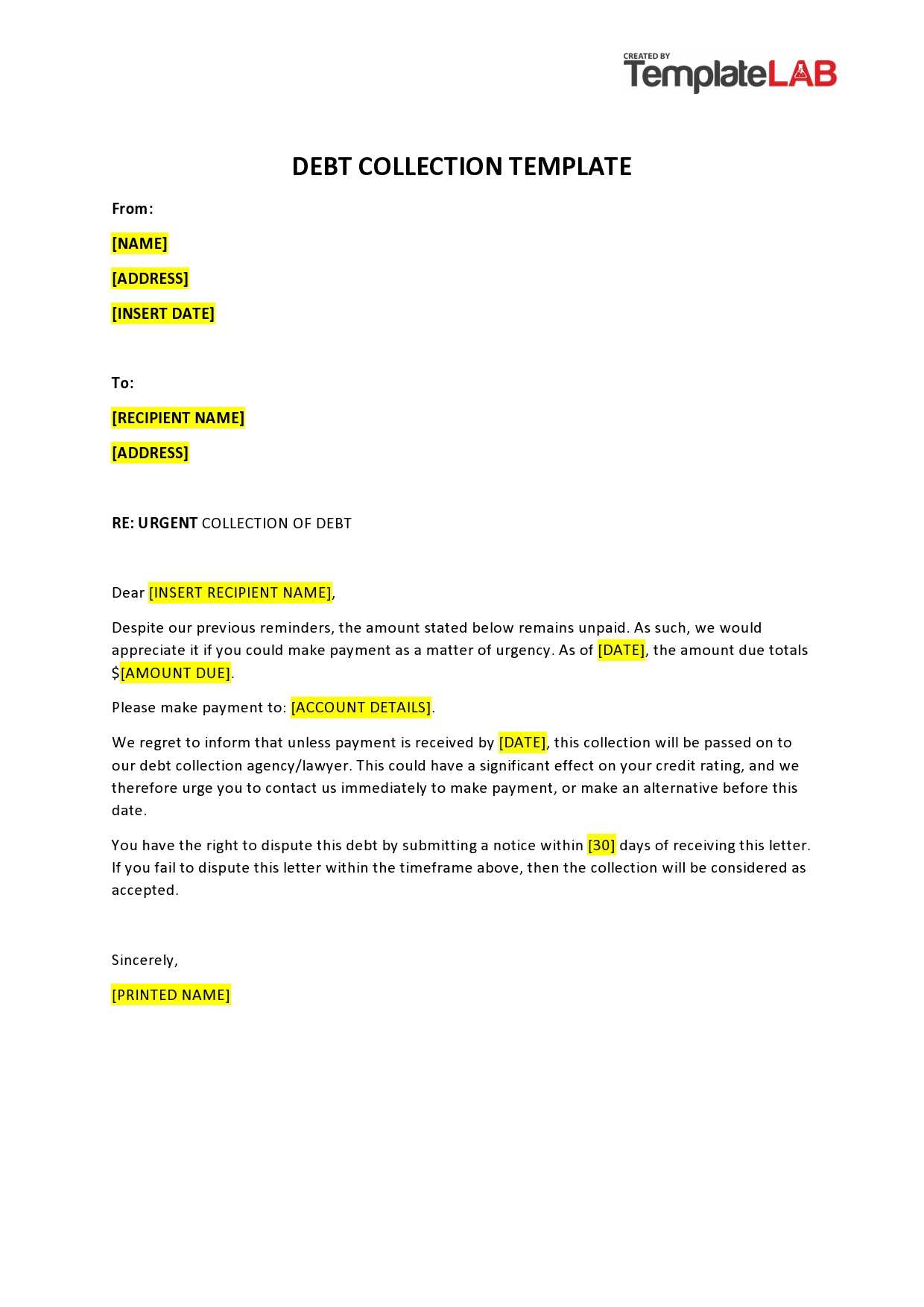

Creating a clear and direct message is essential to avoid confusion or delay in payment. The message should be firm yet respectful, detailing the amount due, the reason for the request, and any consequences if the situation remains unresolved. Including the right tone and legal context can help facilitate a smoother process.

By using a standardized approach, businesses can save time while maintaining consistency in their communications. Such documents can be easily tailored to suit individual cases, providing a personalized yet professional request. Utilizing proven language and structure enhances the likelihood of a positive response from clients.

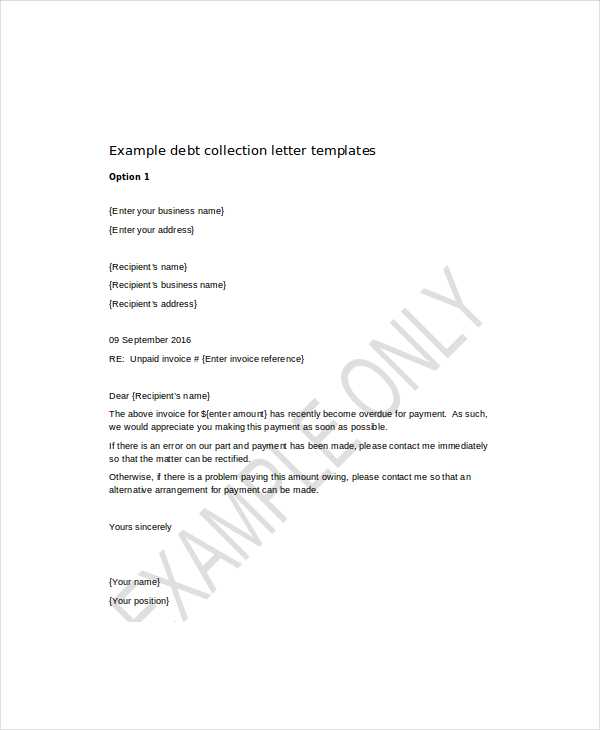

Effective communication regarding overdue payments is essential for businesses to maintain healthy cash flow. A well-structured document aimed at recovering outstanding amounts must balance professionalism with urgency. It serves as an official request for payment, outlining the owed sum and providing necessary details to prompt action from the recipient.

Such documents should be clear, concise, and direct. They convey the seriousness of the situation while preserving a respectful tone. The objective is to encourage prompt payment without damaging the relationship between the business and the client.

Incorporating key elements such as payment terms, deadlines, and legal implications can increase the likelihood of receiving a timely response. These details ensure that the recipient understands the consequences of non-payment, while offering a transparent path to resolution.

Key Components of a Collection Letter

When drafting a formal request for payment, several essential elements must be included to ensure the message is clear and effective. The content should provide all necessary details to make the recipient aware of the situation and prompt them to take immediate action.

Firstly, it is important to clearly state the amount owed, along with a breakdown of the charges if applicable. This transparency helps avoid confusion and reinforces the importance of settling the balance. Additionally, specifying the due date or any payment deadlines gives a sense of urgency.

Another key component is the inclusion of contact information, allowing the recipient to reach out for clarification or to discuss any concerns. Additionally, a polite yet firm reminder of the consequences of non-payment should be included, ensuring that the recipient understands the potential legal or financial repercussions.

How to Tailor Your Letter

Personalizing a payment request is crucial to ensure it resonates with the recipient and increases the likelihood of prompt action. A customized approach helps address the unique circumstances of each case, showing that the business values the relationship and is willing to work with the client.

Here are some key ways to tailor your communication:

- Address the recipient by name: Always use the recipient’s full name or business name to make the communication feel more personal and direct.

- Adjust the tone: Depending on your relationship with the recipient, you can choose a more formal or casual tone. For long-term clients, a more friendly and understanding approach may be appropriate.

- Reference past communications: Mention previous conversations or agreements to remind the recipient of any prior discussions regarding payment.

- Highlight any extenuating circumstances: If the recipient has experienced difficulties, you can offer solutions or extended deadlines to show flexibility, if appropriate.

By incorporating these elements, you ensure that your message is both professional and considerate, increasing the chances of receiving payment on time.

Common Errors to Avoid

When drafting a request for outstanding payments, it’s essential to avoid certain mistakes that can undermine the effectiveness of the communication. These errors can lead to misunderstandings, delays, or even damage to business relationships.

Unclear or Vague Language

One of the most common mistakes is using ambiguous language that doesn’t clearly state the expectations. Be specific about the amount owed, the due date, and any potential consequences for non-payment. This ensures there is no confusion about what is being requested.

Being Too Aggressive

While it’s important to be firm, being overly harsh or demanding can alienate the recipient. Always maintain a respectful tone, even if the payment is overdue. A polite but clear reminder increases the likelihood of a positive response.

By avoiding these common mistakes, you can craft a more effective and professional message that will encourage timely payment without damaging the client relationship.

Best Times to Send a Collection Letter

Timing plays a crucial role when sending a formal payment reminder. The right moment to send such a communication can influence how quickly the recipient responds and settles the balance. Understanding the optimal times can lead to more successful outcomes.

Ideal Timing for Sending Requests

Consider the recipient’s payment cycle, any recent interactions, and the nature of the overdue amount when deciding when to send the request. Sending it too early might not give the client enough time, while waiting too long could result in further delays.

Frequency of Reminders

It’s also essential to balance how often you send reminders. Overloading the recipient with too many requests might be counterproductive, while too few reminders can cause your communication to be ignored.

| Time Frame | Reason for Timing | Recommended Action |

|---|---|---|

| First Week After Due Date | Initial reminder when payment is slightly overdue | Send a polite reminder highlighting the overdue balance |

| End of Second Week | Stronger reminder if no payment has been received | Send a firmer communication outlining consequences |

| One Month After Due Date | Final notice before taking further action | Consider legal or formal action if necessary |

By carefully choosing the right timing and frequency, you can improve the chances of recovering the amount owed efficiently.

Legal Aspects of Debt Recovery

Understanding the legal framework surrounding payment recovery is essential for businesses aiming to recover outstanding amounts. It ensures that any actions taken are within the bounds of the law and helps avoid potential disputes or legal repercussions.

Compliance with Consumer Protection Laws

When initiating any form of communication regarding unpaid amounts, it’s crucial to be aware of consumer protection laws. These regulations vary by jurisdiction but typically prohibit harassment or deceptive practices when seeking payment. Always ensure that your actions are respectful and within the legal boundaries to avoid penalties.

Enforcing Payment through Legal Means

If informal communications do not result in payment, legal measures might be necessary. This could involve sending a formal notice through a lawyer or initiating a court claim. It’s important to understand the process, including any fees, timeframes, and potential outcomes, before proceeding with such steps.

By following the legal guidelines, businesses can recover funds efficiently and maintain good relationships with their clients, ensuring future cooperation without legal complications.

Ways to Increase Response Rates

To ensure a higher likelihood of receiving a prompt response when seeking payment, certain strategies can be employed. By adjusting the approach and enhancing the effectiveness of the communication, businesses can encourage faster action from recipients.

Personalize the Message

A personalized approach can significantly increase the chances of a reply. Addressing the recipient by name and referencing any prior interactions creates a more direct and engaging communication. It demonstrates attention to detail and can make the recipient more inclined to take action.

Offer Flexible Payment Options

Providing multiple payment methods or options for negotiating payment terms can lead to better outcomes. Flexibility shows a willingness to work with the recipient, making it easier for them to settle the amount owed. This can lead to quicker resolutions and improved relationships with clients.

By implementing these strategies, businesses can significantly enhance their chances of receiving timely responses and improving their recovery efforts.