Timely filing letter template

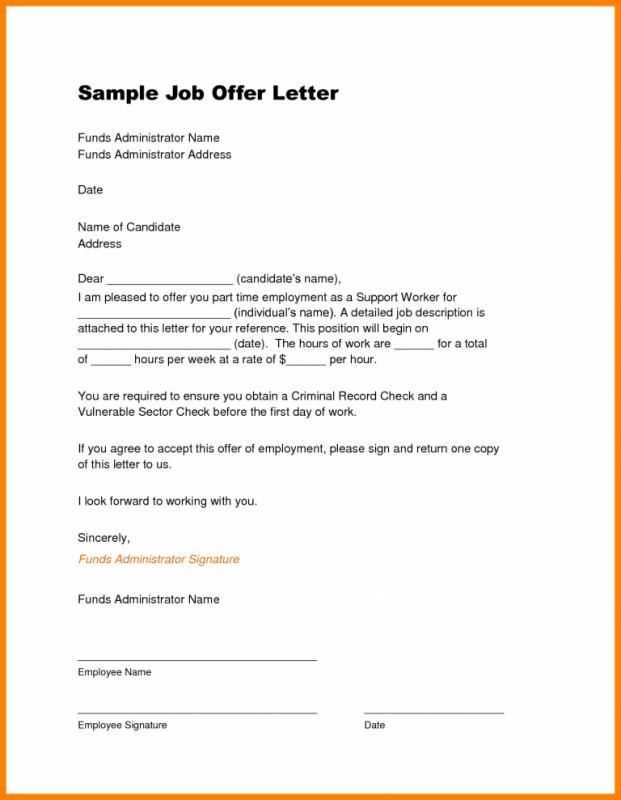

When submitting important documents or claims to an agency or business, it’s crucial to inform them promptly if you’re unable to meet a deadline. A timely filing letter serves as your formal notification, explaining why a submission is delayed. The letter should be clear, professional, and concise, offering specific details that demonstrate your responsibility and intention to comply with regulations or deadlines as soon as possible.

The template for a timely filing letter should start with a direct explanation of the reason for the delay. It’s key to acknowledge the importance of adhering to timelines while providing a clear justification. Additionally, offering a commitment to remedy the delay shows accountability and can often help maintain positive relationships with the recipient.

Including any supporting documentation or evidence can strengthen your case, especially if the delay was due to circumstances beyond your control. Make sure to include any relevant dates and specific actions you’ve taken to resolve the situation. Finally, conclude with a polite closing, thanking the recipient for their understanding and confirming your plan to follow up on the matter.

Here’s a version without redundancies, maintaining the meaning and proper structure:

For a timely filing letter, make sure to address the specific date by which the submission must be made. Clearly reference the form or document in question, along with the exact deadline. Specify any issues that may have caused delays, if relevant, and show that you are actively working to meet the timeline.

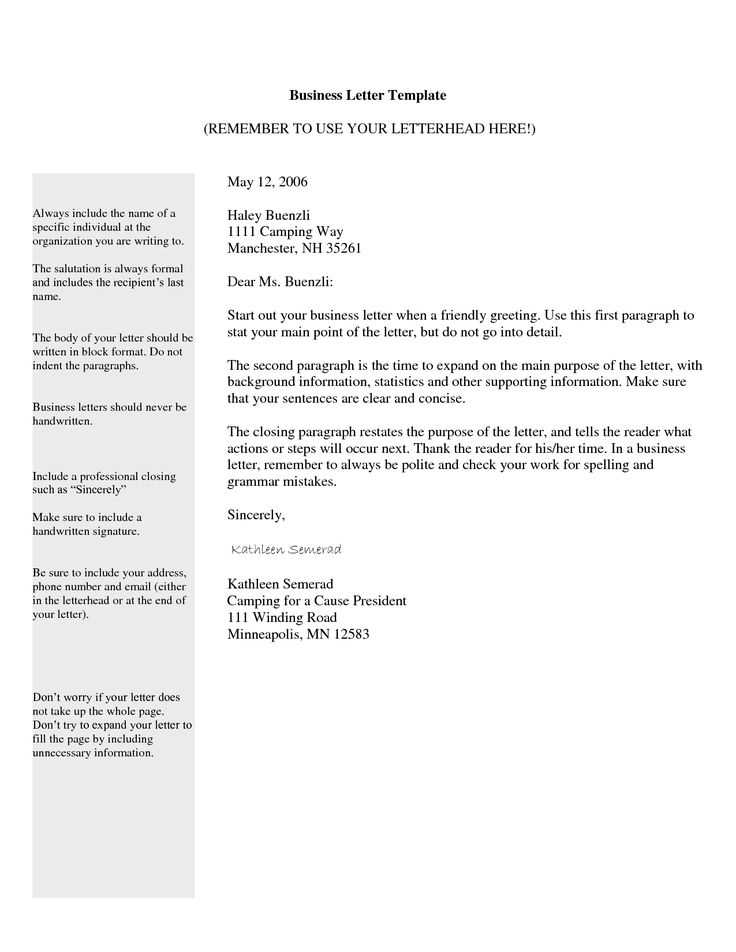

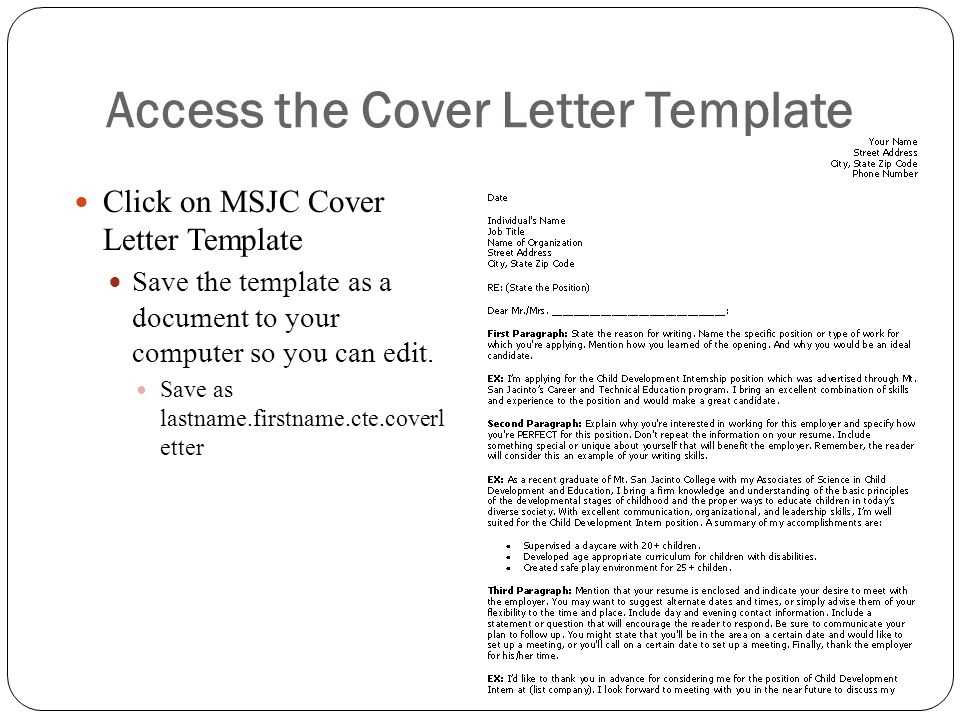

Structure the Letter Effectively

Start with a clear statement of the purpose of the letter. Mention the filing deadline and the steps you are taking to ensure timely submission. If you need additional time, ask for an extension and provide a reasonable explanation. Keep your tone professional and direct.

Be Concise and Direct

Stick to the necessary details. Avoid over-explaining or adding irrelevant information. Use straightforward language that makes it easy for the recipient to understand the situation and your plan for timely submission.

- Timely Filing Letter Template: A Practical Guide

Ensure your timely filing letter clearly conveys the reason for your delay and the steps you’re taking to resolve the issue. Keep the tone polite yet firm, addressing the situation directly. Below is a practical template that you can modify to fit your specific circumstances:

Subject: Request for Timely Filing Extension

Dear [Recipient’s Name],

I am writing to explain the delay in submitting [specify the document or application], which was due on [insert deadline date]. Unfortunately, [briefly explain the reason for delay, e.g., unforeseen circumstances, medical emergency, technical issues].

Despite my efforts to meet the deadline, I was unable to submit the required materials on time. I sincerely apologize for the inconvenience caused and respectfully request an extension of [insert number of days or deadline].

I am committed to submitting the documents as soon as possible and will ensure all necessary materials are provided by [new proposed date]. Thank you for considering my request. Please let me know if any additional information is required to process my request.

Kind regards,

[Your Full Name]

[Your Contact Information]

When using this template, be sure to adjust the details to suit your situation. Providing a clear explanation and proposing a new deadline will help maintain good communication and increase the likelihood of your request being approved.

A timely filing letter serves as a formal acknowledgment that you have filed your tax returns on time or within the allowed extension period. It acts as documentation for your compliance with deadlines, which is vital to avoid penalties and interest. By submitting this letter, you provide proof that the filing was done promptly, ensuring that the tax authorities have the necessary information to process your return without delays.

For individuals or businesses with complex filings, such as claiming deductions, credits, or special tax statuses, a timely filing letter helps clarify your intent and timeline, preventing misunderstandings with the tax office. This can be especially useful if there are discrepancies or questions about the exact date of submission or when the documentation was received.

Additionally, submitting a timely filing letter can prevent the risk of automatic fines for late filing. In many cases, if the tax authority does not receive your return on time, they may issue a penalty. The letter may not eliminate the penalty, but it can mitigate the risk, especially if you can demonstrate that the delay was out of your control, such as postal service issues or system failures.

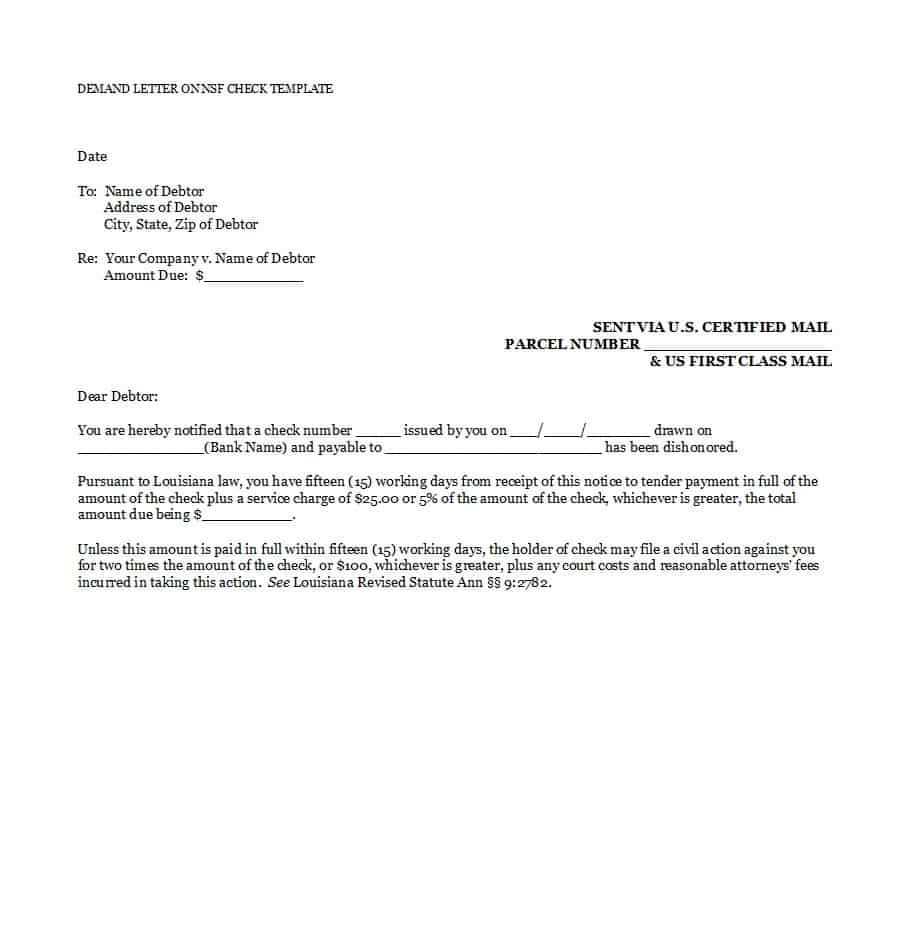

When writing a timely filing letter to the IRS, ensure clarity and conciseness while including all necessary details. Structure the letter professionally, focusing on the reason for the delay and any supporting information that justifies it.

1. Letter Structure

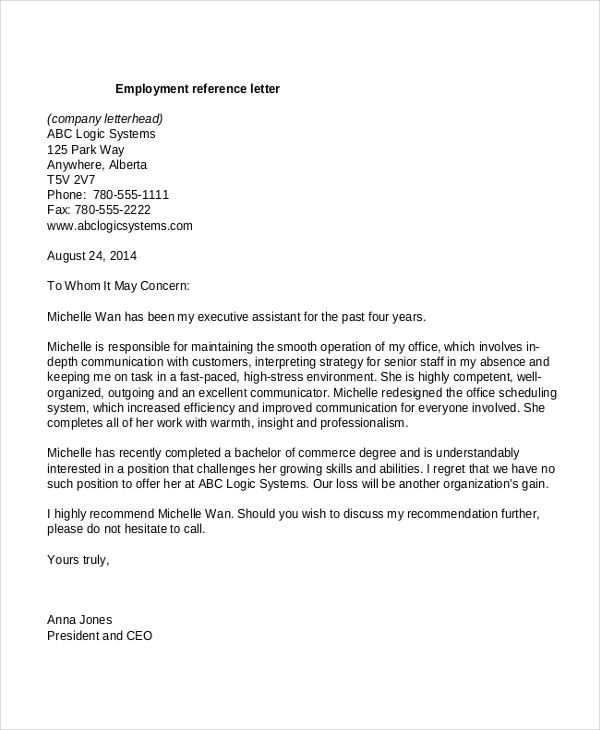

Begin with a formal salutation addressing the IRS. Use “To Whom It May Concern” if the recipient is unknown. Then, include your name, address, and contact information, followed by the IRS’s contact details if necessary. Use a subject line that directly relates to the issue, such as “Request for Timely Filing Consideration for Tax Year [Year].”

2. Provide an Explanation

Clearly state the reason for the late filing. Be specific, whether it’s due to personal issues, errors, or other factors. Ensure that you present factual, concise information without unnecessary elaboration. If you have documentation that supports your case, mention that it’s attached or available upon request.

End with a professional closing, thanking the IRS for their understanding and cooperation. Include your signature and any relevant tax identification number for clarity.

Key Information to Include in Your Filing Letter

To ensure your filing letter is complete and clear, include the following key details:

- Subject Line: Clearly state the purpose of your letter, such as “Request for Extension” or “Late Filing Explanation.” This helps the recipient understand the content at a glance.

- Your Contact Information: Include your name, address, and phone number. Make sure this is clearly visible at the top of the letter.

- Recipient’s Information: Include the name, title, and address of the person or department you are sending the letter to. Double-check the spelling and position to ensure accuracy.

- Reason for Delay: Provide a brief and specific explanation for the late filing. Whether it’s due to personal issues, technical difficulties, or unforeseen events, be clear about the cause.

- Filing Details: Mention what you are filing and include reference numbers if applicable. Clearly identify the documents or forms associated with the filing.

- Proposed Resolution: Offer a solution or plan of action. If you are requesting an extension or providing alternative steps, state them explicitly.

- Apology and Accountability: Acknowledge any inconvenience caused by the delay. A concise apology shows responsibility and professionalism.

- Signature: End with your signature and the date to finalize the letter. If you are sending it electronically, ensure you have a formal email signature with contact details.

One key mistake is neglecting to include accurate dates. A filing letter without proper date references can lead to confusion and delay in processing your request. Always verify the relevant dates and ensure they are clearly stated in the letter.

Another frequent error is vague or incomplete details about the document being filed. Without specific reference to the exact documents, it’s difficult for the recipient to process your request efficiently. Always include document titles, reference numbers, or any other identifiers that provide clear context.

Formatting Issues

Formatting mistakes can undermine the letter’s professionalism. Using inconsistent fonts, unclear headings, or failing to properly align the text makes the letter harder to read. Stick to a clean, professional format, with proper spacing and alignment to ensure readability.

Excessive Length or Unnecessary Information

Filing letters should be concise. Avoid adding irrelevant information or overly detailed explanations that distract from the main points. A short, to-the-point letter is more effective and ensures the recipient quickly grasps your message.

Proofreading and Grammar Errors

Typographical and grammar errors can diminish the letter’s credibility. Carefully proofread the letter before sending, focusing on punctuation, spelling, and sentence structure to ensure accuracy and professionalism.

Inadequate Salutations or Signatures

Skipping formal salutations or leaving out a proper signature is a common mistake. Always include a polite opening and closing, and ensure your signature is properly placed at the end of the letter.

| Common Mistakes | Impact | Solution |

|---|---|---|

| Incorrect or missing dates | Confusion and delay in processing | Verify dates and include clear references |

| Vague document details | Difficult for recipient to process | Provide specific titles and reference numbers |

| Poor formatting | Hard to read and unprofessional appearance | Use consistent formatting with proper alignment |

| Excessive length or irrelevant details | Distracts from the main point | Keep the letter brief and focused |

| Grammar and spelling errors | Reduces credibility | Proofread carefully before submission |

| Missing salutations or signatures | Lack of professionalism | Always include proper opening and closing |

Send your timely letter well before any relevant deadlines to avoid complications. Start by identifying the specific due date for the action you’re addressing. Most deadlines are set by law or contractual agreement and will be communicated in official documents. Missing these dates can result in your request or claim being dismissed, so be proactive in sending the letter.

If you’re dealing with a legal or administrative matter, make sure to allow sufficient time for mailing and potential delays. Sending a letter too close to the deadline may leave no room for unexpected issues, like postal delays or errors in processing. Consider using a tracking service or certified mail to ensure your letter is received on time.

For ongoing claims or recurring situations, such as tax filings or appeals, check for any grace periods or exceptions that might extend the deadline. Some jurisdictions allow a short extension if you can demonstrate good cause. In any case, sending your letter early is always better than risking a missed deadline.

Finally, double-check all requirements, including documentation or forms that may need to be included with the letter. Failing to include the proper paperwork could invalidate your request, regardless of when the letter is sent.

After sending your filing letter, ensure you track the delivery and confirmation of receipt. If you used a service with tracking, check the status regularly. If you haven’t received confirmation after a reasonable period, follow up with the recipient to verify they received it.

- Confirm the Filing: If possible, confirm that the filing has been accepted. Many organizations provide online systems where you can check the status of your filing. If not, contacting the relevant office directly might be necessary.

- Keep Documentation Organized: Save copies of all correspondence related to the filing, including the sent letter and any responses received. This will help you keep track of deadlines and any next steps required on your part.

- Monitor Deadlines: Stay aware of any time-sensitive actions that follow your filing. Mark key dates on your calendar, such as deadlines for responses or additional paperwork that may need to be submitted.

- Prepare for Next Steps: Once your filing is confirmed, review the next steps outlined by the recipient or governing body. Be proactive in completing any follow-up actions to ensure you stay on track.

- Follow Up If Necessary: If the filing requires action on the recipient’s part and the deadline is approaching without feedback, it’s a good practice to follow up. A polite reminder can keep things moving along smoothly.

By staying organized and vigilant, you can ensure that your filing is processed without unnecessary delays and that you’re prepared for what comes next.

So, the text remains clear, and repetitions are minimized.

Focus on clarity by organizing content logically. Begin with the main point and provide concise supporting details. Avoid repeating ideas; instead, present them once with enough context for understanding. Structure your sentences to flow smoothly, linking concepts without over-explaining. Eliminate redundant phrases that don’t add new value. Break up long paragraphs to maintain readability and prevent information overload.

Use direct and specific language, eliminating unnecessary filler words. Reiterate key points only when needed for emphasis, ensuring each repetition serves a purpose. Consider the reader’s perspective and aim for a straightforward, easy-to-follow style.