Travel insurance claim letter template

If you need to submit a travel insurance claim, having a well-structured letter can make the process much smoother. The key is clarity and providing all the necessary information without overwhelming the reader. Keep your letter concise but detailed enough to cover all required aspects of your claim.

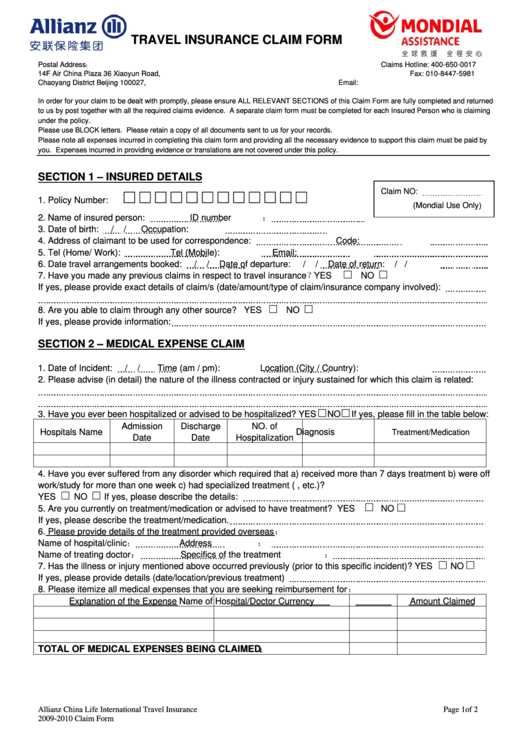

Start by including your policy number, personal details, and a clear description of the incident. Outline the circumstances leading up to the claim, including dates and locations, and attach any supporting documents like medical reports or receipts. Make sure your tone is polite and professional to ensure the insurer processes your claim without delays.

Address the relevant department directly and use formal language throughout the letter. Summarize your expectations, such as compensation or reimbursement, and end with a request for confirmation of receipt or additional steps if needed. A well-organized claim will help your insurance provider assess your case quickly.

Here’s the corrected version of the text with repetition removed:

Clearly state the purpose of your claim. Provide a concise explanation of the incident that led to the need for travel insurance, including dates and locations. Mention any medical treatment received or services used, if applicable, and attach supporting documents such as receipts or hospital records.

Claim Details

List the expenses you wish to claim. Include specific amounts and provide relevant evidence like invoices or itemized receipts. Make sure to mention whether these expenses were incurred before or after the event, and specify if they were related to emergency services, accommodations, or other necessary expenses covered by your policy.

Policy Information

Include your policy number and the type of coverage you have. Be clear about which sections of the policy you believe apply to your claim. If necessary, reference specific clauses or coverage terms to show how they relate to your situation.

Here’s a detailed HTML plan for an article on “Travel Insurance Claim Letter Template,” with six practical and focused subheadings:

Begin by organizing your claim letter into clear sections to ensure all relevant information is included. This structure will make your letter easy to follow and allow the insurance company to process your claim smoothly.

- Claimant Information: Clearly state your full name, address, contact details, policy number, and any other necessary identifying information. This section helps the insurance provider quickly locate your details in their system.

- Claim Details: Describe the incident that led to your claim. Include dates, locations, and a brief overview of what happened. If it’s a medical issue, provide a clear account of the circumstances leading to treatment or hospitalization.

- Documentation: List all the documents you are submitting with the letter, such as receipts, medical records, or photos. Reference each document clearly and ensure all required paperwork is included.

- Coverage Request: Be specific about the compensation or assistance you are requesting. State whether you are seeking reimbursement for medical expenses, lost luggage, or trip interruption. Mention any amounts if applicable.

- Policy Reference: Refer directly to the terms of your policy that cover the incident. Point out any clauses or coverage specifics that apply, ensuring the claims assessor understands the basis for your request.

- Closing Remarks: End the letter politely, expressing your hope for a swift resolution. Provide a contact number or email address in case the insurance provider needs further details or clarification.

Adhering to this structure will help ensure your claim letter is clear, complete, and well-organized, speeding up the process of your claim being reviewed and approved.

- How to Begin Your Claim Letter

To start your travel insurance claim letter, clearly state your policy number and the date of the incident. Include any reference numbers or claim IDs that the insurance company may have assigned you for easier tracking. Make sure these details are near the beginning, so the recipient can quickly identify your case.

Next, provide a brief but specific description of the situation that led to the claim. If possible, use exact dates and locations, and keep the explanation factual and concise. Avoid unnecessary details or unrelated information that may distract from the main issue.

Don’t forget to include your contact details. This ensures that the insurer can easily reach you for follow-up questions or additional information. Provide both an email address and phone number to ensure quick communication.

Provide your full name, address, and contact information at the top. This ensures the insurer can easily identify you and reach out if necessary. Include your policy number and claim reference number if you have them–these help link your claim to the correct account. Mention the date of the incident or the period during which it occurred, as well as a brief but clear description of what happened.

Describe the financial losses or damages in detail. If relevant, attach receipts, bills, or repair estimates to support your claim. Include any police or medical reports, if applicable. Keep the tone concise but direct, focusing on facts that will help the insurer assess your claim effectively. If you have witnesses or photos, mention them as well.

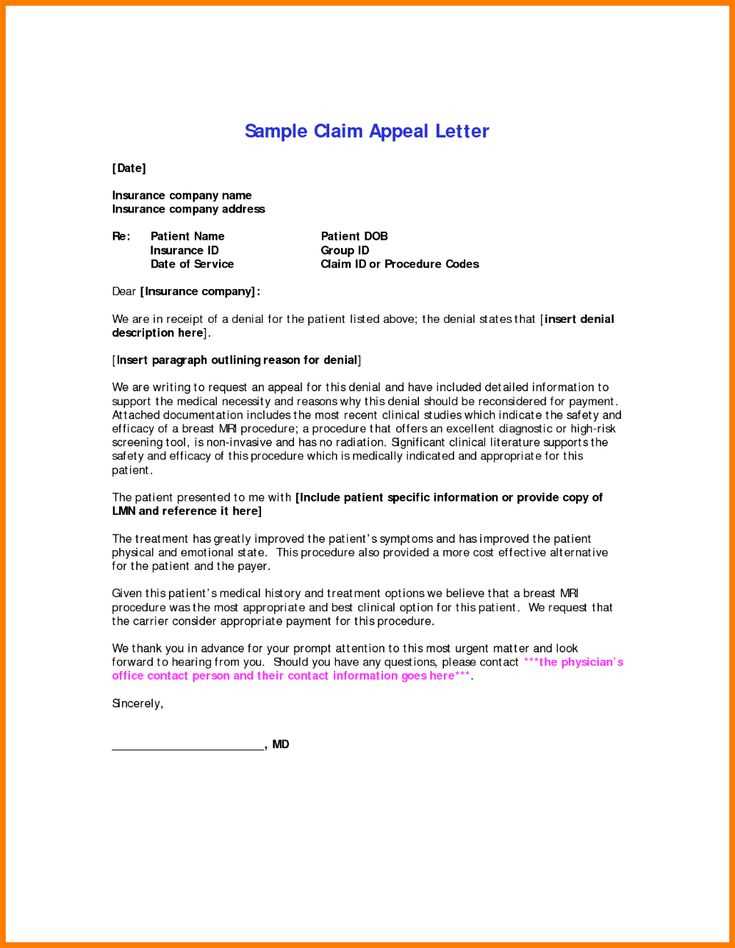

Conclude with a request for the specific compensation you’re seeking. Make sure to include any relevant policy terms that support your request. Always sign the letter at the bottom, as this adds formality and legitimacy to the process.

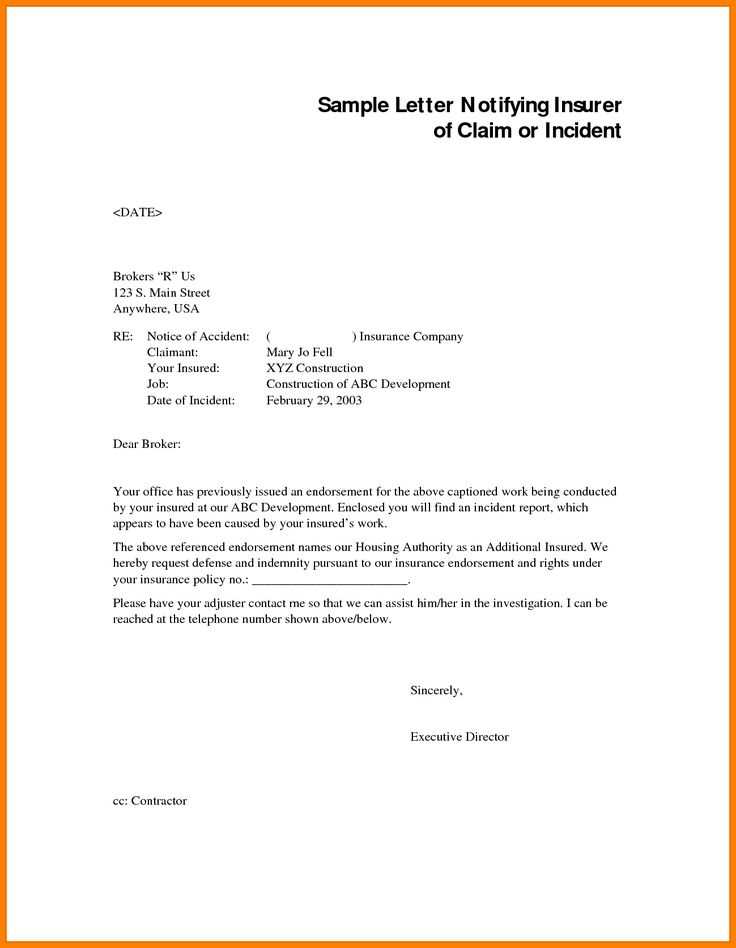

Make sure to address the insurance company by its official name as listed on your policy documents. Avoid using informal terms or abbreviations that could cause confusion. If you’re writing to a specific department, include the exact department name, such as “Claims Department” or “Customer Service Team.” This ensures your letter reaches the right people promptly.

If you know the name of the claims adjuster handling your case, address them directly. Write the full name and their title, such as “Mr. John Doe, Claims Adjuster,” to personalize the communication. This is a sign of professionalism and helps expedite the process. If you’re unsure of the recipient’s name, use a general salutation like “Dear Claims Manager” or “Dear Customer Service Team.”

Ensure you have the correct contact details for the insurance company. This can usually be found on your insurance card, their official website, or your policy documents. Double-check the address and email to avoid delays in correspondence.

| Recipient Type | Recommended Salutation |

|---|---|

| Claims Adjuster | Dear Mr./Ms. [Last Name] |

| Claims Department | Dear Claims Department |

| Customer Service | Dear Customer Service Team |

| General Inquiry | Dear Sir/Madam |

Inaccurate details will delay the process. Always double-check dates, policy numbers, and personal information. Mistakes, even minor ones, can lead to unnecessary complications.

Missing or Incomplete Documentation

Submitting an incomplete claim without supporting documents such as receipts, medical reports, or proof of loss will delay approval. Make sure you include all the required paperwork upfront to prevent unnecessary back-and-forth.

Vague Descriptions

Avoid being vague when explaining your incident. Detail what happened, when it happened, and how it fits within your coverage. A clear and specific account reduces the chance of misinterpretation.

Failing to follow the insurance company’s procedures can also cause problems. Stick to the required format and guidelines to avoid wasting time.

Attach clear copies of documents to back your claim. Ensure each document is legible and complete. Include receipts, invoices, medical reports, or police reports that are relevant to your situation.

Organize Your Documents

Arrange documents logically and label them for easy identification. Create a list of the files you are submitting and match them to the claim’s specific requirements. This will help the claims team review your materials faster.

Check File Formats and Sizes

Ensure your documents are in acceptable formats like PDF, JPEG, or PNG. Verify that the size of each file meets the submission guidelines to prevent errors when uploading or sending your claim.

By taking these steps, you can ensure that your supporting documents are well-prepared and will aid in the smooth processing of your claim.

Once you submit your claim letter, the first step is the acknowledgment from the insurance provider. They typically confirm receipt of your claim via email or mail within a few business days. This acknowledgment will include a claim reference number, which you can use to track the progress of your claim.

Review and Evaluation

After confirmation, the insurer will review your claim. Expect them to assess the documents you provided, including medical reports, receipts, and travel documents. This process may take anywhere from a few days to several weeks, depending on the complexity of your claim and the insurer’s workload.

Possible Follow-Up

If the insurer requires additional information to process your claim, they will contact you directly. Be prepared to provide extra documentation or clarification. Delays can occur if your claim lacks supporting evidence, so keep your records organized and ready for submission when requested.

Make sure you provide all necessary documents when submitting a claim. This includes proof of the incident, receipts, and a copy of your policy. Each insurance provider has different requirements, so check the policy details before you submit.

Clearly describe the incident that led to your claim. Include specific dates, times, and locations, along with a summary of what happened. Being precise helps avoid delays in processing your claim.

Attach any medical records or reports, if applicable, to strengthen your claim. These documents should be current and directly related to the incident.

Double-check your contact information to ensure the insurance company can reach you easily for any follow-up. Provide both an email and phone number where you can be reliably contacted.

Finally, keep copies of everything you send. This ensures you have a record of your claim in case of any disputes or requests for further information.