Printable donation receipt letter template

A clear and concise donation receipt letter is vital for maintaining transparency and trust with your donors. By providing them with a well-organized and easy-to-understand receipt, you help ensure proper documentation for their tax deductions and showcase your appreciation for their support. Using a printable donation receipt letter template makes this task simple and efficient.

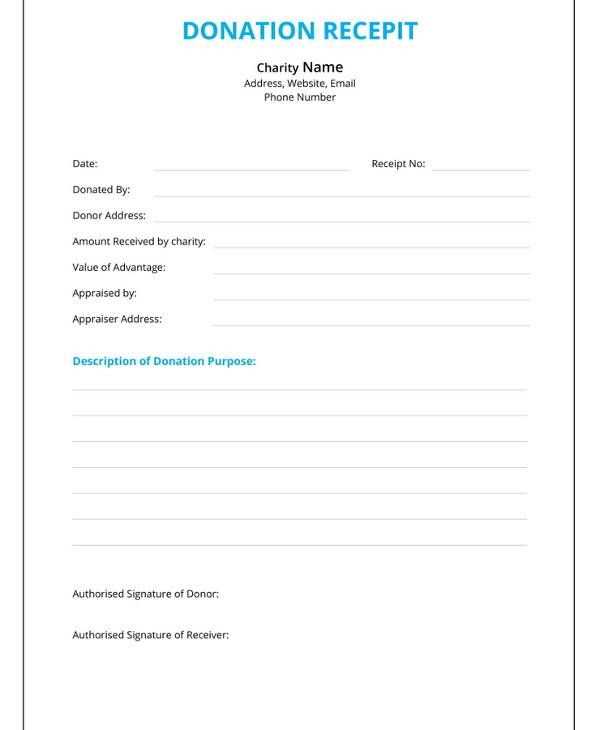

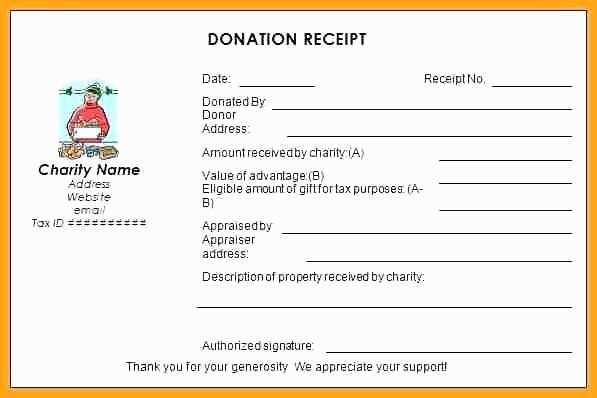

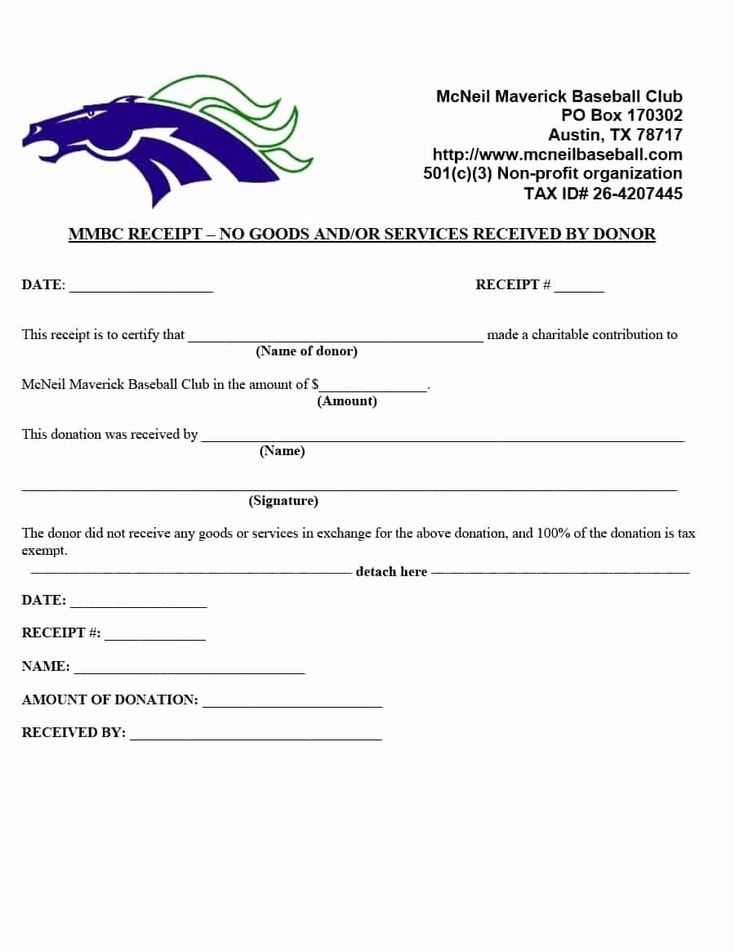

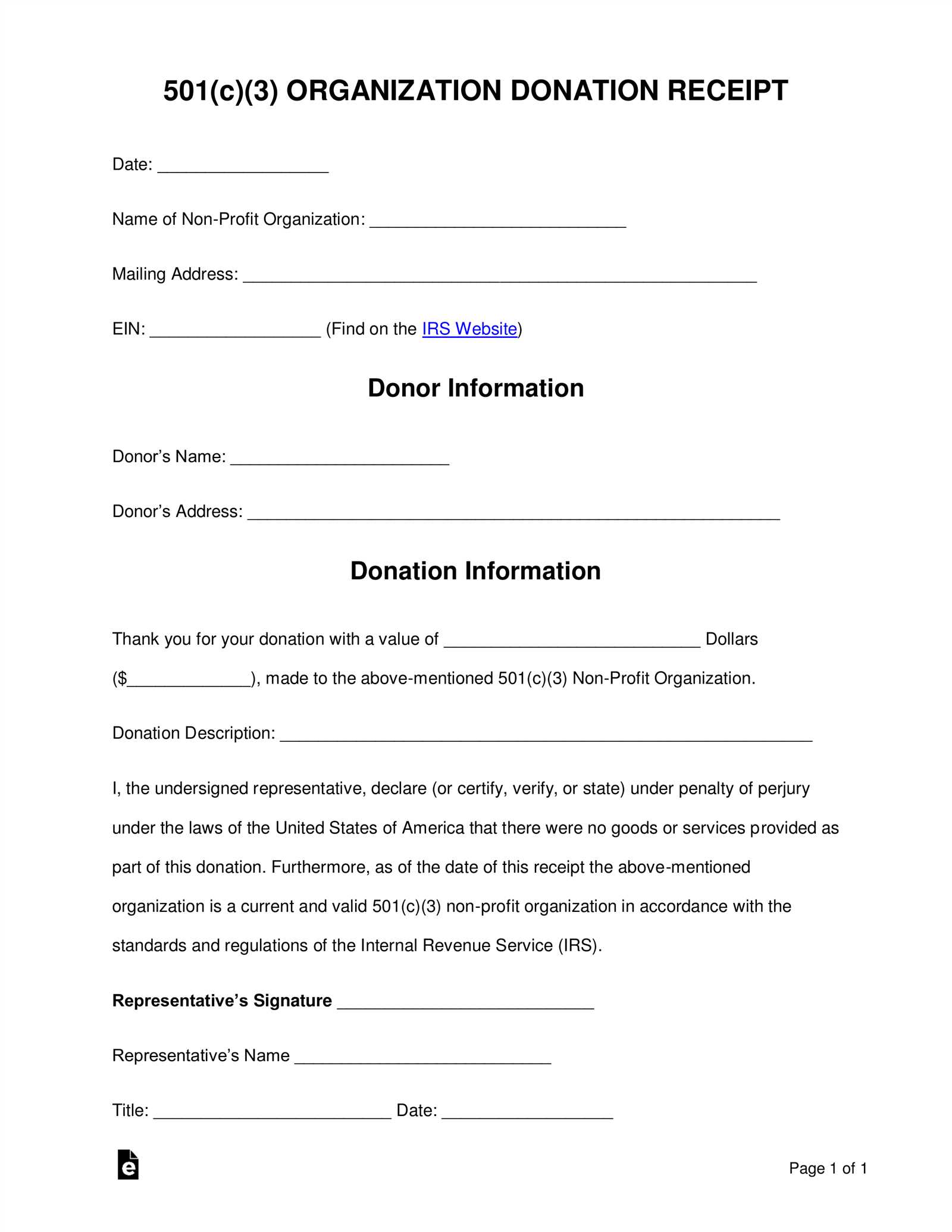

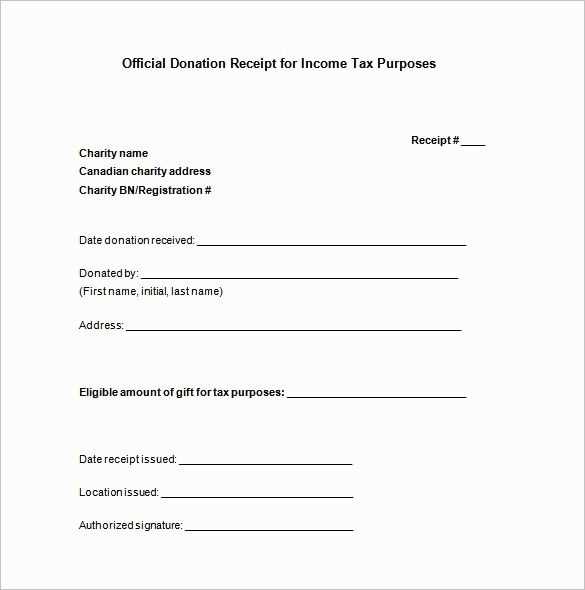

Your template should include key details like the donor’s name, donation amount, date of donation, and the charity’s tax-exempt status. Be sure to include a statement confirming the donor did not receive any goods or services in return for the contribution. This clarity protects both the donor and your organization in the event of an audit.

Customize your template to suit the specific needs of your nonprofit and make it personal to create a stronger connection with your supporters. After all, a well-designed letter can go a long way in reinforcing positive relationships with those who generously contribute to your cause.

Here are the revised lines with minimal repetition:

Use clear and concise language when stating donation amounts. Instead of saying “The total amount of your donation is one hundred dollars,” simply write “Your donation of $100 has been received.” This eliminates redundancy while still providing necessary information.

Ensure that you thank the donor in a meaningful way. Replace generic phrases like “Thank you for your generous contribution” with more personal expressions, such as “We truly appreciate your support of our cause.” Personalization helps the donor feel valued.

Avoid repeating the purpose of the donation multiple times. Instead of restating it in every section, mention it once clearly and refer back to it when needed. For instance, “Your donation will directly support our educational programs” is sufficient without repeating it in every paragraph.

When referring to the receipt, keep it simple. Instead of saying “You will receive a receipt for your generous donation shortly,” try “A donation receipt will be emailed to you shortly.” This keeps the sentence direct and free from unnecessary repetition.

Use bullet points to list the donation details instead of repeating them in long sentences. For example:

- Donation Amount: $100

- Date of Donation: January 29, 2025

- Purpose: Supporting educational initiatives

Keep the tone appreciative but focused. Eliminate fluff like “We hope you enjoyed making this contribution,” and instead say, “Thank you for supporting our mission.” It’s direct and still conveys gratitude.

- Printable Donation Receipt Letter Template

When crafting a donation receipt letter, clarity is key. A concise, well-structured letter not only ensures transparency but also helps the donor with tax deductions. Here’s a streamlined approach for creating a printable donation receipt template.

Key Elements to Include

Make sure your donation receipt includes the following details:

| Element | Description |

|---|---|

| Organization Name | Clearly state your organization’s full name, including the legal name if applicable. |

| Donor’s Name | Provide the donor’s full name as it appears in the donation records. |

| Date of Donation | Include the exact date when the donation was made. |

| Amount or Description of Donation | If it’s a monetary donation, list the amount. If it’s in-kind, describe the donated items. |

| Nonprofit Status | Indicate that your organization is a tax-exempt nonprofit (if applicable), including the IRS tax ID number. |

| Thank You Note | Express gratitude for the donor’s contribution to your cause. |

Formatting Tips

Ensure the receipt is clean and easy to read. Use standard fonts like Arial or Times New Roman in a legible size (10–12 pt). Avoid heavy formatting, as it can distract from the essential details. Keep the layout organized, with clear headings for each section, and make it easily printable on standard letter-size paper (8.5″ x 11″).

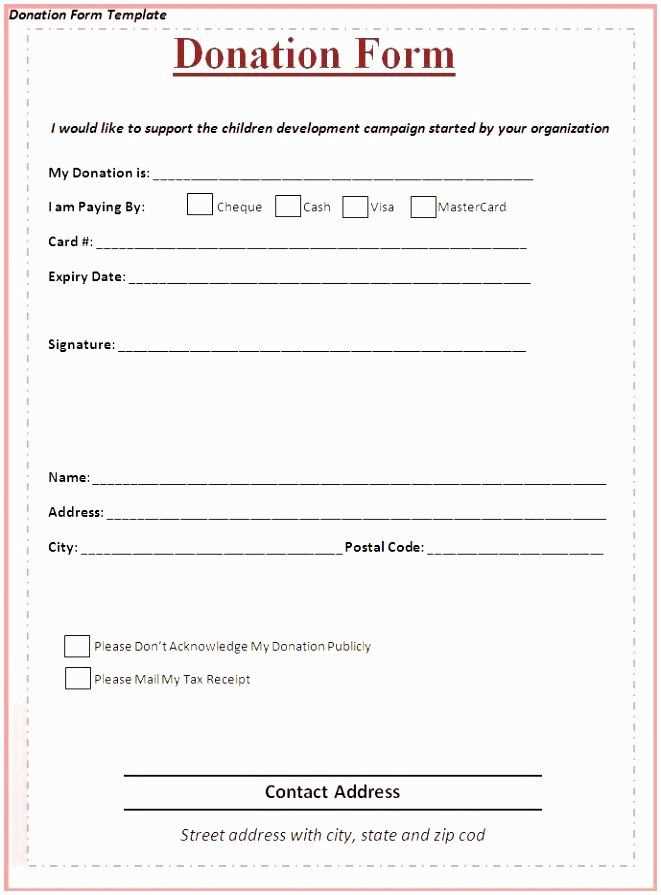

Personalize your donation receipt letter by including the donor’s full name, donation date, and the amount given. Ensure the letter is specific to the type of donation–whether cash, goods, or services–so that it is clear and accurate. For monetary donations, clearly state the amount donated and, if applicable, the payment method.

Add Your Organization’s Details

Position your organization’s name, address, phone number, and website at the top of the letter for easy reference. This establishes credibility and helps the donor identify the receipt as coming from your organization. Make sure this information is up-to-date to avoid any confusion.

Include a Tax Deductibility Statement

Include a statement regarding the tax-deductibility of the donation. This is particularly important for donors who may wish to use the receipt for tax purposes. A simple phrase such as “No goods or services were provided in exchange for this donation” will suffice, or provide the relevant details if the donor received something in return.

Make sure your donation receipt contains these key elements to ensure clarity and compliance:

- Organization’s Name and Contact Details: Clearly list your nonprofit’s name, address, phone number, and email. This helps the donor verify where the donation was made.

- Date of Donation: Include the exact date the donation was received, which is essential for tax purposes.

- Donor’s Name: Mention the donor’s full name or organization name to avoid confusion and to keep records accurate.

- Amount of Donation: Specify the exact amount given. If the donation is a non-monetary item, provide a brief description and estimated value.

- Donation Type: Indicate whether the donation was cash, check, or in-kind. This ensures clarity in how the donor gave.

- Tax Deductibility Statement: Include a note stating that no goods or services were provided in exchange for the donation, confirming its tax-deductible status.

- Receipt Number: Assign a unique number to each receipt for easy tracking and reference.

- Signature (optional): Although not always necessary, including a signature can add a personal touch and show the donation was officially processed.

By including these details, you can create a clear, professional receipt that meets both the donor’s needs and legal requirements.

Make sure the letter is clear, concise, and professionally formatted. Start with a personalized greeting to the donor, using their full name. This shows attention to detail and appreciation for their contribution. Follow with a clear description of the donation, including the date and amount. Always use easy-to-read fonts and ensure sufficient spacing between paragraphs to enhance readability.

Key Elements to Include

| Section | Details |

|---|---|

| Donor Information | Address the donor by name, and include their contact information at the top of the letter. |

| Donation Details | Clearly state the amount donated, whether it was a one-time gift or recurring donation. |

| Organization Information | Provide the organization’s name, address, and a brief description of its mission. |

| Tax Deductibility | Include a statement confirming the donation is tax-deductible, including any necessary IRS reference numbers. |

| Thank You Message | Express sincere gratitude for the donor’s support and emphasize the positive impact of their contribution. |

Layout Tips

Maintain a clean layout with a clear hierarchy of information. Use bullet points or numbered lists when appropriate for easy scanning. Ensure there’s enough white space, particularly around the main content, to avoid a cluttered look. For longer letters, break up text into smaller paragraphs to keep the reader’s attention.

Ensure the donation amount is accurately recorded. Double-check figures to avoid discrepancies. A small error can affect the trustworthiness of your receipt.

Always include the donor’s full name. Omitting or misspelling it can lead to confusion and invalidate the receipt. Accuracy here is non-negotiable.

Don’t forget to list the date of the donation. A missing date leaves a gap that may complicate tax filing or record keeping. This is critical information for both parties.

Clarify whether the donation was monetary or in-kind. Failing to specify could cause problems later, especially when it comes to valuation for tax purposes.

Include the correct legal language regarding the tax deductibility of the donation. Without this, the receipt may not serve its intended purpose for tax deductions.

Be sure to include the name and contact details of your organization. A generic or incomplete organization name may lead to complications for donors needing to verify their donation.

Keep the receipt format consistent. A disorganized or inconsistent receipt may confuse the donor, making it difficult for them to use it properly.

Don’t forget the receipt’s signature if required. A lack of an authorized signature can make the document invalid for official use.

Generating and printing a donation receipt letter online is straightforward. Follow these steps to create and print a professional receipt quickly:

1. Use a Donation Receipt Template

- Search for a customizable donation receipt template. Many free online tools offer templates specifically for non-profit donations.

- Choose one that includes all necessary fields: donor’s name, date, donation amount, organization details, and any tax-exempt status.

- Ensure the template is in a downloadable format like PDF or Word to ensure it’s easy to print and share.

2. Fill in the Information

- Input the donor’s details, including the amount donated, donation method, and any other relevant notes.

- Double-check the organization’s tax ID number and official contact information to ensure accuracy.

- Ensure you personalize the letter with a thank-you message to acknowledge the donor’s support.

3. Review and Customize

- Before printing, review all fields to confirm they are filled out correctly and completely.

- Make any custom adjustments to match your organization’s tone and style.

4. Download and Print

- Once satisfied with the information, download the letter in PDF format for easy printing.

- Open the downloaded file and select the print option on your device.

- Ensure your printer settings are correct, and print the receipt on your letterhead or in a standard format for distribution.

With these steps, you can create a donation receipt letter in no time, ensuring your donors receive their acknowledgment letter quickly and efficiently.

Make sure your donation receipts comply with tax regulations to provide donors with proper documentation for tax deductions. According to the IRS, receipts for donations exceeding $250 must include specific details like the amount donated, a description of the donated items, and a statement that no goods or services were provided in exchange for the contribution. For donations under $250, a receipt with a simple acknowledgment of the gift suffices.

Include the donor’s name, the date of the donation, and the nonprofit’s name and address on every receipt. If a donor received goods or services in exchange for their contribution, provide a description of those goods or services along with their estimated fair market value. For non-cash donations, a description of the items and their condition should be noted.

Failure to meet these requirements could prevent donors from claiming tax deductions, so ensuring the receipt contains all necessary information is critical. The IRS also requires that receipts be issued in a timely manner, ideally by the end of the tax year.

Ensure that your donation receipt clearly outlines the donation amount, date, and donor details. Provide a straightforward summary of the transaction without unnecessary embellishments. Use clean formatting with distinct sections for easy readability.

List the organization’s name, tax identification number, and mission statement. This will help both the donor and tax authorities verify the legitimacy of the donation. Include a brief statement confirming whether the donation is tax-deductible. Acknowledge the type of donation–cash, goods, or services–to ensure clarity for both parties.

In the footer, add a polite thank-you note for the donor’s contribution. A simple, heartfelt message is appreciated and can help build long-term relationships with supporters. Keep the design professional and easy to print or save for the donor’s records.