Free 609 Credit Dispute Letter Templates PDF Download

If you’re looking to challenge inaccurate information on your financial report, there are simple ways to take action. Using specific documents designed to address errors can help you initiate the correction process smoothly. These resources are crafted to guide you through the formal procedure of requesting a reevaluation of any discrepancies that could be affecting your score.

Accessing ready-made resources is an efficient way to avoid unnecessary delays and confusion. With just a few steps, you can begin the process of requesting modifications without needing professional assistance. These resources are available in easily accessible formats, making them ideal for quick use.

In this article, you’ll learn how to navigate these tools and understand their importance in improving your financial health. We’ll cover how to use these resources effectively and avoid common pitfalls, empowering you to take control of your financial future.

What Is a 609 Credit Dispute Letter

This tool is a formal document used to address errors on your financial history. It serves as a means to request a reevaluation of incorrect details that may be negatively impacting your financial standing. By submitting this type of request, you challenge inaccurate or outdated information that should not be on your record.

Purpose and Importance

The primary purpose of this document is to empower individuals to take action against inaccuracies. Often, information on financial reports can be misleading or even incorrect, and this method provides a straightforward way to ensure that only accurate data is considered when evaluating your financial health.

How It Works

The process involves clearly stating the issues found in your file, with supporting evidence to back your claims. Once submitted, the responsible parties are required to investigate and correct any inaccuracies. This simple yet effective approach can help improve your overall financial profile and protect you from potential harm caused by false information.

How 609 Letters Can Improve Credit Scores

By addressing any inaccuracies, the process can provide several benefits:

- Improved Financial Health: Correcting errors can directly boost your standing, making you more attractive to lenders.

- Better Loan Terms: A higher score can help you secure better rates and lower monthly payments.

- Enhanced Opportunities: A positive profile opens doors to a broader range of financial products.

By using formal requests to clear up inaccuracies, you are ensuring that only correct information is considered in future evaluations, ultimately helping you maintain or increase your financial well-being.

Where to Find Free Templates Online

Many websites offer downloadable resources to help with formal requests aimed at correcting mistakes on financial reports. These resources can be found through a simple online search, making them easily accessible for anyone looking to take action. Most of these websites provide tools in a convenient format, ready for immediate use.

Some of the best places to find such resources include:

- Official Financial Websites: Many government and nonprofit organizations offer resources for those seeking to improve their financial records.

- Dedicated Legal Sites: These sites often provide specific documents designed for financial corrections, with clear instructions on how to use them.

- Online Document Repositories: Several websites host a collection of various forms, including those aimed at resolving financial inaccuracies.

With just a few clicks, you can download these ready-to-use forms, ensuring that you have everything you need to begin the process of improving your financial profile.

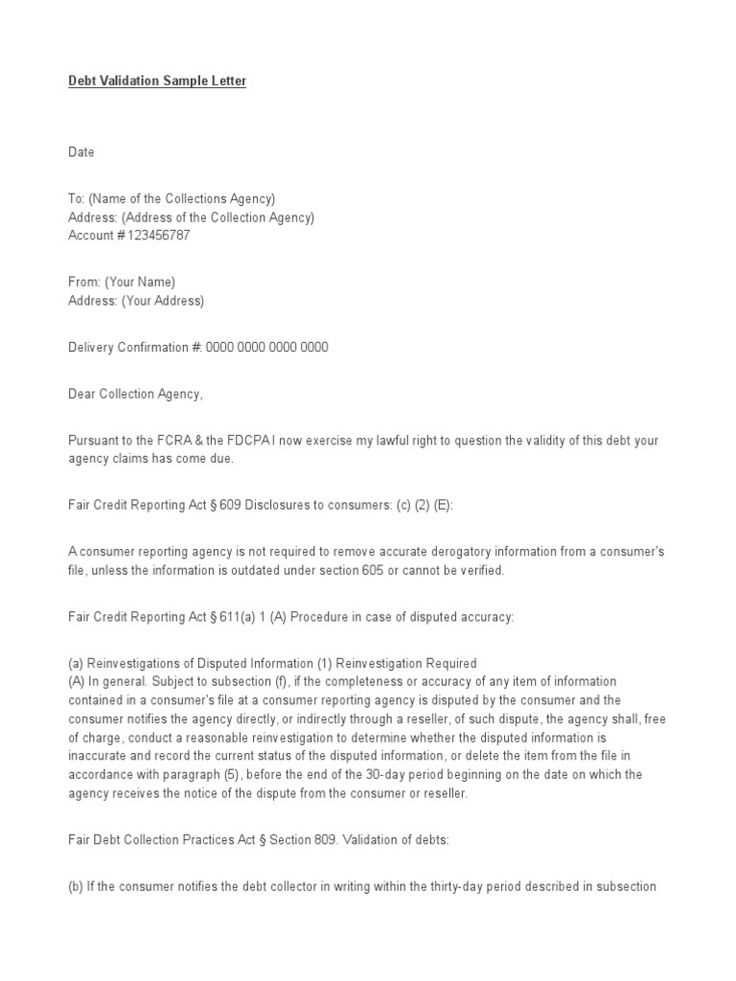

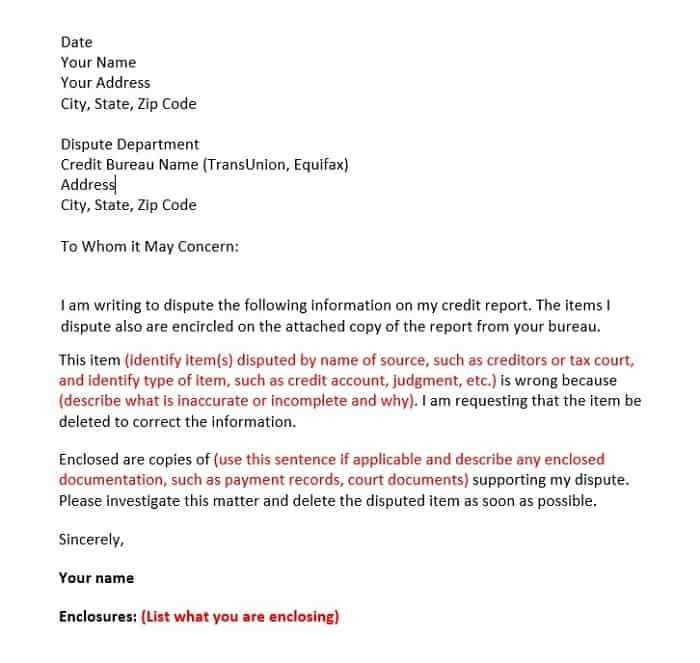

Steps to Write Your Own 609 Letter

Writing your own formal request to correct inaccuracies in your financial report can be a straightforward process if you follow a few key steps. This approach allows you to take control of your financial future and address any errors that may be negatively impacting your score.

Here’s a step-by-step guide to creating a formal request:

- Identify the Errors: Carefully review your financial record to pinpoint any discrepancies or incorrect entries. Make sure you have all the relevant details about the issues you wish to address.

- Gather Supporting Documentation: Collect any evidence that supports your claims. This could include account statements, receipts, or any other records that prove the inaccuracies.

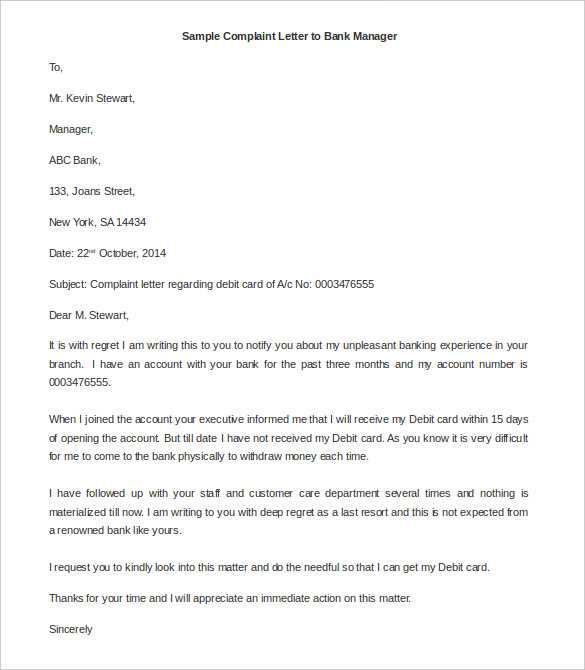

- Write a Clear Request: Clearly state the incorrect information, your reasons for disputing it, and request a correction. Be precise and to the point, outlining the specific errors and how they should be amended.

- Include Your Contact Information: Ensure that your full name, address, and other relevant personal details are included so the recipient can easily identify and respond to your request.

- Follow the Proper Format: Make sure your document is properly structured, including a professional tone and clear organization. This will help ensure your request is taken seriously.

By following these steps, you can create a formal request that effectively communicates your concerns and helps correct any inaccuracies on your financial record.

Common Mistakes to Avoid in Disputes

When challenging inaccurate information in your financial records, it’s important to avoid certain mistakes that could hinder your chances of success. Even small errors in the process can delay or prevent corrections, so it’s crucial to approach the task with care and attention to detail.

Some of the most common pitfalls include:

- Incomplete Information: Failing to provide all necessary details or documentation can lead to your request being dismissed. Ensure that every issue is clearly explained and supported by relevant evidence.

- Vague or Ambiguous Claims: Be specific about the errors you’re addressing. General statements are less likely to be taken seriously, so clearly identify each discrepancy and its impact on your financial profile.

- Incorrect Contact Information: Always include up-to-date contact details to ensure your request can be processed efficiently. Missing or incorrect contact information may cause delays in communication.

- Failure to Follow Proper Procedures: Make sure you understand and follow the correct steps for submitting your request. Ignoring official guidelines can result in your request being ignored or rejected.

- Emotional Language: While it’s natural to feel frustrated when dealing with errors, avoid using emotional or accusatory language in your request. Stick to the facts and maintain a professional tone.

By avoiding these common mistakes, you can ensure that your request is processed smoothly and increase the likelihood of a favorable outcome.

Benefits of Using PDF Templates for Disputes

Using digital resources to address inaccuracies in your financial records offers numerous advantages. The structured format of these resources ensures that your request is clear, organized, and professionally presented, making it easier for the recipient to process. Additionally, using standardized forms helps avoid common mistakes and reduces the time needed to prepare the necessary documents.

Here are some key benefits of utilizing digital resources for these types of requests:

| Benefit | Description |

|---|---|

| Convenience | The ability to download and complete forms directly from your device makes the process quick and easy, eliminating the need for physical paperwork. |

| Consistency | Using pre-designed forms ensures that all the required information is included, reducing the risk of omitting critical details that may delay the process. |

| Accuracy | Standardized formats minimize human error and ensure that your request is presented in the most efficient and professional way possible. |

| Easy Submission | Completed forms can be easily submitted online or printed for mailing, streamlining the process and saving you time. |

Incorporating digital resources into your process helps ensure a smooth, efficient, and effective resolution when correcting financial inaccuracies.