htmlEditCredit Reference Letter Template Guide

htmlEdit

When it comes to securing loans, renting properties, or obtaining various financial services, having a solid recommendation can make a significant difference. This written endorsement serves as a crucial element in proving one’s trustworthiness and reliability. Whether you’re the one writing or requesting such a document, knowing the right approach is essential for making a positive impression.

Understanding the Purpose of this document is the first step. It acts as a formal statement vouching for someone’s financial credibility, typically provided by an individual with knowledge of the person’s financial habits and history. A well-composed statement can build confidence in potential lenders, landlords, or business partners.

There are several key components that should be included to ensure effectiveness and clarity. These elements help convey important details in a way that reflects both professionalism and personal insight. By following some basic guidelines, you can create a document that stands out and fulfills its intended purpose.

htmlEdit

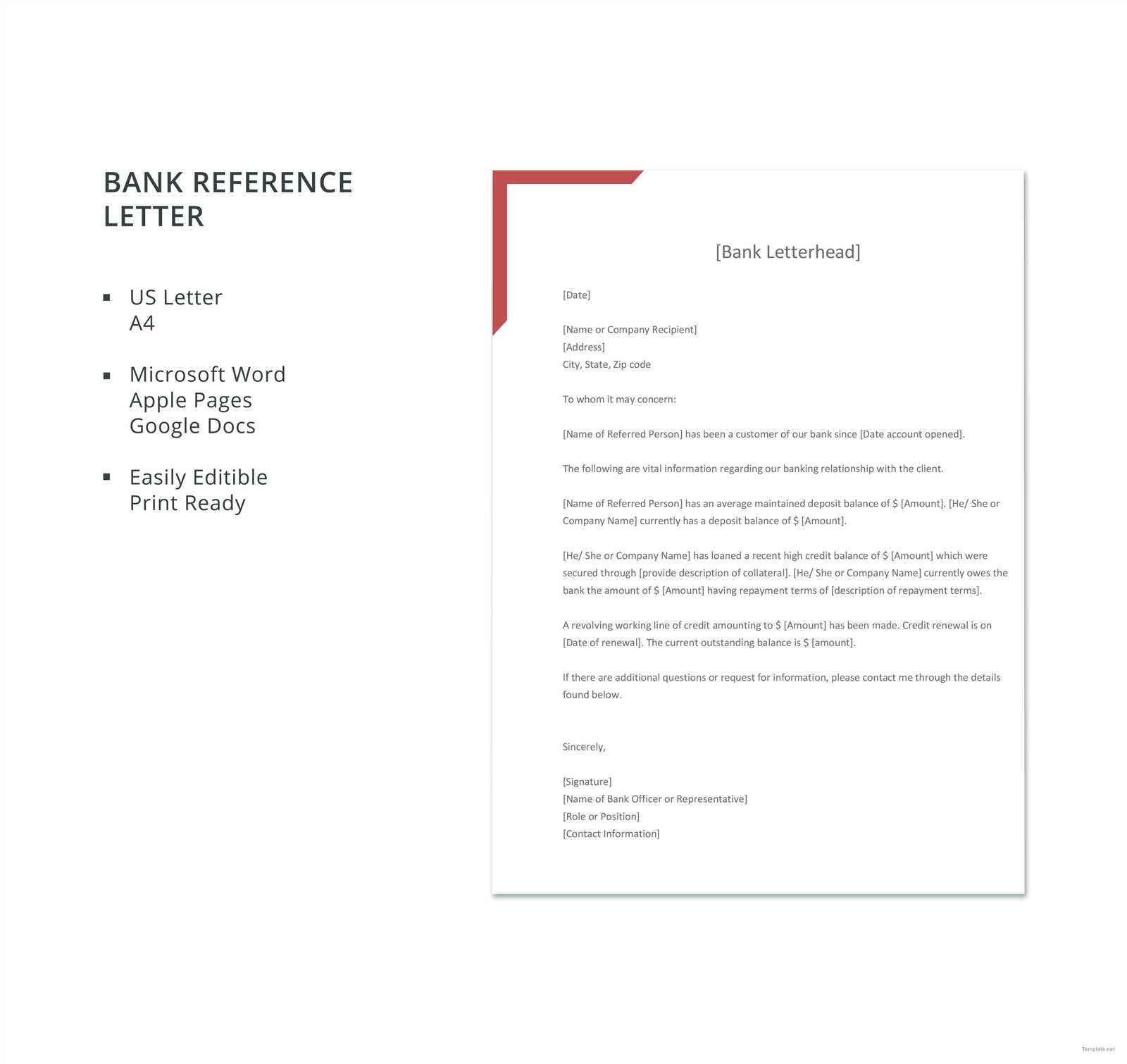

What is a Financial Endorsement Document

In the financial world, certain documents serve to demonstrate a person’s trustworthiness and ability to meet obligations. These written endorsements are typically provided by individuals who can speak to a person’s reliability in managing their financial affairs. Whether for securing loans or renting properties, this kind of endorsement plays a pivotal role in building confidence with potential lenders or landlords.

Purpose of a Financial Endorsement

At its core, this document is intended to validate someone’s financial responsibility. It provides an objective view from an informed source about an individual’s past financial behavior, often focusing on their ability to repay debts, manage expenses, and maintain a good standing with creditors. The value of such a document lies in its ability to offer insight into a person’s financial character.

Key Features of an Effective Endorsement

To make the most impact, a strong endorsement should include relevant details such as the individual’s payment history, reliability, and overall financial conduct. The tone should be professional, and the information should be presented clearly to help the reader make an informed decision. A well-crafted statement can significantly enhance one’s chances of success in financial dealings.

htmlEdit

Why You Need a Financial Endorsement

When pursuing financial opportunities, whether it’s a loan or renting property, having a solid endorsement can play a vital role. This type of document reassures potential partners or institutions of your financial reliability, helping to pave the way for a successful transaction. It serves as a guarantee that you are capable of fulfilling obligations, offering proof of your trustworthiness.

Building Trust is the primary reason for obtaining such an endorsement. By including specific details about your financial habits, such a document can demonstrate that you are a responsible individual, capable of managing your finances. It gives others the confidence to engage with you in financial dealings.

Moreover, having a well-written endorsement can provide an advantage in competitive situations, where proving your reliability could make the difference between approval or denial. It is an essential tool for establishing credibility in your financial matters.

htmlEdit

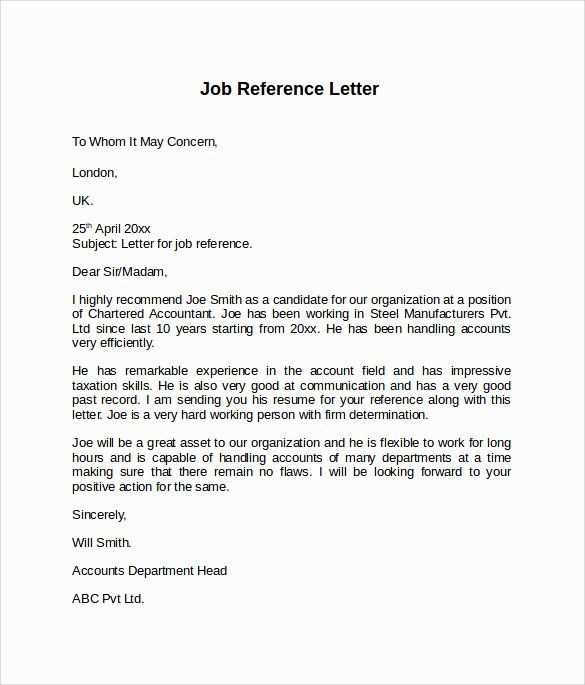

How to Write a Financial Endorsement

Creating an effective endorsement involves providing clear and relevant information that highlights an individual’s ability to manage financial responsibilities. The goal is to offer a truthful representation of their reliability and to assist them in securing the opportunities they seek. The document should reflect professionalism while ensuring that all necessary details are included.

Start with Basic Information by identifying the individual and the purpose for which the endorsement is being written. This sets the context for the reader and establishes the relevance of the information. Be sure to mention how you know the individual and for how long you have been aware of their financial behavior.

Provide Specific Examples of the person’s financial conduct, such as their punctuality in payments, ability to manage credit, and overall trustworthiness. These details add credibility to the endorsement and paint a clear picture of the individual’s financial habits.

htmlEdit

Key Elements in a Financial Endorsement

When drafting an effective financial endorsement, it is essential to include specific details that present a clear and accurate representation of an individual’s financial behavior. The goal is to build trust with the reader and provide valuable insight into the person’s ability to meet financial commitments. Certain key components should always be addressed to ensure the document serves its intended purpose.

Introduction should clearly identify the person being endorsed and the purpose of the statement. Providing context about how you know the individual and your relationship with them establishes credibility and trust from the outset.

Details of Financial Behavior are crucial to make the endorsement meaningful. This section should include examples of the individual’s ability to handle financial matters, such as promptness in payments, managing debts responsibly, and maintaining a good reputation in financial dealings.

Conclusion should reiterate the individual’s qualifications, emphasizing their reliability and trustworthiness. This reinforces the key points made earlier and encourages the reader to consider the individual positively for the opportunity they are pursuing.

htmlEdit

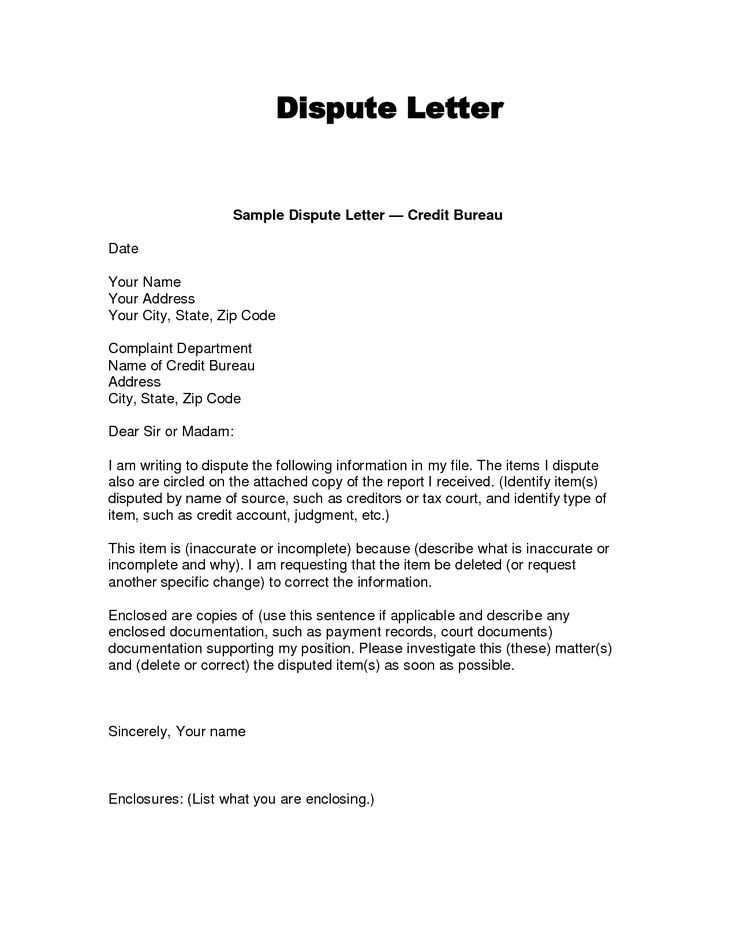

Common Mistakes to Avoid in Financial Endorsements

When crafting a financial endorsement, certain errors can undermine the effectiveness of the document. Failing to address key aspects or presenting misleading information can cause the recipient to doubt the reliability of the endorsement. To ensure that the statement serves its intended purpose, it’s important to be mindful of common mistakes.

Overly Vague Statements

One of the most frequent issues is being too vague. General phrases such as “I think they are responsible” or “They are usually good with money” fail to provide concrete examples that demonstrate financial trustworthiness. Specific details about how the individual manages their finances are much more effective in establishing credibility.

Failure to Tailor the Endorsement

Another common mistake is using a one-size-fits-all approach. A generic statement that doesn’t take into account the individual’s unique situation or the purpose of the endorsement may not resonate with the reader. Customizing the content to reflect the individual’s strengths and the opportunity they are pursuing adds value and increases the likelihood of a positive outcome.

htmlEdit

Tips for Customizing Your Endorsement

Tailoring a financial endorsement is essential to make it more effective and relevant to the individual’s needs. A customized statement not only highlights the person’s strengths but also aligns with the purpose of the endorsement, increasing its chances of success. Personalizing the document helps it stand out and creates a stronger impression.

Understand the Purpose

Before drafting the endorsement, it’s important to understand the specific reason for it. This helps in addressing the right aspects of the individual’s financial behavior. Whether the endorsement is for a loan, rental agreement, or business partnership, focusing on relevant strengths will make the document more persuasive.

Incorporate Specific Examples

Instead of making broad statements, provide clear, specific examples of the person’s financial habits and behavior. These examples should relate directly to the person’s ability to manage money, pay bills on time, or meet other financial obligations.

- Detail instances of timely payments

- Include examples of financial responsibility

- Highlight successful financial transactions or agreements

By using specific and personal examples, you add authenticity to the endorsement, making it more compelling to the reader.