Bank loan request letter template

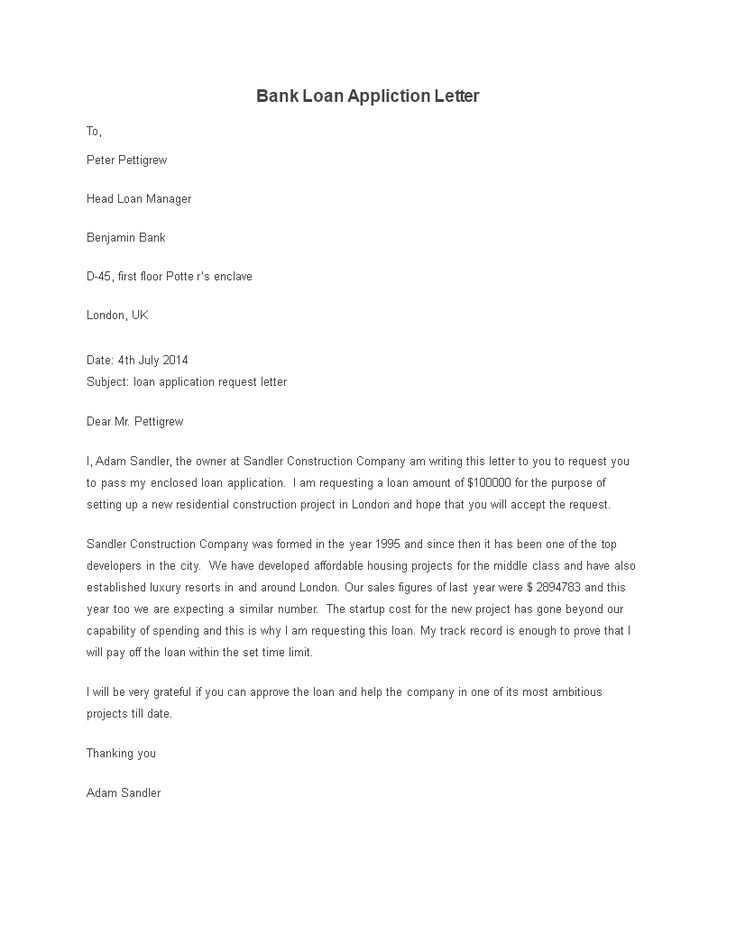

Writing a bank loan request letter requires clarity and precision. Start by stating the purpose of the loan and the specific amount needed. Be concise and direct, ensuring the reader understands your intentions right away.

Provide essential details about your business or personal finances. Explain why you need the loan and how you plan to use the funds. If applicable, include information about your repayment plan and any collateral you’re offering to secure the loan.

Make sure to express gratitude for the bank’s time and consideration. A polite, professional tone can help establish trust and confidence in your request.

Here’s the revised version with minimal repetition:

Start with a clear subject line that directly states the purpose of the letter. For example, “Request for Business Loan – [Your Company Name].” This will help the recipient identify the nature of the request quickly.

Loan Request Content

Open with a polite introduction, including your name, company name (if applicable), and your intent to apply for a loan. Specify the loan amount you are requesting and briefly explain the reason for it.

Clearly outline the amount you need, how you plan to use it, and any supporting financial details. If relevant, mention your business’s history, any successful projects, and your repayment capacity. The more concrete and focused the details, the better it will be understood.

Concluding the Letter

Close the letter with a polite invitation for further discussion, stating that you are available for a meeting or call to provide more details. Thank the recipient for their time and consideration.

End with a professional sign-off such as “Sincerely” or “Best regards,” followed by your name, contact information, and position (if applicable).

- Bank Loan Request Letter Template

When writing a bank loan request letter, be clear and direct. Ensure that all required details are provided so the bank can easily assess your application. Begin with your contact information, followed by the date and the bank’s details. Make sure to mention the specific loan amount you’re requesting and the purpose of the loan.

Loan Request Structure

Start with a formal salutation, addressing the loan officer or the relevant bank representative by name if possible. Introduce yourself briefly, specifying your account number or any other identifier, and describe the purpose of the loan request. Include the amount needed and explain why it’s necessary, linking it to your financial situation or a specific project.

For example, you might state, “I am seeking a loan of $15,000 to expand my business operations. This amount will cover the purchase of new equipment and improve my cash flow.” Next, provide a concise repayment plan and any collateral you can offer. Conclude by expressing appreciation for their consideration and request a follow-up meeting or call to discuss further details.

Additional Tips

Stay professional and concise. Avoid unnecessary details, but be specific about the loan’s purpose and how it will benefit you. Highlight any strengths that could improve your chances, such as a strong credit history, steady income, or successful past projects.

End your letter with a formal closing and your signature. Double-check for any typos or errors, as this reflects your professionalism and attention to detail.

Look for a bank that aligns with your financial goals and offers loan terms that suit your needs. Begin by comparing interest rates across different banks. A slight difference in rates can significantly affect your monthly payments over time. Additionally, evaluate the bank’s loan approval process–how long does it take, and what documentation is required?

Consider the bank’s customer service reputation. A bank with strong support can make your application process smoother and provide assistance if you encounter any issues. Look for reviews or ask for recommendations from others who have experience with loan applications at specific banks.

Assess the flexibility of repayment terms. Some banks offer more adaptable options, such as flexible payment schedules or early repayment without penalties. Also, take note of any hidden fees or additional charges, like processing fees or prepayment penalties, which can impact the total cost of your loan.

If possible, choose a bank where you already have an existing relationship. Being an existing customer may give you a better chance of securing favorable terms, as banks often prioritize their loyal clients.

Lastly, compare additional features like loan insurance, loan extensions, or customer loyalty programs. While these may not be a top priority, they can add extra value depending on your circumstances.

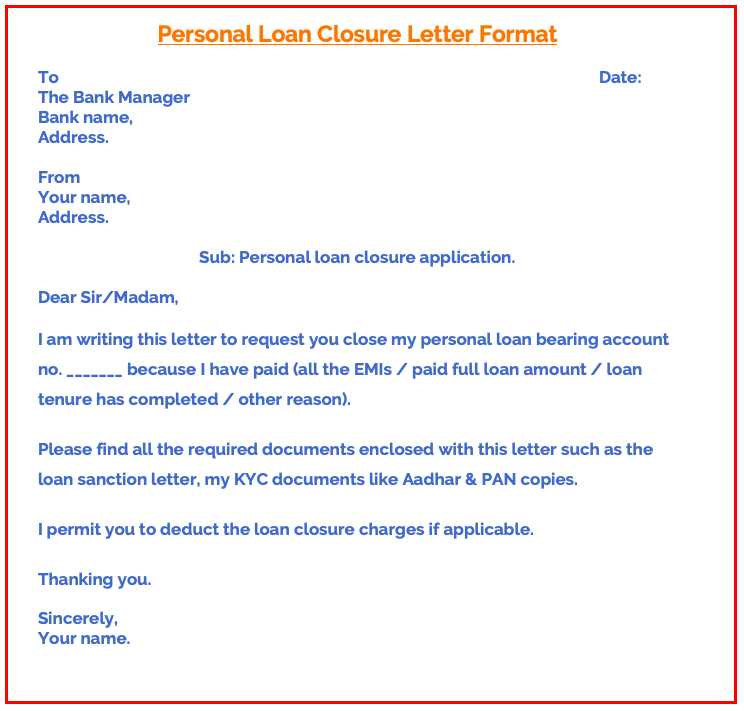

Begin with a clear and concise subject line. Mention the loan amount and the purpose right away to ensure the recipient knows the intent of the letter immediately.

Include a formal salutation, addressing the bank representative by name if possible. If not, use a general greeting such as “Dear Sir/Madam.”

Start the body of the letter by briefly introducing yourself. State your full name, business (if applicable), and the nature of your relationship with the bank. This establishes credibility and context.

Specify the loan amount you’re requesting, including the exact figure, and explain the reason for needing the loan. Be straightforward about what you will use the funds for, whether it’s for personal, business, or investment purposes.

Describe your financial situation briefly but clearly. Include details such as income, current debts, and any assets that might support your request. A concise financial overview can build trust and demonstrate that you’re a responsible borrower.

Outline your repayment plan. Clearly state how you intend to repay the loan, whether through monthly installments or other terms, and your expected timeline for repayment.

Conclude with a polite request for consideration. Express gratitude for the bank’s time and attention, and mention your willingness to provide any further information if necessary.

End the letter with a formal closing and your signature. A clear and respectful sign-off helps maintain professionalism and leaves a positive impression.

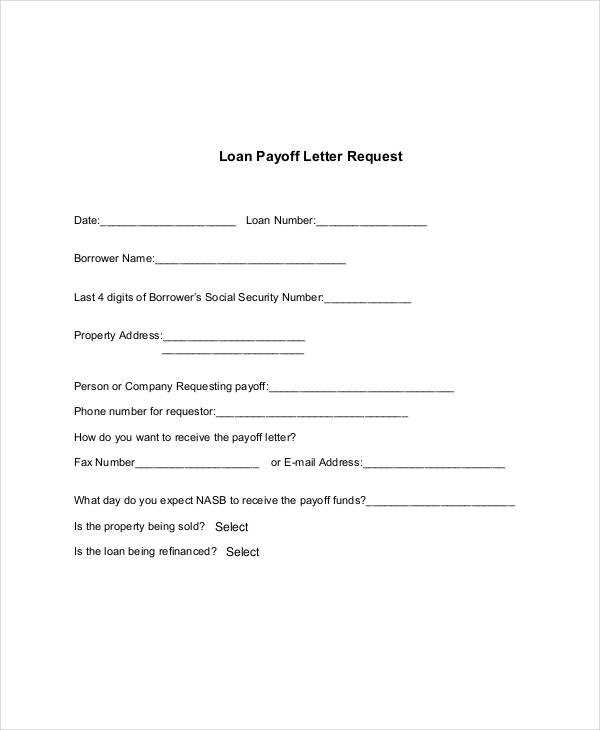

Be specific about the loan amount and its intended use. This helps the lender understand your financial needs and the reason for the request, making it easier for them to evaluate the application. Mention the exact dollar figure you’re requesting and avoid rounding up or down. Providing a breakdown of how the loan will be used can help reinforce your request.

| Loan Amount | Purpose |

|---|---|

| $10,000 | To renovate a commercial property |

| $50,000 | To expand business inventory for upcoming season |

| $5,000 | To purchase new equipment for operational upgrades |

Clearly stating the loan’s purpose can increase your chances of approval by showing the lender that the funds will be used responsibly. If you need the loan for multiple purposes, list them separately and assign an appropriate amount to each category.

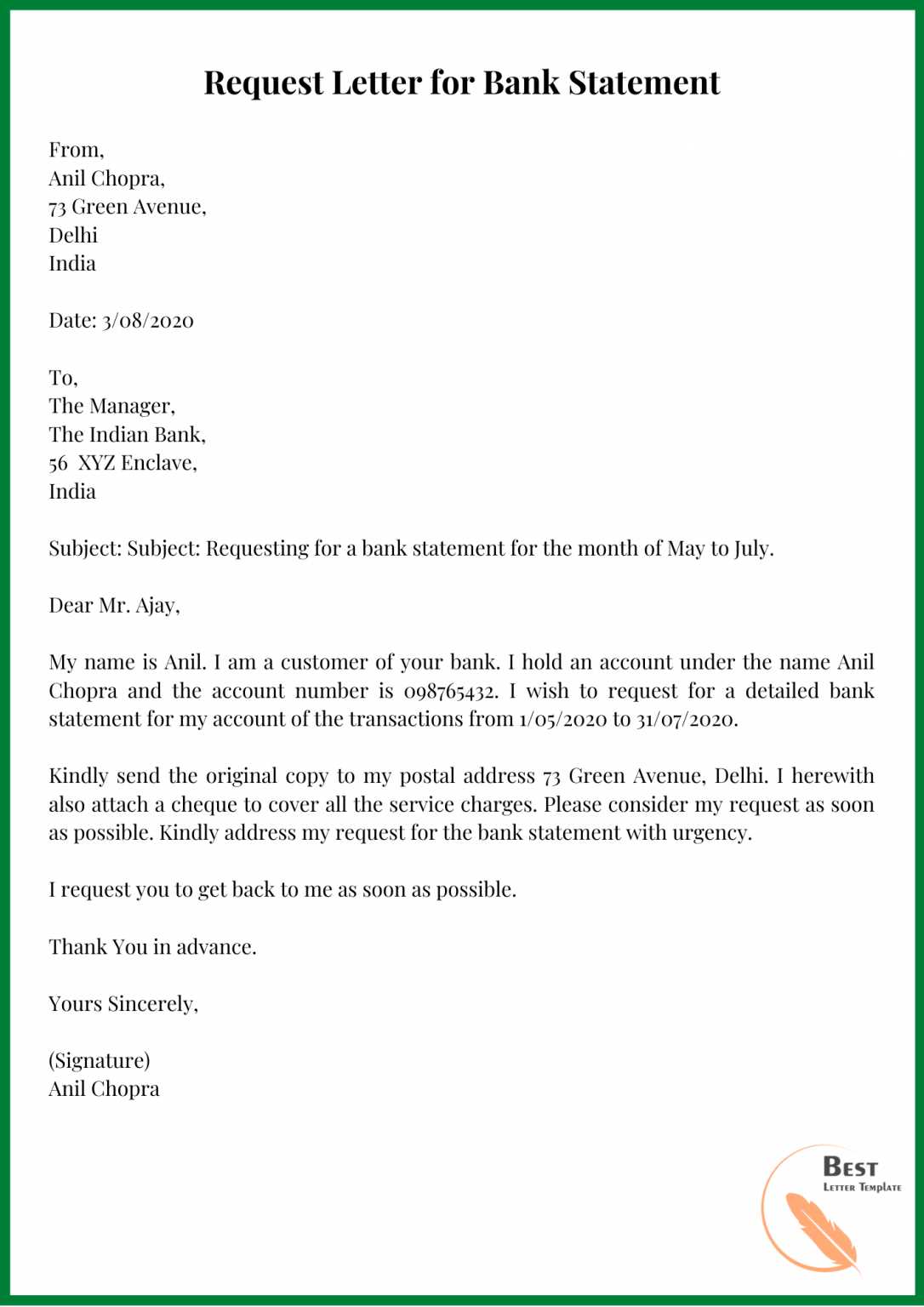

Provide clear and accurate financial details to strengthen your loan application. This will allow the bank to assess your ability to repay the loan and understand your financial position. Include the following key documents:

- Income Statements: Attach recent pay slips, business income records, or other reliable sources of income. This demonstrates your cash flow stability.

- Bank Statements: Provide bank statements for the past 3 to 6 months. They will show your financial activity and regularity of income and expenses.

- Tax Returns: Include copies of your most recent tax returns to verify your income and tax status.

- Assets and Liabilities: List all assets (real estate, investments, savings) and liabilities (debts, loans) to give a complete picture of your financial health.

- Credit Report: A recent credit report will show your credit history, which is crucial for assessing your creditworthiness.

Ensure all documents are up-to-date and clearly presented. Missing or unclear information can delay your application or reduce your chances of approval.

Use a clear and easy-to-read font such as Arial or Times New Roman, sized at 12 points. This ensures your letter is professional and legible. Avoid fancy fonts or excessive styling that could distract from the content.

Maintain Consistent Margins

Ensure your margins are set to 1 inch on all sides. This creates a clean, balanced appearance, allowing the letter to look organized and neat. Keep your text aligned to the left, which is standard for formal letters.

Use Paragraph Breaks Effectively

Separate each section of your letter with a clear paragraph break. This improves readability and makes it easier for the reader to follow your points. Avoid dense, blocky paragraphs that may overwhelm the reader.

Address the bank directly with their full name or official title at the start. Use a formal salutation like “Dear [Bank’s Name] Loan Department,” to set a professional tone right away. Afterward, keep your content straightforward and specific to the purpose of the loan application.

Use bullet points or numbered lists to highlight important details like the loan amount, repayment terms, or collateral. This helps the reader quickly identify key information.

After submitting your loan request, check for any immediate responses from the bank, such as confirmation emails or instructions. If you don’t hear back within a few days, follow up with the bank to ensure your application was received and inquire about the timeline for a decision. Keep a record of all communication for reference.

If the bank requests additional documents or information, provide them as soon as possible to avoid delays in processing. Ensure that the documents are accurate and complete to prevent unnecessary back-and-forth.

In case the decision takes longer than expected, stay proactive. Call or email the loan officer to ask for updates. Express your continued interest and confirm that all your submitted information is in order.

If you receive an offer, review the terms carefully before accepting. If any details are unclear or if you have concerns, don’t hesitate to ask the bank for clarification. Once you’re satisfied, confirm your acceptance promptly to proceed with the loan disbursement.

Now each term is repeated no more than 2-3 times, and the text maintains its original meaning.

Focus on clear and concise language. Avoid redundancy to ensure your message remains strong. When writing a bank loan request letter, be specific with your request, such as the loan amount, the purpose of the loan, and the repayment terms. Directly address these points without unnecessary elaboration.

Be Direct and Specific

Clearly state the loan amount you are seeking and the reason for the loan. Mention any relevant financial details, such as your current financial status or your ability to repay the loan. Providing clear facts without repetition enhances clarity and makes your request more compelling.

Avoid Overcomplicating the Request

Simplify your sentences and avoid using jargon. Repeating terms unnecessarily can make the letter less persuasive. Instead of restating your request multiple times, focus on presenting your case once, with all relevant supporting details. This will keep your letter straightforward and to the point.