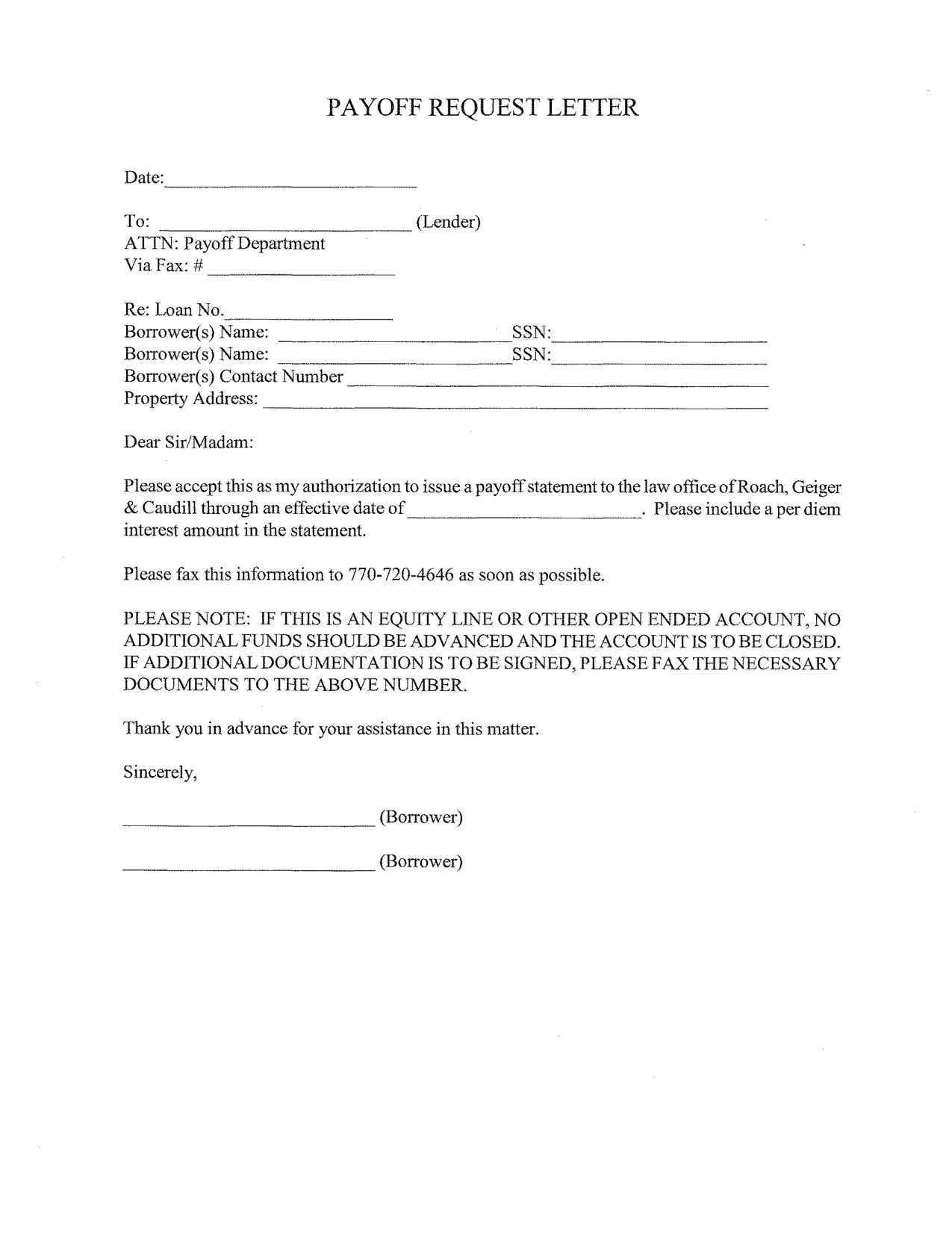

Payoff request letter template

When you need to request the final payoff amount on a loan or debt, it’s crucial to use a clear and professional approach. A well-crafted payoff request letter ensures that all necessary details are communicated effectively to the lender or creditor.

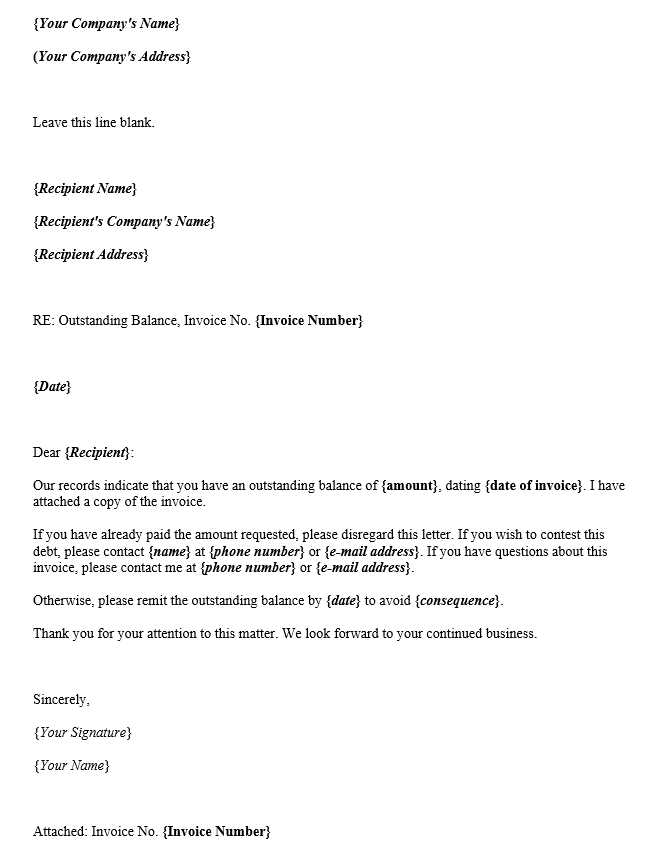

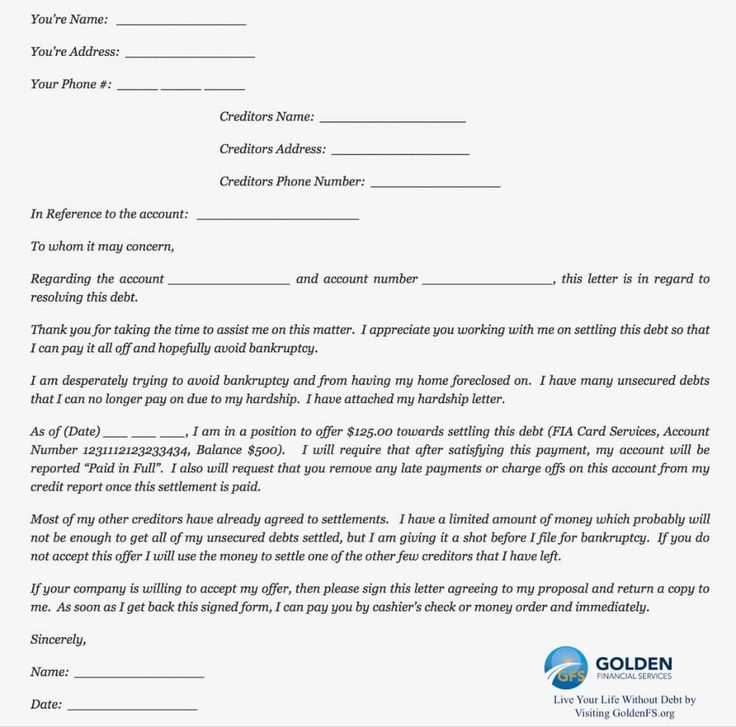

Start by addressing the letter to the correct department or individual. Include your full name, account number, and the loan or debt details. Be specific about the date you are requesting the payoff amount and the deadline for payment. Clear communication will help avoid any misunderstandings or delays.

State the purpose of your request directly. Indicate that you are seeking the total amount due to satisfy the balance, and mention any additional fees or charges that might apply. This helps to ensure that all parties are on the same page about the total amount you need to pay.

Lastly, close the letter politely, offering your contact information for any follow-up. Thank the recipient for their assistance and express your intent to make the payment promptly once the payoff amount is provided.

Here is a detailed plan for an informational article on the topic “Payoff Request Letter Template” in HTML format with six practical and specific headings:

To write a payoff request letter, first ensure that you include essential details, such as your account number, loan information, and the exact payoff amount you’re requesting. Clarity in the opening statement will avoid confusion and expedite processing. Here’s how to structure it effectively:

1. Clear Identification of the Loan

Begin with the basic loan information, including the lender’s name, your account number, and any other identifiers. This ensures the recipient can quickly locate your account and understand the context of your request.

2. Request for Payoff Amount

Specify the exact payoff amount you need. This should include principal, interest, and any applicable fees. Be sure to clarify if you’re requesting a specific date for the payoff calculation to prevent discrepancies.

3. Payment Instructions

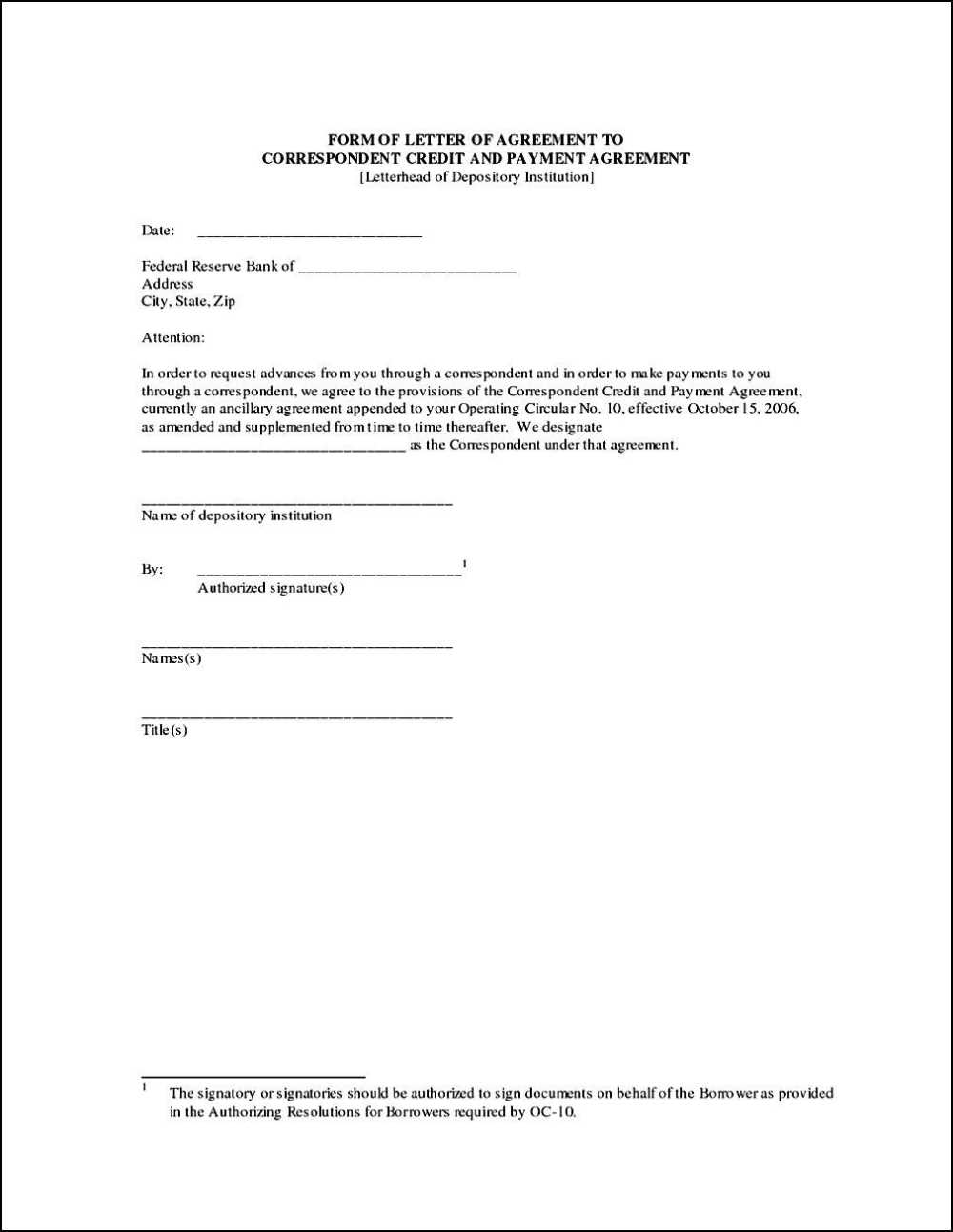

Provide clear payment instructions, including the preferred method of payment and where it should be sent. Include relevant bank details or payment portals, if applicable.

4. Request for Written Confirmation

Ask for written confirmation of the payoff amount and the full settlement of the loan. This document will serve as proof once the transaction is completed.

5. Deadline for Response

Set a reasonable deadline for the payoff statement to be provided. This helps avoid delays and keeps the process on track.

6. Contact Information

Ensure you provide accurate contact details. Include your phone number and email address, so the lender can easily reach you for any clarifications or updates regarding the payoff request.

- How to Structure a Payoff Request Letter

Begin by addressing the recipient formally. Include their full name, title, and company name if applicable. This establishes the context and sets the tone of the letter. Follow this with your own details, including your name, contact information, and any relevant account number or reference to the loan or debt in question.

Clarify the Request

Clearly state the purpose of your letter. Specify that you’re requesting a payoff statement, outlining the exact balance due, including any interest, fees, or penalties that might apply. Avoid ambiguous wording–be direct and precise about what you need.

Provide Required Information

Offer any supporting details that may help the recipient locate your account quickly. This could include loan account numbers, dates, or any relevant documentation, ensuring they can process your request smoothly.

Conclude with a polite request for a timely response. Indicate how you prefer to receive the payoff details, whether by email, mail, or phone. Finally, thank them for their attention to your request.

Be clear and concise when drafting your payoff request letter. To ensure your request is processed quickly, include the following details:

- Loan Information: Provide the loan account number, the lender’s name, and the type of loan. This allows the lender to quickly identify your account.

- Outstanding Balance: State the exact amount you owe. If applicable, include any fees or charges that need to be settled.

- Request Date: Clearly mention the date by which you would like the payoff to be processed.

- Payment Instructions: Specify your preferred method of payment, whether it’s by wire transfer, check, or another method.

- Contact Information: Include a phone number or email address where you can be reached for any follow-up questions.

- Final Date: Request the final date when the payoff should be reflected, and ask for a statement confirming that the loan is paid in full.

Additional Details to Consider

- Prepayment Penalties: If applicable, inquire about any penalties for early repayment.

- Loan Terms: Mention the current interest rate and any remaining terms to avoid confusion during the payoff process.

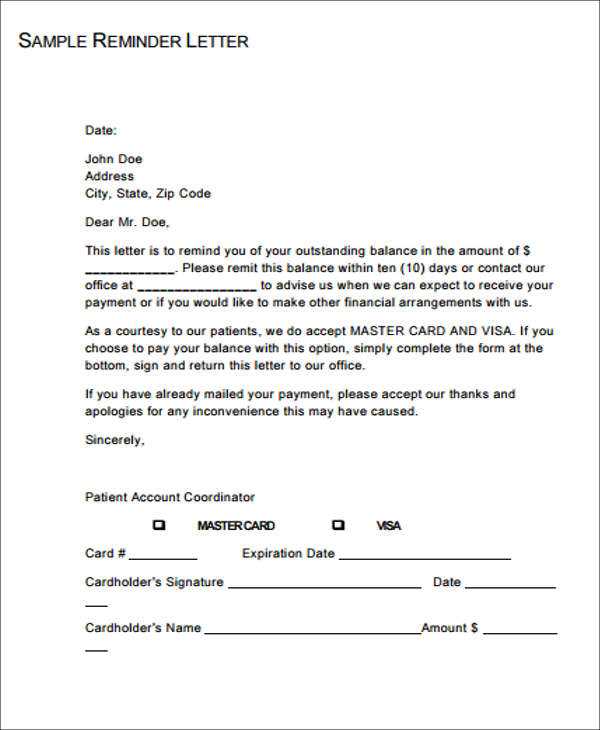

One key mistake is being vague. Always specify the exact amount or type of payoff you’re requesting. A request that lacks details can lead to misunderstandings and delays.

Another issue is failing to include necessary documentation. When applicable, attach supporting documents that justify your request. This will provide clarity and make the process smoother.

- Not addressing the recipient properly: Always ensure you’re directing your request to the correct department or individual who can process it.

- Missing a clear deadline: State when you expect to receive the payoff to avoid confusion about timeframes.

- Overcomplicating the language: Use simple, clear language. Keep your request concise and to the point.

- Ignoring follow-up: Don’t forget to inquire about the status of your request if you don’t receive a response within a reasonable period.

Finally, avoid using an overly formal or impersonal tone. A friendly, polite approach can help encourage a prompt response. Avoiding these mistakes will make your payoff request more effective and efficient.

Ensure the letter is addressed to the correct recipient, typically the lender or financial institution holding the debt. Verify the details of your loan, such as account number, to avoid confusion.

Use clear, direct language to state your request. Be concise and include the specific date by which you expect the payoff amount, referencing any previous communication if applicable.

Attach any required documentation, such as loan statements, and keep copies of all correspondence for your records. You may also want to request confirmation of receipt of your letter.

Before sending, review the letter for accuracy. An error in your payoff amount or account number can delay processing or cause complications.

| Step | Action |

|---|---|

| 1 | Confirm recipient’s details and loan information |

| 2 | Write a clear, concise request with a specified payoff date |

| 3 | Attach relevant documents and request confirmation of receipt |

| 4 | Double-check for accuracy before sending |

Send a polite, concise follow-up email if you haven’t received a response within the expected timeframe. Be sure to reference your original request, providing any necessary details for easy identification. Keep the tone courteous and professional.

Begin by confirming your understanding of their processing times. Mention the date you submitted your request and express your continued interest in receiving an update. This shows that you respect their time while reinforcing the importance of your request.

If applicable, offer to provide additional information or clarification to help expedite the review. This may prompt them to prioritize your request, especially if there’s a missing detail that could delay the process.

Consider reaching out via phone if emails don’t yield a response. A direct conversation can often lead to faster clarification and may result in more immediate action. Always remain respectful and patient during the call.

Lastly, if multiple follow-ups haven’t produced results, check if there is an alternative contact or department. Escalating the matter appropriately can sometimes resolve delays.

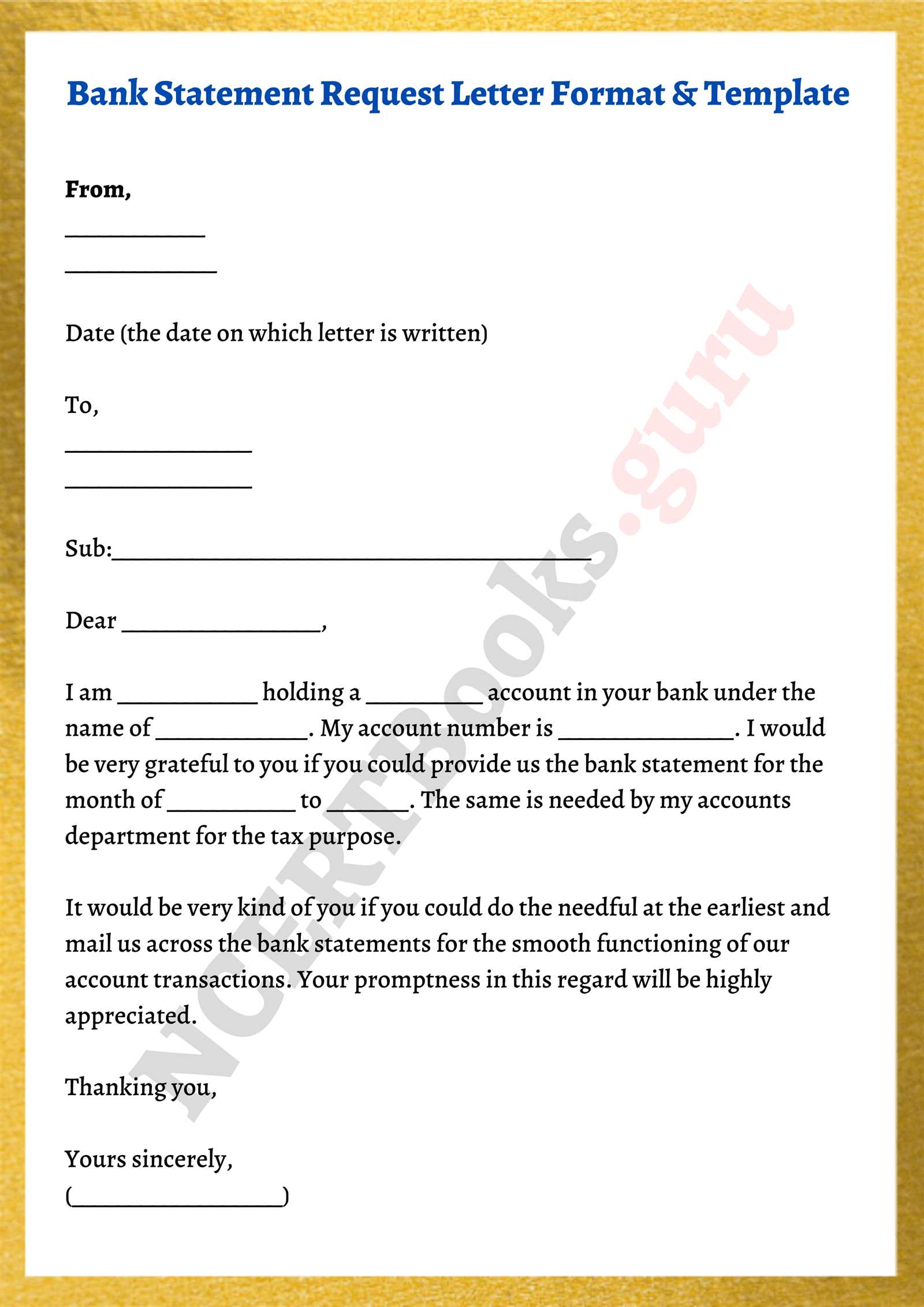

To request a payoff statement, it’s crucial to include all necessary details that the lender will require to process the request. Here’s a template that can help you craft your letter clearly and accurately.

Dear [Lender’s Name],

I am writing to request a payoff statement for my loan account with the following details:

- Loan Account Number: [Your Loan Account Number]

- Borrower’s Name: [Your Full Name]

- Property Address: [Property Address (if applicable)]

- Requested Payoff Date: [Date]

Could you please provide the total amount required to pay off the loan as of [requested payoff date], including any fees, interest, or penalties that may apply?

Thank you for your prompt attention to this matter. I look forward to receiving the requested information at your earliest convenience. Please feel free to contact me should you need any additional information.

Sincerely,

[Your Full Name]

[Your Contact Information]

To craft an effective payoff request letter, begin with a clear statement of the amount owed. Specify the total sum, including any interest or fees if applicable. Always double-check the figures to ensure accuracy.

Address the recipient directly using formal language and a polite tone. Clearly outline the terms of the loan or agreement, referring to specific clauses if necessary. This helps avoid confusion and ensures the request is understood.

Provide a concise timeline for payment, including any deadlines. If you are offering a payment plan, be specific about the terms. This shows flexibility while maintaining a clear structure.

Conclude with a call to action. Request a response or payment by a specific date and provide contact information for follow-up. Always end the letter on a positive, cooperative note, inviting the recipient to address any concerns or questions.