Letter of sale of land template

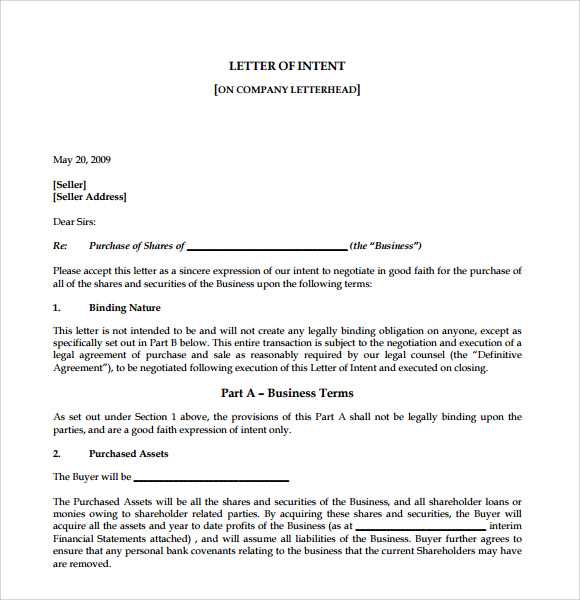

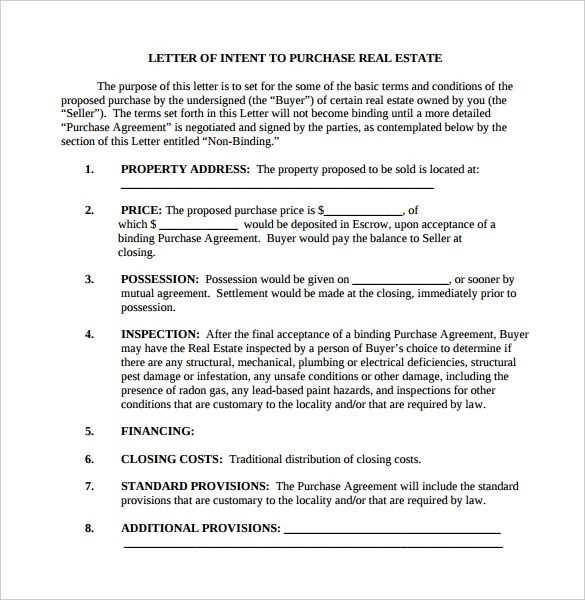

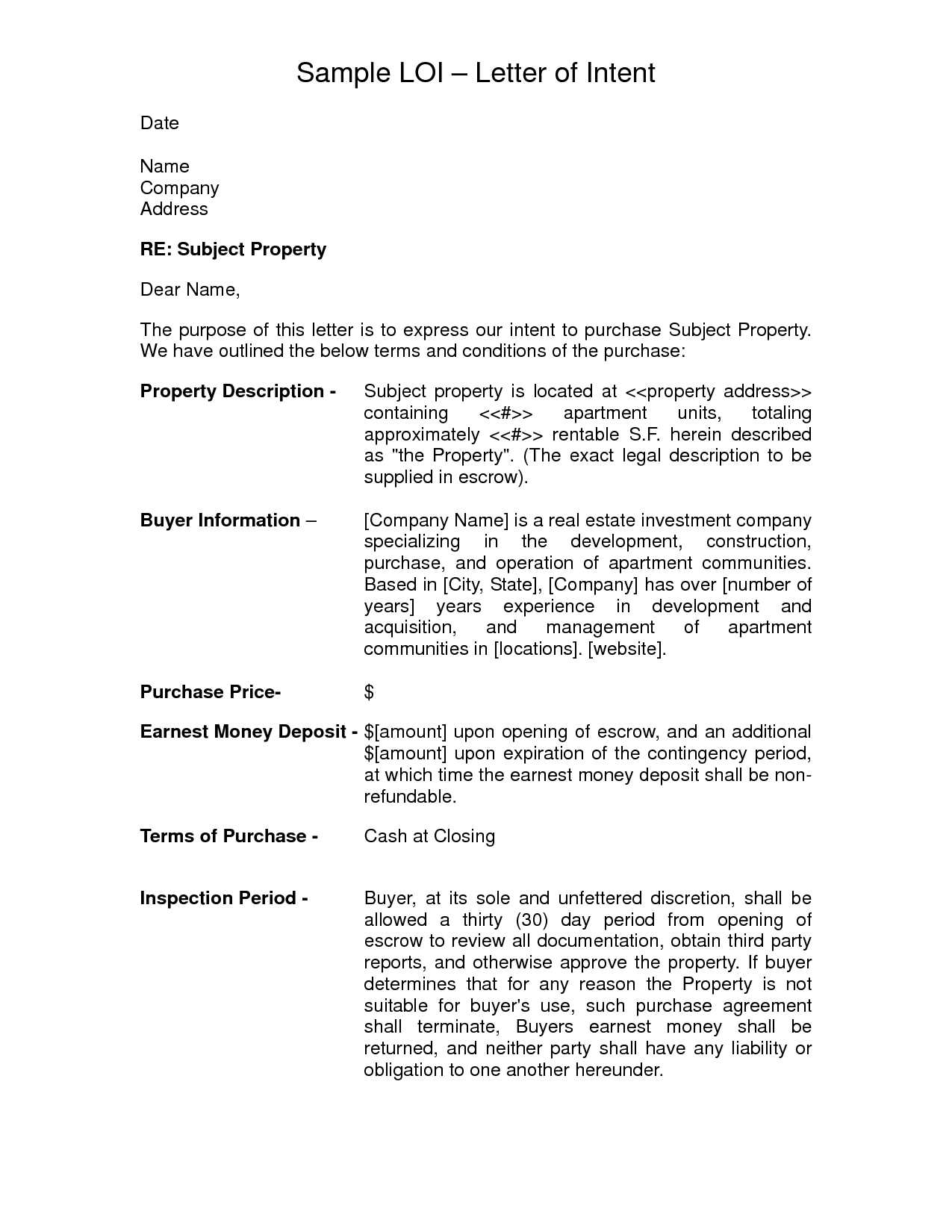

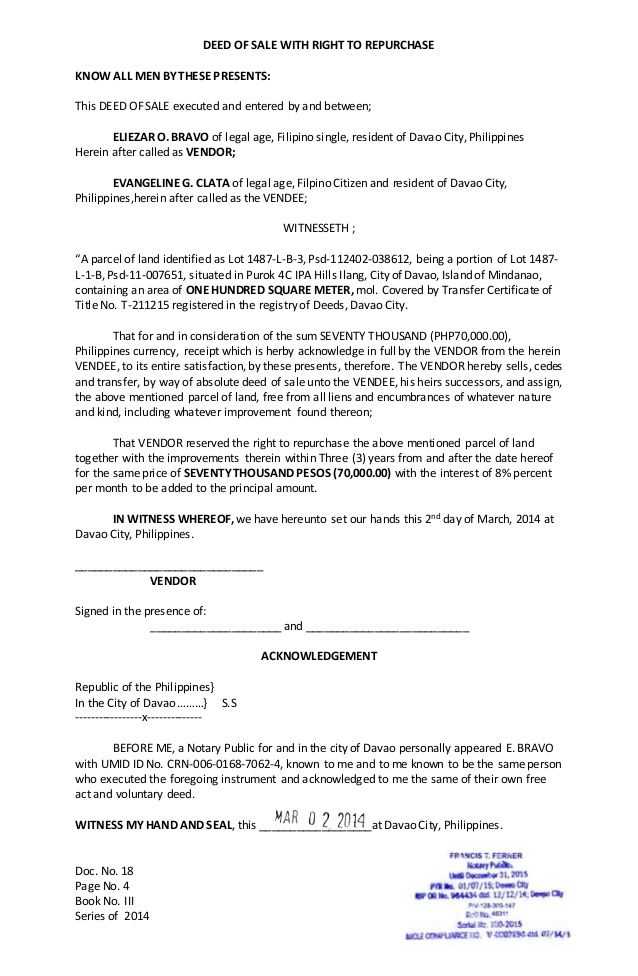

A well-drafted letter of sale is crucial for ensuring a smooth transaction when selling land. This document legally formalizes the agreement between the seller and the buyer, outlining the terms and conditions under which the sale is made. The template should cover specific details about the land, such as the location, boundaries, and any encumbrances, to prevent future disputes.

The letter must include the full names and addresses of both parties, the agreed-upon price, and the date of transfer. It’s also advisable to specify any conditions related to the transfer of ownership, such as payment schedules or responsibilities for taxes. Including a clause for dispute resolution can help mitigate potential issues after the sale is completed.

By using a clear and concise template, both parties ensure that the sale is legally binding and the process is transparent. Make sure to consult a legal expert to ensure the document complies with local regulations and is appropriately signed and notarized.

Letter of Sale of Land Template

Use a clear and direct approach when drafting a land sale letter. Begin by identifying the parties involved, including full names and addresses. Clearly state the property being sold, including its legal description, size, and location. Specify the agreed purchase price and payment method, outlining any deposits, installment schedules, or outstanding balances.

Indicate the effective date of the sale and detail the responsibilities of both the seller and buyer, such as property taxes, fees, and maintenance. Address any contingencies, like inspection or financing requirements, if applicable. Include the closing date and the process for transferring ownership, ensuring that all legal steps are outlined.

Conclude the letter with a formal closing, ensuring all parties sign and date the document. Keep the language straightforward and avoid unnecessary clauses. Using a template streamlines the process, ensuring all important details are included and no legal requirements are overlooked.

Including Accurate Land Description and Boundaries

Provide a detailed and clear description of the property’s boundaries. This will avoid any confusion or legal disputes after the transaction. Specify the land’s exact dimensions, referencing official surveys or legal documents.

- Start with the full legal description, including the parcel number, lot, block, or tract information.

- List the exact measurements of each boundary–lengths, widths, and any irregularities. Use units such as feet or meters to ensure clarity.

- Include any landmarks or notable features (e.g., roads, rivers) that help identify the boundaries.

Make sure to reference a certified survey, if available, as it will offer precise details. Any discrepancies between the description in the deed and the actual property can lead to costly problems later on.

Clearly mention any easements, encroachments, or restrictions that might affect the property. This ensures that both the buyer and seller understand the full scope of the transaction and potential limitations on land use.

- Note any right-of-way or utility easements that may affect part of the land.

- Identify neighboring property features or structures that could potentially impact the land boundaries.

Conclude the description by referencing any applicable maps or diagrams, which can further illustrate the boundaries and give the buyer a clear view of what they are purchasing.

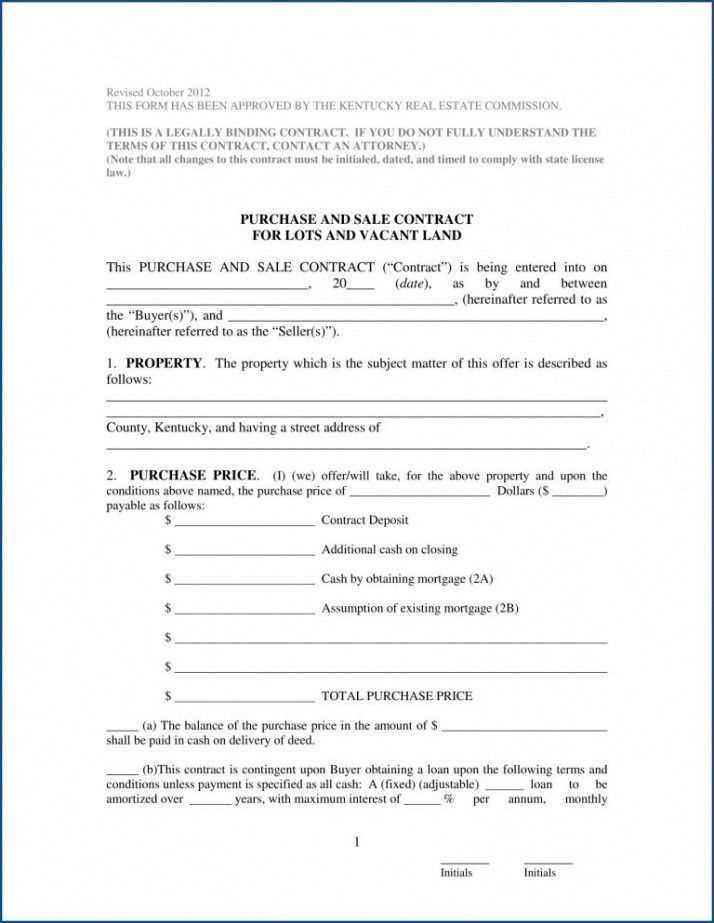

Specifying Payment Terms and Conditions

Clearly define the amount to be paid, the method of payment, and the timeline for payment. For instance, specify whether payments will be made in installments or in a lump sum. If payments are to be made in installments, outline the exact due dates for each payment and the amount required at each stage.

Include any late payment penalties. Specify the exact interest rate or penalty fee for missed or delayed payments, as well as when such penalties will begin to apply. This ensures that both parties are aware of the consequences of late payments.

State the currency in which payments will be made, especially if the transaction is international. This helps to avoid misunderstandings regarding conversion rates or foreign exchange issues.

If applicable, include details about the method of payment. For example, outline whether payments should be made by bank transfer, cheque, or another method, and provide any necessary payment account details or instructions.

Clarify if any deposit is required and, if so, the amount and due date. Ensure it is understood that the deposit is non-refundable if the buyer decides not to proceed with the transaction.

In addition, specify any conditions related to the completion of payment. This could include terms related to the buyer’s satisfaction or confirmation of the transaction before the land is officially transferred.

Clarifying Responsibilities for Taxes and Liabilities

Both the seller and buyer should explicitly define who will bear the responsibility for taxes and liabilities associated with the land transaction. In the letter of sale, include a section that specifies the exact party responsible for property taxes, transfer taxes, and any outstanding debts related to the land. This helps avoid any confusion or disputes after the transaction is completed.

Property Taxes

Clearly state whether the seller or buyer will be responsible for property taxes due before or after the sale. If the seller has already paid taxes for the year, include a clause ensuring that the buyer will reimburse the seller for the prorated portion. If the seller remains responsible for taxes, they should clearly indicate this in the agreement.

Outstanding Liabilities

Identify any existing liabilities tied to the land, such as unpaid liens or mortgages. Make sure to outline whether the seller will clear these debts before the sale or if the buyer will assume them. This will ensure that the buyer is not unexpectedly burdened with past debts, and the seller avoids any potential legal disputes regarding outstanding obligations.

Outlining the Transfer of Ownership Process

The process of transferring land ownership requires specific actions to ensure all legal steps are followed. Start by preparing the necessary documents, which typically include the sale agreement and proof of identity for both parties.

Key Steps in the Transfer Process

- Draft the Sale Agreement: This document should include details about the land, sale price, terms, and any conditions that apply.

- Notarization: The sale agreement must be signed in the presence of a notary to validate the transaction.

- Payment of Taxes: Any applicable taxes or fees related to the transfer must be settled before the ownership can be officially transferred.

- Property Registration: Once all documents are signed, the transaction is recorded with the appropriate land registry to update ownership records.

Post-Transfer Considerations

- Transfer Confirmation: After registering the property, ensure that the new ownership is confirmed in writing from the authorities.

- Notify Relevant Authorities: Update the ownership details with local tax authorities and utility companies to avoid complications in the future.

Including Legal Provisions for Dispute Resolution

Clearly outline the process for resolving disputes in the land sale agreement to avoid complications later. Specify which methods of dispute resolution will be used, such as mediation or arbitration, and the procedure for initiating them.

Arbitration and Mediation Clauses

Include a clause that mandates mediation first before any arbitration or legal action can be pursued. This ensures both parties attempt to resolve the matter amicably. If mediation fails, proceed to arbitration, where an arbitrator makes a binding decision.

Jurisdiction and Governing Law

Determine the location and legal system that will govern any disputes. Indicate the state or country whose laws will apply, and which court has jurisdiction over any potential legal matters arising from the contract.

| Provision | Details |

|---|---|

| Mediation | Both parties agree to attempt mediation within 30 days of a dispute arising. |

| Arbitration | If mediation fails, disputes will be resolved by arbitration under the rules of the specified institution. |

| Jurisdiction | The laws of [State/Country] shall govern any dispute, and the courts of [State/Country] will have exclusive jurisdiction. |