Suspension of Services Due to Nonpayment Letter Template

Managing overdue payments is a crucial aspect of maintaining financial stability for any business. When clients fail to meet payment obligations, it can create complications in business operations, often leading to the need for stricter measures. One way to address this issue is by informing the client about the potential consequences of continued delays.

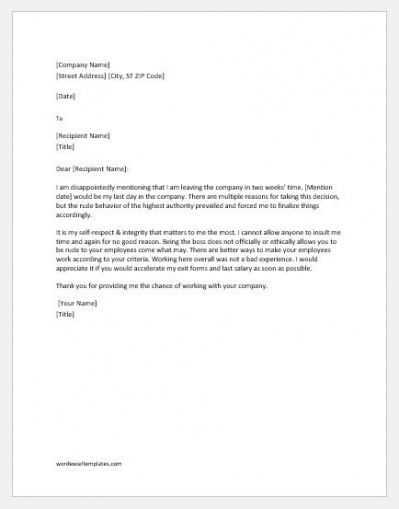

Effective communication in such situations is key. Crafting a clear and professional message can help resolve payment issues while maintaining a positive relationship with clients. This communication should outline the necessary steps to avoid any disruption, emphasizing the importance of prompt action.

In this guide, we will explore the essential components of an effective notice and provide practical tips on how to approach this delicate matter. Whether you are a small business owner or managing accounts for a larger organization, understanding how to address payment delays with clarity and professionalism is essential for minimizing disruption and securing timely payments.

Understanding Service Suspension Due to Unpaid Bills

When clients fail to meet their financial commitments, businesses often face the difficult decision of restricting access to specific functions or resources. This action is usually taken to encourage prompt settlement of outstanding balances. It is essential to approach this situation carefully to ensure that all parties involved understand the reasoning behind the decision.

Clear communication about the consequences of delayed payments plays a significant role in resolving such issues. A formal notice outlining the steps that will be taken if the payment is not received helps set expectations for the client. By addressing the matter professionally, businesses can maintain their relationships while protecting their interests.

While it may seem like a harsh step, this approach can be an effective strategy to maintain cash flow and encourage timely settlements. However, it’s important to ensure that the client has been adequately informed before taking such measures, allowing them the opportunity to settle any discrepancies or misunderstandings regarding the outstanding amount.

Importance of a Clear Suspension Letter

Effective communication is crucial when addressing overdue payments. A well-structured notice helps ensure that the client understands the consequences of continued failure to settle the outstanding balance. Providing clear information regarding the situation and next steps can facilitate resolution and prevent misunderstandings.

By being transparent and precise in outlining the actions that will be taken, businesses can avoid potential conflicts and ensure that the client is aware of the importance of timely resolution. A clear message not only maintains professionalism but also encourages quicker action from the recipient.

Moreover, a formal document serves as a record of the communication, which can be essential in the case of legal disputes. A properly constructed notice protects the interests of the business and reinforces the seriousness of the matter, all while offering the client a final opportunity to fulfill their financial obligations.

Key Elements to Include in the Letter

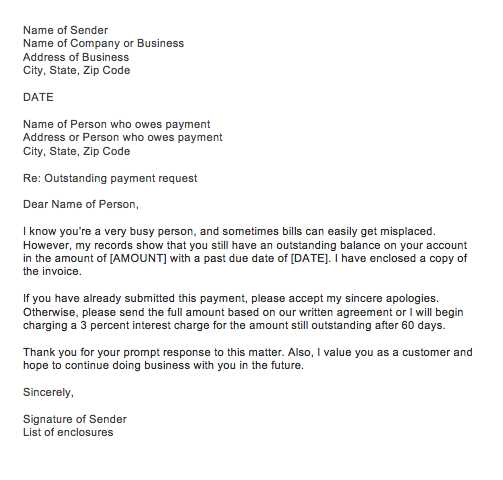

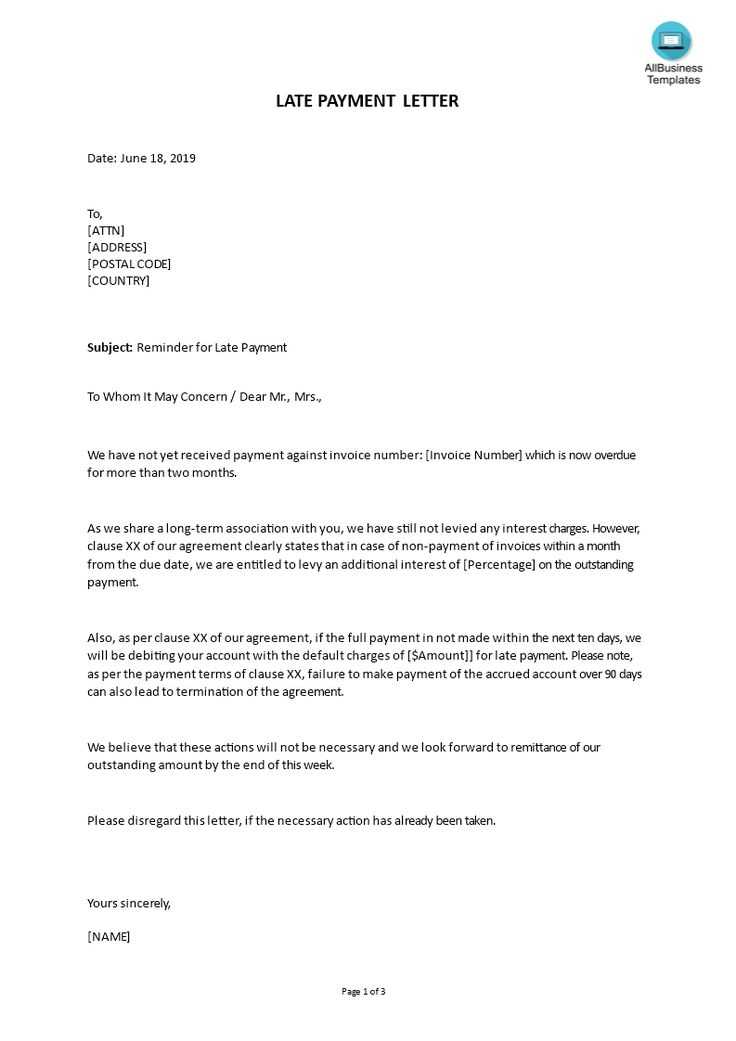

When drafting a formal notification regarding unpaid balances, it’s important to include specific details to ensure clarity and effectiveness. Including the right elements helps avoid confusion and reinforces the urgency of the matter. Below are the essential components that should be present in such a document:

- Recipient Information: Clearly mention the name and contact details of the person or organization receiving the communication.

- Outstanding Balance: Provide a precise breakdown of the amount owed, including any relevant invoices or references to prior communication.

- Action Deadline: Specify a clear deadline by which payment should be made to avoid further consequences.

- Consequences: Outline the potential steps that will be taken if the payment is not received, such as restrictions or account actions.

- Payment Instructions: Include detailed information on how the payment can be made, including methods and any necessary account information.

- Contact Information: Offer a way for the recipient to reach out in case of disputes, questions, or payment issues.

By ensuring that these elements are included, businesses can minimize misunderstandings and create a professional and effective communication process to handle unpaid amounts.

How to Communicate Payment Terms Effectively

Clear communication is essential for ensuring that clients understand their financial obligations and the expectations surrounding payment timelines. Establishing transparent and easily understandable terms helps avoid confusion and fosters positive relationships. By presenting payment information in a direct, professional manner, businesses can promote timely transactions and reduce the likelihood of delays.

Be Clear and Concise

When outlining payment terms, use simple and straightforward language to avoid any ambiguity. Clearly state the payment amount, due dates, and the methods by which payment can be made. Providing specific details ensures that the recipient understands what is expected and when.

Reiterate the Consequences of Delays

It’s important to highlight the potential outcomes if payments are not received as agreed. Politely but firmly communicate the actions that may follow, such as restricted access or other measures. However, always ensure that the tone remains professional and courteous to maintain a positive client relationship.

Legal Considerations When Suspending Services

Before taking any action to limit access or halt the provision of a product or function due to outstanding financial obligations, it is important to understand the legal framework surrounding such decisions. Businesses must ensure that they comply with relevant laws and contractual agreements to avoid potential disputes or legal repercussions. Taking the right steps can protect your organization while maintaining fairness and professionalism.

First, it’s essential to review the terms outlined in the agreement with the client. This includes ensuring that clauses related to payment schedules and actions for non-fulfillment are clearly defined and enforceable. Violating these terms could expose the business to legal risks, such as claims for breach of contract.

Additionally, businesses should be mindful of jurisdiction-specific regulations. Different regions or countries may have laws governing the collection of debts or actions that can be taken when financial obligations are not met. It’s advisable to consult with a legal expert to ensure compliance and to avoid any actions that may be considered unlawful or overly punitive.

Common Mistakes to Avoid in Suspension Notices

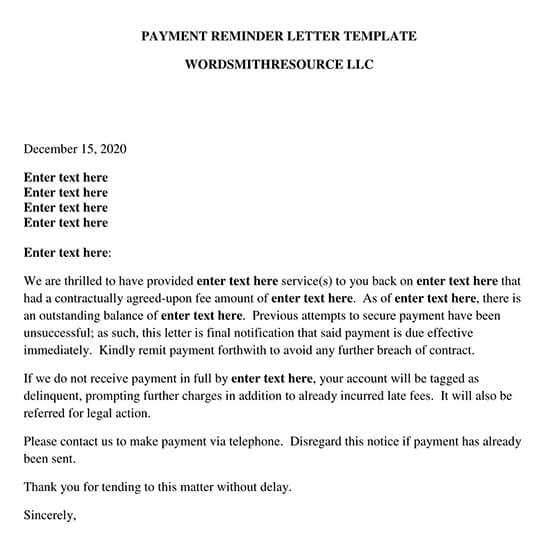

When notifying clients about the consequences of unpaid balances, it’s crucial to avoid common errors that can undermine the effectiveness of the message. A poorly written communication can lead to confusion, misunderstandings, or even legal complications. Ensuring that your notice is clear, accurate, and professional is essential for maintaining a positive relationship while addressing overdue payments.

Vague or Unclear Language

One of the most frequent mistakes is using ambiguous or overly complicated language. Being vague about the amount owed, the deadline for payment, or the potential actions that will follow can create confusion. To avoid this, make sure that every detail is clear and easy to understand. Key points should be highlighted and explained with simple terms.

- Specify the amount owed: Always provide a detailed breakdown of the outstanding amount.

- Clearly state deadlines: Mention the exact date by which the payment should be made.

- Detail the next steps: Be explicit about the consequences if the balance is not cleared on time.

Failure to Offer Payment Solutions

Another mistake is not offering clients clear payment options or instructions. When a client struggles to meet financial obligations, providing easy-to-follow payment methods can make it simpler for them to settle the amount. This helps foster goodwill and encourages timely resolution.

- Provide multiple payment methods: Offer options like bank transfer, credit card, or online payments.

- Clarify the payment process: Explain how the client can make payments, including account details or platforms to use.

Strategies for Resolving Payment Disputes Quickly

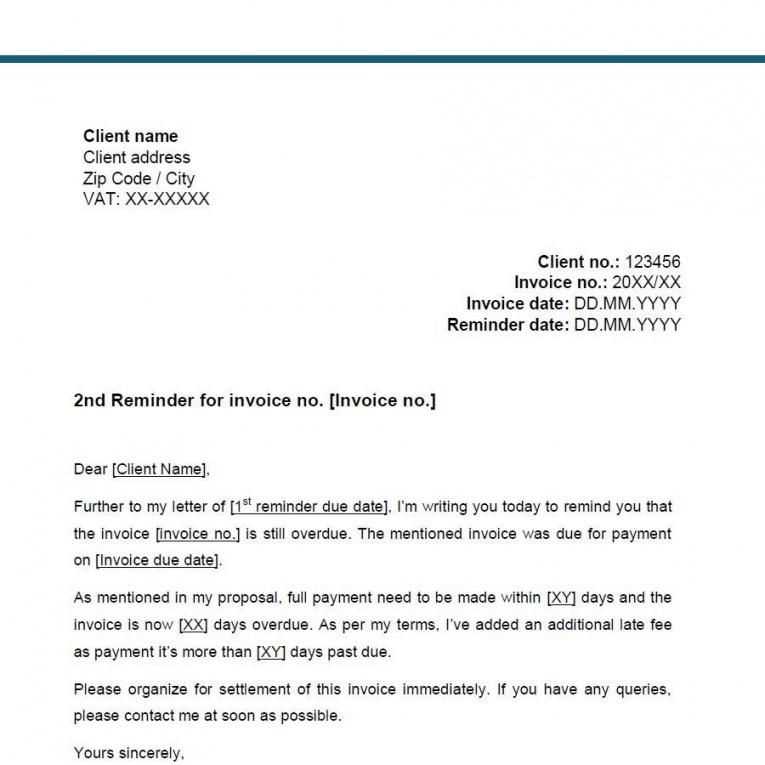

Addressing payment conflicts efficiently is essential for maintaining smooth business operations. By acting swiftly and taking a proactive approach, businesses can resolve disputes while preserving relationships with clients. Implementing the right strategies can help avoid prolonged delays and foster a cooperative environment between all parties involved.

The first step in resolving any dispute is clear communication. Open a dialogue with the client to understand their perspective and identify the root cause of the issue. From there, offering solutions that meet both parties’ needs can pave the way for a swift resolution.

| Strategy | Action |

|---|---|

| Open Communication | Contact the client promptly to discuss the issue, ensuring that both sides are heard. |

| Offer Flexible Payment Options | Provide alternative payment methods or installments to ease the burden on the client. |

| Review Contract Terms | Check the agreement for clauses that can clarify the situation and guide the resolution process. |

| Negotiate Terms | If needed, consider negotiating the payment amount or terms to meet both parties’ needs. |

By using these strategies, businesses can effectively resolve payment disputes and keep operations running smoothly, all while maintaining professional and positive client relationships.