Past Due Letter Template for Word

In any business, managing payments and ensuring timely collection is essential for maintaining cash flow and operational efficiency. When clients or customers fail to settle their accounts on time, it’s crucial to address the situation promptly with a professional approach. A well-crafted reminder can encourage them to pay without damaging the relationship.

Creating a professional message is key to ensuring your communication is both polite and firm. Whether you’re sending a formal notice or a gentle nudge, having the right structure and tone can make all the difference. In this section, we’ll explore how to effectively design a notification to encourage payment while maintaining a positive business rapport.

Addressing outstanding payments early helps to avoid complications later on. By using the appropriate format and wording, you can improve the chances of receiving payments swiftly and keeping your accounts in good standing.

Past Due Letter Template for Word

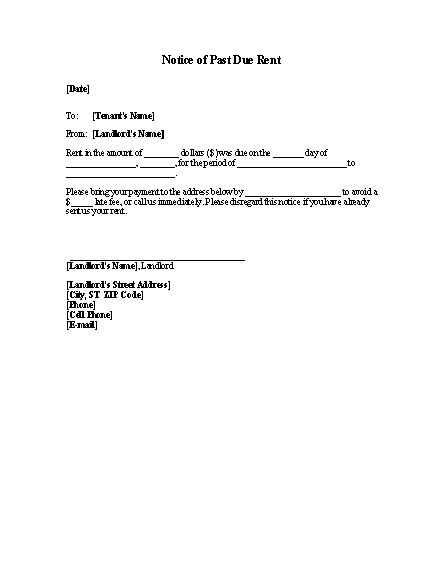

Having a structured form for notifying clients about outstanding payments is essential for any business. A professional payment reminder helps ensure that the recipient understands the urgency while maintaining respect and courtesy. Customizable forms make it easier to adjust the content for different situations and clients, streamlining the process of communication.

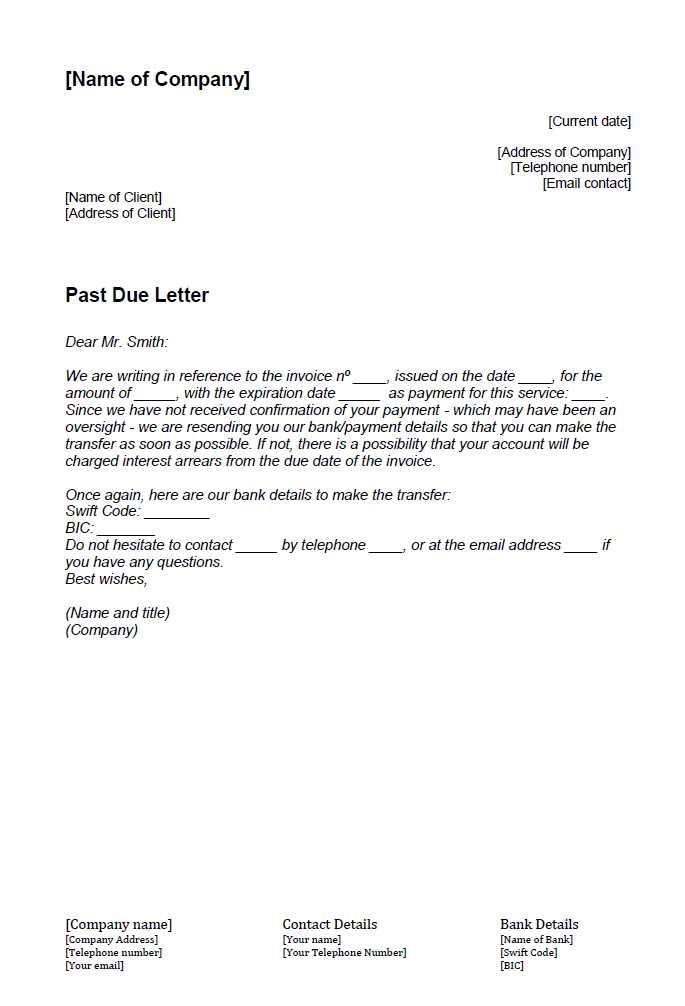

When creating such a reminder, it’s important to maintain a balance between being firm about the payment request and polite in your tone. Below is an example of how to structure your communication effectively:

| Section | Suggested Content |

|---|---|

| Introduction | Start with a polite greeting and reference the previous transactions. |

| Amount Outstanding | Clearly mention the amount that remains unpaid and the original due date. |

| Action Requested | Request payment and provide payment methods or details for settlement. |

| Consequences | Politely mention any late fees or actions that may occur if payment is not received. |

| Closing | Close with a positive note, encouraging the recipient to contact you if needed. |

By following a clear and organized structure, you can create an effective notification that fosters timely payments without damaging client relationships. Customizing these components based on the specific case allows for flexibility and professionalism in your approach.

Importance of Sending Payment Reminders

Timely communication about unpaid balances plays a critical role in maintaining a healthy cash flow for any business. Reaching out to clients who have outstanding invoices ensures that payment obligations are not forgotten, preventing delays that could negatively impact operations. Sending reminders demonstrates professionalism and fosters a clear understanding of financial responsibilities.

Regular reminders help keep the financial aspects of a business organized. By gently reminding clients of their outstanding balances, you reduce the likelihood of payments slipping through the cracks, ensuring that funds are available when needed most.

Clear communication is essential for preserving strong business relationships. A well-crafted reminder shows that the business values its clients and is proactive in managing its financial matters, ultimately leading to a more efficient and responsible working environment.

How to Customize Your Letter Template

Adjusting your communication for different situations and recipients is essential when sending payment reminders. Customization allows you to create messages that are both relevant and personal, making them more effective in encouraging timely settlement. Personalizing your content helps you avoid sounding generic and instead tailor your message to suit the specific context of each client.

Adjusting the Tone and Language

Choosing the right tone is vital to maintaining a professional yet approachable relationship. Depending on the client’s history and the situation, you may want to use a more formal or a softer approach. Be sure to adjust the level of urgency based on how overdue the payment is, while still keeping the tone respectful and cordial.

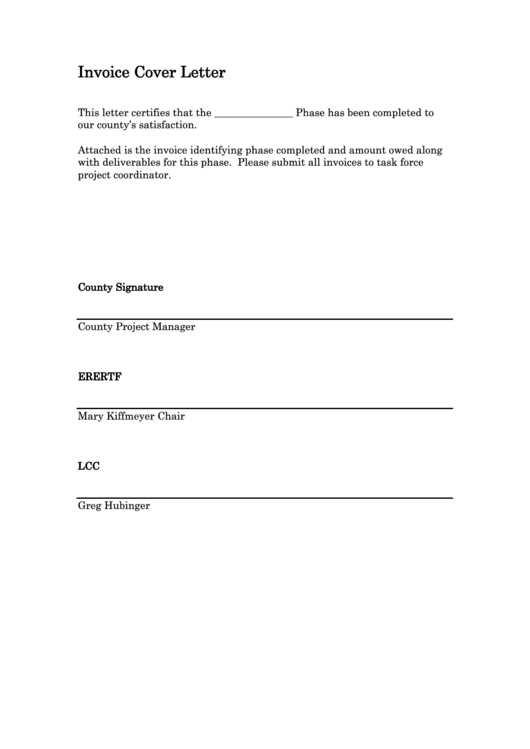

Incorporating Payment Details

Including accurate details, such as the outstanding amount and payment instructions, is essential for clarity. Ensure that your message clearly outlines the next steps, including payment methods and any deadlines for action. The more precise and straightforward you make the information, the easier it will be for the recipient to fulfill their financial obligation.

Key Elements of a Professional Letter

A well-constructed message is essential for conveying professionalism and ensuring the recipient understands the request. A clear structure with the right tone can increase the chances of prompt action while preserving the business relationship. Knowing what to include in your communication can help avoid confusion and ensure your message is both effective and polite.

Clear and concise language is a critical component of any professional note. Avoid overly complex wording and focus on being direct while maintaining respect. The recipient should immediately understand the purpose of the communication without any ambiguity.

Proper structure plays a crucial role in creating a professional image. Begin with a polite introduction, clearly state the issue at hand, and end with a call to action or next steps. This logical flow makes it easy for the recipient to follow through with the required action without feeling overwhelmed.

Common Mistakes to Avoid in Letters

When composing a message to request payment, certain errors can undermine its effectiveness. It’s important to approach the task with attention to detail to ensure clarity, professionalism, and a positive response. Avoiding common pitfalls can make the difference between a successful reminder and one that may strain the relationship with the recipient.

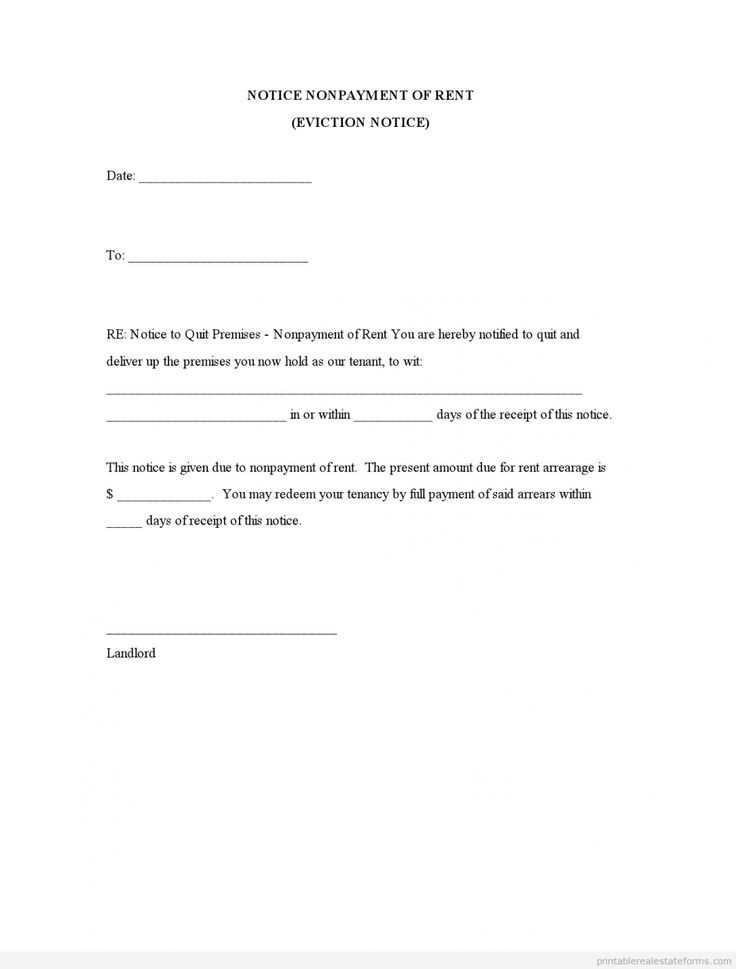

Being Too Aggressive or Too Soft

Striking the right balance between firmness and courtesy is essential. While it’s important to make your request clear, being overly aggressive can cause the recipient to become defensive. On the other hand, being too lenient might make your message seem unimportant. A polite but firm tone is the best approach to encourage prompt action.

Missing Key Information

Omitting critical details, such as the exact amount owed or payment instructions, can create confusion and delay resolution. Ensure that your message includes all necessary information to make it easy for the recipient to fulfill the payment request promptly. Clear instructions help avoid follow-up messages and unnecessary back-and-forth communication.

When to Send a Payment Reminder

Timing is crucial when notifying clients about unpaid balances. Sending a reminder too early may seem unnecessary, while waiting too long could result in delays and even missed payments. It’s important to find the right moment to remind your clients of their obligations without causing unnecessary strain on the relationship.

Typically, sending a reminder a few days after the payment deadline is a good practice. This gives the recipient enough time to make the payment while still being prompt enough to encourage timely settlement. Depending on the terms agreed upon, follow-up messages may be necessary if the payment continues to be delayed.

Tips for Following Up on Payments

When payments are not received within the expected time frame, it is important to take the necessary steps to follow up effectively. A well-thought-out approach ensures that you maintain professionalism while encouraging the recipient to fulfill their obligation. Here are some key tips to help streamline the follow-up process and increase the likelihood of prompt payments.

Stay Professional and Courteous

Maintaining a professional tone throughout the follow-up process is crucial for preserving strong relationships. Even when payments are late, keeping your communication polite and respectful shows that you value the recipient while still emphasizing the importance of fulfilling their financial responsibility.

- Use a polite and clear subject line in your communication.

- Express understanding, but highlight the importance of payment for business operations.

- Remain courteous even if the payment is significantly overdue.

Offer Flexible Payment Options

Sometimes, clients may experience financial difficulties that prevent them from making full payment on time. Offering flexible payment terms or installment plans can make it easier for the recipient to clear their balance while maintaining a good relationship.

- Offer options like extended deadlines or partial payments, if applicable.

- Be clear about any potential late fees or consequences of continued non-payment.

- Ensure that any payment plans are well-documented to avoid confusion.