Workers Compensation Audit Dispute Letter Template Guide

When facing discrepancies with an insurance evaluation, it’s essential to approach the situation with clarity and structure. A formal response can help ensure your concerns are addressed and prevent miscommunication. Crafting a well-written statement is a crucial step in resolving misunderstandings effectively.

Knowing the proper format and content of such a response can make a significant difference in the outcome. Whether you’re challenging an incorrect calculation or questioning a decision, presenting your case in a clear, professional manner is key to ensuring your position is heard and taken seriously.

Understanding the process and the necessary components of an effective response can empower you to take control of the situation. By focusing on specific details, backing up your claims with relevant evidence, and following the appropriate procedure, you increase the likelihood of a favorable resolution.

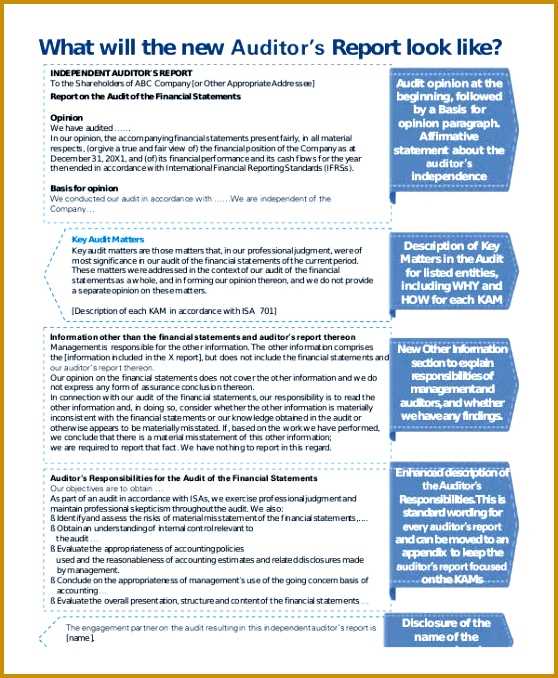

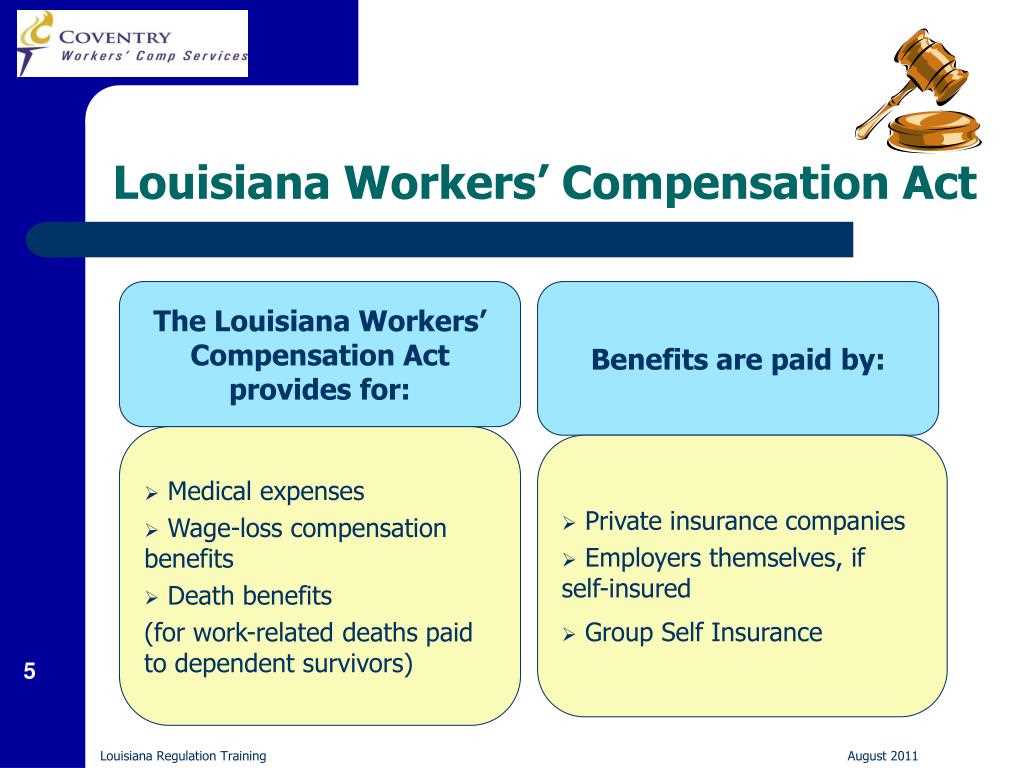

Understanding Workers Compensation Audit Disputes

Dealing with disagreements over an insurance evaluation can be a challenging process. When an assessment doesn’t match expectations, individuals or businesses may find themselves in a position where they need to contest the conclusions drawn. This situation often arises due to misunderstandings, incorrect data, or oversights that impact the final decision.

Common Reasons for Discrepancies

Several factors can contribute to these types of issues. Errors in calculating coverage, misinterpreted policy terms, or outdated information may lead to discrepancies. Additionally, differences in the interpretation of the terms or the documentation submitted can create confusion that requires clarification and correction.

The Importance of Clear Communication

Effective communication is crucial in addressing these concerns. By clearly outlining the reasons for disagreement and presenting supporting evidence, individuals can ensure that their position is properly understood. A well-structured response, with clear points and documented facts, significantly improves the chances of reaching a fair resolution.

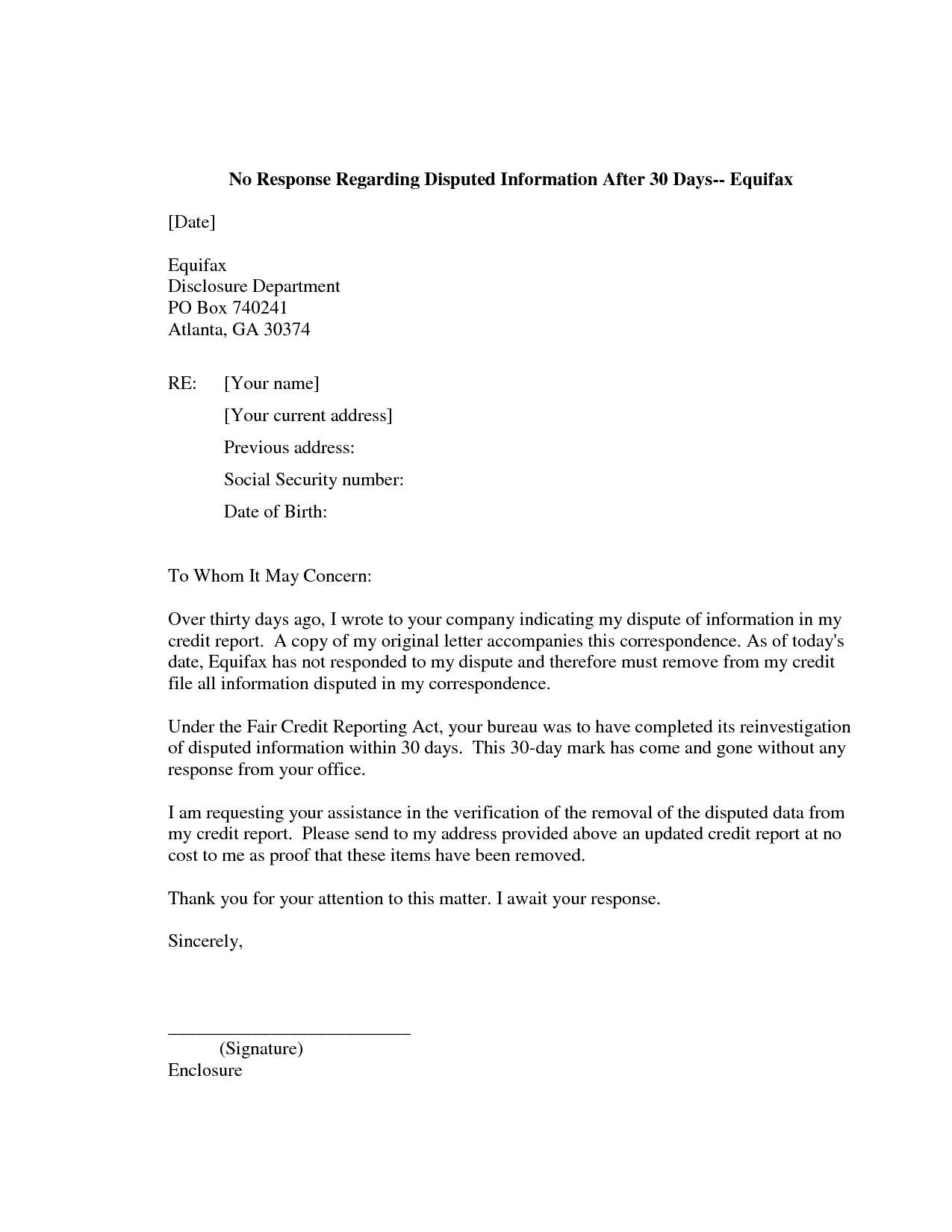

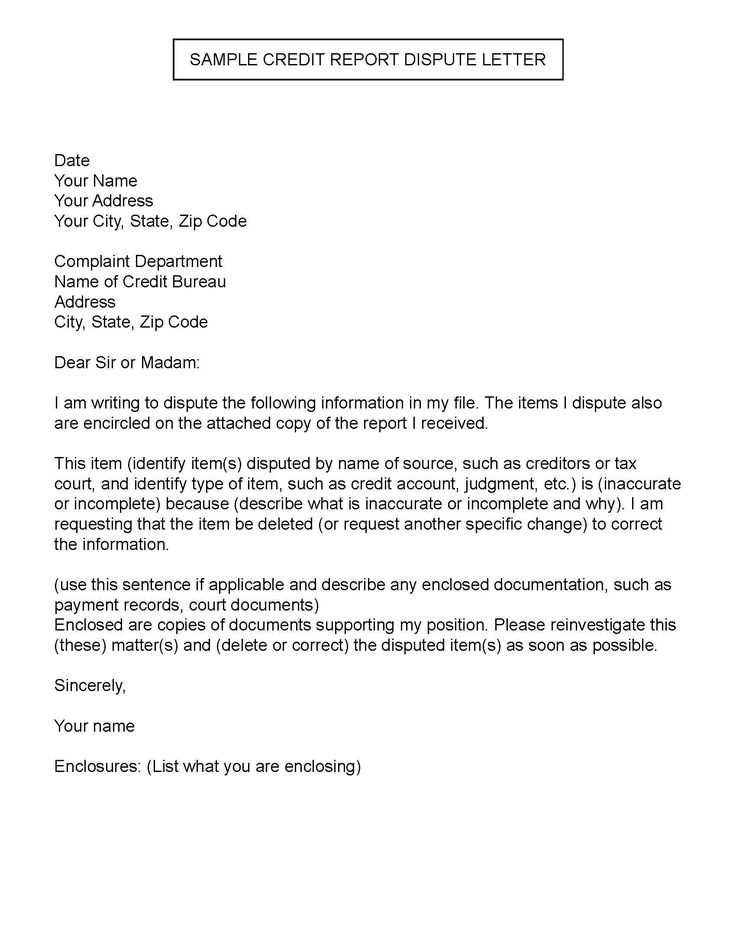

How to Write an Effective Dispute Letter

When contesting an insurance evaluation, it’s important to present your case clearly and professionally. A well-crafted response can make all the difference in ensuring that your concerns are taken seriously. This involves providing relevant details, supporting evidence, and following the proper format to ensure that the message is understood and considered.

Here are some key steps to follow when creating a formal response:

- Begin with a clear introduction: State the purpose of your message right away, explaining that you are addressing a specific issue with the recent evaluation.

- Provide detailed evidence: Clearly outline the errors or points of contention, providing any documents, calculations, or references that back up your claims.

- Be concise and focused: Stick to the facts, avoiding unnecessary details. Ensure each point is easy to understand and directly relates to the disagreement.

- Use a respectful tone: Remain professional and courteous throughout. A respectful tone can increase the likelihood of a positive outcome.

- Conclude with a call to action: Specify what you would like to happen next, whether it’s a review of the data, a correction, or further clarification.

By following these steps, you can ensure that your response is not only clear but also professional, improving the chances of resolving the issue in your favor.

Common Mistakes in Audit Dispute Letters

When contesting an evaluation or insurance decision, it’s easy to make mistakes that can weaken your argument or delay resolution. Avoiding common pitfalls in your response is crucial to ensure that your message is clear and effective. Many individuals make the error of including unnecessary information or failing to address the core issues directly.

Here are some frequent mistakes to watch out for:

- Being too vague: A response that lacks specifics can lead to confusion. It’s important to clearly state the discrepancies and provide relevant evidence to support your position.

- Overloading with unnecessary details: While it’s important to provide evidence, too much irrelevant information can make your argument harder to follow. Stick to the facts that directly relate to the issue at hand.

- Using an aggressive tone: Being overly confrontational or rude can negatively affect the outcome. A professional and respectful tone increases the chances of a positive resolution.

- Failing to organize the information: A disorganized response can make it difficult for the reader to understand your key points. Ensure that your message is clear, logical, and easy to follow.

- Not being concise: Lengthy responses may lose the reader’s attention. Be brief, but thorough, making sure to communicate only what is necessary for resolving the issue.

Avoiding these mistakes can make your communication more effective and improve the likelihood of a timely and favorable resolution.

Key Elements of a Strong Dispute Letter

To effectively challenge an evaluation or insurance decision, certain elements are essential in ensuring that your response is taken seriously. A well-constructed document not only presents your argument clearly but also supports your case with accurate information. Including the right details and structuring them properly is key to achieving a favorable outcome.

Here are the critical components of a strong response:

- Clear and concise introduction: Begin by clearly stating the purpose of your communication. Mention the specific issue you are addressing and why it is important.

- Supporting documentation: Include any relevant documents, calculations, or references that back up your position. Providing concrete evidence will help to substantiate your claims.

- Specific explanation of errors: Identify the specific issues you are challenging and explain why they are incorrect. Use facts to highlight the discrepancies and provide a logical explanation.

- Professional tone: Always remain courteous and professional in your language. A respectful tone increases the likelihood that your concerns will be taken seriously.

- Clear call to action: Conclude by stating what you expect to happen next. Whether it’s a review of the data or a correction of errors, be clear about the action you want the recipient to take.

By incorporating these key elements into your response, you increase your chances of a swift and favorable resolution.

Tips for Negotiating with Insurance Companies

Negotiating with insurance providers can be a daunting task, especially when you believe the initial assessment is incorrect or unfair. To succeed in these situations, it’s crucial to approach the process strategically. Being prepared and understanding how to communicate effectively can help you achieve a better outcome.

Here are some useful tips for successful negotiations:

- Know your policy inside and out: Before engaging in any discussions, review your insurance agreement thoroughly. Understanding the terms and conditions can help you identify any areas where the company may be misinterpreting the policy.

- Document everything: Keep detailed records of all communications with the insurance provider. This includes emails, letters, phone calls, and any other form of correspondence. Having this documentation will serve as evidence if disputes arise.

- Remain calm and professional: Emotions can run high during these negotiations, but staying calm and polite is key. A respectful attitude can help foster a more constructive conversation.

- Present solid evidence: When challenging an assessment, support your position with clear, factual information. This could include additional documentation, expert opinions, or other relevant data that back up your claims.

- Know your bottom line: Understand your goals and be clear about what you are willing to accept. This will help guide the conversation and ensure that you don’t settle for less than what is fair.

By following these strategies, you can strengthen your negotiating position and increase the likelihood of a successful outcome.

When to Seek Legal Assistance in Disputes

While many issues with insurance or assessments can be resolved through direct communication, there are instances when the situation may require professional legal intervention. If attempts to resolve the matter amicably fail or if the stakes are high, consulting with an attorney can provide the necessary expertise to navigate the complexities of the case.

Here are some situations where seeking legal assistance is advisable:

- Unclear or complex terms: If the policy or terms of the evaluation are difficult to understand or open to interpretation, a lawyer can help clarify the situation and ensure you are not being taken advantage of.

- Unsuccessful negotiations: If your efforts to negotiate with the insurer have not led to a satisfactory resolution or if the process becomes unreasonably prolonged, legal support can expedite matters and help protect your rights.

- Significant financial impact: If the outcome of the issue could have a substantial impact on your finances or business operations, having a lawyer involved can help secure the best possible result.

- Threat of legal action: If the insurance company is threatening to take legal action or if you anticipate the need for legal proceedings, having an attorney guide you through the process is essential.

- Repeated errors or negligence: If you believe there is a pattern of mistakes or negligence on the part of the insurer that is undermining your case, legal expertise may be required to hold them accountable.

Seeking legal assistance at the right time can help you avoid costly mistakes and ensure that your interests are fully represented. A lawyer with experience in insurance matters can provide invaluable guidance and increase your chances of achieving a favorable outcome.