Letter of Explanation for Mortgage Lender Template

When applying for a loan, especially a home loan, you may be asked to clarify certain aspects of your financial history. This is a common part of the approval process, as financial institutions seek to better understand your situation and assess your ability to repay. Providing a clear and concise account of any discrepancies or unusual circumstances can greatly improve your chances of approval.

In these cases, submitting a well-written document that addresses the concerns of the lender is essential. This type of communication should be professional, honest, and structured to provide all the necessary details. The goal is to help the financial institution make an informed decision without leaving room for confusion or doubt.

Crafting an effective message that directly addresses the questions posed by the loan provider is crucial. Being transparent while maintaining a clear structure will enhance the credibility of your submission. Taking the time to organize your thoughts carefully will not only help resolve any potential issues but also demonstrate your commitment to the process.

Understanding a Mortgage Lender Explanation

When applying for a home loan, it’s not uncommon for the financial institution to request further clarification regarding specific details in your application. This request usually arises when the bank needs a deeper understanding of certain financial elements, such as a past missed payment or an inconsistency in income records. By addressing these points clearly, you provide the necessary context that can help move your application forward.

Why Clarifications Are Important

These clarifications are vital for the approval process, as they allow the loan provider to make an informed decision about your eligibility. Providing the right information in an organized manner can eliminate doubts and demonstrate your transparency, which is crucial in gaining trust. The goal is to show that any inconsistencies are either understandable or rectifiable, without casting doubt on your financial responsibility.

How to Approach the Request

It’s essential to approach this communication professionally and with clarity. A structured response that addresses each point raised by the financial institution helps them see the full picture. This communication is an opportunity to show that you are proactive and responsible, and it can significantly impact the outcome of your application.

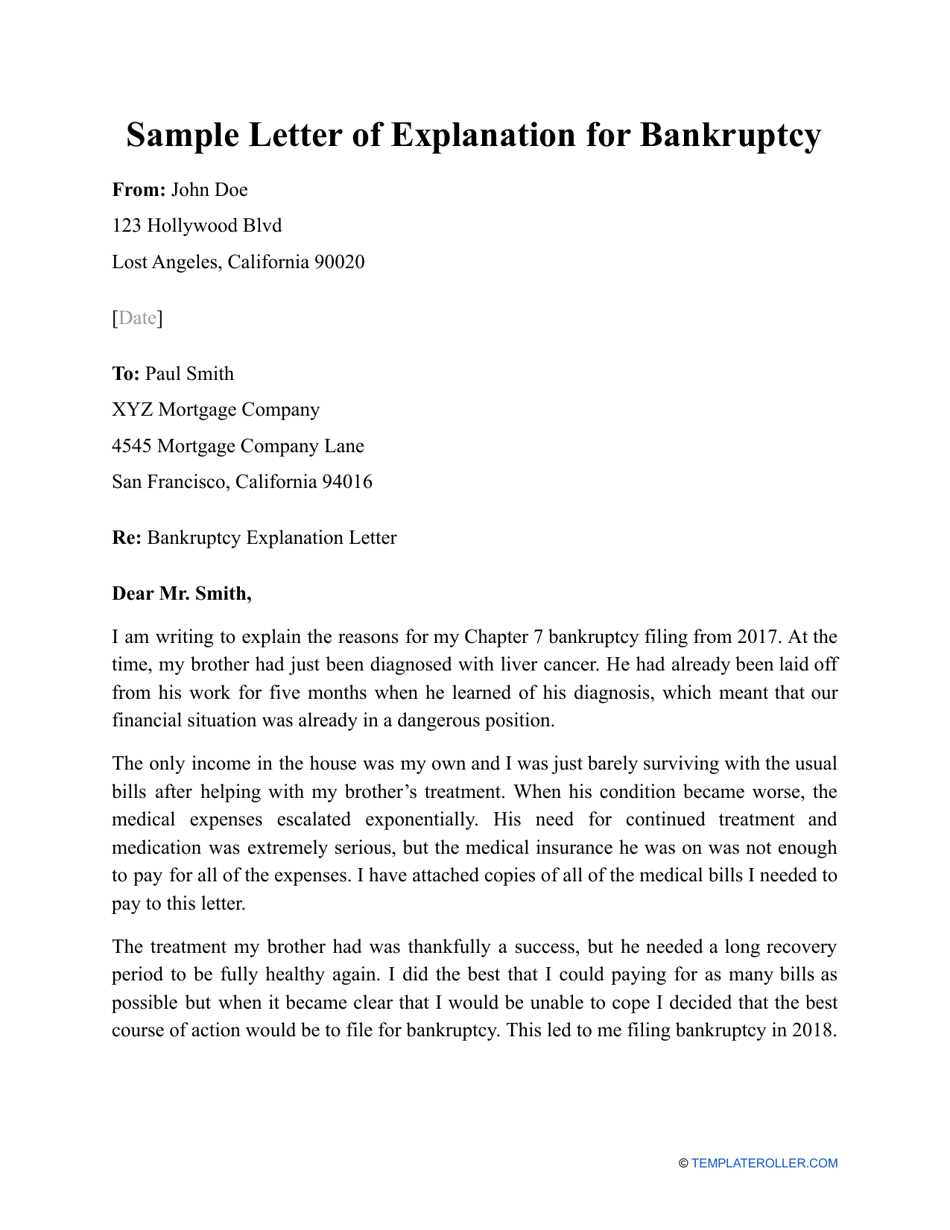

Reasons for Writing an Explanation Letter

When submitting an application for a loan, there are times when the reviewing party requires additional details to fully comprehend certain aspects of your financial background. These requests often arise when discrepancies or unusual patterns are noticed in your records. Clarifying these points helps ensure that your application is considered accurately and fairly.

Such clarifications allow the reviewing institution to understand any anomalies, whether they be missed payments, unexpected income fluctuations, or other irregularities. By providing a detailed account of these events, you demonstrate your willingness to be transparent and cooperative, which can significantly influence the decision-making process.

Additionally, a well-crafted response can help differentiate you from other applicants by showcasing your attention to detail and professionalism. It’s a chance to explain circumstances that might otherwise raise concerns, turning potential red flags into understandable situations that align with your overall financial stability.

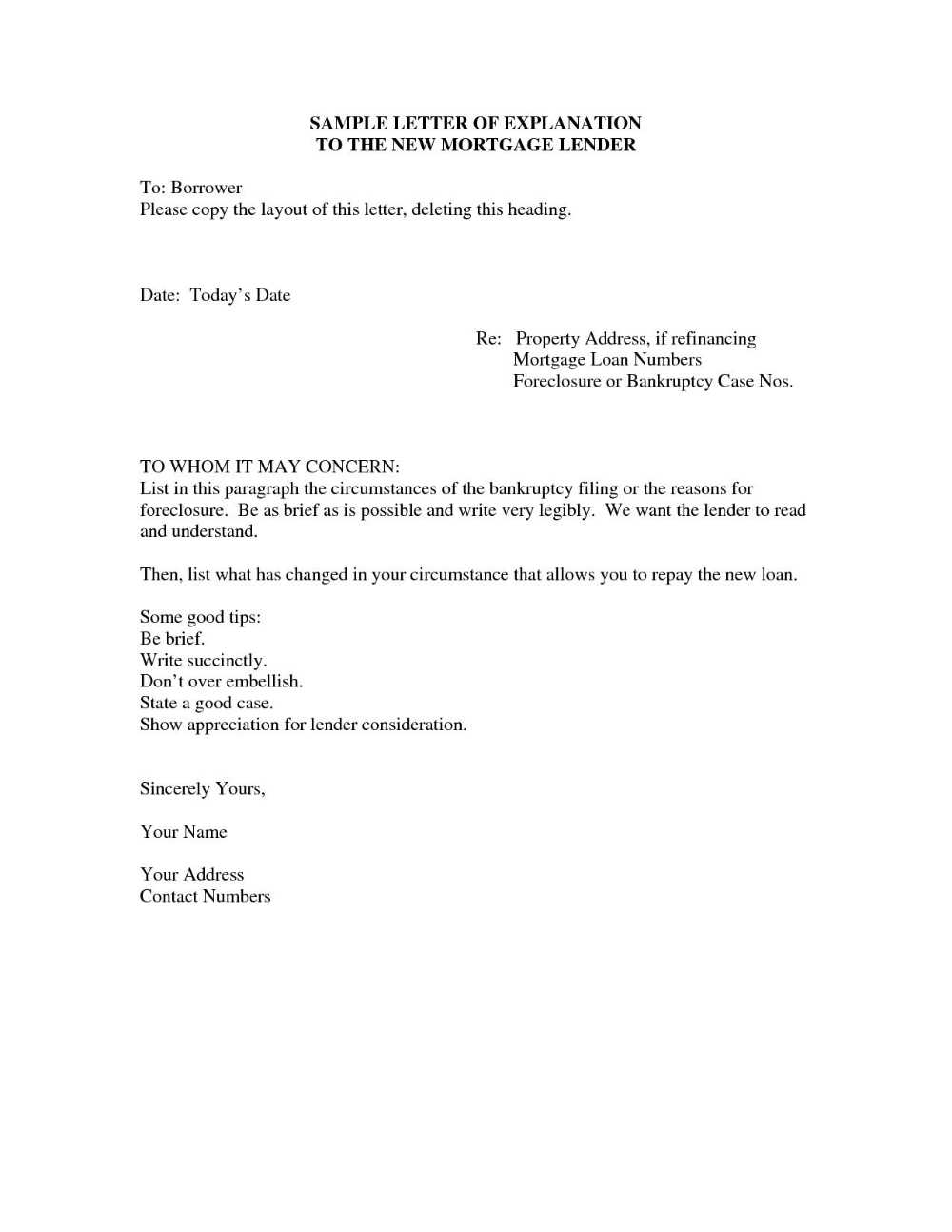

Essential Elements of the Document

When responding to a request for additional information from a financial institution, it’s crucial to include specific details that will address their concerns clearly and comprehensively. A well-organized document should cover all necessary points and be structured to convey your message effectively. Below are the key components that should be included:

- Introduction: Begin with a brief introduction that states your purpose for writing and acknowledges the request for clarification.

- Contextual Details: Provide a clear explanation of the circumstances surrounding the issue in question, such as missed payments, fluctuations in income, or other financial discrepancies.

- Supporting Evidence: If applicable, include any supporting documents or references that validate your explanation, such as bank statements or tax records.

- Resolution or Plan: Explain how you have resolved the issue or outline the steps you are taking to prevent it from happening again.

- Conclusion: Close the document by reaffirming your commitment to providing any additional information if needed and thanking the institution for considering your application.

By including these essential elements, you ensure that your response is thorough, professional, and likely to be received favorably by the reviewing party.

How to Organize Your Explanation

When responding to a request for additional information, structuring your response in a clear and logical manner is essential to ensure your points are easily understood. A well-organized account not only improves the chances of your application being approved but also demonstrates your professionalism and attention to detail. The goal is to present the facts in a coherent and straightforward way.

Start by addressing the key concerns raised, making sure to explain each one thoroughly. Be concise but complete in your explanations, and avoid unnecessary details that may distract from the main issue. Organizing your message into distinct sections can also help improve readability and make it easier for the reviewing party to follow your reasoning.

For clarity, consider the following approach:

- State the Purpose: Begin by clearly stating why you are writing and the specific issue you are addressing.

- Describe the Situation: Provide a detailed but focused explanation of the circumstances surrounding the concern.

- Support Your Claims: Offer relevant supporting evidence to back up your explanation, such as bank statements or income verification.

- Outline the Resolution: Explain how the issue has been resolved or the actions you are taking to prevent a recurrence.

- Wrap Up Professionally: Conclude by expressing your willingness to provide further details and thanking the recipient for their time and consideration.

By organizing your response in this way, you make it easier for the reader to understand the situation and assess your eligibility, ultimately strengthening your application.

Common Errors to Avoid in Letters

When addressing concerns from a financial institution, it’s important to avoid common pitfalls that can weaken your response or delay the approval process. While crafting your response, clarity, professionalism, and accuracy are key. Making certain mistakes can result in misunderstandings or cause your application to be delayed further. Below are some of the most frequent errors to steer clear of:

Vagueness and Lack of Detail

One of the most common mistakes is providing vague or incomplete information. When explaining a financial issue, it’s essential to offer specific details. For example, simply stating “I had some financial issues” does not provide enough context. Instead, give precise examples and dates, and clarify how the situation was resolved. This shows that you understand the problem and have taken steps to address it.

Overloading with Irrelevant Information

While it’s important to explain the issue thoroughly, providing too much unrelated information can detract from your main points. Stick to the facts that are directly relevant to the request. Overloading the response with unnecessary details can make it harder for the recipient to focus on the key points. Stay focused and keep your message concise and clear.

By avoiding these common errors, your response will come across as more professional and will likely have a positive impact on the outcome of your application.

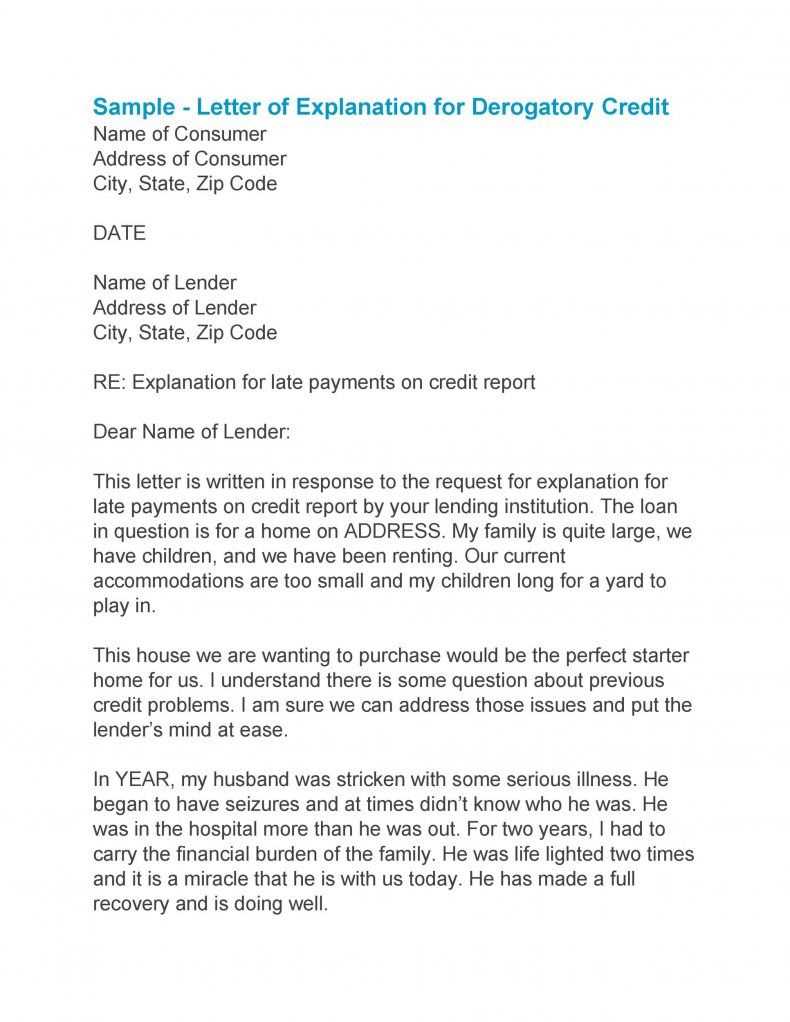

Advice for Crafting a Persuasive Letter

When responding to a request for additional information, presenting your case in a compelling way can greatly increase the chances of a favorable outcome. A persuasive response highlights your understanding of the situation, provides clear and relevant details, and demonstrates your commitment to resolving any issues. Here are some tips to help make your communication more convincing:

Be Clear and Concise

Focus on presenting your message in a straightforward manner. Avoid unnecessary complexity and get to the point quickly. The easier it is to understand your explanation, the more likely the recipient will appreciate it. Key points should stand out, and long-winded explanations should be avoided.

Show Responsibility and Accountability

Financial institutions value applicants who take ownership of their actions. If there were any issues in the past, explain what led to them and acknowledge your role in the situation. This shows maturity and transparency, which can significantly boost your credibility.

- Start with a Strong Introduction: Briefly state the purpose of your communication and what you are addressing.

- Explain the Issue Clearly: Provide relevant facts and describe the circumstances with precision.

- Offer Solutions: Explain the steps you have taken or plan to take to avoid similar situations in the future.

- Express Gratitude: Thank the recipient for their time and consideration, and express your willingness to provide any further information.

By following these guidelines, you can craft a more persuasive and professional response that addresses the concerns effectively and improves your chances of a positive review.

Next Steps After Submission

Once you’ve submitted your response, it’s important to stay proactive and aware of the next steps in the process. This phase involves waiting for feedback, preparing for any further requests, and ensuring you’re ready for the decision that follows. Here’s what you can expect after submitting your document:

Monitoring the Status

After sending your materials, regularly check for updates. Institutions typically provide timelines for reviewing documents, but it’s also a good idea to follow up if you haven’t received any communication within the expected timeframe. Staying informed helps you avoid unnecessary delays and keeps the process moving forward.

Prepare for Further Requests

In some cases, the reviewing party may request additional information or clarification. Be ready to respond promptly. Gather any supporting documents or evidence you may need in advance, so you can address follow-up questions without delay.

| Action | Details | Timeline |

|---|---|---|

| Follow up | Check in with the recipient if no updates are received after the expected review period. | 1-2 weeks after submission |

| Provide additional information | Respond promptly to any requests for further documents or clarification. | As soon as possible after request |

| Review decision | Carefully assess the outcome of the review process, whether positive or negative. | Varies depending on institution |

Being proactive after submission demonstrates your commitment and helps ensure the process goes smoothly. Stay organized, communicate effectively, and be prepared for any next steps that come your way.