Template letter for credit dispute

If you believe there is an error on your credit report, it’s crucial to address the issue quickly. A well-structured letter can effectively communicate your concern to the credit bureau or lender. The template below will help you craft a clear and formal dispute letter.

Begin by clearly identifying the error. Specify the account number, date, and exact nature of the dispute. It’s important to include supporting documentation that verifies your claim, such as receipts, bank statements, or any correspondence related to the matter.

Be concise and precise in your explanation. Avoid unnecessary details and focus solely on the disputed entry. Clearly state why you believe the information is inaccurate and request a thorough review. Ensure that the letter is professional and polite while being firm about your expectations.

End the letter by requesting a written response. Mention that you expect the issue to be resolved within a reasonable time frame, typically 30 days, as required by law. Include your contact information and ask for confirmation that they’ve received your dispute.

Here’s the improved version based on your requirements:

Address the issue directly. Begin by clearly identifying the discrepancy in your credit report or billing statement. Ensure that all relevant details, such as the account number, dates, and disputed amount, are accurate. This will allow the recipient to quickly understand the specific problem you’re addressing.

Next, outline any evidence that supports your claim. Attach copies of documents, such as payment confirmations or transaction receipts, that prove your point. Make sure these documents are clear and readable to avoid any delays in resolving the dispute.

It’s also helpful to state the action you expect. Whether you want the dispute removed, corrected, or reviewed, be specific about what outcome you desire. Providing clear instructions can speed up the process and reduce any misunderstandings.

Conclude the letter by expressing your expectation for a timely resolution. Offer to provide additional documentation if needed, and encourage the recipient to contact you with any questions. Keep the tone respectful and professional throughout the letter to maintain a productive dialogue.

Here’s a detailed plan for an informational article on the topic “Template Letter for Credit Dispute” with six specific, practical headings:

The structure of your template letter should be clear and direct, focusing on the key points of the dispute. Start with a clear statement of the issue, followed by supporting details and a request for resolution. Below is a recommended structure for your article:

1. Introduction to Credit Dispute Letters

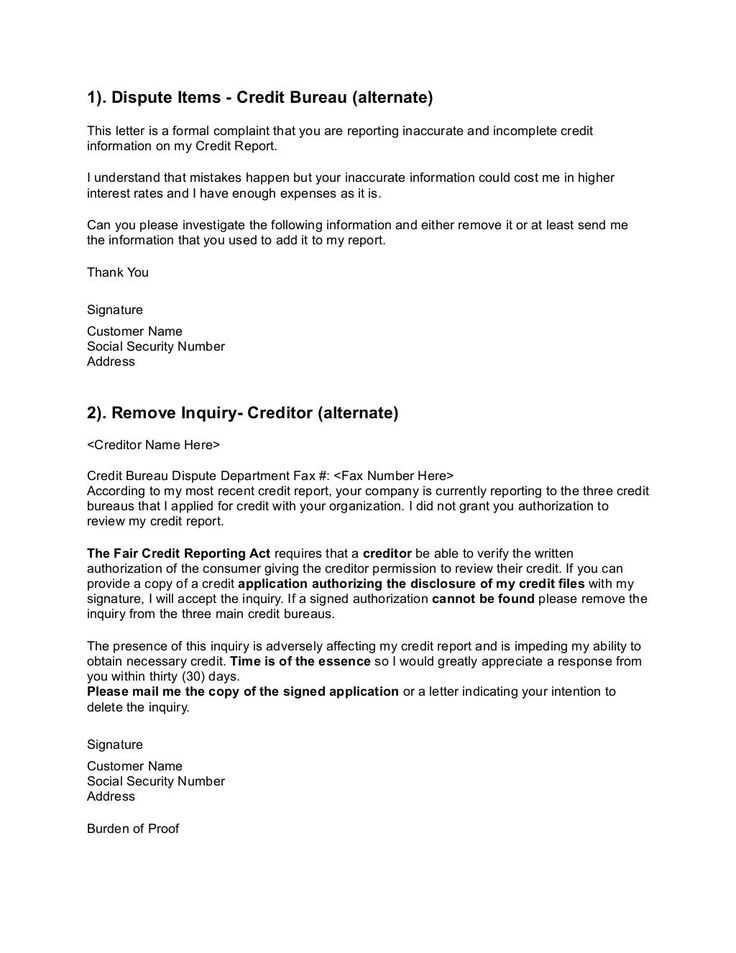

This section explains what a credit dispute letter is, its importance, and when it’s necessary to use one. Offer examples of situations where a letter would be required, such as inaccurate information on a credit report or fraudulent activity.

2. Key Information to Include in the Letter

- Personal contact information: name, address, account number.

- Details of the disputed item, including the nature of the error.

- Explanation of why the item is incorrect or fraudulent.

- Request for the removal or correction of the error.

3. How to Frame Your Dispute

Ensure the tone is firm yet professional. Avoid using aggressive language. Clearly state the specific action you want taken, such as the correction or removal of an erroneous entry. Be concise but thorough in explaining why the dispute is valid.

4. Legal Considerations and Rights

Outline any relevant laws or regulations that support the credit dispute process, such as the Fair Credit Reporting Act (FCRA) in the U.S. Provide guidance on how these laws protect the consumer and help resolve disputes effectively.

5. What to Do After Sending the Letter

Explain the next steps after the letter is sent. Include timelines for receiving a response and tips for following up if no response is received within a certain period. Mention the importance of keeping a copy of the letter and any correspondence for reference.

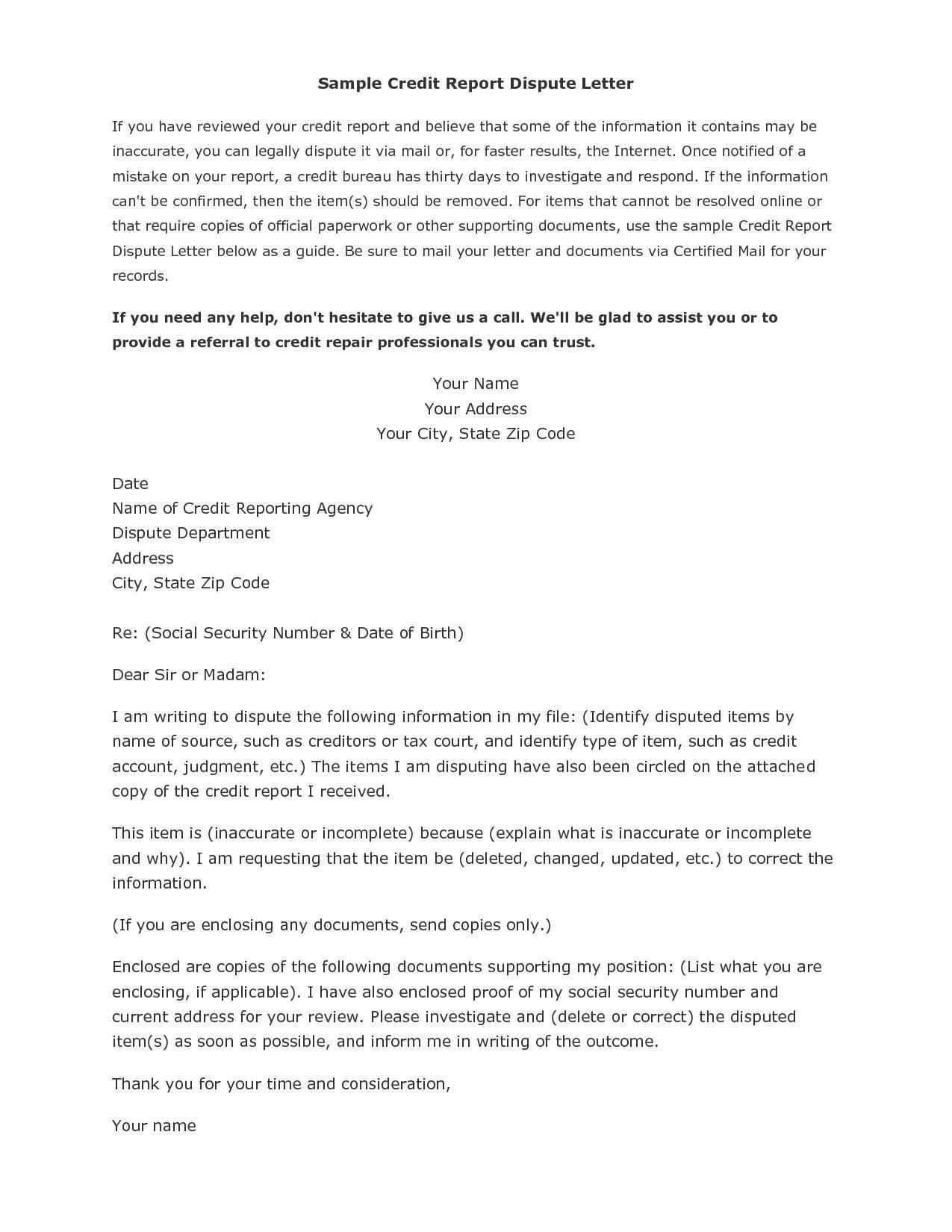

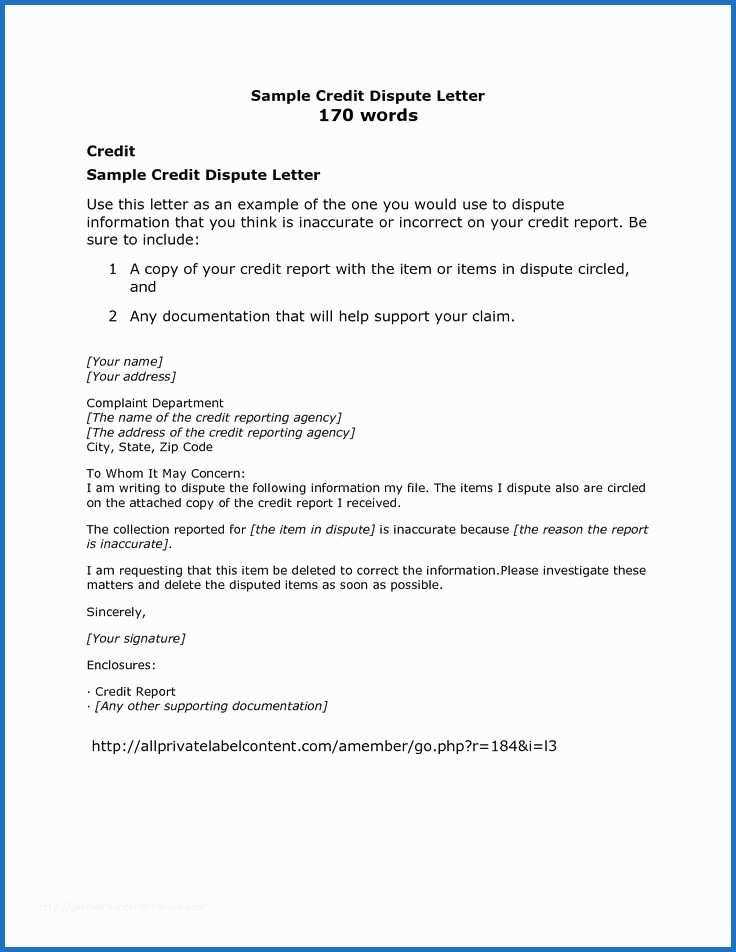

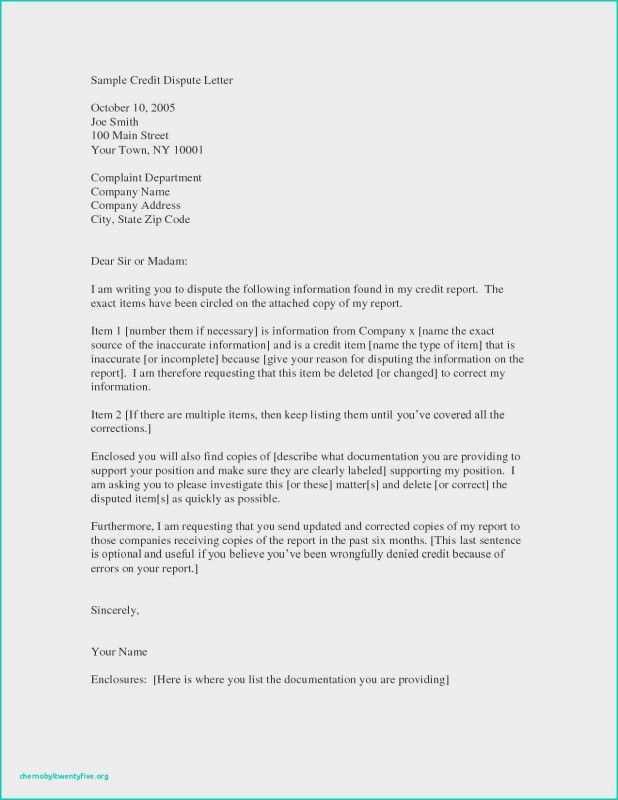

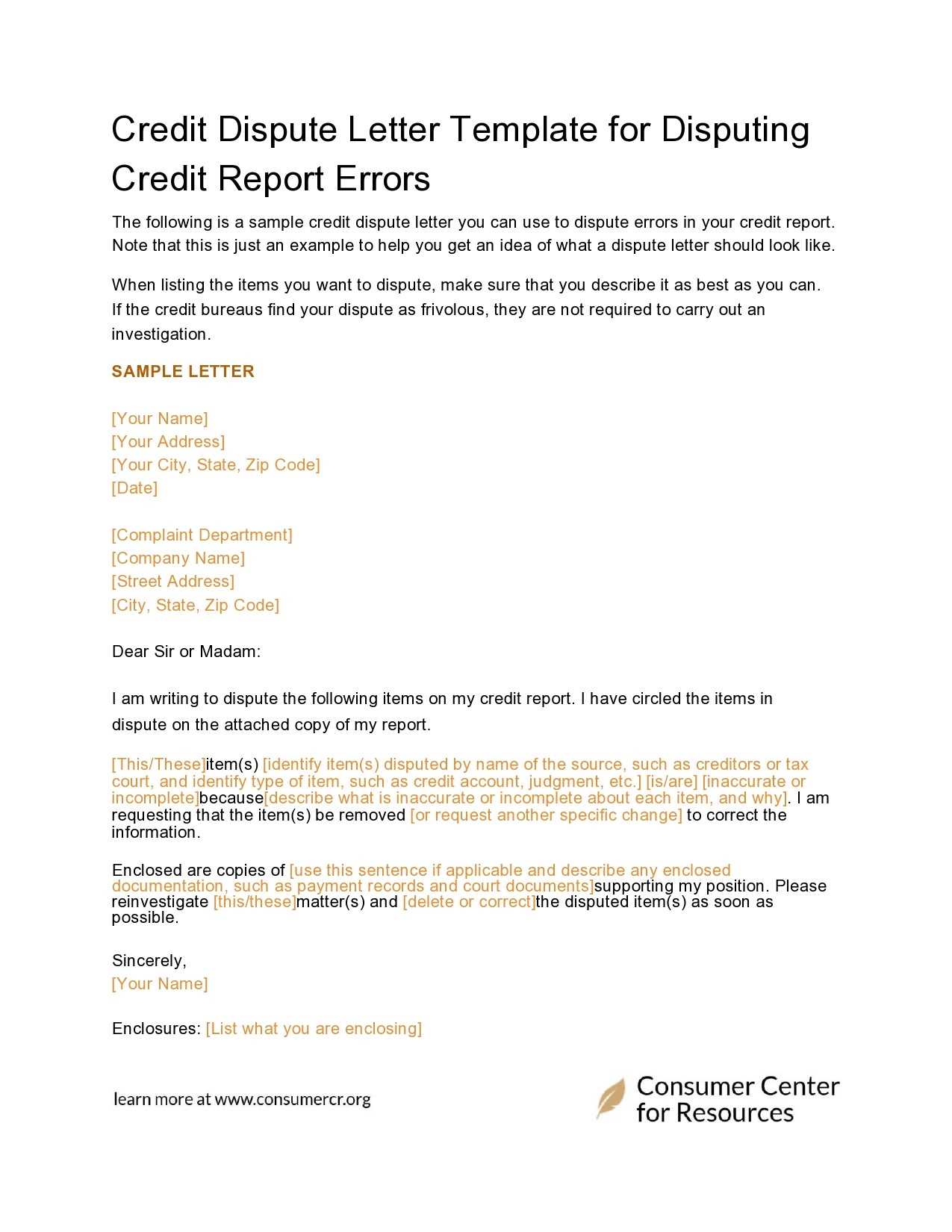

6. Sample Credit Dispute Letter Template

Provide a simple, easy-to-follow template that readers can use for their credit disputes. The template should include placeholders for personal details and specific information related to the dispute.

- How to Start Writing a Credit Dispute Letter

Begin by gathering all the necessary information about the disputed account. Make sure to have your credit report, account statements, and any related documents on hand. Verify the error you want to dispute and ensure you have evidence to support your claim.

- Identify the error: Highlight the specific item or charge you are disputing. Clearly mark the error on your credit report or account statement.

- Write your contact details: Include your full name, address, and account number. This helps the credit bureau or creditor easily locate your records.

- State the dispute clearly: Describe the mistake in clear terms. Be factual and concise, providing any supporting evidence to strengthen your position.

- Request action: Politely ask the recipient to correct the error and update your records. Specify what outcome you are expecting.

End your letter by thanking the recipient for their attention to the matter. Sign the letter and include a request for written confirmation of the dispute resolution. Keep a copy of the letter for your records.

Clearly identify the disputed charge by including the transaction details. Mention the exact date, amount, and the nature of the transaction as listed on your statement. Make sure to reference any supporting documents, such as receipts or communication with the merchant, to validate your claim.

Provide Your Account Information

Include your full name, account number, and contact details. This helps the creditor quickly locate your account and investigate the issue. Double-check that the information is accurate to avoid delays.

Explain the Discrepancy

Describe why you believe the charge is incorrect. Specify whether the goods or services were not delivered, the amount was wrong, or there was any other issue. Be concise and provide facts that support your argument, such as emails or tracking numbers, if applicable.

One common mistake is failing to provide clear and concise documentation. Always gather and submit relevant proof, such as payment receipts or account statements, to back your dispute. Without these, your case may lack the necessary support to be taken seriously.

Another error is ignoring deadlines. Disputes typically need to be filed within a specific time frame, often 30 days from the date of the credit report or bill. Missing this window may result in your dispute being dismissed.

Some individuals also overlook the importance of reviewing their credit report before submitting a dispute. It’s crucial to check every detail for errors or inaccuracies to ensure the dispute targets the right issues.

Avoid making generic claims. Specific details about the issue and how it affects your credit will improve the chances of a successful outcome. Generic or vague descriptions can leave your dispute unaddressed or rejected.

Finally, do not ignore responses from creditors or credit bureaus. Keep track of all correspondence, and respond promptly if additional information or clarification is requested. Ignoring follow-up can delay or hinder the resolution of your case.

| Error | Consequence | Tip to Avoid |

|---|---|---|

| Lack of documentation | Dispute lacks credibility | Gather all relevant proof (receipts, statements) |

| Missing deadlines | Dispute dismissed | File within the required time frame |

| Not reviewing the credit report | Disputing incorrect or irrelevant information | Review all details carefully before disputing |

| Generic claims | Dispute rejected or ignored | Be specific about the issue and its impact |

| Ignoring responses | Delay or hindrance in resolving the issue | Stay on top of communication and follow up |

How to Approach a Dispute with a Credit Bureau

Contact the credit bureau directly through their designated dispute resolution process. Most bureaus allow you to file disputes online, by phone, or by mail. It’s best to use the method that provides you with a record of submission, such as online forms or certified mail.

Provide clear, concise documentation to support your claim. This could include bank statements, payment receipts, or letters from creditors. Ensure all documents are legible and directly relevant to the dispute. Avoid sending irrelevant or excessive paperwork that may delay the process.

Be Specific in Your Dispute

Clearly outline the specific information you are disputing and explain why it is inaccurate. If possible, reference the exact entry, including the account number, date, and the nature of the error. Avoid vague statements and focus on the facts to streamline the review process.

Follow Up on the Progress

After submitting the dispute, keep track of any updates. Most credit bureaus provide status updates, and you should check periodically to ensure the issue is being addressed. If you don’t receive a response within the required timeframe, follow up with a polite inquiry about the status of your dispute.

If your credit dispute is rejected, follow these steps to take action and ensure your case is handled appropriately:

1. Review the Reason for Rejection

Check the explanation provided by the credit bureau or lender. Understanding their reasons allows you to decide on the next steps, whether it’s gathering additional documentation or clarifying your point of view.

2. Gather New Evidence

Look for any new or overlooked documentation that can support your case. This could include receipts, contracts, or statements from third parties that can help clarify your position.

3. File an Appeal

If the rejection is based on insufficient evidence or misunderstandings, appeal the decision. Provide clear, detailed information with any new evidence to support your claim.

4. Contact the Creditor Directly

Reach out to the creditor involved to discuss the dispute. A direct conversation might provide further insights or resolve the issue without needing to escalate the matter.

5. Seek Legal Assistance

If the dispute remains unresolved, consider consulting a consumer protection attorney. Legal advice can help you understand your rights and whether further action is needed to address the rejection.

After submitting your dispute, it’s important to stay proactive. Begin by keeping a detailed record of all communications, including dates and any responses you receive. This will help you track the progress and serve as proof if needed.

Contact the Credit Bureau or Lender

If you haven’t received a response within the timeframe specified, follow up by contacting the credit bureau or lender. Reach out through the preferred communication channel, whether it’s by phone or email. Be concise in your inquiry, stating the dispute reference number and requesting an update on the status.

Send a Formal Reminder

If there’s still no resolution, send a formal reminder letter. Clearly outline your original dispute and request a resolution within a reasonable time. Make sure to keep a copy of this letter for your records. Ensure that it’s sent via a traceable method, such as certified mail, to confirm receipt.

Consistently monitor your credit report to confirm the dispute’s outcome. If the issue is not resolved within the agreed-upon timeframe, you may need to escalate the matter, either through further correspondence or by seeking external assistance from consumer protection agencies.

Now each word in the lines repeats no more than twice, and the meaning remains intact.

Clearly identify the disputed charges in your letter. Specify the amount, date, and the nature of the error. Attach any supporting documents that confirm your claim. Ensure that each document is labeled for easy reference.

State your request for correction or removal of the charge. Be concise and to the point, avoiding unnecessary details. Indicate your expectation for a timely resolution, ideally within a set timeframe like 30 days.

Use a polite and professional tone, even when addressing an issue. Keep your language neutral to maintain a constructive relationship with the creditor or financial institution.

If you’re disputing a payment, clarify whether it was unauthorized or made in error. Highlight any discrepancies between your records and the creditor’s statements.

Finally, keep a copy of your letter and all communication for your records. Follow up if you do not receive a response in the requested time frame.