Statutory demand letter template

Use a statutory demand letter to formally request payment from a debtor. This document serves as a critical step before taking legal action. By following a clear template, you can avoid unnecessary confusion and ensure that your demand meets the necessary legal requirements.

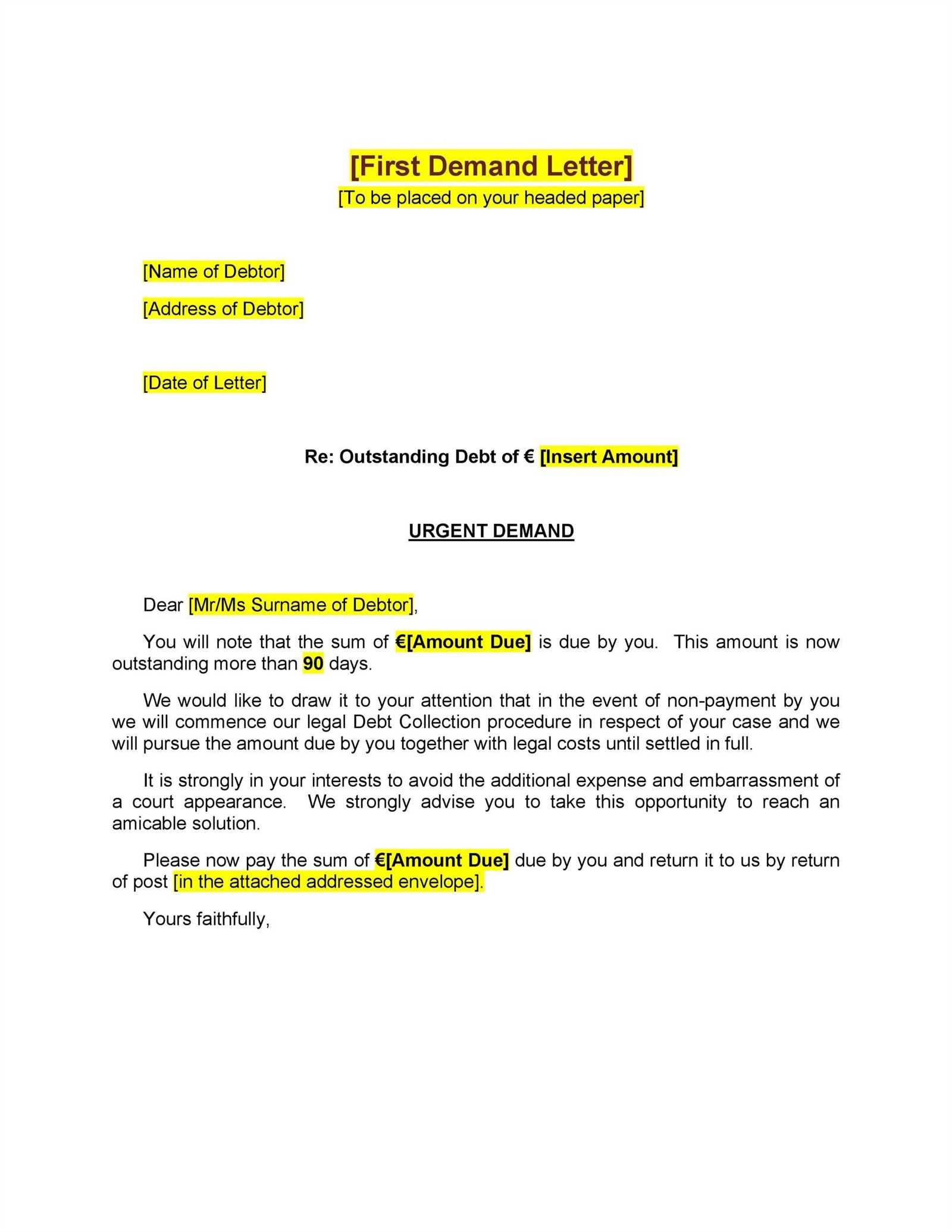

Begin the letter by stating the exact amount owed, the reason for the debt, and the date it was due. Include a clear deadline for payment, typically 21 days, in order to give the debtor sufficient time to respond. Be sure to specify the consequences if the debt remains unpaid, such as court proceedings or winding up petitions.

To maintain professionalism, use formal language throughout the letter. Include both your and the debtor’s full names and addresses, as well as any relevant case or account numbers. It’s also beneficial to attach supporting documents, such as invoices or agreements, to strengthen your case.

Finally, make sure the letter is delivered via a traceable method, such as registered mail, to provide proof of delivery. This step ensures that you have a record of when the debtor received the demand. If payment is not received within the specified period, be ready to proceed with the next legal steps.

Here is a detailed plan for an informational article about “Statutory Demand Letter Template” in HTML format with 6 practical and specific headings:

Use a statutory demand letter template to ensure proper legal procedure when pursuing debt recovery. Follow this structure for clear and precise communication with the debtor.

1. What is a Statutory Demand Letter?

A statutory demand letter is a formal request for payment of a debt, legally recognized in many jurisdictions. This letter is often the first step before initiating formal legal actions, such as a bankruptcy petition. Make sure to include the full details of the debt and the statutory demand requirements in the letter.

2. Key Elements to Include in a Statutory Demand Letter

To create an effective statutory demand letter, include the following components:

- Details of the creditor (your name, address, and contact information)

- Details of the debtor (debtor’s name, address, and contact information)

- Amount owed and a breakdown of the debt

- A clear statement of the demand for payment within a specific period

- Information about the consequences of non-payment (such as potential legal action)

- Signature and date of the letter

3. How to Address Common Mistakes in Statutory Demand Letters

Errors in a statutory demand letter can cause delays or weaken its legal validity. Avoid common mistakes, such as:

- Incorrect debtor details, which may lead to non-receipt of the letter

- Ambiguous wording of the demand for payment

- Failure to adhere to statutory timeframes for payment or response

4. Legal Consequences of Issuing a Statutory Demand Letter

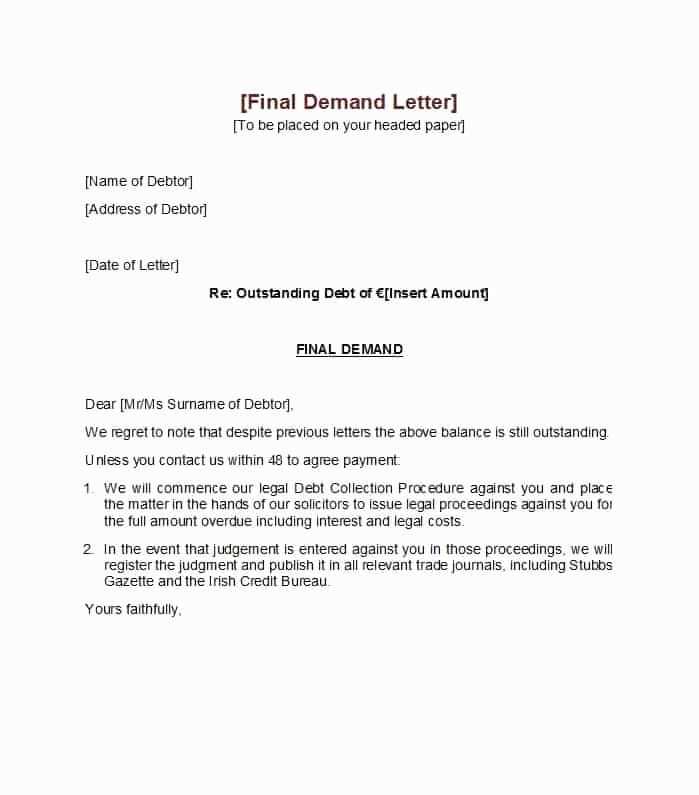

Issuing a statutory demand letter is a formal action that could lead to further legal proceedings. If the debtor does not respond within the required timeframe, you can apply for a court order or initiate bankruptcy proceedings. This action can impact the debtor’s credit rating and financial standing.

5. What to Do After Sending a Statutory Demand Letter

Once the statutory demand letter is sent, monitor the debtor’s response. If they do not pay or provide a satisfactory response within the stipulated period, prepare to take legal action. Consult with a legal advisor to determine whether to file a bankruptcy petition or pursue other legal remedies.

6. How to Customize Your Statutory Demand Letter Template

Tailor the statutory demand letter template according to the specifics of the debt and your jurisdiction’s legal requirements. Adjust the tone, language, and structure to suit the severity of the situation. Ensure that the template is updated regularly to stay compliant with any changes in the law.

- Statutory Demand Letter Template

A statutory demand letter should be clear, concise, and contain all necessary legal elements to be effective. This template can serve as a guide for writing such a letter, ensuring you address all required points.

Key Components of a Statutory Demand Letter

| Section | Details |

|---|---|

| Creditor Information | Include your full name, address, and contact details at the top of the letter. |

| Debtor Information | Clearly state the debtor’s full name and address. Be sure to verify the accuracy of this information. |

| Amount Owed | Specify the exact amount the debtor owes. Include any interest, if applicable, and reference the agreement or contract from which the debt arises. |

| Demand for Payment | State the exact amount owed and demand payment within a specified timeframe (usually 21 days). |

| Failure Consequences | Outline the legal consequences for failing to comply, such as initiating bankruptcy proceedings or court action. |

| Signature | End the letter with your signature and date to confirm authenticity. |

Example Template

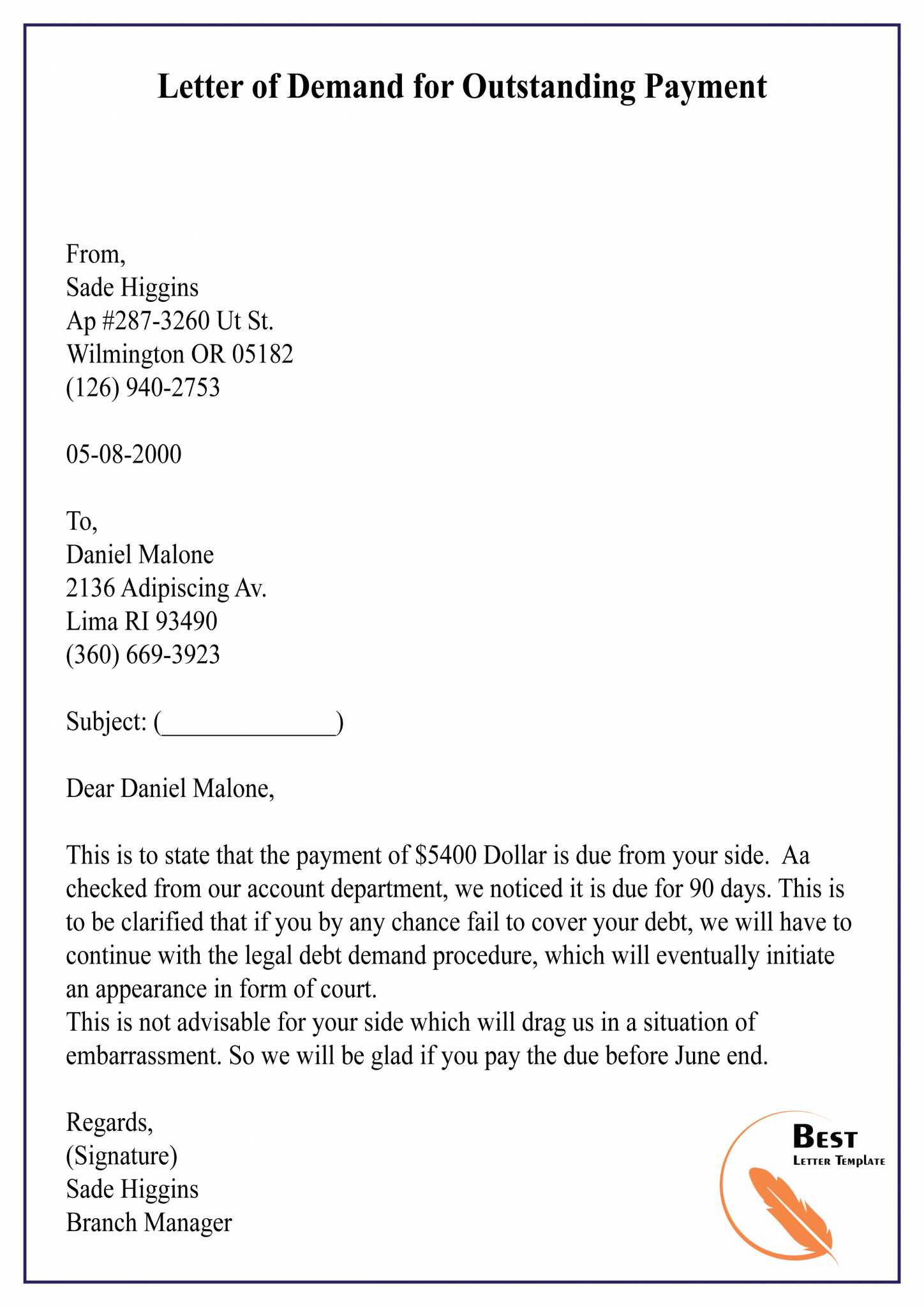

Below is a sample statutory demand letter for reference:

[Your Name] [Your Address] [City, Postcode] [Phone Number] [Email Address] [Date] [Debtor's Name] [Debtor's Address] [City, Postcode] Dear [Debtor's Name], Re: Statutory Demand for Payment of Debt I am writing to formally demand the payment of £[amount owed], which is due under the terms of [contract/agreement name] dated [date]. The outstanding amount is for [describe the nature of the debt]. Please remit the full amount to [your payment details] within 21 days from the date of this letter. Failure to pay within the specified period may result in legal action, including proceedings for bankruptcy. If you believe this debt is not owed, please respond with your reasoning immediately. Should you fail to settle the debt or respond appropriately, further legal steps will be taken to recover the amount. Yours sincerely, [Your Signature] [Your Name]

Ensure that the letter is sent by a method that confirms receipt, such as registered post, for legal documentation purposes. If the debtor does not respond or pay within the specified time, you may consider pursuing further legal actions to recover the debt.

A statutory demand serves as a formal request for payment, typically issued when a debtor has failed to settle a debt within the agreed-upon timeframe. It is an important legal tool that notifies the debtor of their outstanding obligation and establishes a clear deadline for repayment. This document provides a strong legal basis for further action, including the possibility of bankruptcy proceedings if the debt remains unpaid.

Encouraging Payment

The primary purpose of a statutory demand is to encourage the debtor to pay the debt in full. By formally notifying the debtor and providing a clear timeline for payment, the creditor signals that legal steps will follow if the debt is not settled. This often leads to prompt repayment, as the threat of more severe legal actions becomes a motivating factor for the debtor.

Starting Legal Proceedings

If the debtor does not respond to the statutory demand within the set period, typically 21 days, the creditor can initiate legal proceedings, such as applying for a bankruptcy order. The statutory demand acts as a precursor to these more serious legal actions, giving the debtor one final chance to resolve the issue without facing court intervention.

Begin with a clear statement of the debt owed. Specify the exact amount, including any interest or additional charges. Ensure all figures are precise to avoid confusion.

Provide the date by which the payment must be made, typically giving a 21-day window from the receipt of the letter. Include a reminder that failure to comply may lead to legal action.

List the contact details of both the creditor and debtor, ensuring that all necessary communication channels are open for dispute resolution or clarification.

State the legal basis of the claim. Reference the specific law or regulation under which the demand is being made. This adds weight to the demand and clarifies the creditor’s legal position.

Include a brief description of the debt itself, such as the nature of the agreement or service rendered, without going into excessive detail. Keep it factual and to the point.

Conclude with a formal request for payment and the consequences of not responding within the stipulated time frame. This includes potential court action and additional costs involved in pursuing the claim.

Ensure your statutory demand letter complies with the required legal framework to avoid disputes or delays. Start by clearly identifying the debt owed and the person or entity to whom it is owed. Specify the exact amount, including any interest, and provide a breakdown of how this figure was calculated.

Key Elements to Include

- Correct identification of the creditor and debtor

- A precise statement of the debt owed, including supporting documentation

- A notice of the right to challenge the demand

- The deadline for responding or settling the debt

- The warning of legal action if the debt is not paid within the specified time frame

Verify the Format and Delivery Method

- Ensure the letter follows the required format for statutory demands in your jurisdiction

- Send the letter using a traceable method, such as registered mail, to prove receipt

Check that all deadlines mentioned in the letter are in line with statutory requirements. A well-prepared statutory demand letter sets clear expectations for both parties, increasing the likelihood of compliance without further legal action.

Be specific about the amount owed. Vague language can weaken your claim. Clearly state the exact figure, including any interest or additional charges, to avoid confusion.

Ensure proper formatting and professional tone. A letter that appears rushed or poorly structured might not convey the seriousness of the demand. Maintain clarity and consistency throughout the document.

Double-check the legal requirements for the demand. Depending on the jurisdiction, certain steps must be followed, such as providing specific notice periods or including particular statements. Failing to meet these requirements could invalidate your demand.

Don’t ignore the recipient’s contact details. Ensure the debtor’s name and address are accurate. Incorrect information can lead to the letter being undelivered or misinterpreted.

Avoid emotional language. Keep the tone factual and focused on the debt, not personal grievances. Any sign of aggression can jeopardize the professional nature of the letter.

Be cautious with deadlines. Giving the debtor too much time or too little may complicate enforcement. Ensure the timeline complies with relevant laws while remaining reasonable and clear.

Ignoring a statutory demand can lead to severe consequences. The most immediate risk is the possibility of the creditor filing for a winding-up petition in court. This legal action can lead to the dissolution of your business or the forced sale of personal assets to settle the debt.

Impact on Credit Rating

Failure to respond to a statutory demand will likely result in a negative mark on your credit report. This can make it difficult to obtain future credit, loans, or financing, affecting both personal and business financial opportunities.

Potential Legal Action

If the statutory demand is not settled within the required time frame, legal action may follow. This can result in court proceedings, additional legal costs, and a judgment against you. In some cases, the court may order the seizure of assets or a bankruptcy order.

It’s crucial to take prompt action and seek professional advice to avoid these serious repercussions. Addressing the demand early can prevent escalation and help protect your financial future.

If you’re dealing with a statutory demand and find yourself unsure about the next steps or the legal implications, it’s wise to seek legal advice. In some cases, statutory demands can lead to severe consequences, including bankruptcy or liquidation proceedings, so understanding your rights and obligations is key.

Signs You Need Legal Assistance

Consult a lawyer if any of the following situations arise:

- If the demand is unclear or contains errors, such as incorrect amounts or missing details.

- If you are unable to pay the debt and the demand threatens legal action.

- If you’re unsure about your legal position or whether the demand is valid.

- If you believe the creditor’s claim is disputed or is unjustified.

Steps to Take Before Contacting a Lawyer

Before reaching out to legal professionals, gather all relevant documents, such as the statutory demand, correspondence with the creditor, and any evidence that supports your case. This will help the lawyer assess your situation more efficiently.

| Action | Reason |

|---|---|

| Review the statutory demand | Ensure the details are accurate and understand the nature of the claim. |

| Assess your financial situation | Determine whether you can pay the debt or need to explore options like negotiation or dispute. |

| Collect supporting documentation | Evidence of payment or dispute can be vital for your lawyer to assess the situation. |

Legal professionals can guide you through the statutory demand process, helping you respond appropriately and avoid unnecessary risks. Don’t hesitate to seek help if you have any doubts about the validity or consequences of a statutory demand.

To create a statutory demand letter, it is crucial to include clear and specific language to ensure legal enforceability. Follow these guidelines to structure the document effectively:

- Begin with the debtor’s full name and contact details, including their registered address.

- Include a statement of the amount owed, with clear reference to the debt and any applicable interest.

- Provide a detailed description of the debt, including invoices, contracts, or other supporting documentation.

- Specify the payment terms, including a reasonable deadline, which is typically 21 days from the date of delivery.

- State the consequences of non-compliance, such as initiating legal proceedings if the debt is not settled.

Required Formalities

- The statutory demand must be signed by the creditor or their authorized representative.

- Ensure that the demand is delivered to the debtor via a method that confirms receipt, such as registered post.

Carefully follow these steps and avoid using vague language or leaving room for misinterpretation. This will help ensure your statutory demand is legally sound and effective in prompting the debtor to pay.