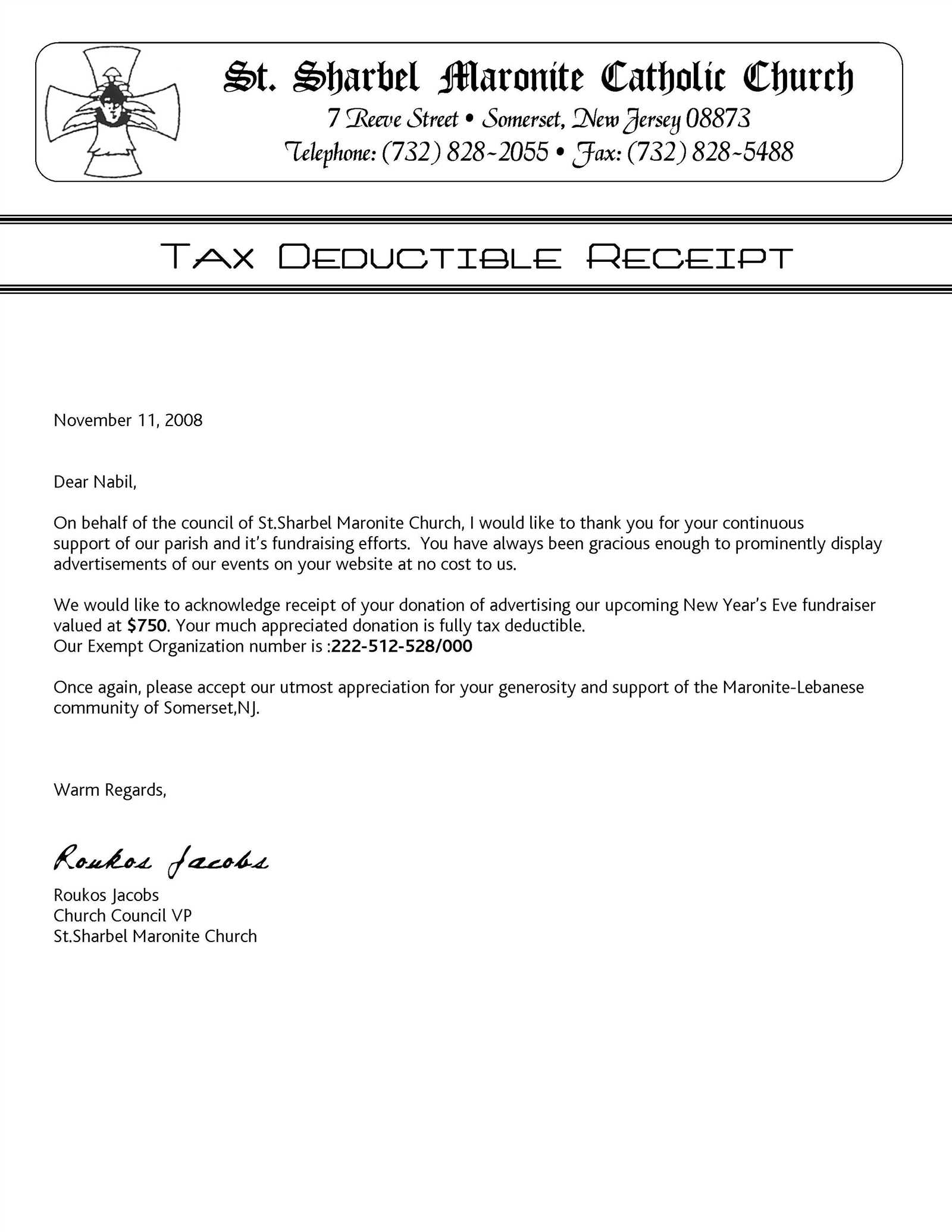

Church donation receipt letter template

When crafting a donation receipt for your church, ensure that the letter clearly states the contribution details, donor information, and a thank-you message. A well-structured receipt helps both the church and the donor maintain accurate records for tax purposes and encourages future giving. The receipt should be concise, professional, and personalized to reflect the church’s values.

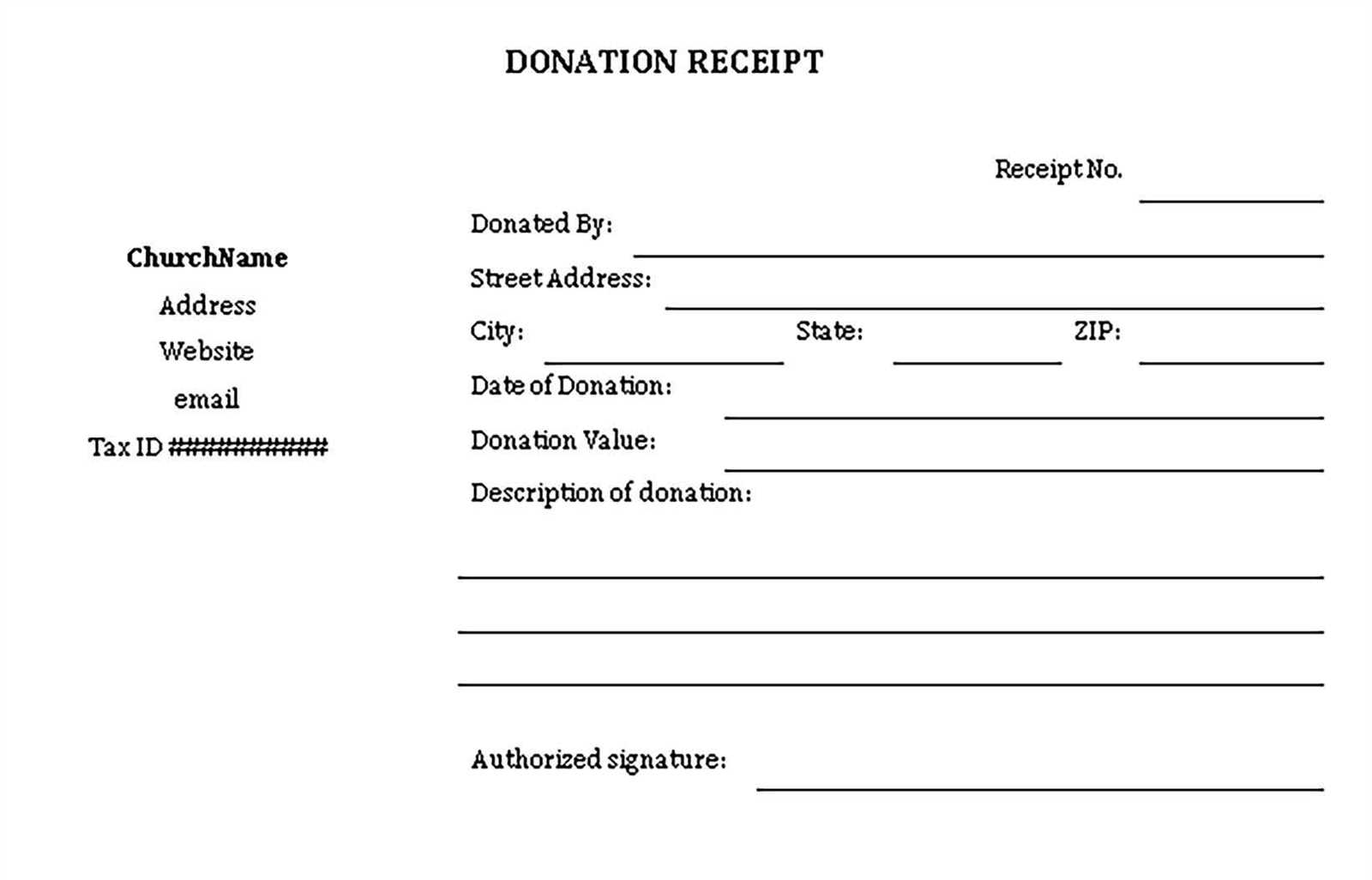

The key elements of a donation receipt include the donor’s name, the date of the donation, the amount donated, and a statement confirming whether any goods or services were provided in exchange. If there were no goods or services, this should be stated clearly. This ensures the donor can claim the appropriate tax deduction. Include your church’s name, address, and tax-exempt status, as these are crucial for the donor’s tax records.

Make sure to express your appreciation for the donation. A brief message of gratitude helps reinforce the donor’s connection to the church and its mission. Highlight how their gift will support your community and initiatives, offering a sense of fulfillment for their generosity.

Church Donation Receipt Letter Template

Begin the letter with a clear statement acknowledging the donation and expressing gratitude. Specify the amount or description of the donation and confirm that no goods or services were exchanged in return. This will help donors with their tax deductions. Make sure to include the name of the church, its tax-exempt status, and the date of the donation.

Example:

Dear [Donor’s Name],

Thank you for your generous donation of [Donation Amount or Description] received on [Date]. Your support helps us continue our mission to [brief description of church activities]. We want to confirm that no goods or services were provided in exchange for your gift. Our tax-exempt status number is [Church Tax ID Number], and your contribution is fully deductible under applicable tax laws.

If you have any questions or need further documentation, please feel free to contact us at [Phone Number or Email Address].

We truly appreciate your ongoing commitment to our church community.

Sincerely,

[Your Name]

[Your Position]

[Church Name]

How to Start a Church Donation Receipt Letter

Begin by including your church’s name and contact information at the top of the letter. This makes it easy for the donor to identify where the donation came from and how to reach you if needed. The letter should start with a clear statement of gratitude. Express sincere appreciation for the donor’s contribution right away.

After the greeting and thanks, include the date of the donation. This ensures that both parties have a clear record of the donation for tax and record-keeping purposes. If the donation is made for a specific purpose, mention that in the letter as well. This shows transparency and helps the donor understand how their contribution will be used.

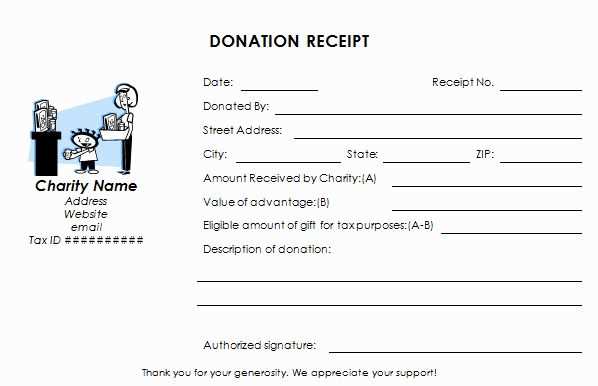

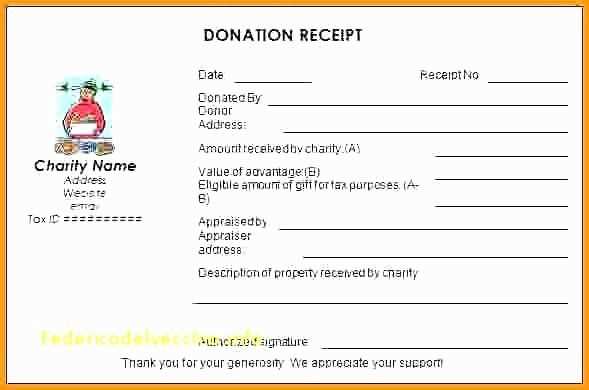

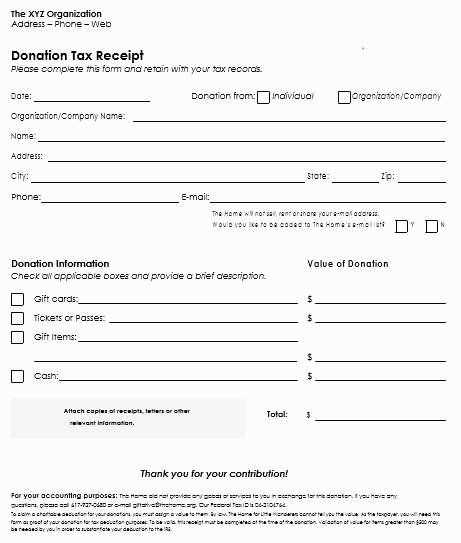

Details to Include in the Letter

| Information | Description |

|---|---|

| Donor’s Name | Include the full name of the donor for proper identification. |

| Donation Amount | Clearly state the amount or value of the donation made, including cash or goods. |

| Donation Date | Record the exact date the donation was received. |

| Purpose of Donation | If the donation is designated for a specific project or fund, mention it here. |

Final Steps

End the letter by re-expressing your gratitude. Ensure the donor knows their generosity is appreciated, not only for the immediate benefit but also for the long-term impact on the community. Sign the letter with a personal note or from a church leader to add a personal touch.

Formatting the Letter for Clarity

Use simple, concise language throughout the letter. Ensure that the structure is easy to follow by breaking the text into short paragraphs. Each paragraph should focus on one key point to avoid overwhelming the reader.

Start with the donor’s name and the donation details. Make these elements stand out by placing them in a separate line or section, ensuring they are easy to locate. Follow this with a brief statement of gratitude.

To enhance readability, include bold or italics for important details like donation amounts or dates. This draws attention to key information without making the letter feel cluttered.

Provide a clear subject line at the top of the letter. This should briefly describe the purpose of the document, such as “Donation Receipt for [Date]”. A direct and informative subject helps the reader immediately understand the content.

Lastly, avoid long sentences or jargon. Stick to everyday language and get straight to the point to maintain clarity. When possible, use bullet points or lists for recurring or detailed information like donation breakdowns or specific instructions for tax purposes.

Detailing the Donation Amount and Type

Clearly state the exact amount of the donation in both numerical and written form to ensure accuracy. This helps avoid any misunderstandings and provides transparency. For example, if the donation is $100, write it as “One hundred dollars ($100).” If the contribution is in a non-cash form, specify the type of donation, such as goods, services, or volunteer hours.

For cash donations, include the method of payment (e.g., cash, check, or credit card) and specify any details that may apply, such as check number or transaction reference. If the donation was made online, mention the platform used, including the transaction ID for reference.

In the case of non-cash donations, list the items donated with a brief description. For instance, “5 boxes of winter clothing” or “100 textbooks for the community center.” Include the fair market value of these items if applicable, especially if the donation qualifies for tax deductions.

- If multiple donation types are involved, list them separately for clarity.

- For recurring donations, include the frequency and duration of the commitment, such as monthly, quarterly, or annually.

- Always acknowledge any matching gifts from employers or other organizations, detailing the amount and donor if possible.

Including Tax-Exempt Status Information

Clearly indicate your church’s tax-exempt status in the donation receipt letter. This helps donors claim deductions on their tax returns. Include the following details:

- Tax-Exempt Status Number: Mention your church’s IRS-assigned tax-exempt identification number (EIN). This number is vital for tax reporting purposes.

- Tax-Exempt Confirmation: State that your church is a 501(c)(3) organization, or whichever section of the IRS code your status falls under.

- Specific Language: Use language like “This organization is a tax-exempt entity under Section 501(c)(3) of the Internal Revenue Code” to ensure clarity.

- Receipt Purpose: Include a sentence like “This donation is tax-deductible to the extent allowed by law” to confirm eligibility for a tax deduction.

These details give donors the information they need for their personal records and for tax purposes. Always consult a tax professional to ensure you meet all local and federal requirements.

Expressing Gratitude Professionally

Begin with a sincere acknowledgment of the donation. Address the donor by name, making them feel valued and appreciated. A straightforward approach works best: “Thank you, [Donor’s Name], for your generous contribution.” This sets a positive tone immediately.

Be specific about the donation. Instead of just saying “Thank you for your donation,” mention the amount or the cause it supports. For example, “Your donation of $500 will directly support our youth programs.” This shows the donor how their contribution will make an impact.

Use clear, positive language to express how much their support matters. Rather than vague expressions, try: “Your gift allows us to continue our work in the community and helps us reach more individuals in need.” This demonstrates how their donation plays a role in your mission.

End with an invitation to stay engaged. Include a call to action like: “We would love to keep you updated on the progress of the projects you are supporting.” It shows that you value their involvement beyond just the financial contribution.

By combining appreciation with clear, purposeful language, the donor feels recognized and motivated to continue supporting your cause.

Sending and Archiving the Receipt

Send the donation receipt as soon as the transaction is completed to ensure timely acknowledgment. Choose the method that best fits your donor’s preference, whether it’s through email or postal mail. For email, a PDF format is typically the best choice, as it preserves the layout and details of the receipt, ensuring clarity. For postal mail, ensure that the receipt is printed clearly and included with any necessary supporting documentation, such as a thank-you letter or an organization brochure.

Emailing the Receipt

For emails, personalize the subject line and ensure the sender address is recognizable to the recipient. Attach the receipt as a PDF file to avoid formatting issues. Consider including a brief message in the body of the email expressing gratitude for the donation and highlighting any relevant information about the tax implications of the donation.

Properly archive donation receipts to comply with legal and organizational standards. Maintain an organized database where each receipt is stored securely with relevant donor information. Digital archiving is preferable for ease of access and backup. Ensure receipts are easily searchable by donor name, donation amount, or donation date. Regularly back up this data to prevent loss.