Free final demand letter template

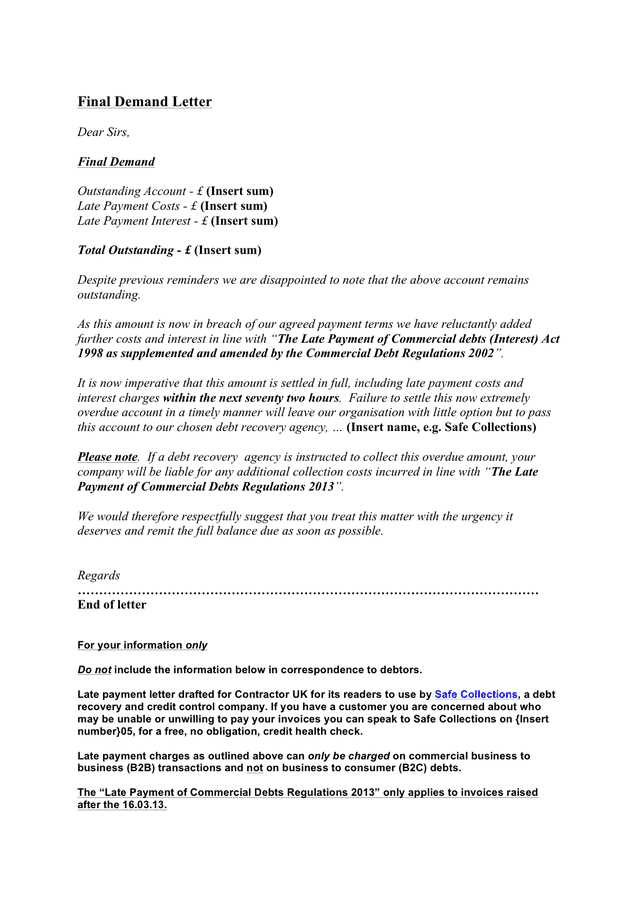

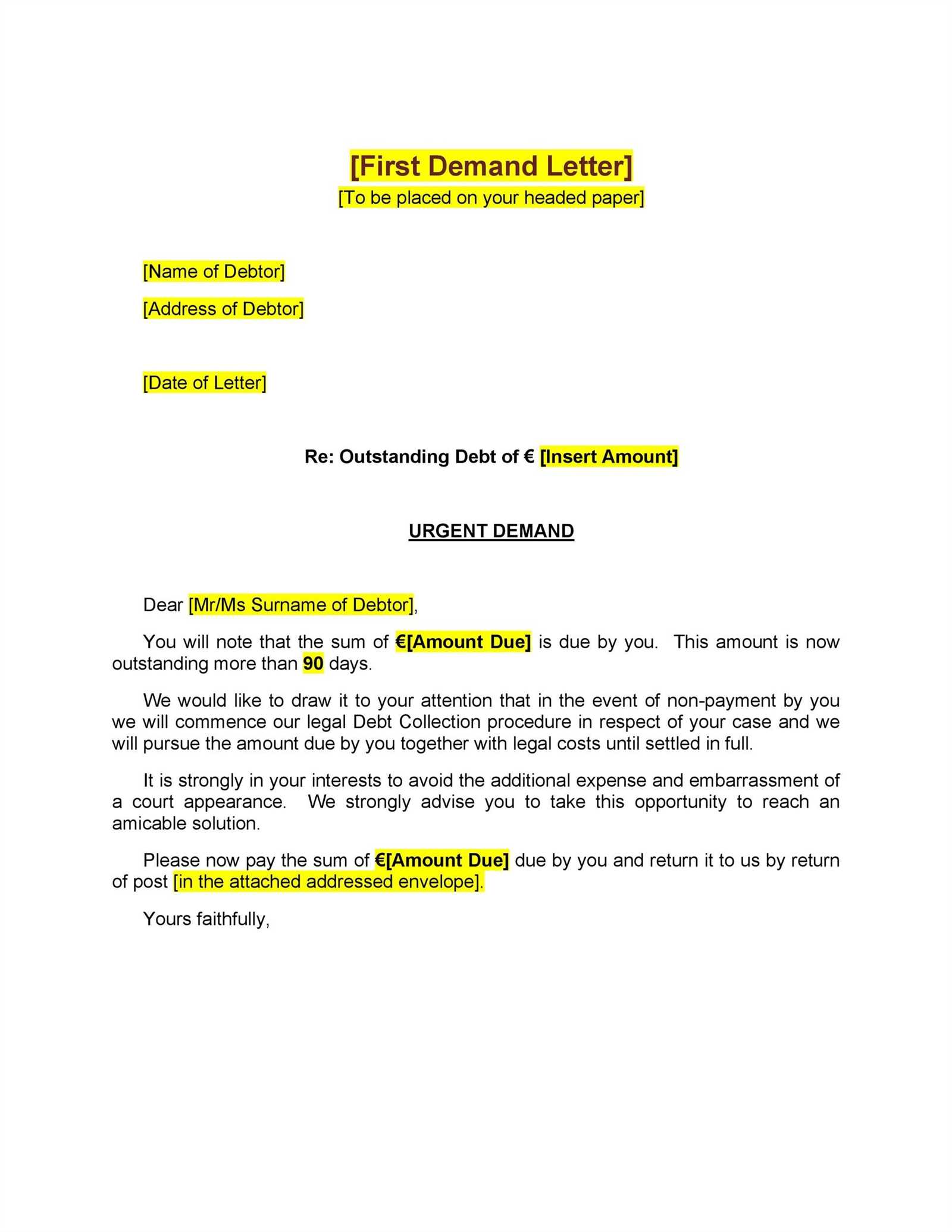

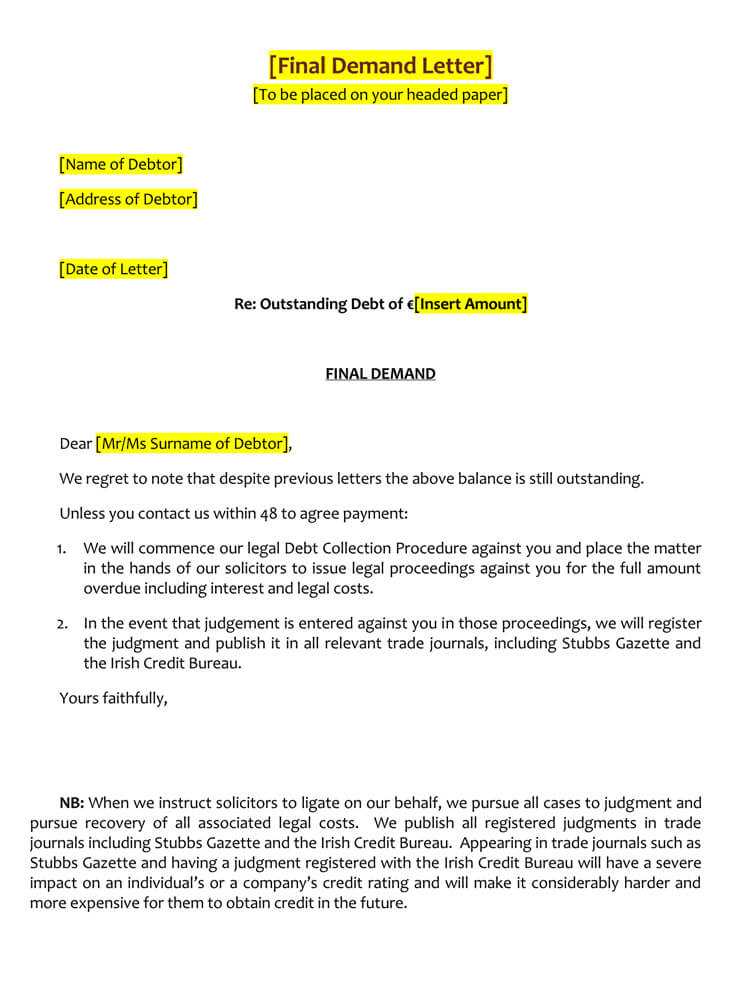

Use this template to create a final demand letter and clearly communicate your payment expectations. The letter should be concise, direct, and provide a clear deadline for payment. Below is a customizable example to help you get started.

In the first paragraph, state the amount owed and the due date. Mention any previous communications or payments related to the debt. Be firm but polite in requesting payment.

Next, include a clear deadline for payment. Specify the consequences of failing to meet the deadline, such as legal action or a negative impact on the credit score. This section should show urgency without being aggressive.

Finish by thanking the recipient for their attention and encouraging them to contact you if they need clarification or wish to resolve the issue. Ensure your contact details are easy to find.

By using this template, you can ensure your letter remains professional and effective in communicating the urgency of the situation.

Here are improved phrases maintaining meaning and minimizing repetitions:

First, consider removing unnecessary formalities to get straight to the point. For example, instead of saying “I would like to kindly remind you,” simply say “This is a reminder.” This creates a direct, clear message.

Use clear action verbs to prompt a response, such as “Please send payment by [date]” instead of “We kindly ask for payment to be made.” This keeps your request simple and unambiguous.

When referencing previous communications, be specific. Instead of “As previously stated,” use “As mentioned in my email dated [date].” This makes your letter more precise and less repetitive.

Eliminate redundant expressions like “I am writing to inform you” or “I am contacting you to request.” Simply starting with “I am requesting payment” saves space and keeps the tone assertive.

For emphasis, use strong verbs such as “require” instead of “would appreciate.” This makes your demand clear and firm without being overly formal or wordy.

Keep sentences short and direct, removing filler words. For example, instead of “I would like to take this opportunity to inform you,” simply say “Please note.” This conveys your message without adding unnecessary words.

- Free Final Demand Letter Template

Use this final demand letter template to formally request payment from a client or debtor. A well-structured letter increases the likelihood of getting a response and payment. Make sure to include all necessary details to avoid confusion and provide clarity on the payment terms.

Key Elements of a Final Demand Letter

Start by addressing the recipient clearly with their full name and company, if applicable. Include the date the letter is being sent, as well as a reference to the invoice or debt. Be specific about the amount owed and the due date. Mention any previous attempts to resolve the issue, such as phone calls or emails.

Clear Call to Action

Clearly state the amount that remains unpaid, the final deadline for payment, and the potential consequences of non-payment. This could include legal action, reporting to credit agencies, or additional fees. End the letter by providing your contact information for any queries.

Adjust your final demand letter template by focusing on key details to make it specific to your situation. Start by clearly stating the amount owed, including any interest or fees, and the original due date. This ensures there’s no confusion about the financials.

Modify the recipient’s information accurately. Include their full name, address, and any other relevant contact details. Make sure the salutation is appropriate for the relationship, whether formal or more personal.

Be clear about the consequences if payment is not received. Indicate the next steps, such as legal action or involving a collections agency, while maintaining a professional tone. Adjust the deadline for payment according to your specific timeline–make sure it’s realistic but firm.

Include any previous correspondence or agreements to provide context. This shows the progression of your attempts to resolve the matter, demonstrating that you’ve given ample time and opportunity for the recipient to pay.

Finally, make sure the letter reflects the nature of your business and communication style. Whether it’s more formal or conversational, your tone should be consistent with your brand and relationship with the recipient.

A final demand letter should be clear, direct, and unambiguous. Focus on these key elements to ensure it serves its purpose:

1. Contact Information

- Include your name, address, and contact details at the top.

- List the recipient’s name and address to ensure it reaches the right person.

2. Amount Due

- Clearly state the total amount owed, including any applicable late fees.

- Provide a breakdown of the debt if necessary, showing how the balance was calculated.

3. Payment Terms

- Specify the deadline for payment. State a specific date and any conditions related to payment.

- Include acceptable methods of payment (bank transfer, check, etc.) and any reference numbers for tracking payments.

4. Consequences of Non-Payment

- Explain what will happen if the debt is not paid by the stated deadline, such as legal action or collection efforts.

- Make sure the language is firm but professional, leaving no room for confusion about the next steps.

5. Previous Attempts to Resolve

- Reference prior communication regarding the debt, such as emails, phone calls, or previous letters.

- Highlight that this is a final opportunity to resolve the issue before further actions are taken.

6. A Call to Action

- Clearly ask the recipient to pay the outstanding amount by the specified deadline.

- Offer an alternative, such as contacting you to discuss payment arrangements if necessary.

Incorporating these elements ensures your final demand letter is both effective and professional.

One of the biggest mistakes is failing to specify the exact amount owed. Always include a clear breakdown of the debt, such as the principal amount, interest, and any additional fees. This ensures the recipient understands the total liability.

Not Setting a Clear Deadline

A vague deadline can weaken your demand. Specify an exact date by which payment must be made. This creates urgency and avoids confusion over when the issue needs to be resolved.

Using Ambiguous Language

Be direct and unambiguous in your wording. Avoid using terms like “as soon as possible” or “soon.” Clearly state the consequences of non-payment, such as legal action or further collection efforts, to leave no room for misinterpretation.

Neglecting to include any prior communication is another common oversight. Reference previous attempts to resolve the issue, whether they were phone calls, emails, or letters. This shows you have made efforts before resorting to a final demand letter.

Lastly, leaving out any contact details or instructions for payment can hinder the process. Include all necessary details, like where to send payment or how to contact you with questions, to facilitate a smooth resolution.

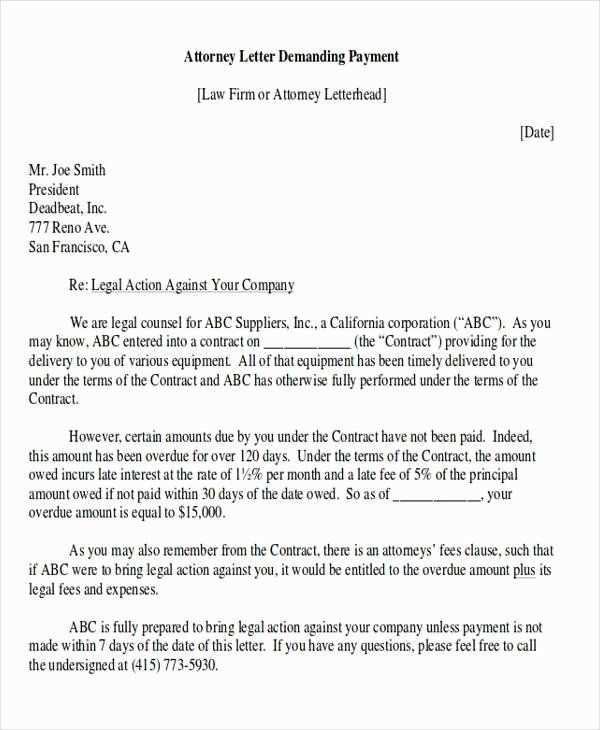

Specify the legal grounds for your claim, referring to the agreement or contract that outlines the terms of payment. Clearly mention any breach of those terms, such as unpaid invoices or missed deadlines, and refer to the specific clause that supports your case. It is important to show the reader that they have violated a legal obligation.

Include Relevant Dates

Incorporate key dates, like the due date for the payment and any prior communication attempts. By showing a timeline of events, you demonstrate your efforts to resolve the issue before escalating the matter legally.

Outline the Consequences

Explain the next steps if the demand is not met within the stated deadline. This can include legal actions such as pursuing a lawsuit or involving a collection agency. Make sure the recipient understands the seriousness of the matter and the legal repercussions of non-compliance.

| Action | Timeline | Legal Consequences |

|---|---|---|

| Final Demand Sent | Insert Date | Failure to pay may lead to legal action |

| Deadline for Payment | Insert Date | Collection efforts or court proceedings |

By addressing these legal aspects, you create a clear, enforceable demand letter that leaves no room for ambiguity. This approach increases your chances of prompt payment while protecting your legal rights.

Prepare your letter thoroughly before sending it. Double-check for any inaccuracies or incomplete information that could affect the outcome.

1. Review Your Letter

Read through your final demand letter carefully. Make sure all relevant details, including the amount owed and any previous communications, are clearly stated. Avoid using vague language, as clarity is key.

2. Choose the Right Delivery Method

Opt for a method that provides proof of delivery. Certified mail or courier services allow you to track the letter, ensuring it reaches the recipient and you have a record of when it was received.

Tip: Consider sending a copy via email as well, if possible, but keep the original delivery method formal to ensure validity.

3. Keep a Copy for Your Records

Make a copy of the letter before sending it. This serves as your backup in case further legal steps are required.

4. Set a Deadline for Response

Clearly state the deadline for payment or resolution in the letter. Give the recipient a specific timeframe, such as “within 10 business days” to avoid any ambiguity.

5. Send the Letter

Once everything is in order, send the letter using your chosen delivery method. Keep your receipts and tracking numbers in case you need to reference them later.

Wait for a response. If you don’t hear back within the specified time frame, follow up with a polite reminder. Be firm but courteous, reiterating the terms outlined in the letter.

If payment is made, ensure the amount is correct. Once confirmed, send a receipt acknowledging the payment and consider the matter resolved.

If no payment is received and there’s no communication, assess your next steps. Explore legal action options, such as filing a claim in small claims court or involving a collection agency. Consult with a lawyer to understand your rights and available remedies.

Document all interactions. Keep a record of communications, payments, and any relevant details. This will be important if the issue escalates and requires further legal action.

Revisit your original terms to confirm that you’ve complied with all necessary steps. If needed, adjust your approach based on advice from professionals to strengthen your case.

Free Final Demand Letter Template

Creating a final demand letter requires precision. Ensure your language is firm and clear, specifying the amount owed and the actions to be taken. Avoid ambiguity to make your message direct and to the point.

Steps to Write a Final Demand Letter

Start by addressing the recipient and stating the nature of the debt. Include the total amount owed and the due date. Be clear about the consequences if the debt is not settled. A typical demand letter should also provide details of previous communications to show that you’ve attempted to resolve the issue amicably.

Key Points to Include

Clear Statement of Debt – Outline the amount due and reference any invoices or contracts. List any penalties or interest charges that apply, based on your agreement.

Time Frame for Payment – Provide a reasonable deadline for payment, typically 7 to 14 days. This sets expectations and adds urgency.

Legal Action Mention – If payment isn’t received by the deadline, state that you’ll pursue further action, such as contacting a collections agency or taking legal steps. Keep the tone firm but professional.

Conclude with your contact information and a request for a response. Keep the letter formal and respectful, ensuring all details are accurate and easy to follow.