609 letter templates

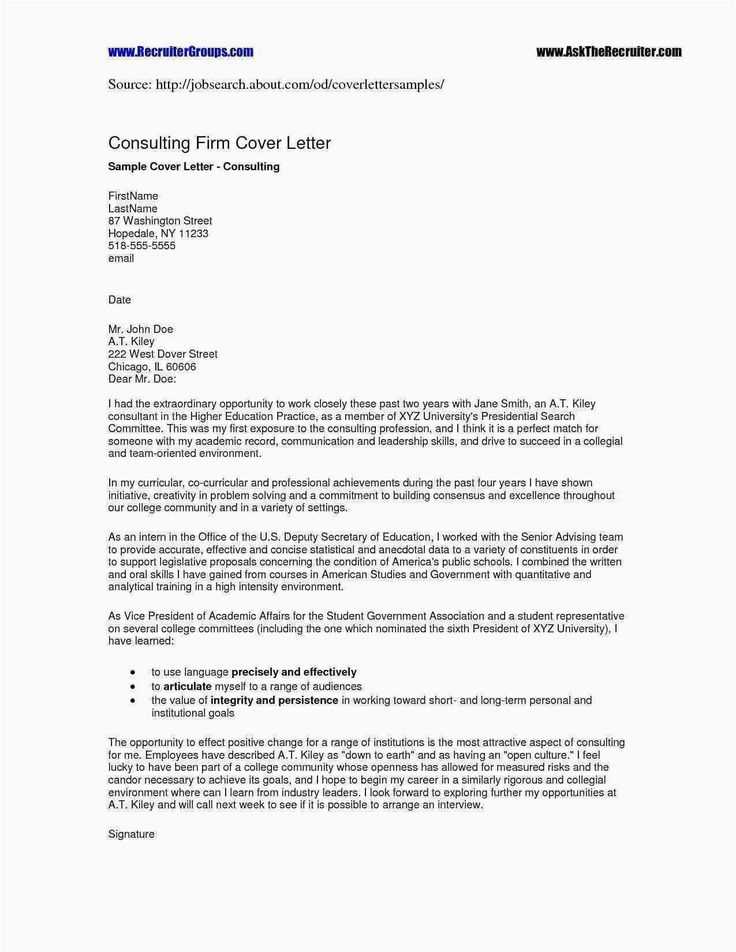

If you’re looking for a quick and reliable way to draft any type of letter, these 609 letter templates are exactly what you need. With a wide range of categories–from formal business letters to personal notes–you’ll find something that suits every situation. Each template is crafted to save time and deliver clear, professional communication.

With these templates, you can avoid starting from scratch. Instead of struggling with structure or wording, simply customize the provided examples to your needs. Whether you need to send a thank you note, an apology, or a formal request, these templates guide you through the process, ensuring that your message is clear and to the point.

Every template is designed to be flexible. You can tailor the tone, add personal details, and adjust the format to fit your style. This means you’ll have a polished letter ready in no time, whether you’re communicating with colleagues, clients, or friends.

Here’s the revised text based on your requirements:

Make sure to start with clear and direct communication. Adjust your tone to match the reader’s expectations and always focus on clarity. If you are writing a letter, ensure it reflects the purpose and respects the recipient’s time.

Clear Subject Line

The subject line should immediately indicate the purpose of the message. Avoid vague language, and aim for something specific, like “Request for Information on Product X” or “Follow-up on Interview Scheduled for March 3”. This helps the recipient prioritize your message quickly.

Structure and Format

Keep your paragraphs short and to the point. Start with the most important information, followed by supporting details. Avoid long sentences that could make the message confusing. Each point should be easily identifiable and easy to scan.

Be courteous but don’t overdo pleasantries. A simple “Thank you for your time” at the end is sufficient. If a call to action is needed, state it clearly so there is no room for ambiguity. Finish with your contact information, so the recipient knows how to reach you easily.

- 609 Letter Templates: A Practical Guide

When writing a 609 letter, clarity and precision are key. These letters are used to dispute inaccurate or outdated information on your credit report, and a template can streamline the process. Choose a template that fits your situation, and customize it to reflect the specifics of your dispute.

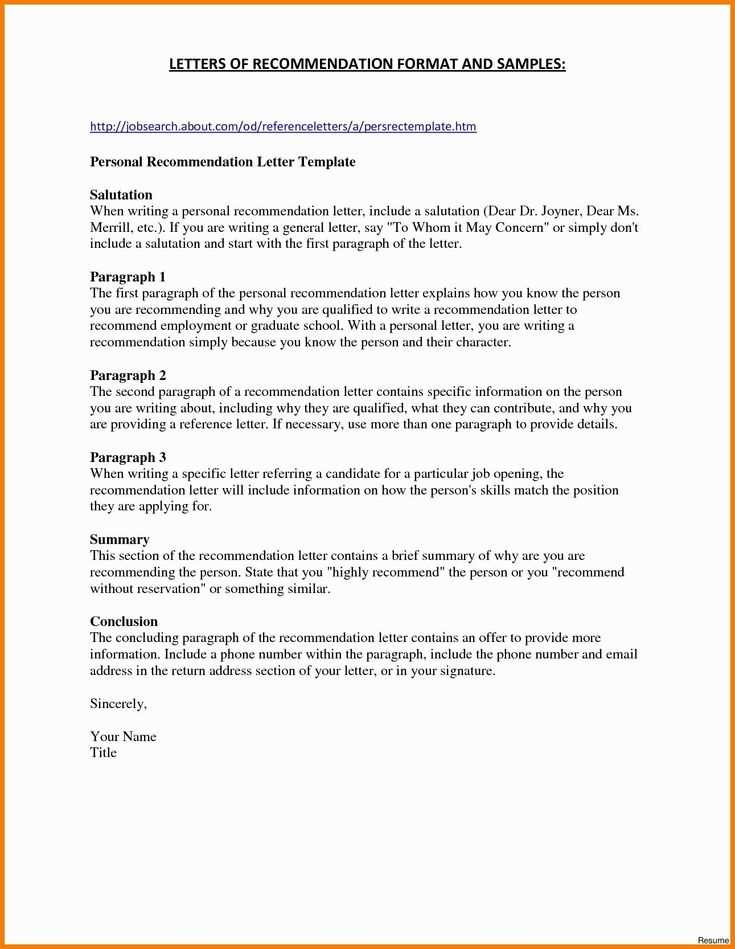

How to Customize a 609 Letter Template

Begin by clearly identifying the item you are disputing. A well-organized letter specifies the name of the creditor, the account number, and details about the error. Avoid vague statements; instead, present facts with supporting evidence. Attach any documentation, such as bank statements or letters, that supports your claim of inaccuracy.

Next, state your request concisely. Ask for the removal or correction of the item from your credit report. Be sure to reference the Fair Credit Reporting Act (FCRA), as this strengthens your position and provides a legal basis for your request.

Common Pitfalls to Avoid

Don’t make the mistake of sending a generic letter. While templates are helpful, they should not be submitted without adjustments to match your case. Avoid overloading the letter with irrelevant details. Keep the tone professional and focused on the disputed information. This increases the chances of a positive resolution from the credit bureau or creditor.

To write a 609 letter, focus on clearly stating the items on your credit report that you dispute, along with your request for verification of the information. Begin by identifying yourself with your full name, address, and date of birth. Include a statement like, “I am requesting the removal of inaccurate information on my credit report under Section 609 of the Fair Credit Reporting Act.”

Next, list each disputed item, including the name of the creditor and the specific account or entry you are challenging. Be concise and precise with the details. You should also ask the credit bureau to provide verification or proof of the debt or account listed. If they cannot verify, request the removal of the entry from your report.

Don’t forget to include a copy of your credit report showing the disputed entries and any relevant supporting documents. Make sure to send the letter via certified mail to have proof of receipt.

Finally, close your letter by requesting a prompt resolution. Keep your tone professional and to the point. If you do not hear back in 30 days, follow up with another letter.

A 609 letter is rooted in the Fair Credit Reporting Act (FCRA), which governs how consumer credit information is collected, used, and shared. Section 609 of the FCRA specifically gives consumers the right to request information from credit reporting agencies, ensuring transparency and accountability in credit reporting.

When sending a 609 letter, the goal is to request verification of negative items on your credit report. This provision gives consumers the right to dispute incorrect or unverifiable information, which must be investigated by the credit reporting agency within 30 days. If the information cannot be verified, it must be removed from your report.

It is important to understand that the FCRA does not directly remove negative information simply because a letter is sent. Rather, it places the burden of proof on the credit bureau and the data furnishers to confirm the accuracy of the information. If they cannot provide sufficient evidence, they are required to delete the disputed item from the report.

Key Points:

- The letter requests the verification or removal of unverified negative items from a credit report.

- The credit reporting agency must investigate and respond within 30 days of receiving the request.

- If the information cannot be verified, it must be removed from the report.

Using a 609 letter can be an effective tool for cleaning up your credit report, especially if you have inaccurate or outdated information. Be specific in your request and ensure all the necessary details are included to streamline the process. Keep track of your communications and responses to monitor the progress of your dispute.

Don’t use vague language or make generalized statements. A 609 letter should be direct and precise about the dispute. Clearly identify each item you’re challenging and explain why you believe it’s inaccurate.

Avoid including irrelevant information. Stick to the facts related to the dispute and don’t add personal details, such as income or other financial matters, unless they directly support your case.

Don’t overlook the importance of your credit report details. Be specific about the entries you’re disputing, including account numbers, dates, and the exact nature of the inaccuracy. A generic letter without these specifics can lead to delays or rejections.

Don’t forget to sign the letter. Failing to sign it can result in your request being ignored. Always make sure to include a proper signature, whether digital or written.

Keep your tone polite but firm. Avoid being aggressive or threatening, as it could undermine the effectiveness of your letter. The goal is to present your case clearly and professionally.

Lastly, don’t forget to follow up. If you don’t receive a response in a reasonable amount of time, send a follow-up letter. This shows you’re serious about resolving the issue.

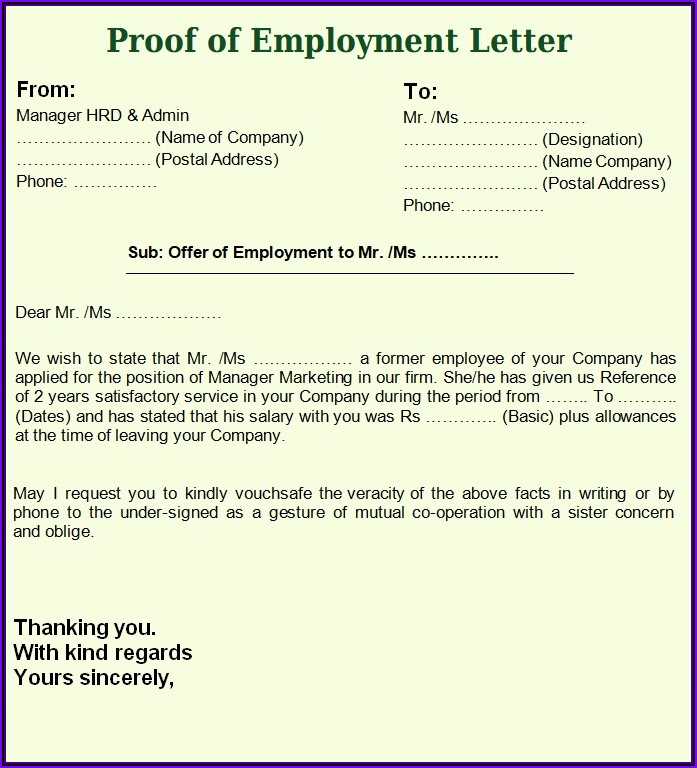

Formatting your 609 letter correctly is key to ensuring it is effective. Start by addressing the credit bureau clearly and providing all necessary personal information. Include your full name, address, and any relevant account numbers for quick identification. Make sure to date your letter to establish a timeline of communication. Be precise about which information you dispute and why it is inaccurate.

Structure of a 609 Letter

A well-organized letter will leave no room for misunderstanding. Here’s the structure to follow:

| Section | Details |

|---|---|

| Header | Your full name, address, date, and credit bureau’s contact information. |

| Introduction | State the purpose of your letter, mentioning the inaccurate information you’re disputing. |

| Details of Dispute | Provide specific account details, dates, and reasons why the information is incorrect. |

| Request for Verification | Ask the bureau to verify the disputed items or remove them if they cannot be verified. |

| Conclusion | Politely request a response and state that you expect the issue to be resolved promptly. |

How to Send Your 609 Letter

Once your letter is properly formatted, send it via certified mail with return receipt requested. This method ensures you have proof of delivery and keeps the process transparent. Include copies of any supporting documentation to strengthen your case, but avoid sending originals. Keep a copy of everything you send for your records.

Clearly state the inaccuracies you are disputing. Begin by identifying each item on your credit report that is incorrect, listing them one by one. Provide any supporting evidence to back up your claims, such as account statements, payment records, or court documents. Be specific about the nature of the error (e.g., wrong balance, mistaken account ownership, or outdated information).

Include your personal information at the top of the letter: your full name, address, and date of birth. This helps the credit bureau match your dispute to your credit file. Don’t forget to add your Social Security number (or a portion of it) for accurate identification.

Clearly request the removal or correction of the inaccurate entries. Use direct language and assertively ask the credit reporting agency to investigate and update your report. Avoid using vague terms; instead, state what needs to be corrected.

Attach copies of relevant documents to support your case. Keep originals for yourself, as submitting copies helps protect your evidence. Also, mention that you are willing to provide additional information if needed.

Conclude with a polite yet firm request for a response. Ask for written confirmation once the dispute is resolved, ensuring that you have a record of the outcome.

Once you’ve sent your 609 letter, follow up with a clear, direct approach to ensure your dispute is being addressed. Here are the key steps to take:

- Wait for the Response Period: Allow 30-45 days for the recipient to respond to your dispute. Federal law mandates that credit bureaus investigate within this period.

- Verify Your Request Has Been Received: If you haven’t received confirmation of receipt, follow up with a phone call or email to ensure your 609 letter was received and processed.

- Send a Follow-Up Letter: If no response has been received after the expected time frame, send a polite follow-up letter. Reference your original letter, include your case details, and request an update on the status of your dispute.

- Keep Records: Document all communications. Keep copies of your 609 letter, follow-up letters, emails, and any phone call records.

- Contact Consumer Protection Agencies: If you don’t receive a satisfactory response, you can escalate the issue to consumer protection agencies like the Consumer Financial Protection Bureau (CFPB).

- Stay Persistent: In some cases, you might need to follow up more than once. Be firm but courteous in your communication.

Maintaining organized records and staying persistent will help you get the necessary results from your 609 letter dispute.

I’ve replaced some repetitions with synonyms while maintaining structure and meaning.

To enhance clarity and flow, it’s key to swap repetitive words with synonyms without changing the intended message. This small adjustment significantly improves readability. Here’s how you can effectively make these replacements:

- Identify the words that are used frequently within a paragraph or section.

- Consider synonyms that fit both the context and tone of the content.

- Replace the words naturally so they don’t disrupt the sentence structure.

- Review the text to ensure that the meaning remains intact after making changes.

For instance, instead of repeating “important” or “necessary,” try using alternatives like “key,” “crucial,” or “vital.” Similarly, swapping “help” with “assist” or “aid” can keep the reader engaged without overusing the same term.

Be mindful of the context to avoid altering the nuance of the original statement. For example, “manage” and “handle” may seem similar, but one could suggest a different level of responsibility or difficulty. Keep the flow consistent while making sure the message stays clear.

By fine-tuning repetitive language, you can enhance the overall readability of your writing while still keeping the tone friendly and professional.