IOU Letter Template for Clear Debt Documentation

When individuals lend money or make promises of repayment, it’s often crucial to have written confirmation of the agreement. A formal document can clarify the terms and avoid future misunderstandings. This written confirmation serves as an acknowledgment of debt, outlining the details of the arrangement between the parties involved. Creating a clear and concise record of the debt can protect both the lender and borrower.

Why Use a Debt Acknowledgment?

Having a formal written record can be important for both parties. It helps ensure that there is no ambiguity about the terms and repayment schedule. A properly drafted document provides legal security and can prevent disputes in the future. It offers a clear reference point should any disagreements arise regarding the amount owed, payment deadlines, or other essential details.

Benefits for the Lender

- Legal Protection: A written record can be used in court if necessary.

- Clear Terms: Both parties are on the same page regarding repayment conditions.

- Accountability: The borrower knows their obligations and the consequences of defaulting.

Advantages for the Borrower

- Clarity: The borrower understands exactly how much is owed and when repayment is expected.

- Fair Terms: The borrower can negotiate terms and avoid misunderstandings.

- Reduced Stress: A clear agreement can reduce anxiety about repayments and expectations.

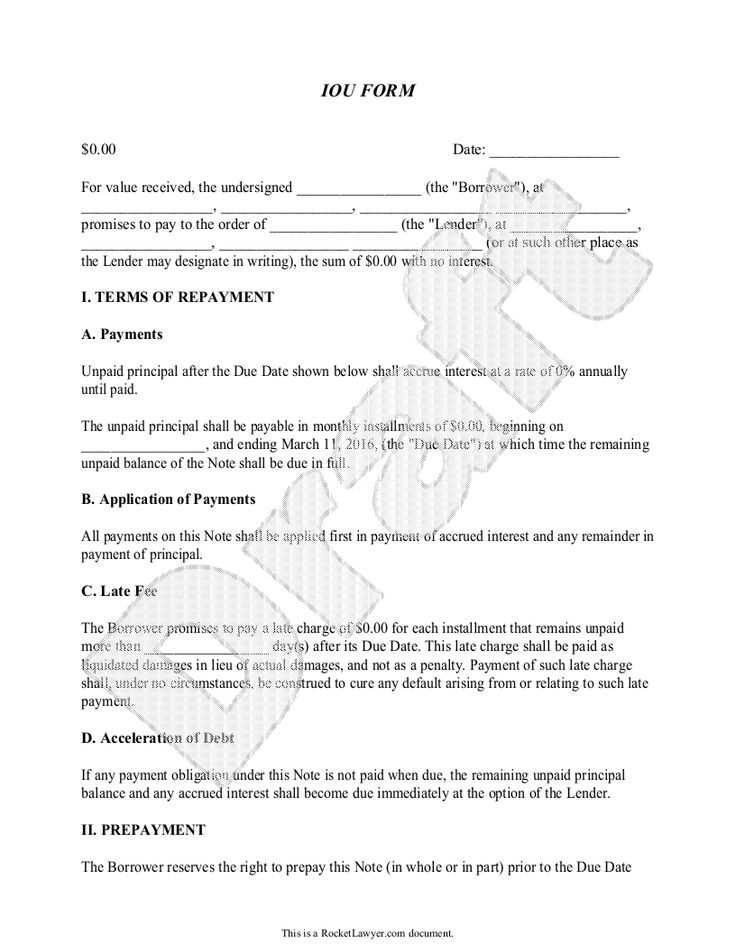

How to Draft a Debt Agreement

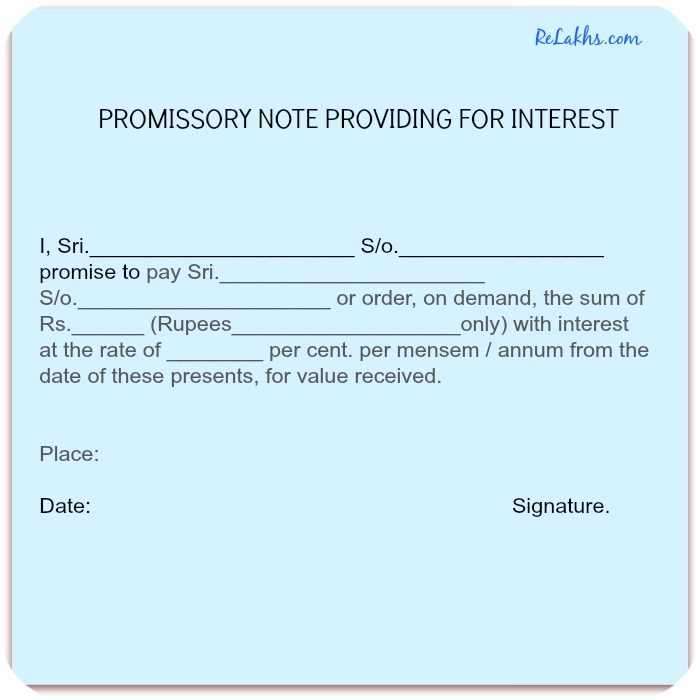

Creating an effective document requires including essential details that both parties can agree on. The document should contain the names of the involved parties, the total amount of money being borrowed, the repayment schedule, and any interest rates if applicable. It’s important to also specify the consequences if the borrower fails to meet the agreed-upon terms.

Key Details to Include

- Names of the Parties: Include both the lender’s and borrower’s full names.

- Amount Owed: State the total amount of money being borrowed.

- Payment Terms: Clearly outline when and how repayments should be made.

- Interest Rate: If applicable, include any interest charges or fees.

- Late Fees: Specify any penalties for late payments.

Making the Agreement Legally Binding

For the agreement to hold legal weight, both parties should sign the document. It can also be helpful to have a witness or notarization to confirm the authenticity of the signatures. While the document is legally binding, it’s important that both parties keep a copy for their records in case of any disputes.

Common Mistakes to Avoid

- Vague Terms: Avoid leaving out important details like repayment dates or amounts.

- Missing Signatures: Without signatures, the document may lack legal validity.

- Failure to Keep Copies: Both parties should retain copies of the signed document for reference.

In conclusion, a well-drafted debt acknowledgment document is an essential tool for ensuring clear, enforceable agreements. By including the necessary details and avoiding common mistakes, both the lender and borrower can protect themselves from future complications.

Understanding Debt Acknowledgment Documents

A written agreement between two parties concerning a borrowed amount is crucial for ensuring that both parties understand the terms and obligations of the arrangement. This document serves as a formal record, helping avoid misunderstandings and disputes in the future. By outlining the terms of repayment and the responsibilities of each party, it provides a clear framework for the transaction.

Using such an agreement offers multiple advantages. It helps create a legal record that can be referred to if any conflicts arise. Both parties are aware of their obligations and can avoid unnecessary complications. Furthermore, this document can provide reassurance for both the lender and borrower, ensuring that all terms are agreed upon in a transparent manner.

There are several key components that must be included for the agreement to be valid. It should state the names of the parties involved, the total amount owed, the repayment schedule, and any interest or late fees. Including these essential details helps avoid ambiguity and ensures that both parties understand the specifics of the transaction.

To create an effective document, it’s essential to start with a clear and concise statement of the debt and the repayment terms. Both parties should agree on the specific amount owed, any applicable interest, and the timeline for repayment. Once these details are settled, the document should be signed by both individuals, ideally in the presence of a witness or a notary to add credibility.

Common mistakes in such agreements often include vague language, missing details, or lack of signatures. These errors can lead to confusion and potential legal issues down the road. It’s important to ensure that all terms are clearly outlined and that both parties fully understand their rights and obligations before finalizing the document.

To make the agreement legally enforceable, both parties must sign the document. In some cases, having a notary public or a witness can provide extra security. By having these formalities in place, the agreement becomes a legally binding contract, which can be used as evidence in a court of law if needed.