Company Car No Claims Bonus Letter Template

When it comes to securing a reduction on your insurance premiums, presenting a well-written request can make a significant difference. This document is essential for those who have maintained a clean record and are looking to benefit from discounts based on their history. Crafting an effective request not only highlights your eligibility but also ensures that you present your case clearly to the insurer.

Understanding the key components of such a request is crucial. A well-structured message allows you to emphasize your spotless record, making it easier for the recipient to process your application efficiently. Whether you are a long-term client or someone new to the service, knowing what to include and how to format your content is vital.

By using a simple yet professional approach, you can increase your chances of success. A clear, concise submission tailored to the requirements of the insurer can often lead to a favorable outcome. In this guide, we will walk you through the necessary elements of an effective request and provide insights on how to optimize your communication for the best results.

Understanding the No Claims Bonus Concept

In the realm of insurance, many providers offer discounts to individuals who have a history of making few or no incidents. This reduction in premiums is typically tied to a customer’s record of safe practices and responsible behavior. The fewer the incidents, the more likely it is that the individual will be rewarded with a better rate.

These incentives are designed to promote safer habits and to encourage policyholders to maintain a risk-free track record. The idea behind such reductions is simple: a driver with fewer incidents is considered less likely to need compensation, making them less of a financial risk to the insurer.

- Reduction in premiums over time

- Incentive for safe driving habits

- Financial benefits for customers with clean records

- Gradual increase in discounts as the record improves

As you progress through your insurance history, maintaining a clean record often leads to a higher discount. It’s important to be aware of how such reductions work and how they can significantly impact the overall cost of your coverage.

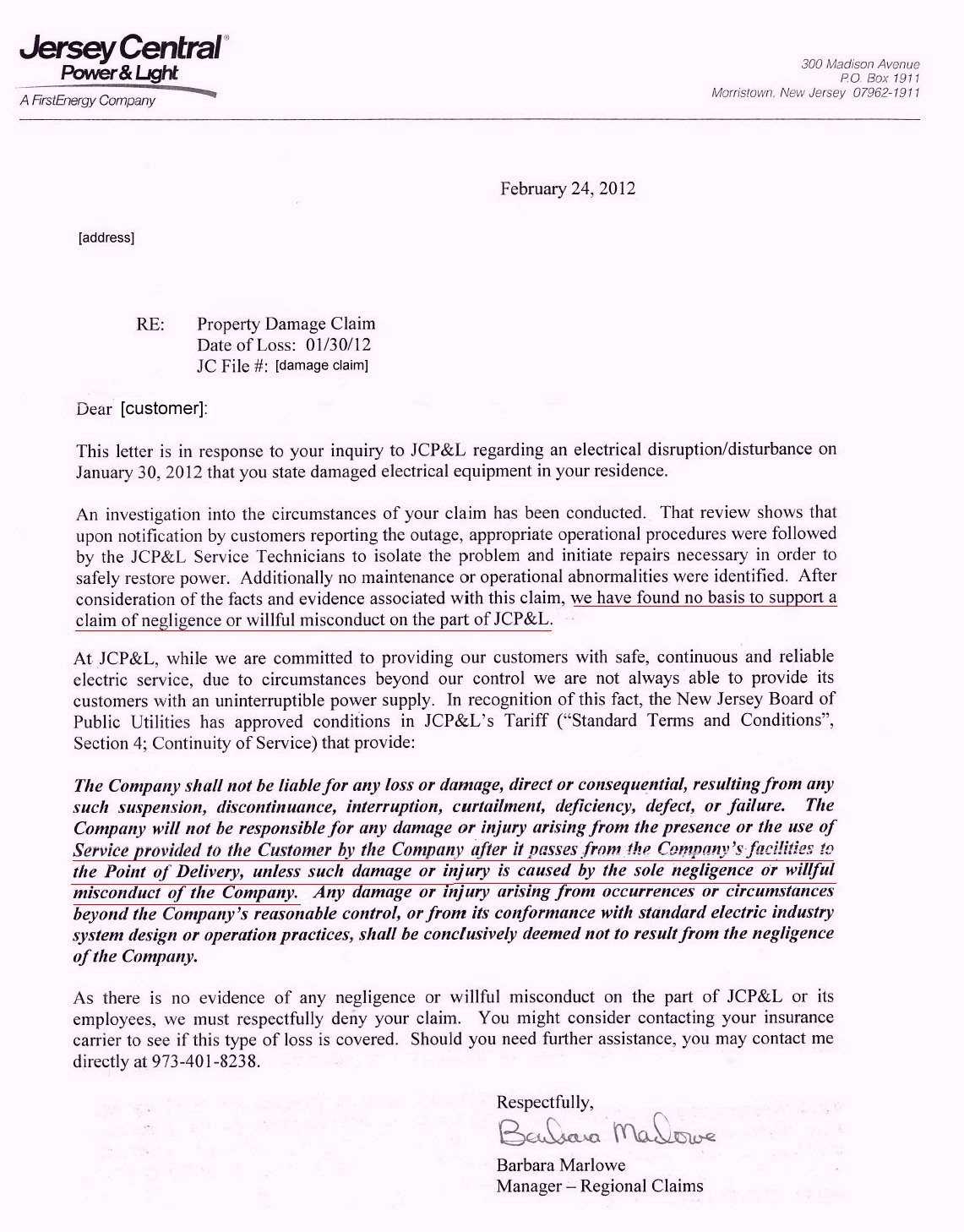

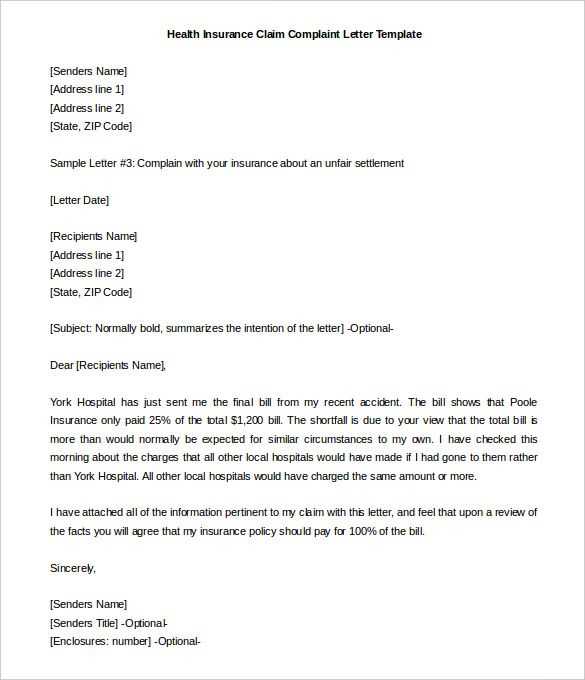

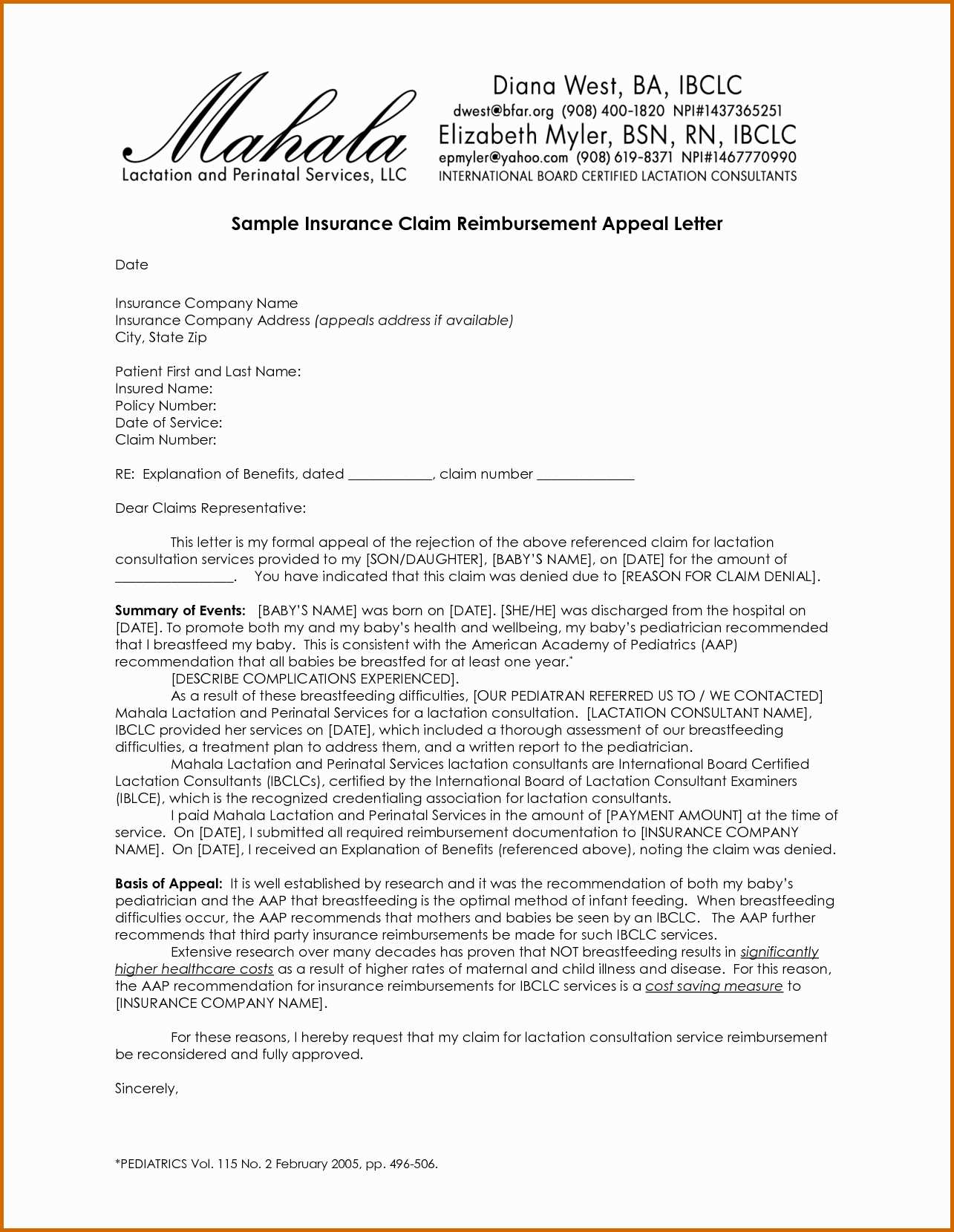

What to Include in Your Letter

When requesting a premium reduction based on a history of no incidents, it’s important to include specific details that will help your case. The more precise and clear the information, the higher the chances of a successful outcome. Ensuring all necessary elements are addressed will help the recipient understand your request fully and allow them to process it efficiently.

Essential Information to Include

Your communication should highlight key points that support your request. The main components typically include your personal information, the specifics of your driving record, and any proof that demonstrates your history of safe behavior. Here are some of the most important items to cover:

| Item | Details |

|---|---|

| Your Personal Information | Name, address, policy number, and contact details |

| History of Incidents | Proof of a clean record over a specified period of time |

| Insurance Information | Policy details, including the type and duration of coverage |

| Request Statement | Clear request for the discount based on your history |

Supporting Documents

In addition to the information above, including any supporting documents can strengthen your request. These may include certificates, confirmation letters from insurers, or records that show your commitment to maintaining a low-risk profile.

Why a Template Can Save Time

Using a predefined format for your request can significantly reduce the amount of time spent crafting your message. Instead of starting from scratch, a ready-to-use structure provides a clear outline that helps you focus on the most important details. This approach streamlines the process, ensuring that all essential information is included without the need to worry about formatting or forgetting key components.

Having a consistent structure also ensures that your communication is professional and organized. By following a proven format, you avoid the risk of leaving out critical points that could delay the processing of your request. Whether you’re submitting it to an insurer or another recipient, using an efficient layout can make your request stand out and be processed faster.

In addition, many templates are customizable, so you can easily adapt them to suit your specific needs. This flexibility allows you to maintain both efficiency and personalization in your communication, making it easier to achieve the desired result.

Common Mistakes to Avoid

When submitting a request for a premium reduction based on your track record, it’s easy to overlook small details that could impact your application. These errors can delay the processing of your request or even cause it to be rejected. By being mindful of the most common mistakes, you can ensure that your submission is both accurate and effective.

Incomplete or Vague Information

One of the biggest mistakes is providing insufficient or unclear details. It’s essential to include all relevant information, such as personal contact information, policy numbers, and evidence of your clean record. Failing to do so can result in the recipient needing to contact you for further clarification, which can slow down the process.

Overlooking Proper Formatting

Another common issue is submitting a disorganized or unprofessional document. Whether it’s inconsistent formatting, missing sections, or poorly structured content, a messy request can make it harder for the recipient to process your information. Always ensure that your message is well-organized, with clear headings and sections that follow a logical order.

How to Personalize Your Letter

Customizing your communication can make a significant impact on how your request is received. A personalized message shows that you’ve put thought into your submission, which can help demonstrate your sincerity and increase the likelihood of a positive outcome. Personalization ensures that your request is tailored to your specific situation, making it more relevant and convincing to the recipient.

Start by addressing the recipient directly and using the appropriate salutation. Include your details, such as your name, contact information, and any specifics about your situation that make your request unique. This can help the recipient understand your eligibility for the reduction and highlight why you’re asking for consideration. Additionally, be sure to refer to any relevant experiences or milestones that could strengthen your case.

Finally, ensure that your tone remains professional and courteous. A well-balanced approach, expressing both your request and appreciation, can leave a lasting impression and increase the chances of your request being processed efficiently.

Tips for Submitting Your Letter

Submitting a well-prepared request is only part of the process; how you submit it can also affect the outcome. Following the correct procedures and ensuring that your submission is properly formatted and delivered will help ensure it reaches the right people in a timely manner. This section provides tips to make sure your submission is as effective as possible.

Choose the Right Delivery Method

When sending your request, consider the most appropriate delivery method. If possible, send it via a trackable service, such as certified mail or email with a read receipt. This ensures that your request is received and allows you to track its progress. If sending via email, ensure your subject line is clear and direct to avoid confusion.

Double-Check for Accuracy

Before submitting, take the time to review your document for any errors. Check for accurate contact details, correct policy information, and ensure that all necessary documents are attached. Submitting an incomplete or incorrect request can cause delays or result in it being ignored.