Debt acknowledgement letter template

For anyone dealing with financial obligations, a clear and concise debt acknowledgment letter can help ensure that all parties are on the same page. Use this template to officially confirm your recognition of a debt and agree on its repayment terms. This simple step can reduce misunderstandings and provide a written record of the agreement.

Start by clearly stating the amount owed, including any interest or late fees that may have accumulated. This sets the foundation for the letter and ensures there’s no ambiguity about the debt’s size. Be specific about the original loan agreement or the reason for the debt, especially if it is tied to services rendered or goods provided.

Next, outline the repayment schedule. Provide clear dates or installments, along with any conditions for repayment. If applicable, mention any flexibility in the arrangement or payment methods. Be sure to express your commitment to fulfilling the agreed terms, keeping things professional and to the point.

End the letter by confirming your contact details for any further communication regarding the debt. This will make it easier for the creditor to reach out if needed. Sign off with a courteous tone, reaffirming your intent to resolve the matter promptly.

Here’s the revised version:

Start the letter with a clear acknowledgment of the debt owed. Be specific about the amount and any relevant dates, such as when the loan was taken or when payments were due. Acknowledge the debt directly without ambiguity.

Debt Details

State the exact amount owed and reference the original agreement, including any changes that might have occurred over time. This shows transparency and helps prevent any confusion later. For example, “I acknowledge that I owe you $1,500, as agreed upon in the loan contract dated May 5, 2023.”

Payment Plan or Proposal

If possible, outline a payment plan. Whether the debt is being paid off in installments or a lump sum, providing a clear timeline of when payments will be made is helpful. For instance, “I propose to pay $300 per month until the full amount is settled.” If no payment plan exists yet, state that one will be provided shortly.

- Debt Acknowledgement Letter Template

Start with a clear statement acknowledging the debt. Be specific about the amount owed, the date, and any agreed terms. Mention the reason for the debt, if applicable, to ensure transparency. Acknowledge the lender’s patience and your commitment to repaying the amount.

For clarity, outline the payment plan or the next steps. Include dates, amounts, and any other necessary information about how and when the debt will be settled. This can help prevent misunderstandings and ensure both parties are on the same page.

In the closing section, express your willingness to discuss the debt further if necessary. Acknowledge that you are open to communication and want to resolve the matter smoothly. Always end on a positive note, indicating your intent to honor the agreement.

| Section | Content Example |

|---|---|

| Debt Acknowledgment | I hereby acknowledge the debt of $500, which I owe to [Lender Name], due on [Due Date]. |

| Payment Plan | I will repay the full amount in installments of $100 each, starting on [Payment Start Date]. |

| Commitment to Pay | I am committed to ensuring the full repayment of the debt by [Final Payment Date]. |

| Closing Statement | If any issues arise, please do not hesitate to contact me at [Your Contact Information]. |

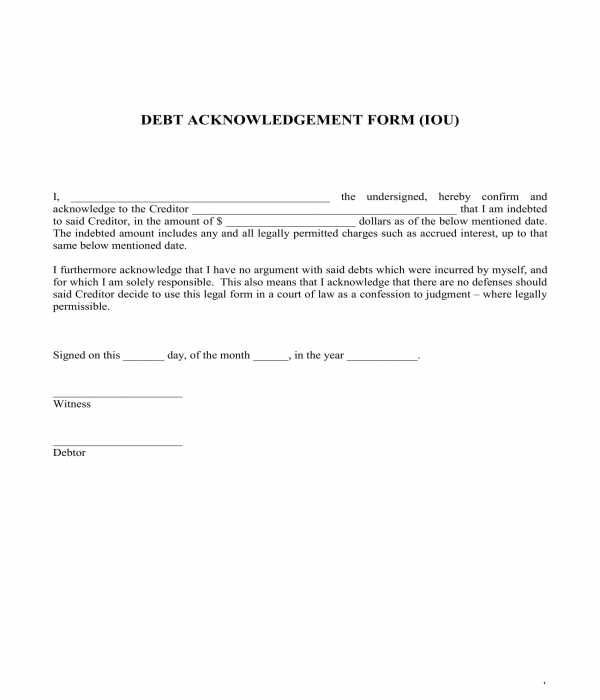

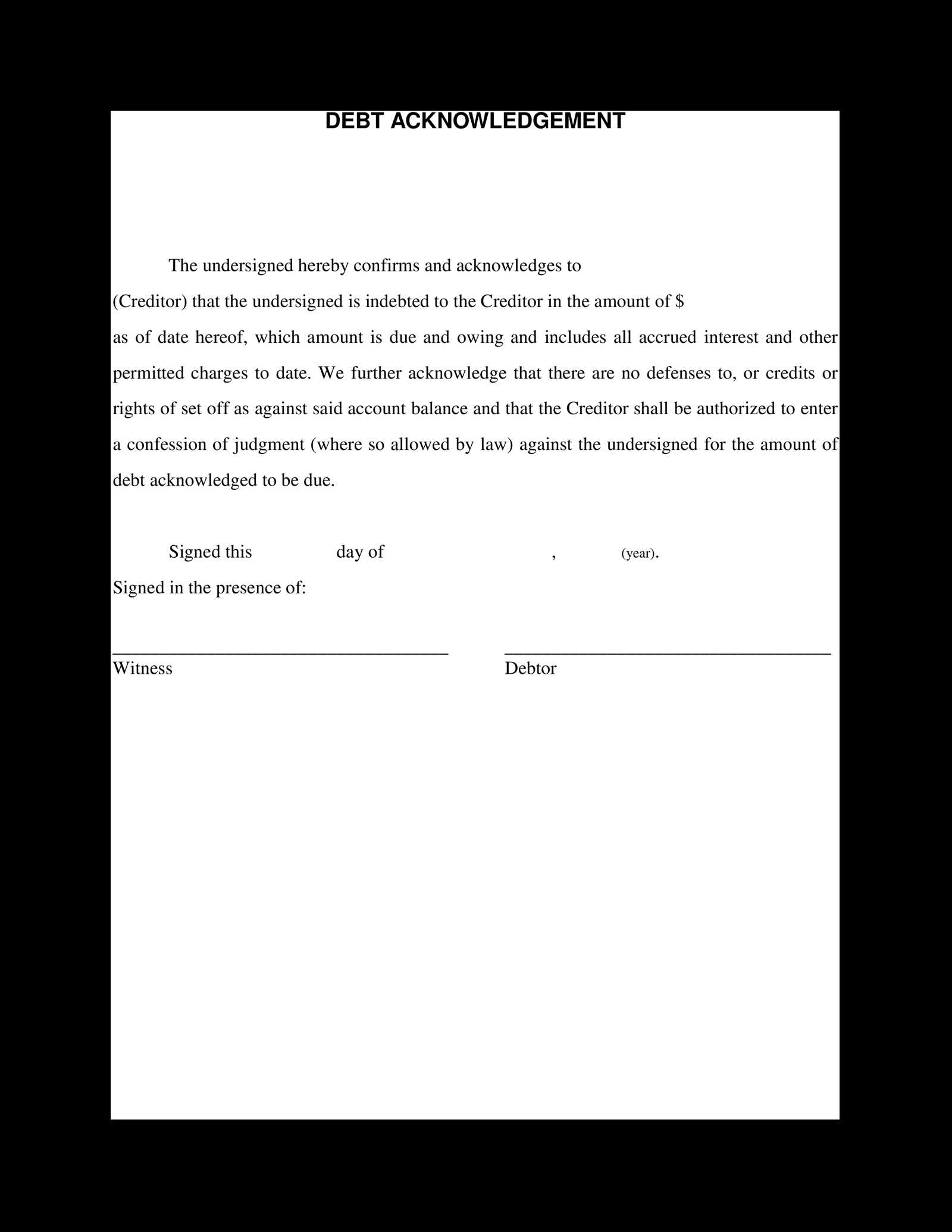

A debt acknowledgement letter should be clear and precise. Include the following elements for clarity and legal validity:

1. Debtor and Creditor Information

Start by clearly stating both the debtor’s and creditor’s full names and addresses. This ensures the letter is easily identifiable and legally binding.

2. Amount of Debt

Specify the exact amount owed, including any interest, fees, or other charges. Clearly state the total sum to avoid confusion later.

3. Payment Terms

Outline the terms for repayment, such as payment schedule, due dates, and acceptable payment methods. Be specific about the expectations to prevent misunderstandings.

4. Date of Acknowledgement

Include the date the letter is written and the date when the debt is acknowledged. This creates a clear record for both parties.

5. Signatures

Ensure both parties sign the letter. Signatures are necessary to confirm agreement and make the letter legally enforceable.

6. Statement of Agreement

Include a statement that both parties agree to the terms listed in the letter. This formalizes the commitment to the repayment plan.

7. Legal Provisions

If applicable, mention any legal consequences for failing to meet the payment obligations. This adds weight to the agreement and encourages compliance.

8. Contact Information

Include contact details for any follow-up queries or disputes. This ensures ongoing communication between the debtor and creditor.

| Element | Details |

|---|---|

| Debtor and Creditor Information | Full names, addresses |

| Amount of Debt | Exact amount, including fees or interest |

| Payment Terms | Repayment schedule, due dates, payment methods |

| Date of Acknowledgement | Date of letter and debt acknowledgment |

| Signatures | Signatures of both parties |

| Statement of Agreement | Both parties’ confirmation of agreement |

| Legal Provisions | Consequences of non-payment |

| Contact Information | Details for follow-up |

Clearly state the amount owed and any relevant payment details. Be specific with the figure and ensure that the language used is unambiguous to avoid confusion. For example, specify the exact sum, like “$1,500” or “One thousand five hundred dollars,” instead of leaving it open to interpretation.

Define the payment terms in a clear manner. If you’re offering an installment plan, outline the payment schedule, such as “three equal payments of $500 due on the 1st of each month.” Make sure to include any late fees or penalties if applicable. If there’s a set date for the full payment, state it directly–”payment due by May 15th.”

Additional Considerations

Always clarify whether interest is being charged. If so, specify the rate and how it applies, like “an interest rate of 5% annually will be applied to unpaid balances.” Transparency in this regard prevents future misunderstandings.

Formatting Tips

Use bullet points or numbered lists to break down the details for better clarity. This makes it easier for the recipient to read and understand the terms. When using figures, avoid vague terms such as “approximately” or “around”–precision helps ensure everyone is on the same page.

Signatures and dates provide legal weight to a debt acknowledgment letter. Both serve as clear evidence that all parties involved agree to the terms presented. Without them, the letter could lack enforceability in a court of law.

Signatures

A signature confirms that the signer understands and accepts the content of the letter. It holds the person accountable for the debt and acknowledges the commitment to repayment. Both the debtor and the creditor should sign the letter. If applicable, witnesses or notaries can also sign, adding an extra layer of validity.

Dates

Including the date of signing clarifies the timeline of the agreement. This is important for establishing when the debt acknowledgment was made, helping to track any deadlines or payment schedules. It also determines when any legal actions can be taken if the terms are not met.

Keep the structure clear and simple. Use a formal tone and ensure the content is easy to read. Break the letter into logical sections, such as the introduction, body, and closing. This helps the recipient quickly grasp the key points. Keep the language straightforward and avoid jargon.

1. Use Clear Paragraphs

Each paragraph should focus on one key idea. For example, the first paragraph could mention the acknowledgment of the debt, while the next one could describe the terms of the agreement. Short, concise paragraphs make the letter more digestible.

2. Consistent Font and Spacing

Choose a professional font, such as Arial or Times New Roman, at a readable size (usually 12-point). Make sure the letter is spaced with a single line between each paragraph and double spaces between sections for readability.

Include a formal header with the date and contact information of both parties at the top of the letter. This adds structure and ensures both sides have the details readily available.

Keep the tone polite and respectful, even if the content involves financial matters. This helps maintain a professional relationship.

Lastly, ensure the closing section reaffirms the commitment to the agreement and provides a way for further communication, such as a phone number or email for follow-up.

One of the most common mistakes is failing to clearly state the amount or details of the debt. Make sure to specify the exact sum or terms to avoid any confusion later on.

1. Missing Important Details

- Always include the date, amount owed, and any relevant references like invoice numbers or account details.

- Provide a clear timeline for any repayment or other actions to ensure both parties are on the same page.

2. Being Too Vague or General

- Avoid ambiguous language. Be specific about what you are acknowledging and the terms of the agreement.

- For example, instead of saying “the amount owed is significant,” state the exact amount clearly.

Another mistake is not confirming the method of communication. If the letter is to be delivered in a specific way, state it upfront, whether by email, mail, or in person.

3. Not Providing a Clear Acknowledgement

- Ensure that your letter explicitly acknowledges the debt. It should be clear that you understand the financial obligation and its terms.

Finally, don’t forget to include a polite closing that invites further discussion or clarification. This will keep the lines of communication open.

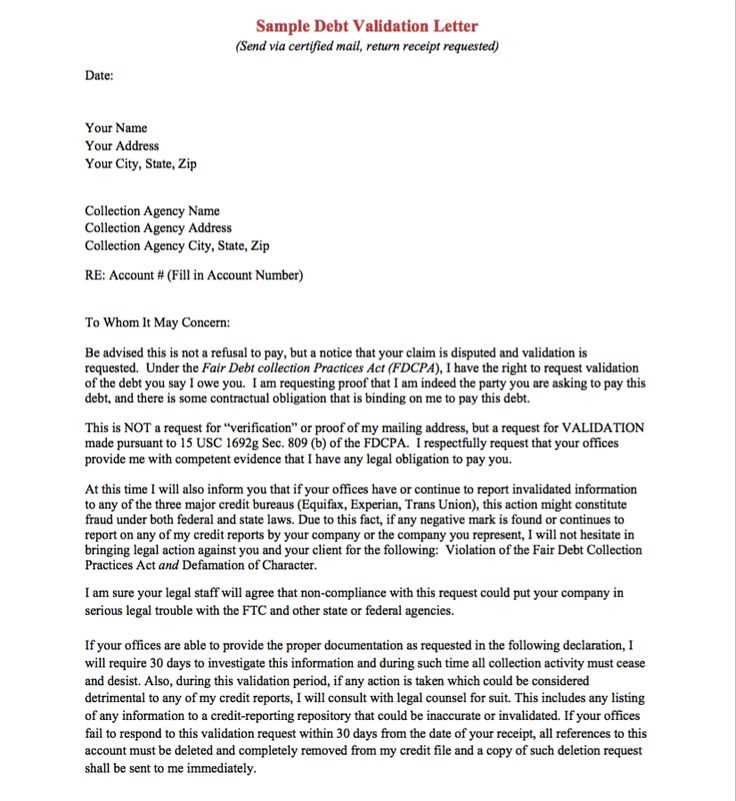

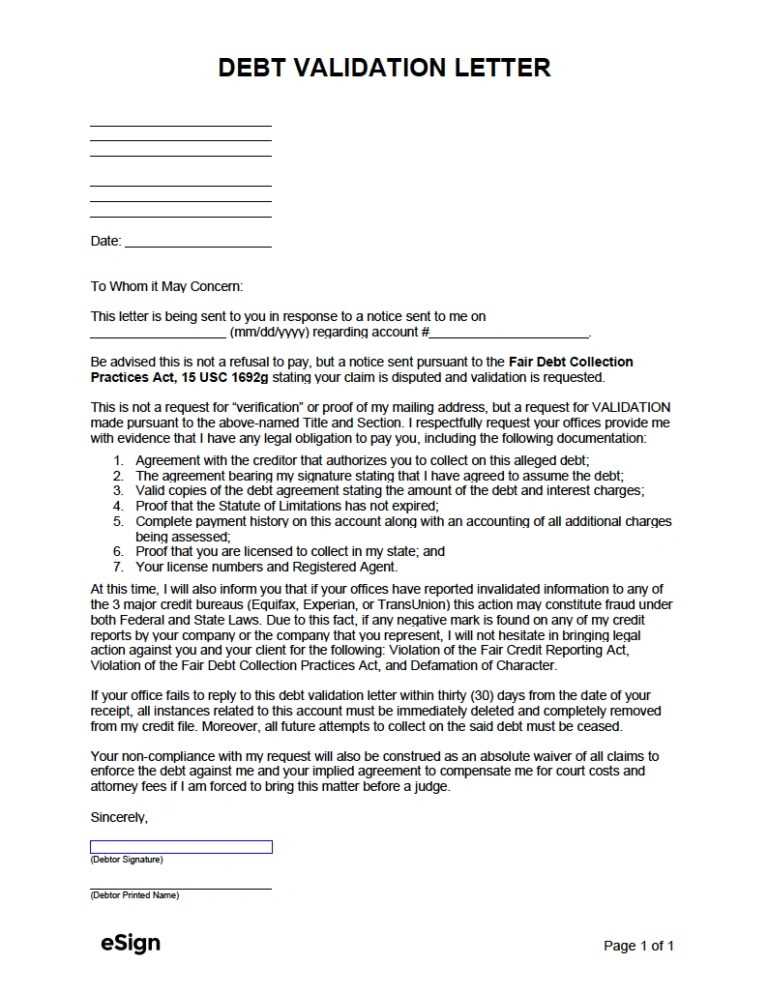

If a debt letter includes terms or conditions that seem unclear or unfair, it’s time to consider legal advice. A lawyer can assess whether the letter complies with applicable laws and if it has any potential to harm your rights.

Unclear or Disputed Amounts

When the amounts owed are unclear or disputed, consulting a legal expert ensures that you understand your obligations. A lawyer can help clarify any discrepancies in the amount claimed and assist in negotiating the terms.

Threats of Legal Action

If the debt letter threatens legal action or demands immediate payment under harsh terms, seek legal guidance. A lawyer can explain your rights, identify potential violations, and guide you through the next steps in dealing with such threats.

- If you’ve received a demand for payment with a specific deadline, without clear proof of the debt.

- If the debt collector fails to provide documentation to validate the debt.

- If the letter violates consumer protection laws or contains illegal terms.

Legal advice can prevent you from making misinformed decisions that may negatively impact your financial situation.

Include a clear and straightforward subject line in your letter. A concise subject ensures that the recipient understands the purpose of your communication right away.

Key Points to Address in the Letter

- State the acknowledgment of the debt clearly.

- Provide details of the debt: the amount, the original creditor, and any relevant dates.

- Outline the repayment terms, including any agreed-upon schedule or payment plan.

- Confirm your intent to fulfill the debt obligations or request a discussion of terms if necessary.

Formatting Tips

- Keep your tone polite and professional throughout.

- Ensure the letter is signed at the bottom with a space for your name and date.

- Double-check for any legal language if required for your specific case.