Debt Collection Letter Templates for Successful Recovery

When managing unpaid invoices, clear and professional communication plays a crucial role in ensuring that funds are recovered in a timely manner. A well-crafted document can significantly improve the chances of successful reimbursement, while maintaining a respectful tone and relationship with clients.

Creating formal written reminders that outline the outstanding balance and expectations can help both parties come to an understanding. These communications should be precise, direct, and maintain a courteous approach, especially in more formal business environments.

Utilizing the right structure for such communications can streamline the process and help avoid misunderstandings. It’s essential to adjust the content based on the situation, whether it’s a first reminder or a follow-up request, to ensure it resonates effectively with the recipient.

Effective Communication for Payment Recovery

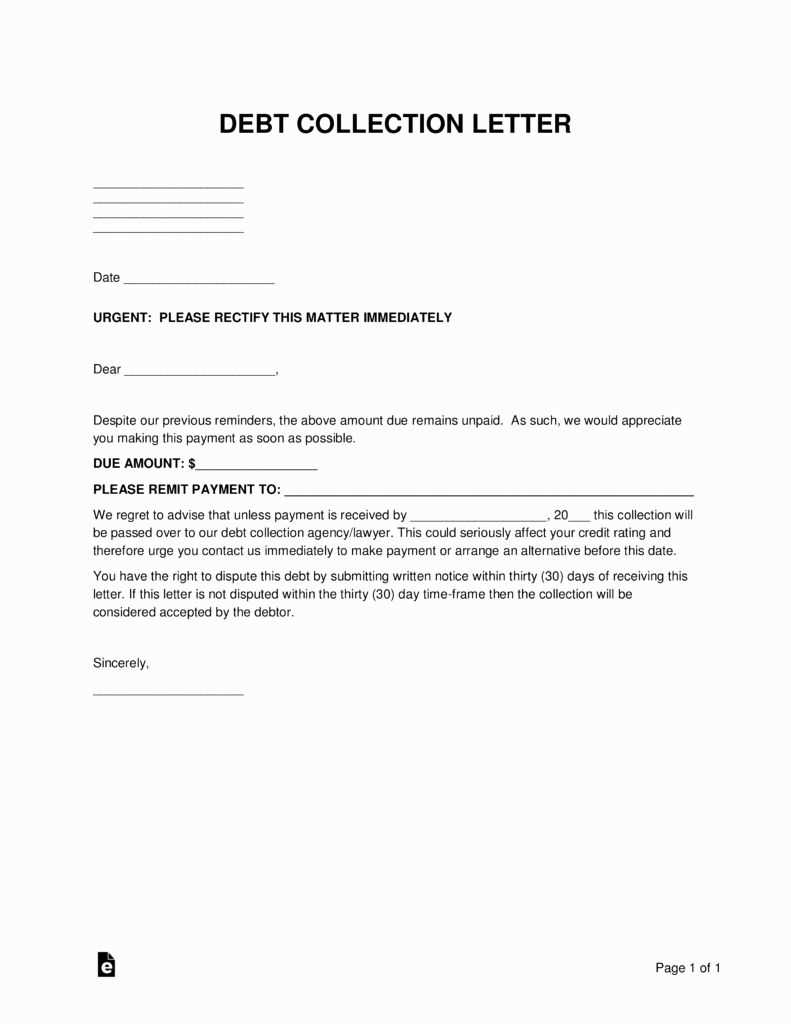

When businesses face outstanding financial obligations, clear and direct communication is essential. Formal written requests for payment serve as a professional reminder of an existing balance, helping to avoid misunderstandings or overlooked invoices. These documents are key in ensuring that clients understand their responsibilities and the consequences of delayed payments.

Building Professional Relationships

One of the main reasons for sending well-structured formal reminders is to maintain good relationships with clients while addressing payment issues. A thoughtful approach allows businesses to remain respectful yet firm, reducing the likelihood of damaging important partnerships. This balance can help preserve long-term client trust, even when the topic is sensitive.

Ensuring Legal and Financial Clarity

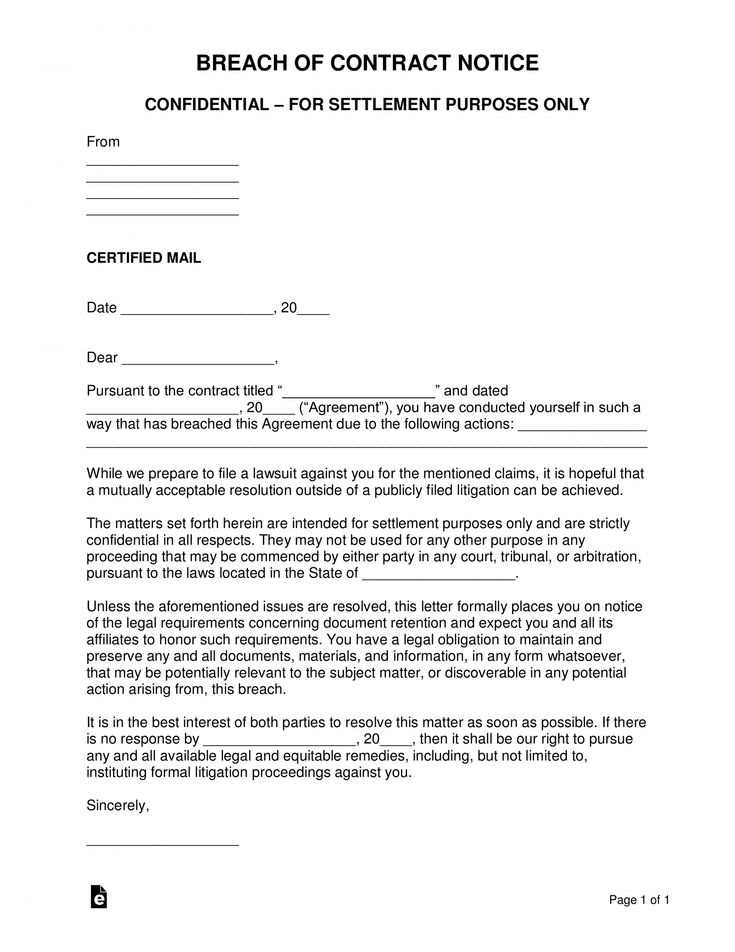

Another significant benefit is the legal and financial clarity these communications provide. By outlining specific terms, due dates, and amounts owed, businesses protect themselves by creating a record of the request. This can be invaluable should further action be necessary, as it establishes a documented history of the collection efforts.

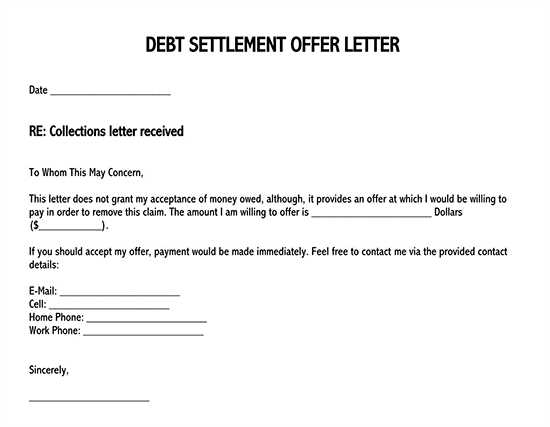

Key Elements of Effective Templates

For a payment reminder to be successful, certain aspects need to be included to ensure clarity and professionalism. The structure of the communication is vital, as it sets the tone and conveys important details efficiently. A well-designed document can increase the likelihood of a prompt response while avoiding misunderstandings.

Clarity is the most critical element. Clearly stating the amount owed, the payment due date, and any relevant payment methods allows the recipient to quickly grasp the situation. The language should be direct yet courteous, ensuring that the purpose of the communication is understood without confusion.

Another important factor is tone. A professional, neutral tone ensures that the message is taken seriously without sounding aggressive. Striking the right balance between firmness and politeness can help maintain a positive business relationship while urging prompt payment.

Additionally, it’s essential to outline next steps. Including information about any potential consequences for non-payment or follow-up actions helps set clear expectations. This ensures that the recipient understands the seriousness of the situation, without feeling overwhelmed.

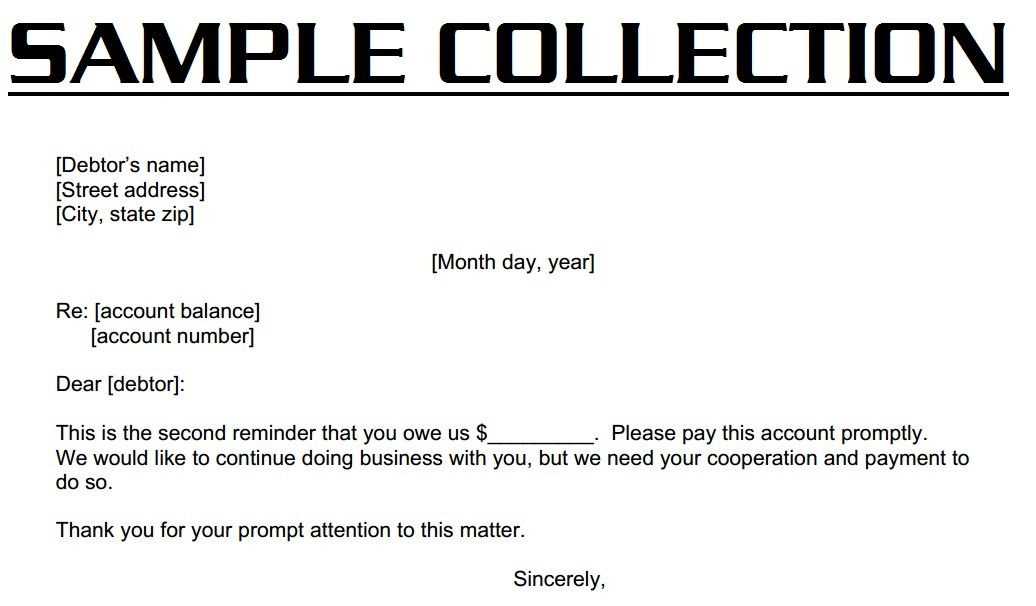

Making the Message Relevant to the Recipient

To increase the effectiveness of payment reminders, it’s essential to tailor the communication to each specific situation. Customizing the content helps ensure that the recipient feels personally addressed and understands the importance of resolving the matter promptly. By adding personalized details, the communication becomes more relevant and impactful.

Address the Recipient by Name–a simple but important step. Using the individual’s or company’s name right at the beginning helps create a more direct connection. It also shows that the message is specifically for them, rather than a generic notice sent to multiple people.

Another effective way to personalize is by referencing past communications or agreements. If there have been prior discussions, acknowledging them within the message can show that you’re aware of the context and are approaching the situation with understanding. This can make the recipient feel that they are not being treated as just another case, but as an individual.

Including specific payment details, such as the outstanding amount or the date of the original agreement, also adds a personal touch. This shows that the communication is tailored to their unique situation, making it more likely they will respond promptly.

Common Errors in Collection Letters

While sending formal reminders for outstanding payments, certain mistakes can reduce the effectiveness of the communication. These errors often stem from a lack of clarity, inappropriate tone, or missing important details, which can result in confusion or an unproductive response from the recipient. Avoiding these pitfalls is key to ensuring that the message has the desired impact.

Overly Aggressive Tone

One common mistake is using a tone that is too harsh or confrontational. While it’s important to be firm, sounding overly aggressive can damage business relationships and create unnecessary tension. It’s best to maintain professionalism and be assertive, but with respect.

Lack of Clear Information

Another frequent error is not providing enough detail. If the recipient is unclear about what is owed or why, they may disregard the communication or delay addressing the issue. Always include specific amounts, due dates, and relevant references to previous agreements.

| Error | Consequences | Solution |

|---|---|---|

| Overly aggressive tone | Damaged relationships, ignored communication | Use a firm but respectful approach |

| Lack of details | Confusion, delayed payment | Include all relevant payment details and references |

| Generic language | Recipient feels disengaged, lower response rate | Personalize the communication for each case |

Understanding the Legal Framework

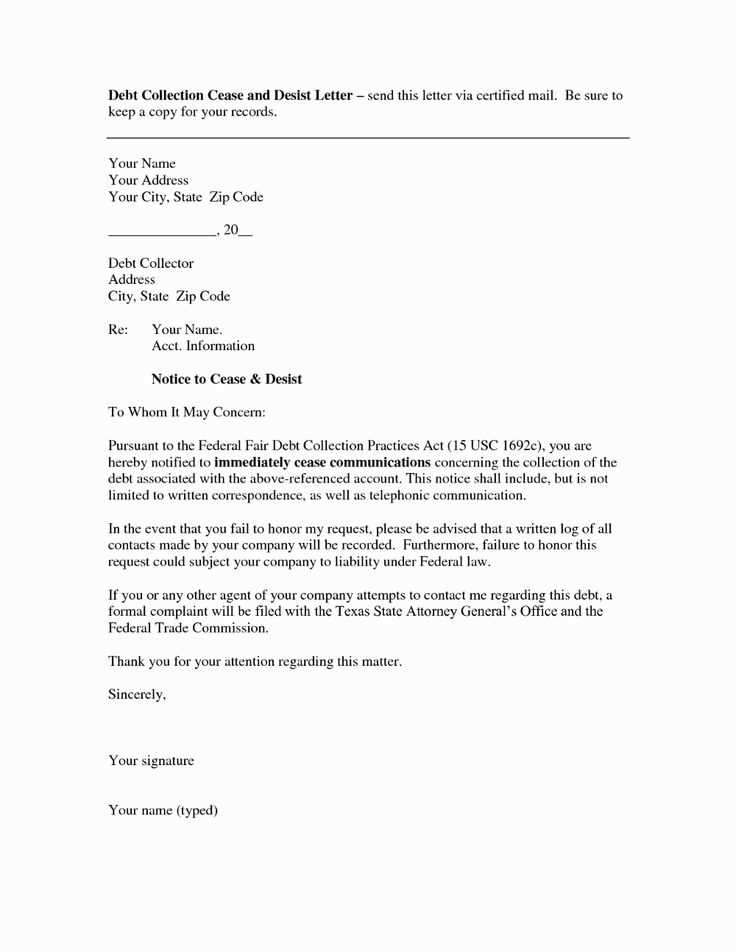

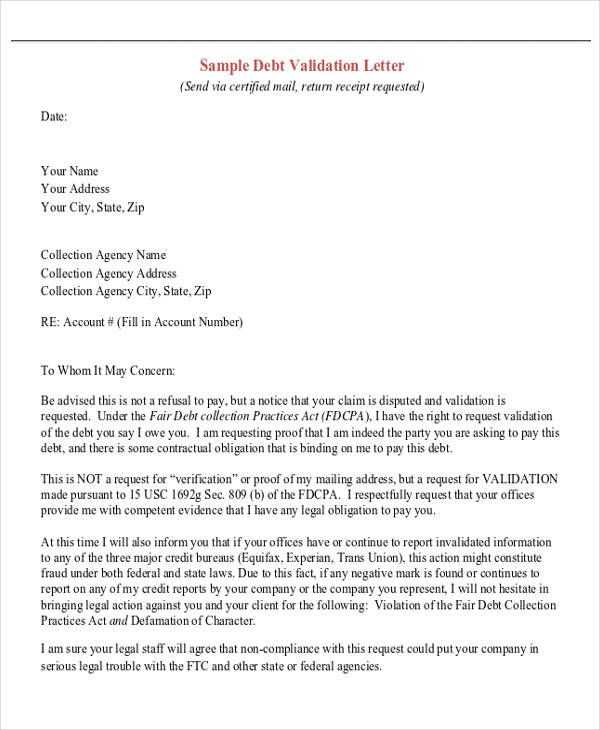

When crafting formal payment reminders, it’s essential to understand the legal considerations that govern such communications. These documents can have serious implications, both for the business and for the recipient. Ensuring compliance with applicable laws helps avoid potential disputes and legal consequences, while protecting the integrity of the communication process.

Key Legal Considerations

- Fair Debt Collection Practices – Ensure that the language used is not abusive or misleading. Many jurisdictions have strict guidelines on what constitutes harassment or unfair practices when seeking payment.

- Privacy Regulations – Be mindful of the information shared in these communications. Ensure that sensitive financial data is protected and not disclosed improperly.

- Clear and Accurate Information – The communication must accurately reflect the amount owed, the original agreement, and any terms for repayment. Failing to provide clear information can lead to confusion or legal challenges.

Important Steps to Stay Legally Compliant

- Ensure the communication is polite, non-threatening, and professional.

- State the amount owed, due date, and any relevant references or agreements clearly.

- Avoid threatening legal action unless you are prepared to follow through within the legal framework of your jurisdiction.

- Respect the recipient’s rights to dispute the claim or request further clarification.

Best Practices for Sending Letters

When sending formal reminders for unpaid balances, it’s important to follow certain best practices to ensure that the communication is effective, professional, and legally sound. Taking the right approach increases the likelihood of receiving payment and maintains positive relationships with clients. Here are a few key strategies for sending successful payment requests.

Timely and Clear Communication

- Send reminders early: The sooner you send a payment reminder after the due date, the better your chances of receiving payment promptly.

- Keep the message clear and concise: Include all necessary details, such as the outstanding balance, due date, and payment options, without overloading the recipient with excessive information.

- Send multiple reminders if needed: If the first message is ignored, consider following up with additional communications, but maintain professionalism in each message.

Maintain a Professional and Courteous Tone

- Always use polite language, even if the situation is frustrating. A respectful tone encourages cooperation and helps avoid damaging the relationship.

- Avoid threats or aggressive language, which may lead to negative outcomes or potential legal issues.

- Ensure that the message is personalized and specific to the recipient’s situation, showing that the communication is not a generic form but a tailored reminder.