Receipt of Money Letter Template for Clear Documentation

When handling financial transactions, it’s essential to have a written record that confirms the exchange. Such documents not only provide clarity for both parties involved but also serve as proof in case of disputes. Whether you’re accepting funds for a service, a product, or a loan, having a clear statement of the transaction is a must for proper documentation.

These documents serve as an official acknowledgment, helping to avoid misunderstandings or legal complications. A well-crafted form ensures that all necessary details are captured, such as the amount, date, and the parties involved. By using a structured format, you can ensure that the information is accurate and easy to reference in the future.

Understanding how to create and utilize these documents correctly can save time, prevent errors, and offer security to both the giver and the receiver. A solid template helps you avoid confusion and provides a professional approach to tracking financial dealings. It’s crucial that every key point is clearly stated and formatted for easy comprehension.

How to Write a Payment Acknowledgment

Creating a document to confirm a financial transaction requires a straightforward approach. This record must clearly detail the exchange to ensure both parties understand the terms and conditions. The structure should be simple, yet thorough enough to cover all important aspects of the deal, leaving no room for ambiguity.

Begin by including the essential information, such as the amount received, the date, and the purpose of the transaction. Make sure the names of both parties are clearly stated, along with any reference numbers if applicable. Additionally, it’s crucial to include any payment method used, such as cash, check, or electronic transfer, to provide a full account of the transaction.

Finally, close with a brief statement confirming that the agreed-upon terms have been fulfilled, and both parties are satisfied with the exchange. This helps establish mutual understanding and serves as an official document should any issues arise in the future.

Key Elements to Include in Your Document

When drafting a confirmation of funds exchange, it’s crucial to ensure that all necessary details are clearly presented. A well-organized document helps establish the terms of the transaction and serves as a reliable reference. Below are the key components to include in your document:

- Transaction Date: The exact date the funds were exchanged should be noted to establish the timeline.

- Amount: Clearly state the total amount involved in the transaction, ensuring accuracy to avoid future confusion.

- Parties Involved: Include the names of both the payer and the recipient, along with any relevant contact information if necessary.

- Payment Method: Specify how the payment was made (e.g., cash, bank transfer, check, etc.) to provide clarity on the transaction process.

- Purpose of the Transaction: Describe the reason for the exchange, whether it’s for goods, services, or other purposes.

- Signature: Both parties should sign the document to confirm their agreement and understanding of the transaction details.

By including these essential elements, you ensure that the document is comprehensive, accurate, and legally sound. This provides protection for both parties involved and makes future references to the transaction straightforward.

Understanding the Importance of Payment Acknowledgment Documents

In any financial transaction, having a written acknowledgment provides both security and clarity for all parties involved. These documents serve as proof that an exchange has taken place, ensuring that both the giver and receiver have a clear understanding of the terms. Without such records, disputes can arise, and the integrity of the transaction may be questioned later on.

Legal and Financial Protection

One of the most important aspects of such documents is the protection they offer. In cases where disagreements occur, these records act as a legal safeguard, confirming that the transaction was completed as agreed. They provide essential evidence if legal action is required or if either party needs to validate the exchange for future reference.

Trust and Professionalism

Issuing a clear acknowledgment of an exchange helps to build trust and professionalism. It shows a commitment to transparency and assures both parties that their interests are being protected. Whether for business or personal dealings, these documents contribute to a sense of reliability and formalize the process, leaving no room for confusion.

Why Accurate Documentation Matters

Maintaining precise records of financial exchanges is essential for clarity, security, and transparency. Inaccurate or incomplete information can lead to misunderstandings and disputes, making it harder to resolve issues if they arise. Having a clear, well-organized document ensures that both parties can refer back to the terms of the transaction at any time, minimizing potential confusion.

Legal Protection and Accountability

Accurate documentation is crucial for legal purposes. It serves as proof of the transaction and can protect both parties in case of any future legal disputes. Without clear records, it becomes difficult to demonstrate the terms of the deal or the exact nature of the exchange, leaving both parties vulnerable.

Efficiency and Trust in Transactions

Well-documented exchanges also promote efficiency and trust. When both parties have access to precise, organized information, the likelihood of errors is significantly reduced. This strengthens professional relationships and ensures that the transaction is processed smoothly, fostering confidence and reliability between the individuals or businesses involved.

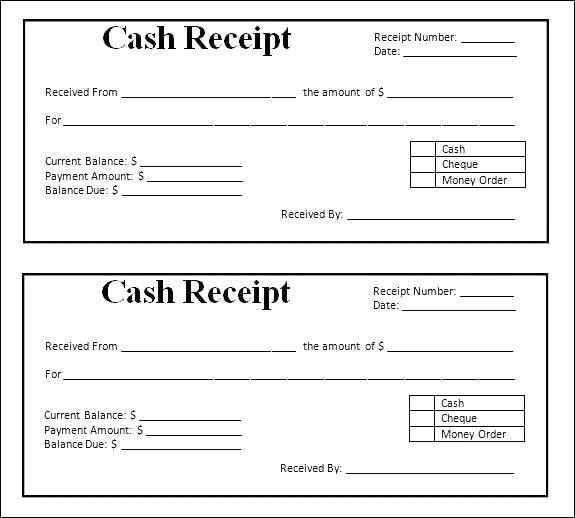

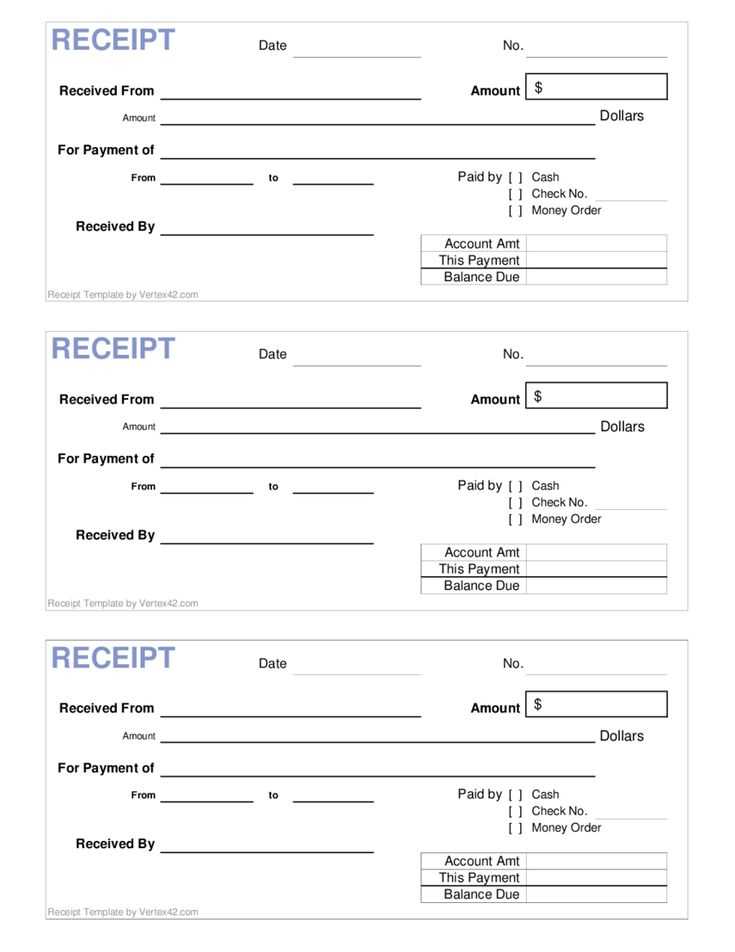

Examples of Payment Acknowledgment Forms

There are several ways to structure a formal acknowledgment for financial transactions. The key is to adapt the format based on the nature of the transaction and the specific requirements of the involved parties. Below are a few examples of formats that can be used in different scenarios to ensure a clear and professional documentation process.

Basic Acknowledgment Format

This is a simple structure that works well for everyday transactions where only the essential details need to be recorded.

- Amount: Clearly state the amount exchanged.

- Transaction Date: Include the exact date when the payment occurred.

- Purpose: A brief description of what the payment is for.

- Payment Method: Note the method used for the exchange (e.g., cash, bank transfer, check).

- Signatures: Both parties should sign to confirm the exchange.

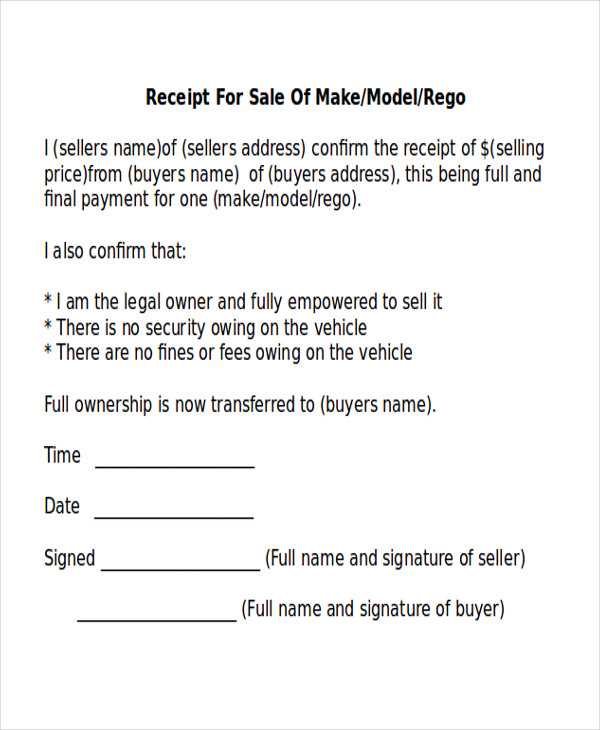

Business Transaction Format

This format is more detailed and works well for formal business transactions that require specific information for accounting or legal purposes.

- Invoice Number: If applicable, include any related reference or invoice number.

- Party Names: Full names or business entities involved in the transaction.

- Detailed Description: A more comprehensive explanation of the goods or services involved.

- Terms and Conditions: Outline any agreed-upon terms, including due dates or follow-up actions.

- Authorized Signatures: Include signatures from authorized individuals from both sides.

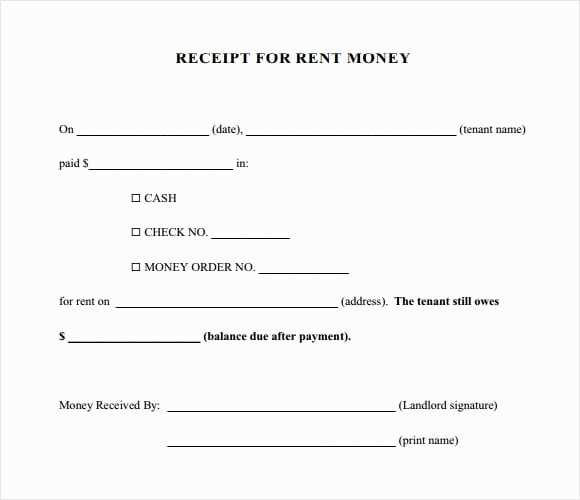

Simple Formats for Different Situations

Depending on the nature of the exchange, the documentation format can vary in complexity. Whether it’s a personal transaction or a business deal, having a clear and simple structure ensures the transaction is properly recorded. Below are a few basic formats that can be adapted to various situations, making it easy to keep track of financial exchanges.

Personal Transactions

For informal or personal transactions, a straightforward format can suffice. The key is to ensure that both parties have a clear understanding of the exchange, even if the transaction is not formalized through a contract or invoice.

- Amount: State the total amount involved.

- Transaction Date: Include the date when the exchange took place.

- Purpose: A brief note on what the payment is for.

- Parties Involved: List the individuals involved in the exchange.

Business Transactions

In business scenarios, a more detailed format is often needed to ensure that all terms are clearly laid out for future reference, especially for accounting or legal purposes.

- Reference Number: Include any related invoice or transaction reference.

- Detailed Description: A clear explanation of the goods or services provided.

- Payment Method: Specify how the transaction was completed (e.g., via check, wire transfer, etc.).

- Agreement Terms: Outline any conditions, such as payment deadlines or follow-up actions.

Legal Considerations When Issuing Receipts

When documenting financial exchanges, it is important to understand the legal requirements associated with issuing formal acknowledgments. These records not only serve as proof of transaction but also help ensure that the transaction complies with applicable laws. Businesses and individuals must be aware of key considerations to avoid potential legal issues.

Compliance with Tax Laws

In many jurisdictions, it is a legal obligation for businesses to provide accurate documentation of all financial exchanges for tax purposes. Failing to issue proper records can lead to penalties, audits, or loss of credibility. Keeping proper records helps ensure that both income and expenses are correctly reported to tax authorities.

Ensuring Clarity and Accuracy

It is crucial that all details included in the acknowledgment are clear and accurate. Any ambiguity or errors could lead to disputes or misunderstandings. Both parties should be able to reference the document with confidence, ensuring that all terms of the transaction are accurately captured.

| Element | Legal Importance |

|---|---|

| Transaction Date | Establishes the timeline of the exchange for legal and tax records. |

| Amount | Essential for accounting and ensuring correct tax filings. |

| Purpose of Exchange | Helps clarify the nature of the transaction for legal clarity and transparency. |

| Signatures | Provides evidence of mutual agreement, ensuring accountability for both parties. |

Ensuring Compliance with Financial Regulations

When engaging in any form of financial transaction, it is crucial to ensure that all practices align with the applicable financial regulations. Compliance with laws and standards helps mitigate risks, promotes transparency, and establishes trust between parties. Ensuring that all required documentation is in place and accurate is essential for maintaining legal and regulatory integrity.

Adhering to Tax Reporting Standards

Accurate documentation of all exchanges is vital for proper tax reporting. Tax authorities often require detailed records to verify income, expenses, and other financial activities. Failure to comply with tax regulations can result in fines or legal repercussions, making it essential to maintain clear and precise records.

Following Anti-Money Laundering (AML) Guidelines

In many regions, businesses and individuals must ensure that their transactions comply with Anti-Money Laundering (AML) regulations. These regulations require businesses to verify the identities of their clients, monitor transactions, and report suspicious activities to prevent financial crimes. Proper documentation helps in maintaining an audit trail that can be referenced for compliance with AML laws.

Financial institutions, in particular, are required to implement internal controls and processes to ensure that all exchanges meet legal requirements. These steps include verifying the legitimacy of transactions and ensuring proper documentation is generated and retained as evidence of the exchange.