How to Use a Validate Debt Letter Template for Disputes

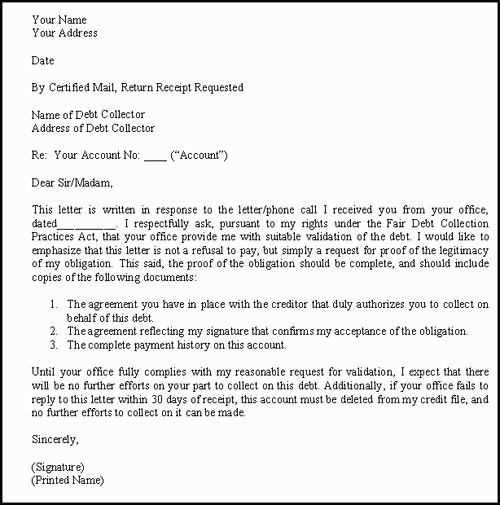

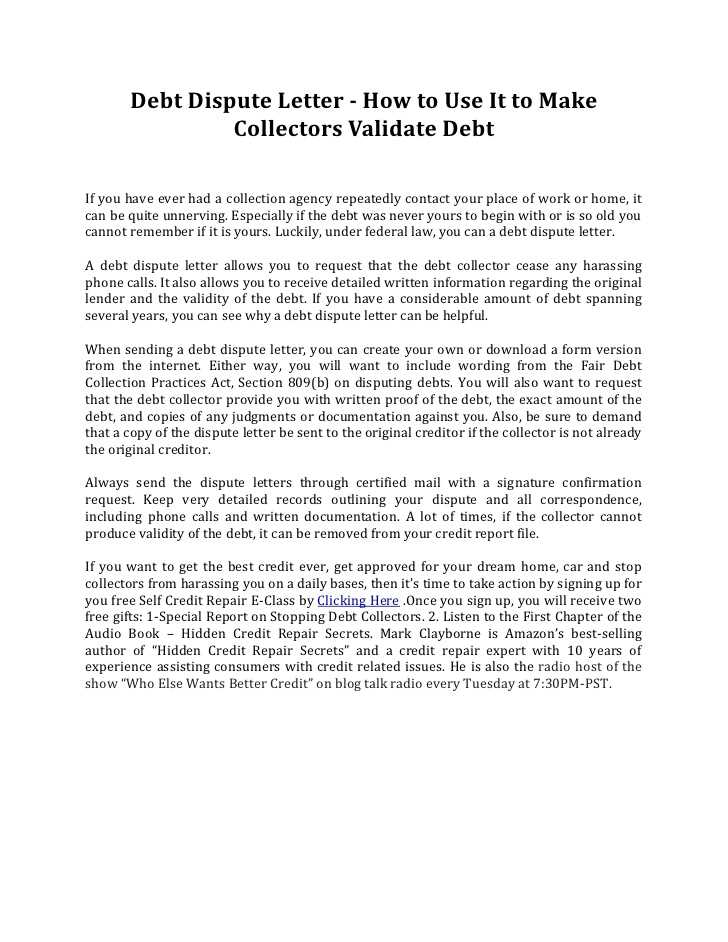

When facing a financial dispute or questioning the accuracy of an outstanding amount, it’s crucial to formally request confirmation of the claimed balance. This ensures that the information being presented is accurate and that the amount being requested is legitimate. A well-constructed document serves as an essential tool for anyone seeking to resolve such issues in a clear and organized manner.

Why Requesting Confirmation Matters

Whether it’s an unknown charge or a disputed balance, asking for written verification provides a solid foundation for addressing the situation. This process helps protect individuals from being unfairly charged or held responsible for errors that may have occurred. In many cases, this formal request can prompt further investigation or resolution from the creditor or collector.

Key Points to Include

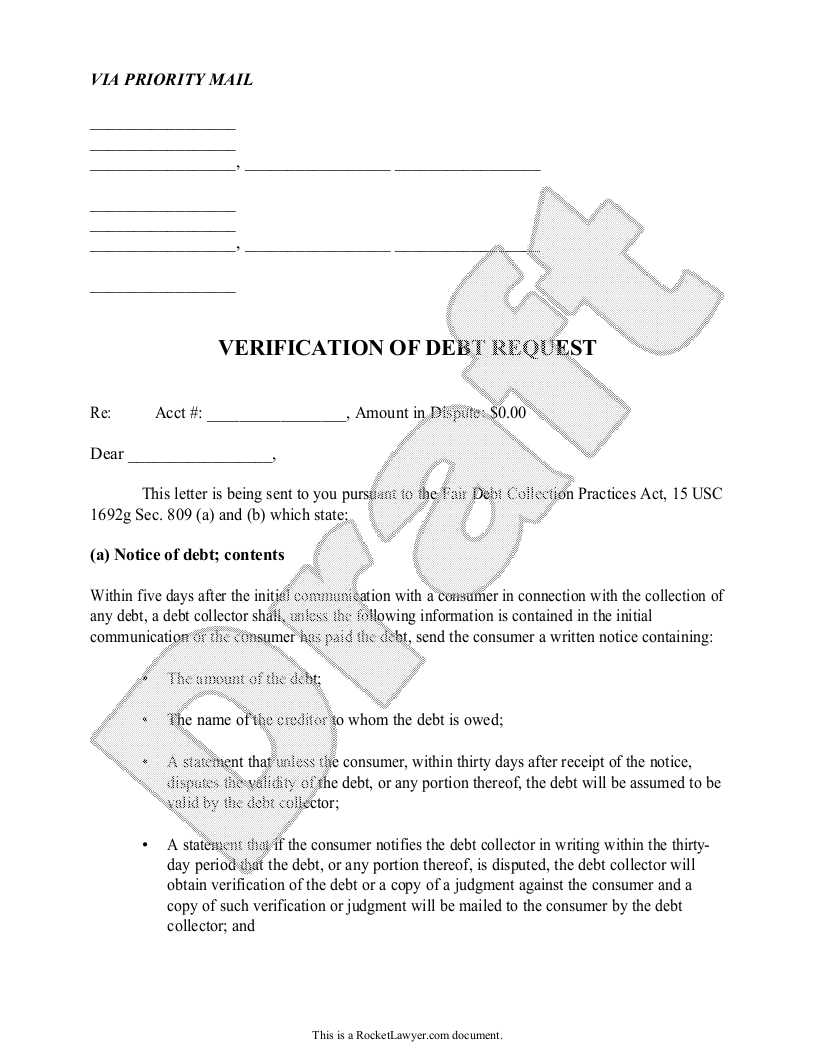

- Clear Identification: Ensure that both your details and those of the creditor are correctly outlined.

- Specific Inquiry: Request the exact breakdown of the claimed amount, including dates and charges.

- Request for Documentation: Ask for copies of any contracts, agreements, or records supporting the claim.

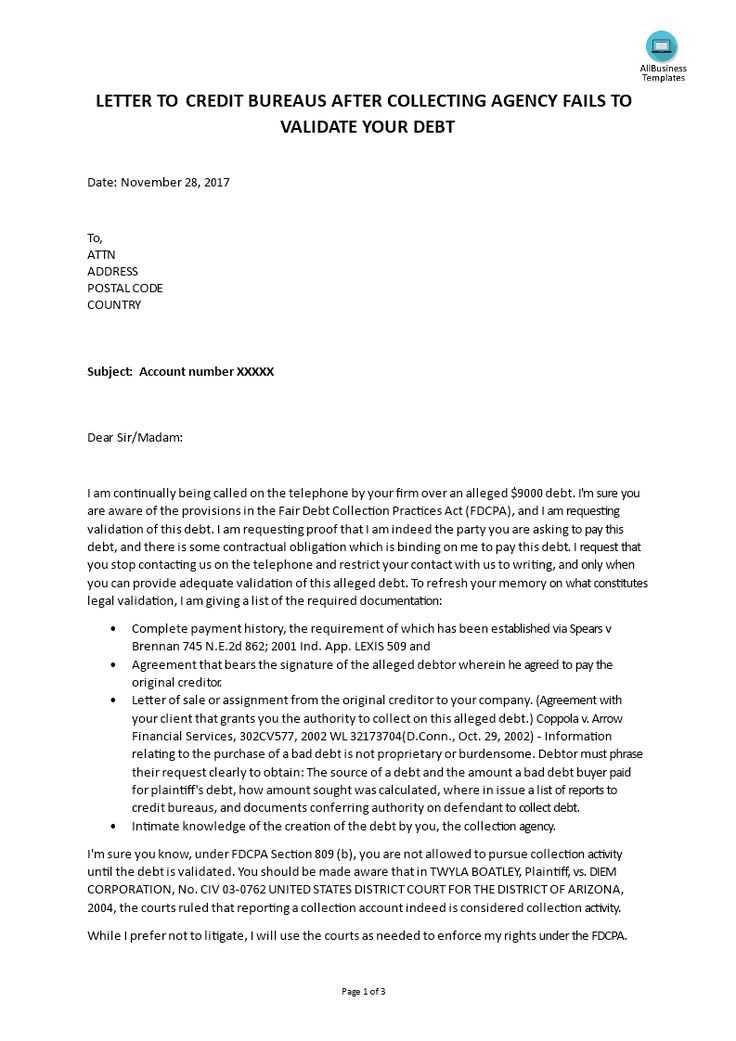

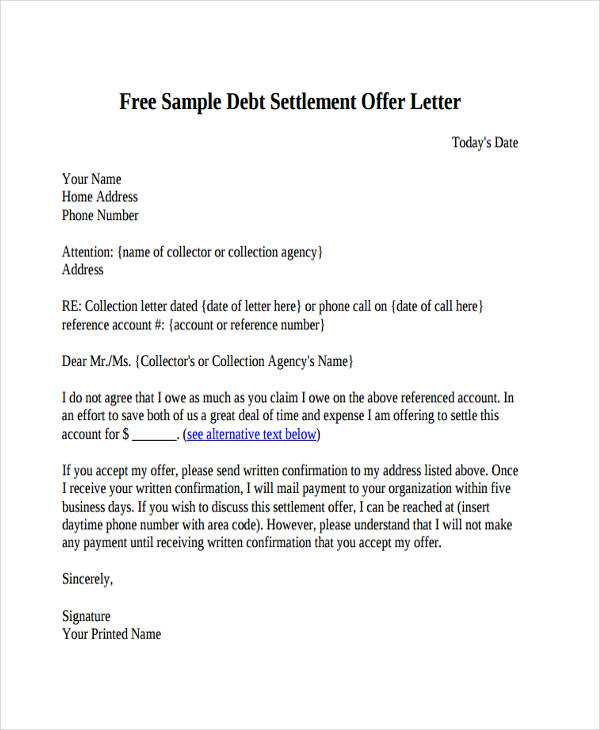

Steps to Craft an Effective Dispute Notice

Creating a well-written communication can greatly increase the likelihood of a positive outcome. Start by making sure your communication is professional and concise. Follow these steps to ensure the process goes smoothly:

- Introduce Yourself Clearly: State your full name, contact information, and any relevant account numbers.

- Describe the Discrepancy: Explain the exact issue or charge you are disputing in clear terms.

- Request Verification: Ask for specific evidence to confirm the accuracy of the claim.

- Specify a Time Frame: Give a reasonable period for a response, typically 30 days.

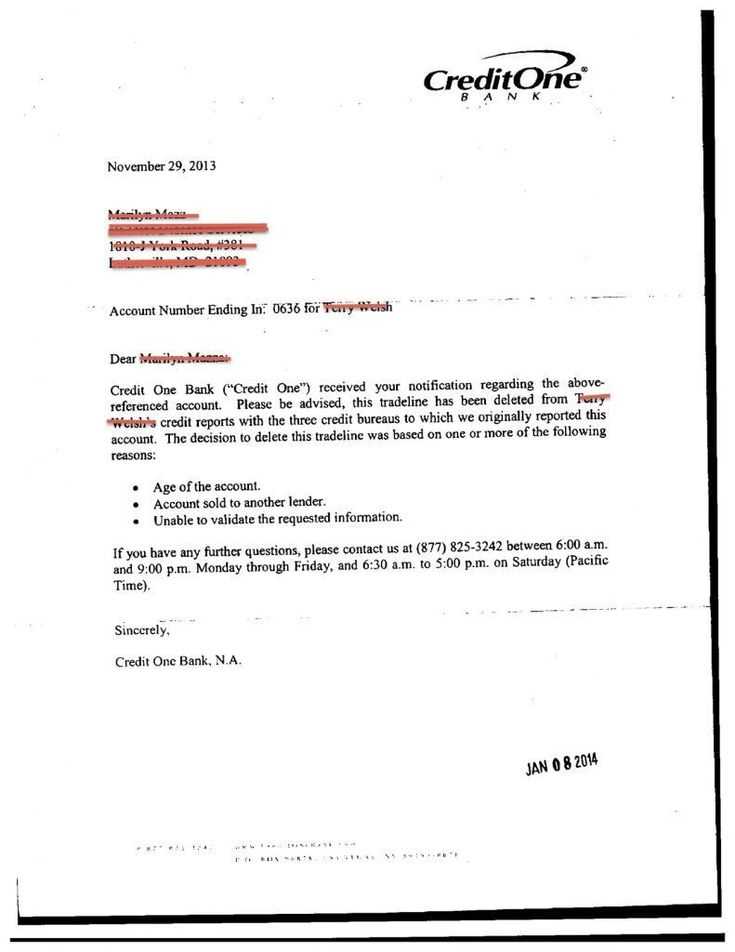

What to Do After Sending Your Request

Once the communication is sent, it’s essential to monitor your records closely. Ensure you receive a prompt reply or follow-up action. If you don’t hear back within the given period, consider reaching out again or escalating the issue further.

Remember: Document all interactions related to the dispute. This includes emails, phone calls, and any written responses, as this can be critical should you need to pursue further actions later on.

Understanding the Process of Verifying Financial Claims

When faced with a questionable financial obligation, it is crucial to ensure that the amount requested is accurate and substantiated. This process involves formally requesting proof or clarification regarding the details of the charge. The goal is to safeguard against errors or unfair practices while maintaining transparency in financial dealings.

Knowing when to initiate such a process is equally important. If you receive an unexpected demand or notice discrepancies in your balance, it’s time to request further verification. This allows you to challenge any inaccuracies or avoid paying for charges that may not be legitimate.

Creating an effective communication for disputing an incorrect claim requires clarity and precision. Outline the issue, provide all necessary details, and request specific documentation to substantiate the claim. A well-structured dispute increases the chances of a favorable resolution.

There are key elements that every formal request should include to ensure its legitimacy. These include clear identification of the parties involved, specific information about the disputed amount, and a request for relevant evidence to support the charge. A solid request will not only help clarify the situation but also demonstrate your commitment to resolving the matter professionally.

In disputes, it is important to avoid common mistakes that could hinder the process. For example, being vague or failing to specify a clear timeline can delay or even invalidate your request. Always be precise, polite, and follow up if necessary to ensure that the issue is addressed in a timely manner.

Finally, understanding your legal rights is crucial when challenging a financial claim. You have the right to request evidence, dispute inaccuracies, and seek third-party intervention if needed. Familiarize yourself with these rights to ensure that you are fully prepared to protect your financial interests.