Sample proof of funds letter template

To demonstrate financial capability, a proof of funds letter is an important document. This letter provides a clear confirmation of your available financial resources, whether for a property purchase, visa application, or any other financial transaction requiring proof. Use the template below to create a concise and professional letter that clearly showcases your financial standing.

Template:

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient’s Name]

[Recipient’s Title/Position]

[Company Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient’s Name],

Subject: Proof of Funds

I, [Your Name], am writing to confirm that I have sufficient financial resources available to complete the transaction related to [describe purpose, e.g., purchasing a property, applying for a visa]. As of [date], I have a total amount of [amount] in my [bank account type] at [bank name]. I have attached an official bank statement as evidence of this amount, which clearly shows the available balance as of the mentioned date.

If you require any further details or additional documentation, please feel free to contact me at [phone number] or [email address].

Sincerely,

[Your Name]

By following this template, you can quickly create a professional and clear proof of funds letter, ensuring your financial position is presented accurately and confidently. Tailor the details to match your specific situation for the best results.

Here’s the revised version with repeated parts removed:

Ensure your letter of proof of funds is clear and concise. Focus on providing the most relevant details that prove your financial stability. Avoid unnecessary repetition, which can distract from the key information.

Structure of a Proof of Funds Letter

The letter should begin with the financial institution’s name, address, and the date. Include your account number or reference code. Clearly state that the document serves as proof of your available funds. If possible, mention the account balance or the amount available for the transaction.

Formatting Tips

Keep the letter to the point. Use simple, direct language. Avoid any complicated financial jargon that may confuse the recipient. Ensure the document is properly signed by an authorized representative of the financial institution, confirming the accuracy of the details provided.

By following these guidelines, you can present your proof of funds clearly and efficiently, leaving no room for confusion or errors.

- Sample Proof of Funds Letter Template

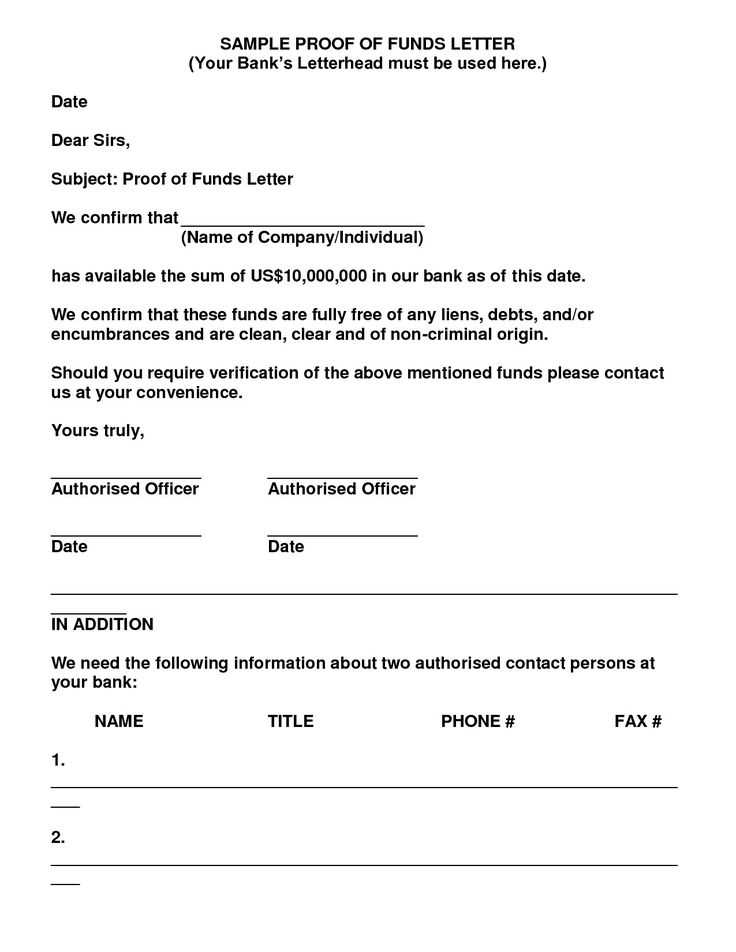

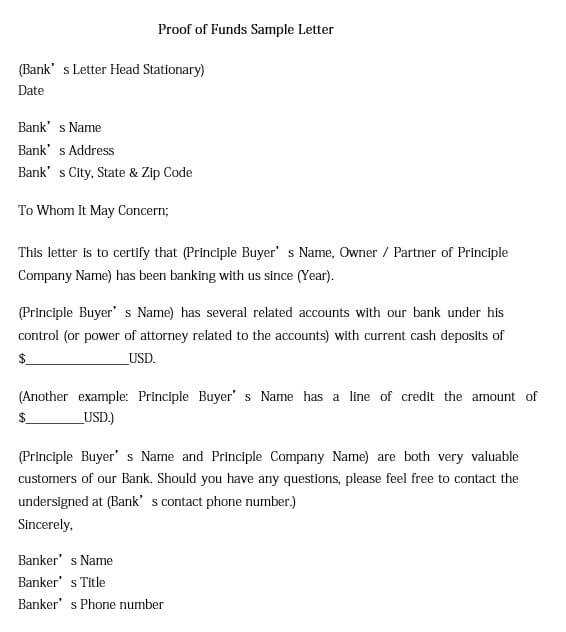

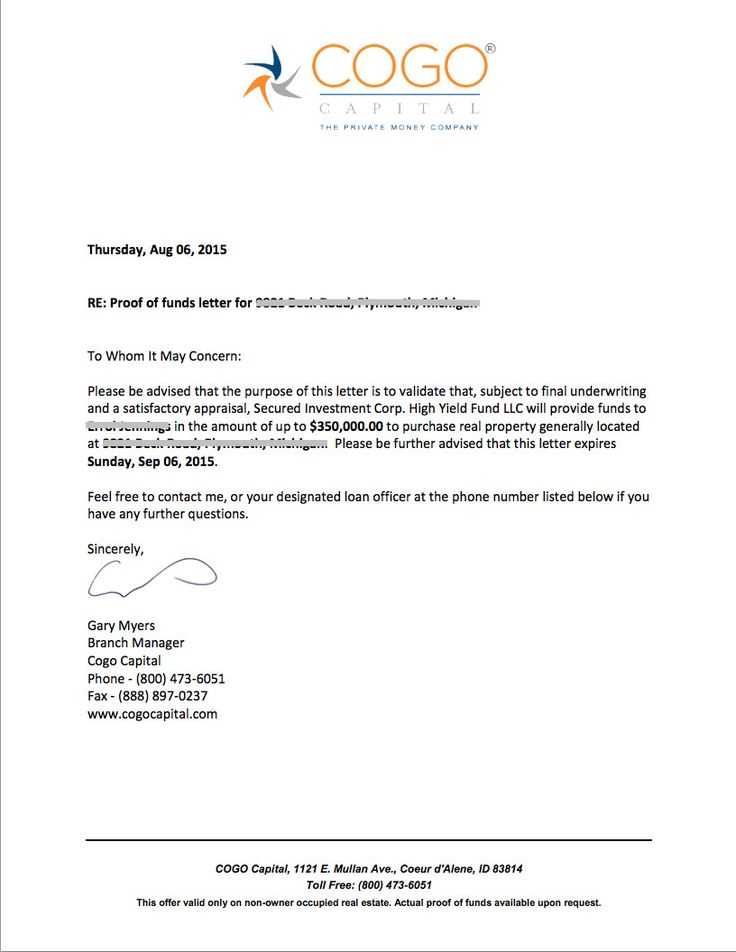

A Proof of Funds letter is a formal document used to verify that an individual or entity has enough financial resources to proceed with a purchase or investment. This template will help you structure a professional letter that can be presented to banks, landlords, or other parties requesting financial verification.

Template for Proof of Funds Letter

Bank Name

Bank Address

City, State, Zip Code

Phone Number

Email Address

Date: [Insert Date]

To Whom It May Concern,

We are writing to confirm that [Full Name], a client of our bank, has sufficient funds in their account to cover the required amount for [specific purpose]. The details of the accounts held by [Full Name] are outlined below:

Account Holder Name: [Full Name]

Account Number: [Account Number]

Account Type: [Checking/Savings/Other]

Current Account Balance: $[Amount]

Date of Balance: [Date]

The account holder has maintained a positive balance for a period of [time period]. Should you require further details or clarification, please do not hesitate to contact us at [Bank Contact Information].

Thank you for your attention to this matter. We look forward to your prompt response.

Sincerely,

[Bank Officer Name]

[Title]

[Bank Name]

Additional Information

Ensure that the Proof of Funds letter is signed by an authorized bank officer to validate the information. If you are requesting a proof of funds letter from your bank, be clear about the purpose and the specific amount needed to expedite the process. Always verify the details with the recipient to avoid misunderstandings.

When writing a proof of funds letter for a real estate transaction, be clear and concise. The letter should clearly demonstrate that the buyer has enough financial resources to complete the purchase. Start by including key details such as the buyer’s name, the amount of funds available, and the source of the funds.

1. Include Basic Information

- Buyer’s full name

- Amount of funds available for the transaction

- Bank or financial institution’s name

- Account holder’s name (if applicable)

- Date the letter is issued

2. Confirm Availability of Funds

The letter should state that the funds are readily available for the transaction and not tied to any conditions, unless specified. If you are using a bank statement, the amount should reflect liquid funds in the account, not assets such as investments or loans.

3. Provide Verification of Funds Source

For additional clarity, mention where the funds come from (e.g., savings, sale of another property, gift, inheritance). This will help reassure the seller or agent that the funds are legitimate and accessible.

4. Keep It Brief and Formal

The letter doesn’t need to be long. Keep it professional, but don’t add excessive details. A brief and formal tone is sufficient to communicate the necessary information.

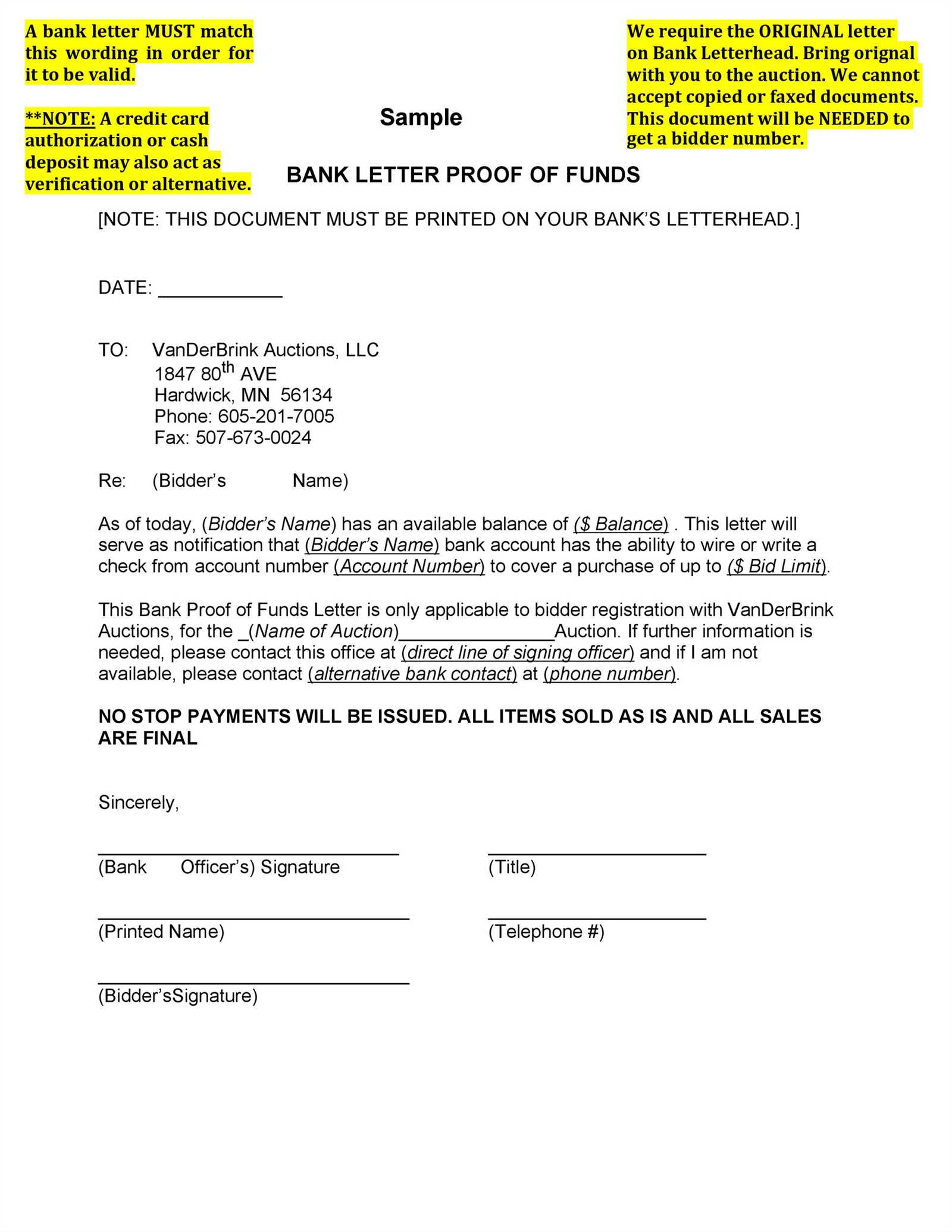

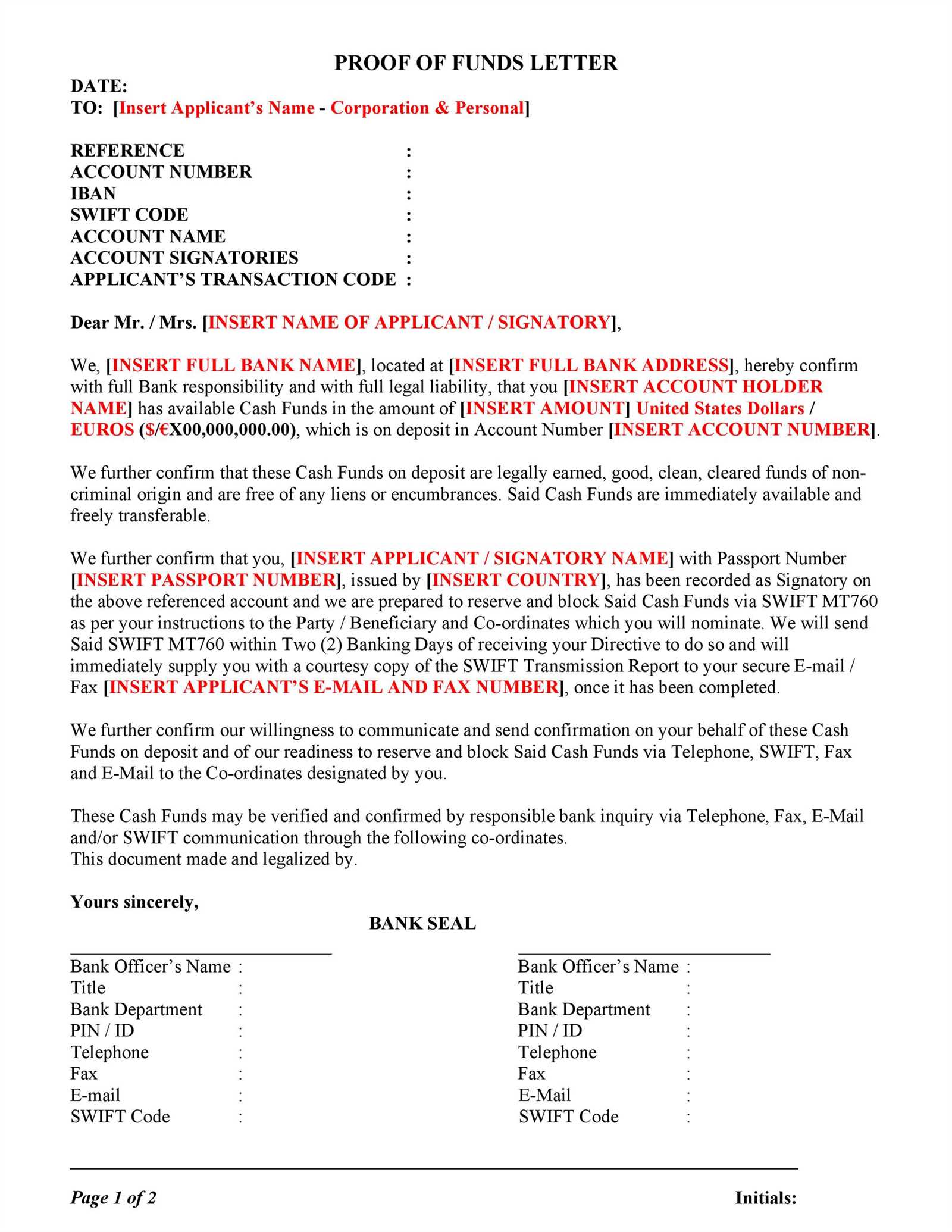

Ensure that your Proof of Funds (POF) letter contains the following critical elements to avoid any delays or misunderstandings:

- Letterhead or Bank Information: The letter should be printed on official bank letterhead, which includes the bank’s name, address, and contact details. This establishes authenticity.

- Account Holder’s Information: Include the full name and address of the account holder. This links the funds directly to the person submitting the letter.

- Bank Account Information: Clearly specify the account type (checking, savings, etc.) and provide the account number, if required. This shows where the funds are located.

- Balance or Funds Available: State the current balance or available funds in the account. Include the currency for clarity.

- Date of the Letter: Always include the date the letter was issued to confirm the funds are current and valid at the time of writing.

- Confirmation of Funds Source (if needed): In some cases, you may need to indicate where the funds came from (e.g., salary, sale of property, investments). This provides transparency.

- Signature and Contact Information: The bank officer or representative should sign the letter, including their contact details in case further verification is needed.

These elements create a clear and verifiable document that assures recipients that the funds are available as needed.

Tailor the proof of funds letter to meet the specific requirements outlined by the embassy or consulate of the country you’re applying to. Begin by including your name, address, and contact details. Ensure the document states your financial capacity clearly, using precise language that aligns with the visa category you’re applying for. For example, if applying for a tourist visa, specify the amount required to cover travel expenses, accommodation, and daily living costs. Adjust the tone and content to reflect the financial expectations for student, work, or residency visas as well.

Next, mention the source of funds. If it’s a bank account, include the name of the bank, account type, and the account holder’s details. Clearly state the amount of money available and the duration of the account’s activity. If the funds come from investments or assets, describe their nature and current value. For example, if it’s from a property, provide a valuation report or recent transaction history.

Ensure the letter includes a formal statement confirming the funds are readily accessible. If necessary, attach relevant supporting documents like bank statements, investment certificates, or asset appraisals to validate your claim. The embassy or consulate may ask for these to verify the legitimacy of the funds mentioned in the letter.

To further personalize the letter, add details of your relationship with the financial sponsor if they are covering your expenses. Include their name, address, and proof of their financial standing if applicable. If the sponsor is a business or organization, provide their official letterhead, business registration, and proof of business operations.

Lastly, maintain clarity and professionalism in the letter. Avoid excessive technical language or unnecessary details, but ensure it fully supports the financial aspect of your visa application.

To verify the authenticity of a Proof of Funds (POF) document, check several key elements. Start with confirming the legitimacy of the financial institution. Look for official letterhead or bank logo on the document, ensuring it matches the bank’s official branding. Contact the institution directly using verified contact details, not the ones on the document, to confirm that the statement was issued by them.

Verify the Account Details

Ensure that the account details provided in the POF document are accurate. This includes verifying the account holder’s name, account number, and the available balance. Cross-reference these details with the bank’s statement records, if possible, and ask for a breakdown of the balance if necessary.

Check for Authorization Signatures

Authentic POF letters typically include a bank representative’s signature or other forms of authorization. Ensure that the signature is legitimate by cross-referencing with the bank’s known signatures. If available, ask the institution for an official confirmation of the signatory’s role and authority.

Finally, inspect the document for any unusual signs such as incorrect formatting or spelling errors, which could indicate fraud. A genuine document will follow the formal structure and language used by the issuing financial institution.

Common Mistakes to Avoid When Creating a Proof of Funds Statement

Ensure the document reflects accurate and up-to-date financial information. Including outdated bank statements or incorrect details could lead to rejection or delays.

1. Failing to Include Complete Details

A common mistake is not providing all necessary information, such as your account number, bank name, or the date of the statement. Always make sure the proof of funds statement includes all the required elements. Missing details can raise doubts and cause unnecessary complications.

2. Using an Inappropriate Format

Make sure the document follows a professional format that banks or institutions accept. Avoid using informal screenshots or unverified sources. It’s best to get an official letter from your bank or a formal bank statement that clearly indicates the funds you have available.

3. Lack of Clarity in the Source of Funds

Clarify where the funds are coming from. Whether it’s savings, investments, or another source, make sure this is specified. Not doing so can create confusion and may lead to a rejection of the document.

4. Providing Inconsistent Information

Cross-check all details in your proof of funds letter. Inconsistent data, such as mismatched names, incorrect balances, or discrepancies with previous statements, could result in unnecessary questioning. Make sure everything matches perfectly.

5. Omitting Currency Information

Always specify the currency of the funds. This is particularly important if you are dealing with international transactions. Without clear currency information, it can be difficult to assess the exact value of the funds you’re presenting.

6. Forgetting to Include Contact Information

Provide a contact number or email address for verification. If the institution needs to confirm details, they should have an easy way to reach you. Missing contact information can delay the process significantly.

| Common Mistakes | What to Do Instead |

|---|---|

| Incomplete details | Ensure all required information is included (account numbers, bank details, etc.) |

| Incorrect format | Provide an official bank statement or a formal letter from your bank |

| Unclear source of funds | Clearly state where the funds come from (savings, investments, etc.) |

| Inconsistent information | Double-check all details and ensure they match previous records |

| Missing currency information | Clearly indicate the currency of the funds |

| No contact information | Include contact details for verification purposes |

A Proof of Funds document is required in various business scenarios to confirm financial capability. Whether you’re securing a loan, negotiating a merger, or making a large investment, you may need to show that you have sufficient liquid assets to back your transactions. This document is crucial in establishing trust and credibility with other parties involved in the deal.

In business deals such as acquisitions, investors often request proof of funds before engaging in negotiations. This reassures them that you’re financially prepared to close the deal without unexpected delays. When you’re purchasing real estate or other high-value assets, sellers may require proof to confirm that you have the necessary funds to complete the purchase.

Another instance where a Proof of Funds document is necessary is during the process of securing business loans or funding. Financial institutions or investors will request this document to assess the stability of your financial situation. It helps them evaluate your ability to meet repayment obligations or manage the investment effectively.

Being proactive with proof of funds can speed up decision-making and streamline business transactions. Having this document ready when you approach potential partners or investors can prevent delays and demonstrate professionalism, potentially giving you a competitive edge in negotiations.

Now the repetitions are minimized, and the meaning is preserved.

Avoid redundancy by organizing the content clearly and efficiently. Prioritize simplicity without sacrificing important details.

Structure Your Proof of Funds Letter

The proof of funds letter should follow a logical sequence. Start with the sender’s name and contact details, then the recipient’s information, followed by the subject. Clearly state the purpose of the letter in a straightforward manner.

| Section | Description |

|---|---|

| Sender’s Information | Include the name, address, phone number, and email of the person providing the proof. |

| Recipient’s Information | Write the name and details of the person or entity receiving the letter. |

| Statement of Funds | Provide an exact statement verifying the available funds and their source. |

| Bank Details | Include the bank name, account number, and relevant details to back the claim. |

| Signature | End the letter with the signature of the authorized person verifying the information. |

Be concise in every section to avoid unnecessary elaboration. Each part should directly address the purpose of verifying the funds, making it easy for the recipient to review the document.

Key Considerations

Ensure accuracy in the details provided. Incorrect or vague information can lead to rejection. Always verify the financial data with your bank before submitting the letter.